Bitcoin Market At Decision Point: aSOPR Retests Crucial Level

The Bitcoin market could also be near a choice level as on-chain knowledge reveals the Adjusted Spent Output Revenue Ratio (aSOPR) is retesting the 1.0 degree.

Bitcoin aSOPR Has Declined In direction of A Worth Of 1.0 Not too long ago

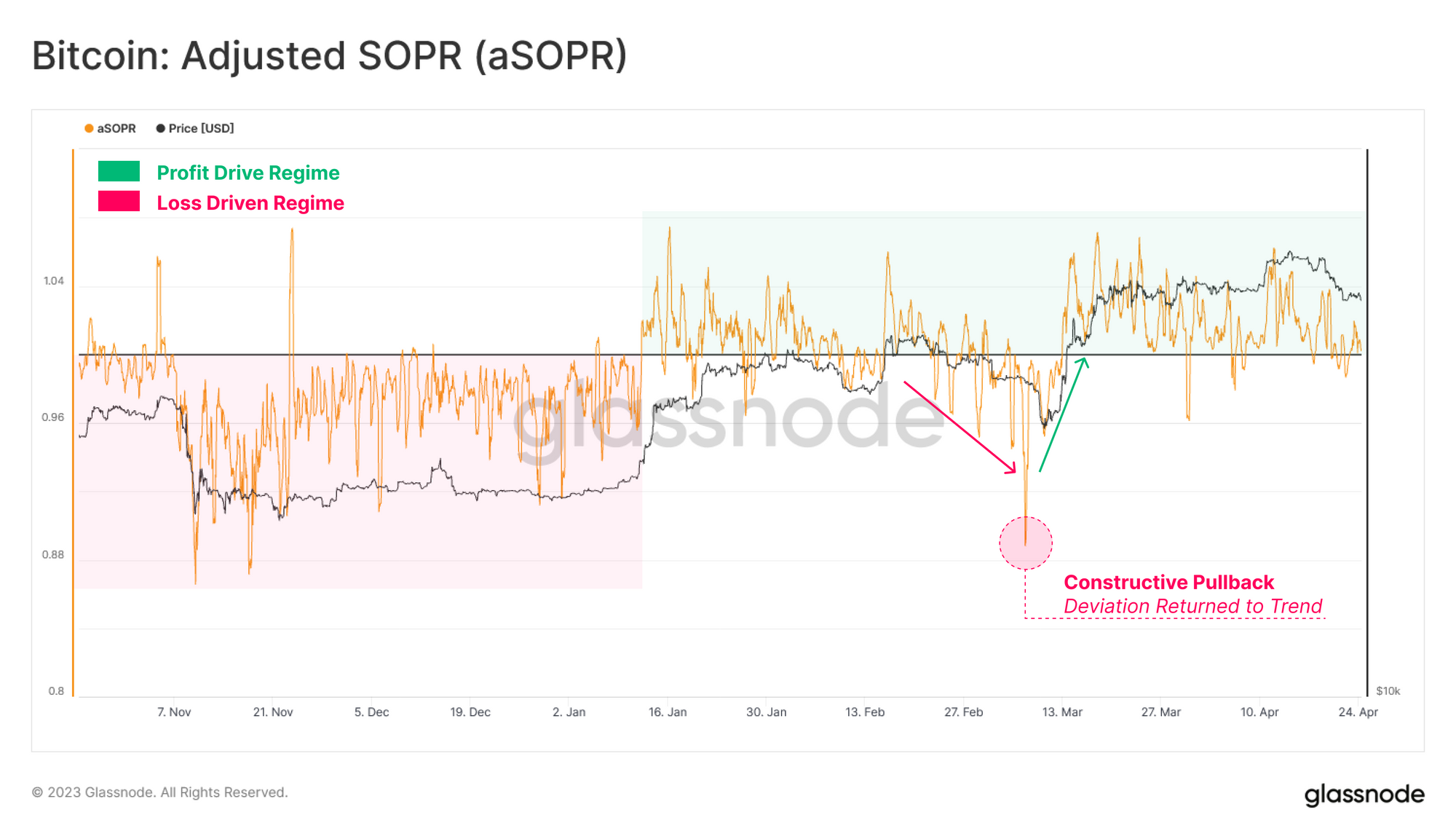

Based on the newest weekly report from Glassnode, the BTC market had shifted in the direction of a profit-dominated regime again in January. The “aSOPR” is an indicator that tells us whether or not the typical investor is promoting their Bitcoin at a revenue or at a loss presently.

The “adjusted” in aSOPR comes from the truth that this metric has been adjusted for filtering out transactions/gross sales of all cash that have been completed inside just one hour of the earlier transaction/buy. The advantage of making this restriction is that it removes all noise from the information that wouldn’t have had any noticeable implications for the market.

When the worth of this indicator is larger than 1.0, it means the full quantity of earnings being harvested by the traders is greater than the losses proper now. Then again, values of the metric beneath the edge recommend the market as a complete is realizing some losses in the intervening time.

The 1.0 degree itself naturally serves because the break-even mark, the place the full quantity of earnings turns into equal to the losses.

Now, here’s a chart that reveals the pattern within the Bitcoin aSOPR over the previous couple of months:

The worth of the metric appears to have been above the 1.0 mark in current days | Supply: Glassnode's The Week Onchain - Week 17, 2023

Traditionally, the aSOPR 1.0 degree has been fairly essential for Bitcoin, because it has represented the mark the place the transition between bullish and bearish traits has taken place.

Throughout bear markets, the indicator usually stays beneath this degree, as traders naturally notice massive losses. The mark acts as resistance in such market situations, which means that any makes an attempt to interrupt above it often find yourself in failure.

Quite the opposite, the 1.0 degree acts as a assist for the worth throughout bullish durations, ensuring that the indicator stays within the earnings zone. Each these patterns may also be seen in motion within the above graph, because the 2022 bear market noticed the metric being caught within the zone beneath 1.0, whereas the rally that began in January has noticed it’s within the inexperienced space.

There was an exception final month, nonetheless, when the Bitcoin aSOPR sharply plunged beneath the 1.0 mark attributable to a pointy plunge within the value. It wasn’t lengthy, although, earlier than the metric (and likewise the worth) returned again towards the bullish pattern, implying that it was solely a brief anomaly.

Not too long ago, because the asset’s value has as soon as once more been taking place, the indicator has additionally declined towards the 1.0 degree. “With aSOPR presently retesting the break-even degree of 1.0, this places the market near a choice level,” explains Glassnode.

It now stays to be seen whether or not the retest can be profitable, and this degree will act as assist for the worth, or if a break beneath will happen, presumably bringing with it extra decline for the cryptocurrency.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,300, down 10% within the final week.

BTC has seen some sharp decline not too long ago | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com