Binance Coin [BNB] open interest surges, funding rate declines; still…

- BNB’s open curiosity elevated as merchants turned to the coin for potential income

- The funding charge declined throughout all exchanges as BNB risked a worth reversal from away from the weekly greens registered

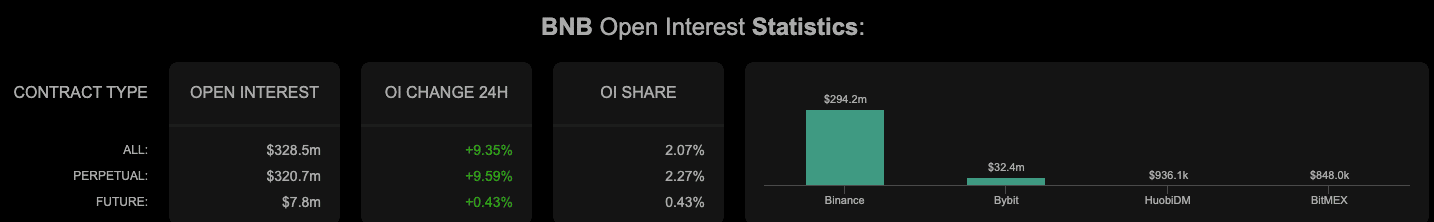

Binance Coin [BNB] loved some undivided consideration from merchants as its open curiosity surged following a 13.90% seven-day worth enhance. In accordance with Coinalyze, the open interest of the trade coin elevated 9.35% within the final 24 hours, driving it as much as $294.2 million on the Binance platform.

It was about $328 million throughout all exchanges. This implied that there have been quite a few contracts open in a bid to revenue from BNB.

Supply: Coinalyze

Learn BNB’s Value Prediction 2023-2024

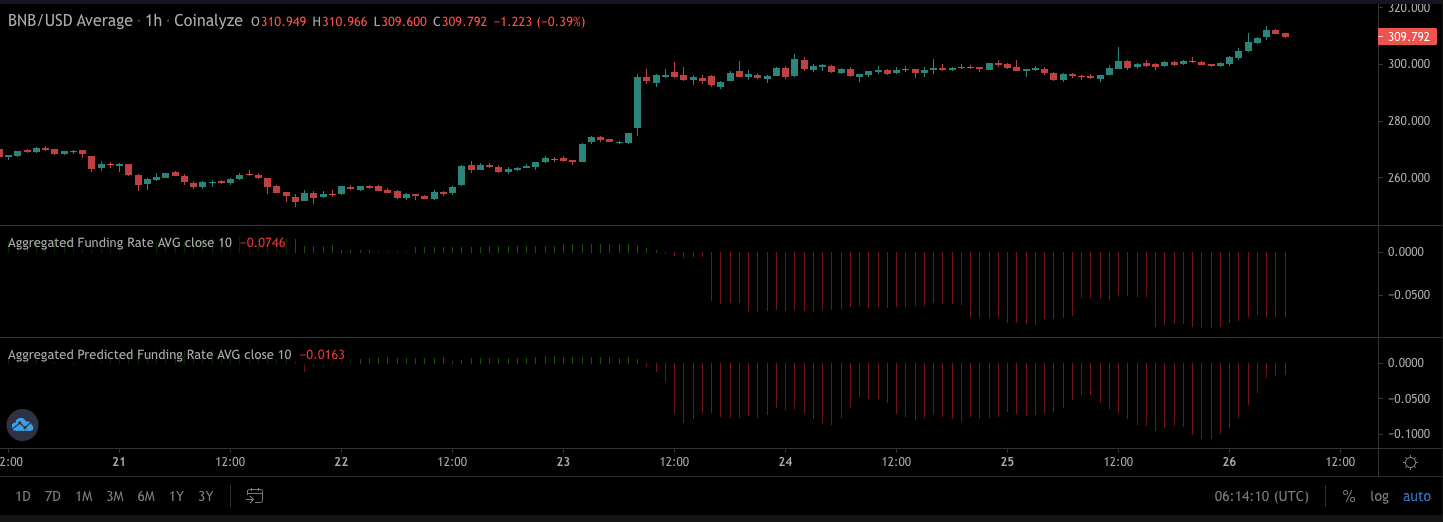

Nonetheless, the case was completely different with the funding charge. In accordance with the futures market information aggregator, BNB’s funding charge was mostly negative. The funding charge helps to know market sentiment and doable worth developments. Within the present situation, with much less capital deployed, BNB might seemingly trip alongside the bearish strains.

