Bitcoin Dominance Grows As Crypto Risk Appetite Remains Low

The crypto market has been shifting within the purple throughout right now’s buying and selling session with Bitcoin and Ethereum surrendering the previous week’s good points. The primary cryptocurrency by market capitalization appears to be reacting to the Federal Open Market Committee (FOME) assembly set for tomorrow.

Throughout this occasion, the U.S. Federal Reserve (Fed) is predicted to doubtlessly announce a rise in rates of interest. Projection geared toward a 75 foundation factors (bps) hike, however the monetary establishment would possibly shock the market with a 100 bps in an try to chop down inflation.

The Shopper Value Index (CPI), a metric used to measure inflation within the U.S. greenback, stands at a 40-year-old excessive. This has compelled the Fed to shift its financial coverage by mountain climbing rates of interest, lowering its stability sheet, and eradicating liquidity from world markets.

As a consequence, Bitcoin and the crypto market have been trending to the draw back. The benchmark crypto noticed a interval of relative stability when it was in a position to stabilize at round $20,000, BTC’s worth present stage.

The altcoins sector was much less lucky as Ethereum (ETH), Cardano (ADA), Solana (SOL), and different main cryptocurrencies broke under important resistance. Some altcoins return to their 2020 ranges as Bitcoin dominance trended to the upside.

This is a sign of uncertainty and risk-off sentiment within the crypto market. The metric noticed a decline over the previous two weeks on the again of expectations of mitigating inflation, supported by a drop within the worth of commodities, and the announcement of a date for the Ethereum “Merge”.

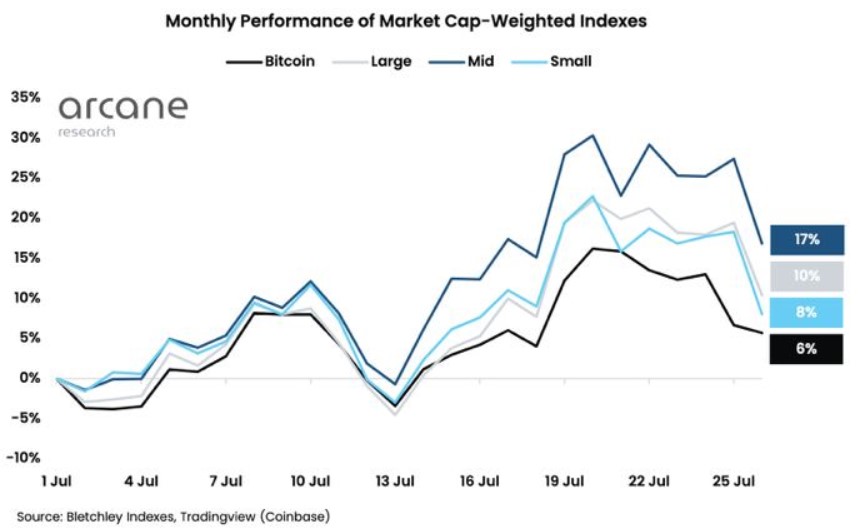

Information from Arcane Analysis helps the above because the analysis agency information a lower in efficiency for his or her Massive, Mid, and Small Cap Index. As seen under, these indexes have been recording heavier losses than Bitcoin as BTC Dominance picks up bullish momentum.

Bitcoin Dominance Spike Hints At Crypto Market Uncertainty

Arcane Analysis famous that the general weak point within the sector is pushed by a “pure rotation as merchants search security in a falling market”. The rise in Bitcoin dominance has been accompanied by an increase in stablecoin whole market share.

In different phrases, market individuals are shopping for Bitcoin and stablecoins to guard them from potential draw back dangers. The report acknowledged:

Ether’s lack of energy relative to bitcoin has triggered its market dominance to fall 0.34% during the last week. Alternatively, Bitcoin has seen its market share enhance by 0.47%. It is a pure rotation as market fall, provided that buyers understand bitcoin as a lower-risk asset than ether.

Tomorrow’s FOMC assembly will determine the short-term destiny of BTC dominance and the destiny of bigger cryptocurrencies.