Binance Coin reaches a significant resistance zone, can the bulls conquer it?

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

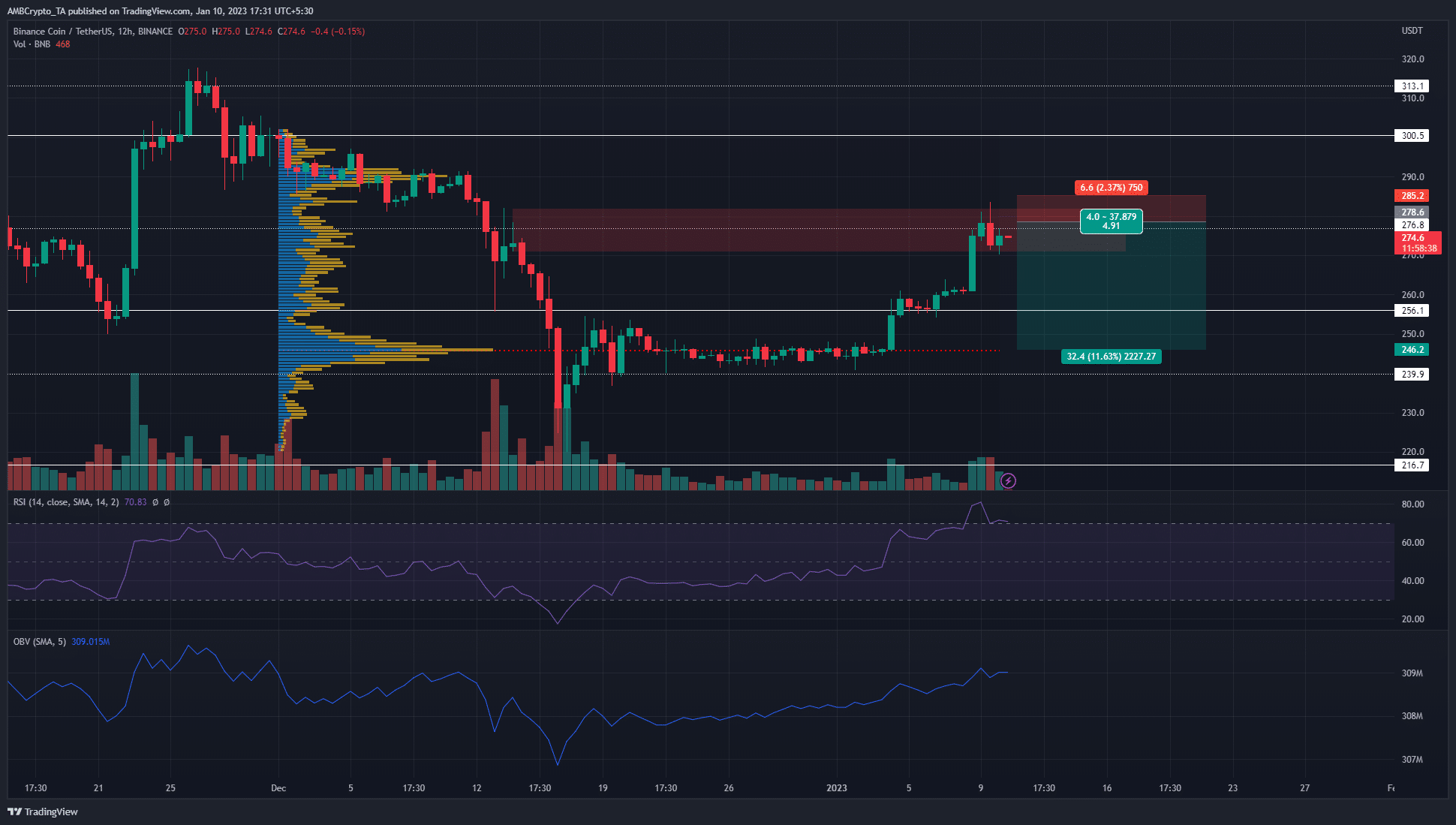

- The $278 mark and its neighborhood had a powerful confluence of resistance ranges

- Merchants can watch for a decrease timeframe break within the construction downward earlier than shorting

Binance Coin has recovered from the sharp plunge it noticed in mid-December. The $250 space was anticipated to pose stiff resistance to the value, however the asset was in a position to flip $256 to help and climb larger.

Learn Binance Coin’s [BNB] Worth Prediction 2023-24

This got here within the wake of some short-term bullish momentum from Bitcoin. The king of crypto was in a position to climb previous the $17k mark, and at press time stood at $17.2k. It confronted resistance at $17.3k and $17.6k. A breakout previous these ranges might usher in one other transfer upward throughout the crypto market.

The sturdy surge in latest days has left inefficiencies to the south that the value might fill

Supply: BNB/USDT on TradingView

There are a lot of paths for Binance Coin going ahead. A transfer above the bearish order block at $278 will probably see Binance Coin rise to $300 and $315. Nevertheless, consumers may have to beware a faux rally previous $280 earlier than a reversal.

