Can these Avalanche developments help keep the approaching bears at bay

- AVAX’s growth exercise was up

- AVAX’s market indicators pointed in the direction of an extra worth plummet

Avalanche, on 9 November, revealed that the primary Avalanche [AVAX] bounty to create analytics for Dune Analytics was accomplished efficiently.

The primary #Avalanche bounty to create analytics for @DuneAnalytics is accomplished!

Zhongyiio.eth efficiently created a dex.trades mannequin for Frax Swap by @fraxfinance.

Take a look at all the open bounties on @deworkxyz: https://t.co/Ck00NaAOgN

— Avalanche 🔺 (@avalancheavax) November 8, 2022

Along with the aforementioned growth, Avalanche did have another information as properly. The Avalanche Basis was additionally offering incentives price $4 million in AVAX tokens for the decentralized buying and selling platform GMX. Avalanche Rush, which occurs to be a $180 million liquidity incentive program, was the supply of the incentives.

We’re grateful to be part of #AvalancheRush. Let’s deliver buying and selling on @avalancheavax to the following degree, collectively.https://t.co/ZILUC8tsWb

— GMX 🫐 (@GMX_IO) November 8, 2022

Although these developments appeared fairly promising for AVAX, final week didn’t favor AVAX when it comes to its worth motion. The AVAX token registered over 16% adverse weekly positive factors. At press time, AVAX was trading at $14.97 with a market capitalization of $4,486,370,761.

Nonetheless, was the AVAX downfall an consequence of the present bearish market or was there an even bigger image to be appeared out for?

Learn Avalanche’s [AVAX] Value Prediction 2023-24

Ought to buyers loosen up?

Traders might need issues with AVAX’s latest worth motion, however a take a look at the token’s on-chain metrics painted a special image. This was as a result of some metrics performed in favor of AVAX.

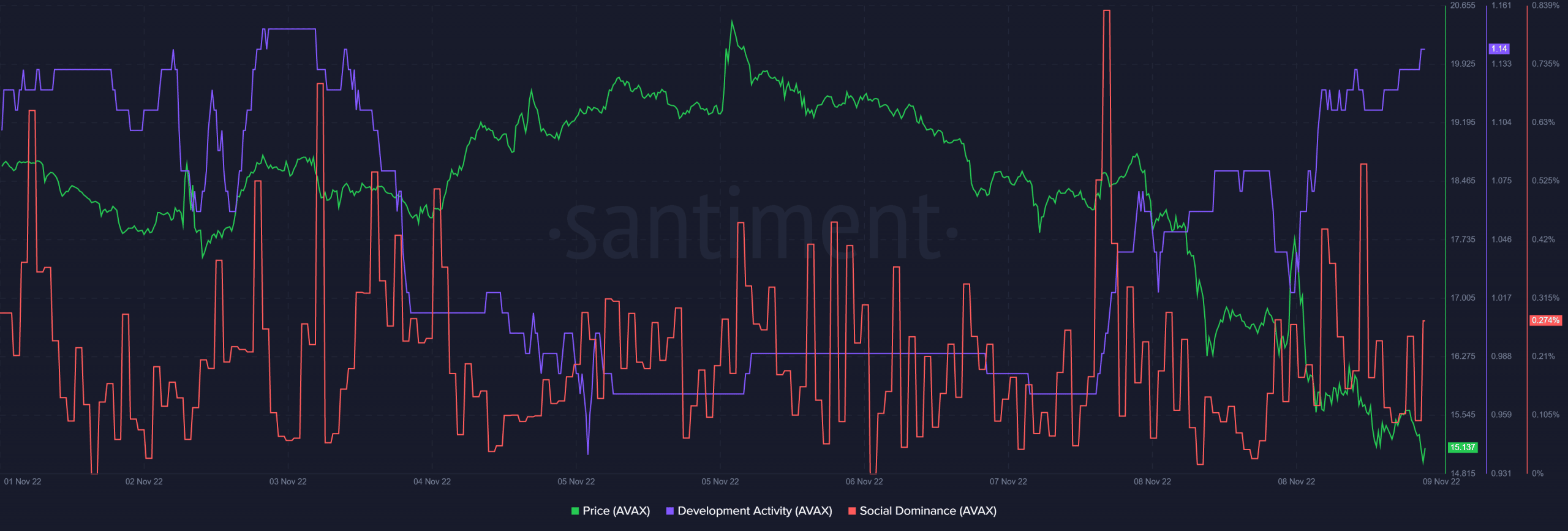

AVAX’s growth exercise witnessed a surge just lately, which was signal as a result of it represents builders’ efforts in the direction of the community. AVAX’s additionally remained fairly in style within the crypto neighborhood, as its social dominance spiked on 7 November.

