Bitcoin Barrels Towards $24k As Miners Move $300 Million From Wallets

Provided that the worth of Bitcoin has been lingering above the $17K–$20K vary over the previous few weeks, Bitcoin’s sharp downturn has come to an finish. The value is at present retesting the $23K resistance degree after being rejected thrice from the $20K help space.

Bitcoin Advocates Rejoice

The market flashed its first vital reduction rally in not less than a month, and crypto lovers rejoiced on the sight of inexperienced on July 19 because the months of “down solely” value motion lastly got here to a cease.

In response to TradingView information, Bitcoin’s (BTC) breakthrough over resistance at $23,000 to succeed in a each day excessive of $23,447—its first considerable transfer above the 200-week transferring common—is essentially liable for the renewed optimism.

The $23K degree can be experiencing further opposition from the 50-day transferring common. An additional retest of the $20K help degree and maybe a deeper adverse continuation are anticipated on this state of affairs as a result of it seems as if these two factors are at present rejecting the worth’s transfer downward. The bulls, although, appear eager to grab the extent.

BTC/USD barrels in the direction of $24k. Supply: TradingView

So as to assess the probability of a adverse reversal, the worth motion on the decrease timeframes needs to be intently monitored all through the course of the following couple of days. A rally into the $30K provide zone is the subsequent transfer, particularly if a bullish breakthrough occurs above the $23K-$24K vary.

Whereas many have predicted an increase to the mid-$30,000 space, a number of analysts have expressed concern that it’d simply be one other fakeout pump.

“Weekly Candle Shut Above $22,800”

Rekt Capital, a cryptocurrency analyst, posted the next chart with the remark that “For the primary time in weeks, BTC is placing in a good effort to attempt to reclaim the 200-week MA as help.” The analyst has been paying shut consideration to the transfer again above the 200-week MA.

Associated Studying | Mid Cap Crypto Cash Lead In July, Greatest Means To Climate The Winter?

In latest weeks, the 200-week MA has obtained quite a lot of consideration because it has historically acted as a reliable bear market indicator that has given perception into when a backside has been set.

As per Rekt Capital,

“BTC must Weekly Candle Shut above $22800 to efficiently verify a reclaim of the 200-week MA as help.”

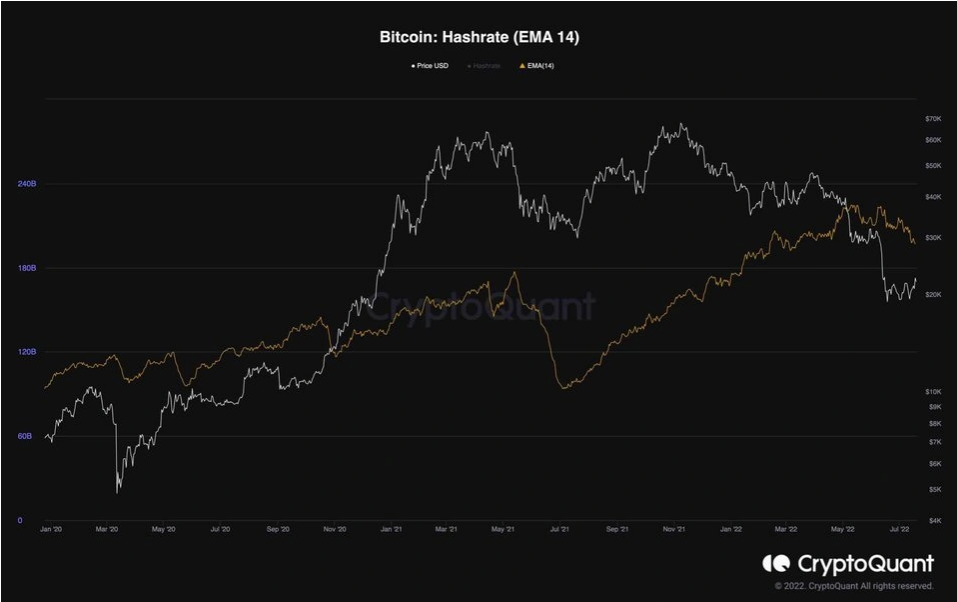

Miners Capitulate

Miners have entered the capitulation part, who’ve began to barely distribute their holdings. The hashrate of Bitcoin has been in a minor downturn following a brand new all-time excessive throughout the earlier shakeout, exhibiting the identical conduct.

Inside a 24-hour interval, cryptocurrency miners eliminated as much as 14,000 bitcoin, every value $300 million, from their wallets.

As a result of latest decline within the worth of many digital currencies, miners offered their bitcoin holdings.

Supply: CryptoQuant

This minor fall within the hashrate is predicted on condition that Bitcoin’s value is at present roughly 74% off its all-time excessive and that mining will not be worthwhile for a lot of miners and swimming pools. However regardless of the present value correction’s measurement, the hashrate continues to be doing pretty nicely. Previously, the bear market’s final part has been recognized by the capitulation of the miners. Subsequently, there’s a robust probability that Bitcoin will quickly attain its long-term backside and begin a contemporary uptrend towards increased value ranges.

Associated Studying | Bitcoin Marks One Month Of Destructive Funding Charges, Extra Decline Incoming?

Featured picture from iStock Picture, charts from TradingView.com and CryptoQuant