The opposite path was consolidation between $260-$280 for BNB. Just like the consolidation in late December, this might give bulls time to reload ammunition earlier than launching BNB larger. This was a extra unlikely situation, as Bitcoin confronted intense resistance at $17.6k.

Are your holdings flashing inexperienced? Test the BNB Revenue Calculator

A extra probably path was a rejection within the $275-$280 space. The swift transfer upward has left honest worth gaps on the chart that the value might search out. For merchants to enter brief positions, a transfer beneath $270 and a subsequent retest can provide a promoting alternative.

A transfer northward can power a considerable amount of liquidations, and merchants can watch for a northward flush earlier than assessing their choices.

Bears can anticipate a transfer south to the Level of Management at $246. This was the Level of Management based mostly on the Fastened Vary Quantity Profile, which additionally confirmed the $283.7 mark to be the Worth Space Excessive.

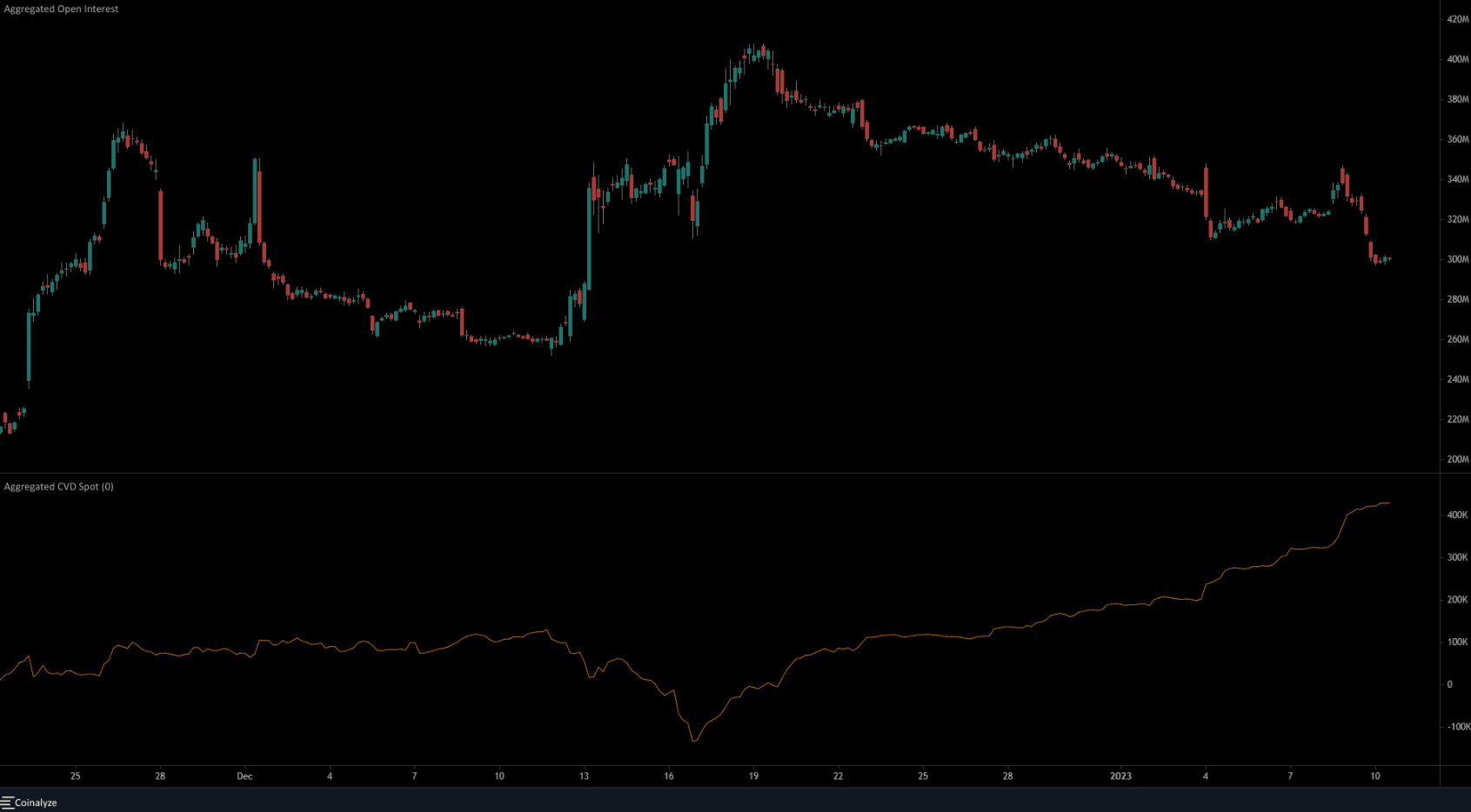

The Open Curiosity pointed towards discouraged lengthy positions

Supply: Coinalyze

On 12 December, Binance Coin started to drop from $285. On 16 December it reached the lows at $225. Throughout this time the Open Curiosity was rising, to point out sturdy bearish sentiment. Nevertheless, when BNB solid its restoration again to the $280 zone, solely the spot CVD was on the rise.

Actually, over the previous couple of days, when BNB climbed from 260 to $280, the Open Curiosity has really declined. This was indicative of discouraged longs, and pointed towards some bearishness available in the market.