Supply: Santiment

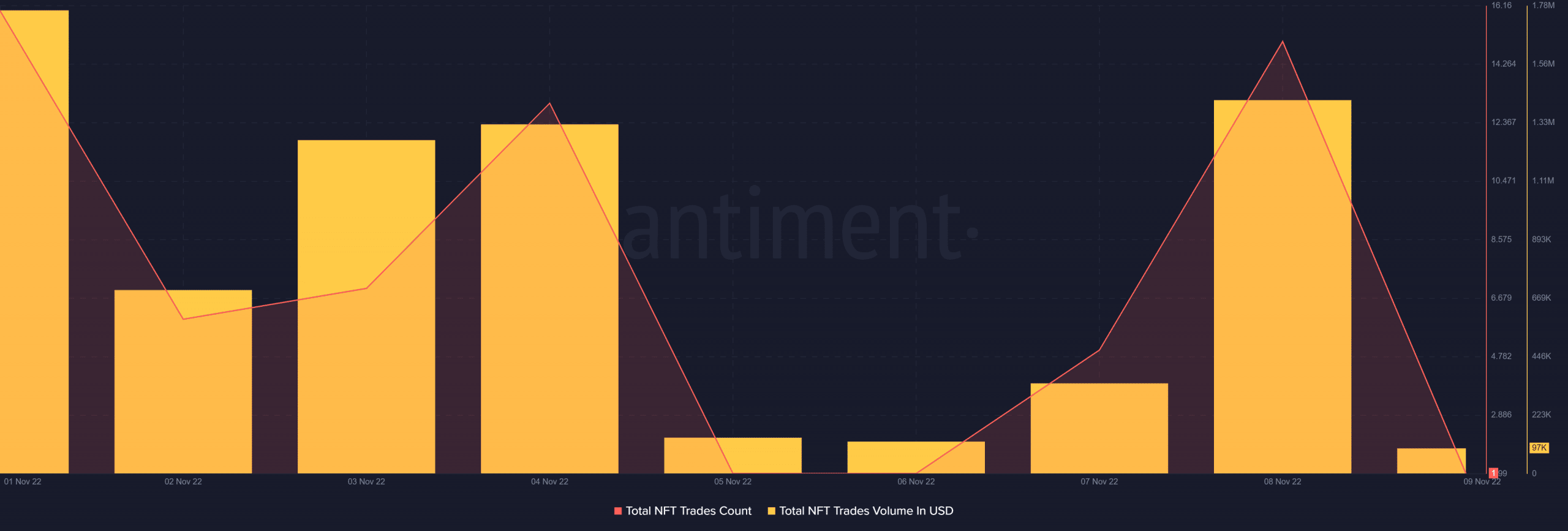

Moreover, AVAX’s NFT area additionally witnessed development as whole NFT commerce depend elevated. The NFT commerce quantity in USD additionally witnessed a spike on 8 November.

Supply: Santiment

AVAXDaily, a well-liked Twitter deal with that posts about developments within the Avalanche community, additionally posted an informative tweet. The tweet revealed the Avalanche NFT collectibles rating by quantity gross sales within the final seven days.

Avalanche NFT Collectibles rating by Quantity Gross sales 7D@PlayCrabada@Assethas@NoxBeyond@Apelanche@MadSkullz_NFT@pumpskin_xyz@OgerzKlan@OuroborosGameFi@EvoxCapital@HatchyPocket#avalanche $AVAX #NFT pic.twitter.com/eTHscJ8A26

— AVAX Every day 🔺 (@AVAXDaily) November 8, 2022

LunarCrush’s data additionally revealed that AVAX’s volatility was significantly excessive. Taking into consideration the latest adverse efficiency of AVAX, the hike in volatility would possibly point out an extra downtrend.

The bears are right here

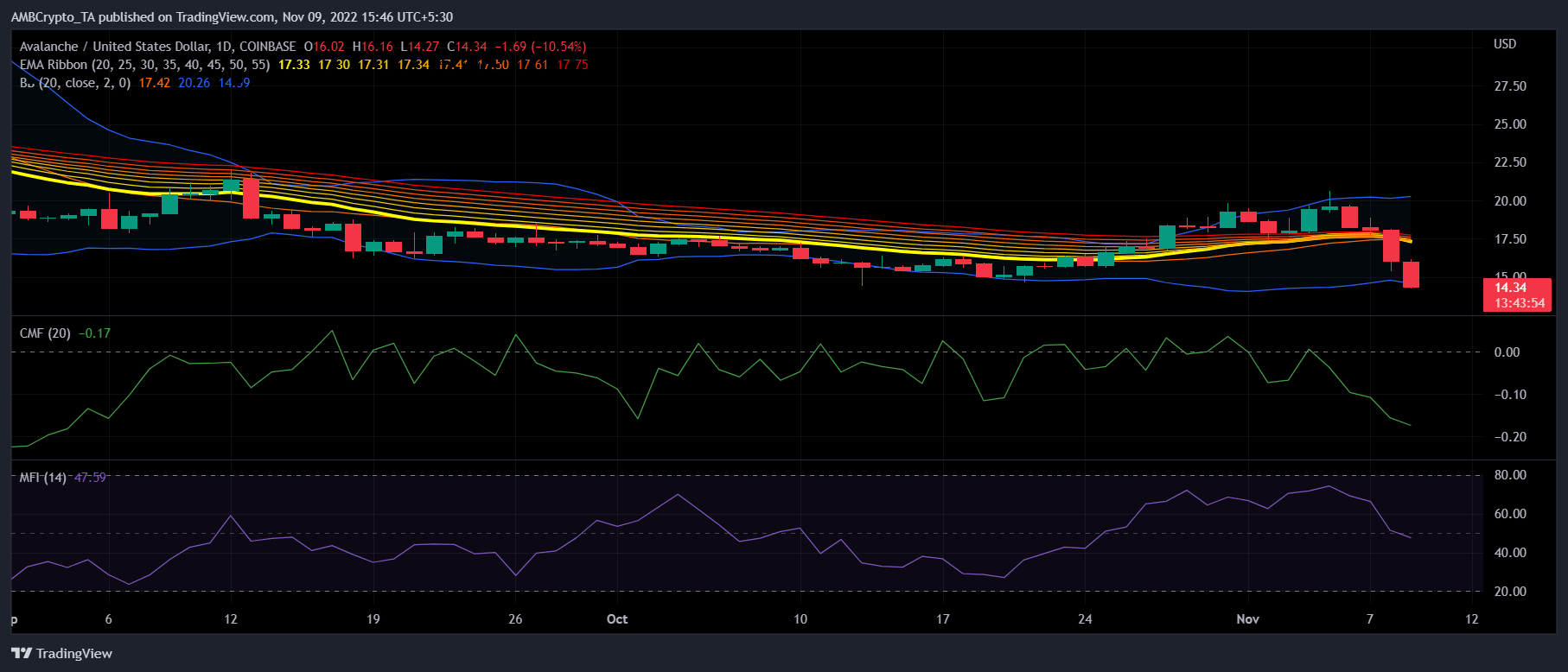

AVAX’s day by day chart instructed that the bears had been gearing up, as many of the market indicators revealed that AVAX’s worth would possibly get additional down within the days to return. As an illustration, the Exponential Transferring Common (EMA) Ribbon displayed a bearish crossover.

Not solely this, however the Cash Circulate Index (MFI) additionally registered a downtick and was headed under the impartial mark. This might be thought-about as a adverse sign. The Chaikin Cash Circulate (CMF) additionally adopted the same path and went down considerably. The Bollinger Bands (BB) instructed that AVAX’s worth was in a excessive volatility zone, additional rising the possibilities of a worth plummet.

Supply: TradingView