As per the chart under, merchants’ short-position is perhaps the order of the day. The liquidation information revealed that longs have been already “donating” to their opposing counterparts.

Supply: Coinalyze

Weekly features and impending happenings

Regardless of the rivalry between the funding charge and open curiosity, the BNB chain might nonetheless maintain its weekly data. In a tweet dated 25 November tweet, the deal with of BNB Chain confirmed that the platform had registered 3.18 million common each day transactions. This implied {that a} good variety of addresses had interacted with the community.

Atone for the important thing metrics of BNB Chain from the previous week ⤵️ pic.twitter.com/JxgcAD7xR8

— BNB Chain (@BNBCHAIN) November 25, 2022

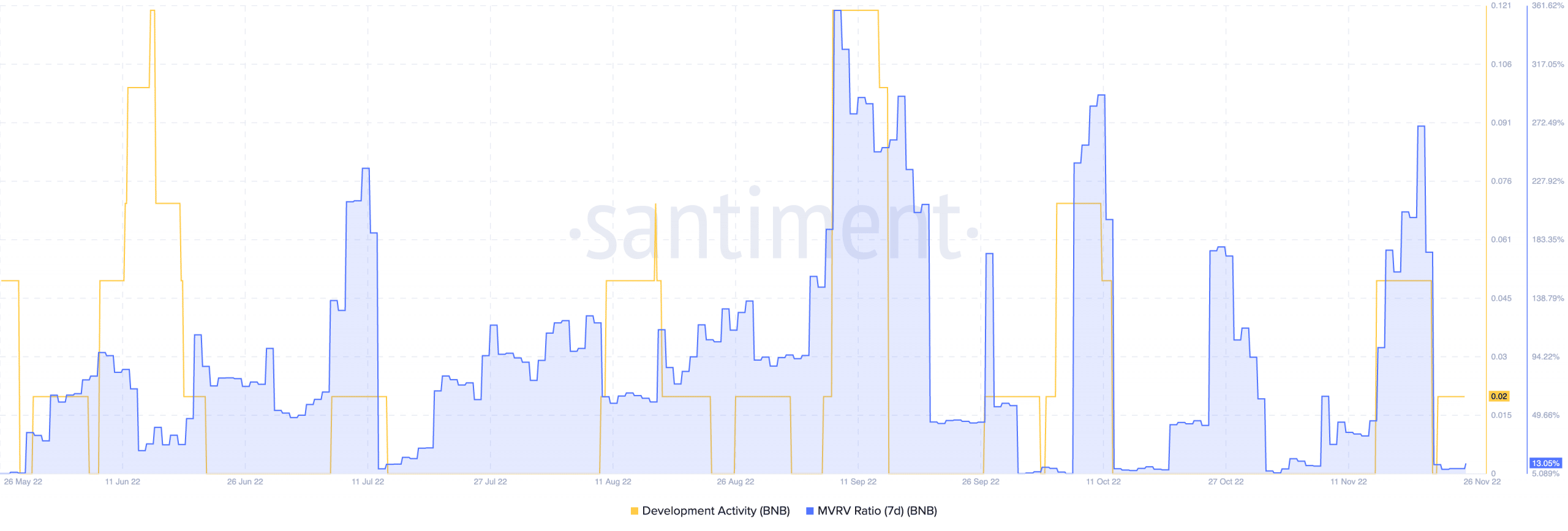

Nonetheless, the uptick gathered within the final seven days couldn’t drive traders’ revenue to important ranges. In accordance with Santiment, the Market Worth to Realized Worth (MVRV) ratio had decreased to 13.05% on the time of this writing. As of 20 November, the MVRV ratio stood at a excessive of 269%.

This position meant that traders’ income have been removed from hitting double of their holdings. Nonetheless, it is perhaps thought of an undervalued state for the reason that ratio was not unfavorable.

As for its improvement exercise, the on-chain analytic platform revealed that it was in the identical place since 22 November. Thus, there was a minimal want for upgrades on the BNB chain. Regardless, it didn’t imply that there was decreased dedication to the challenge, particularly as the identical metrics elevated to 0.02 a couple of days again.

Supply: Santiment

Binance whales would relatively maintain on

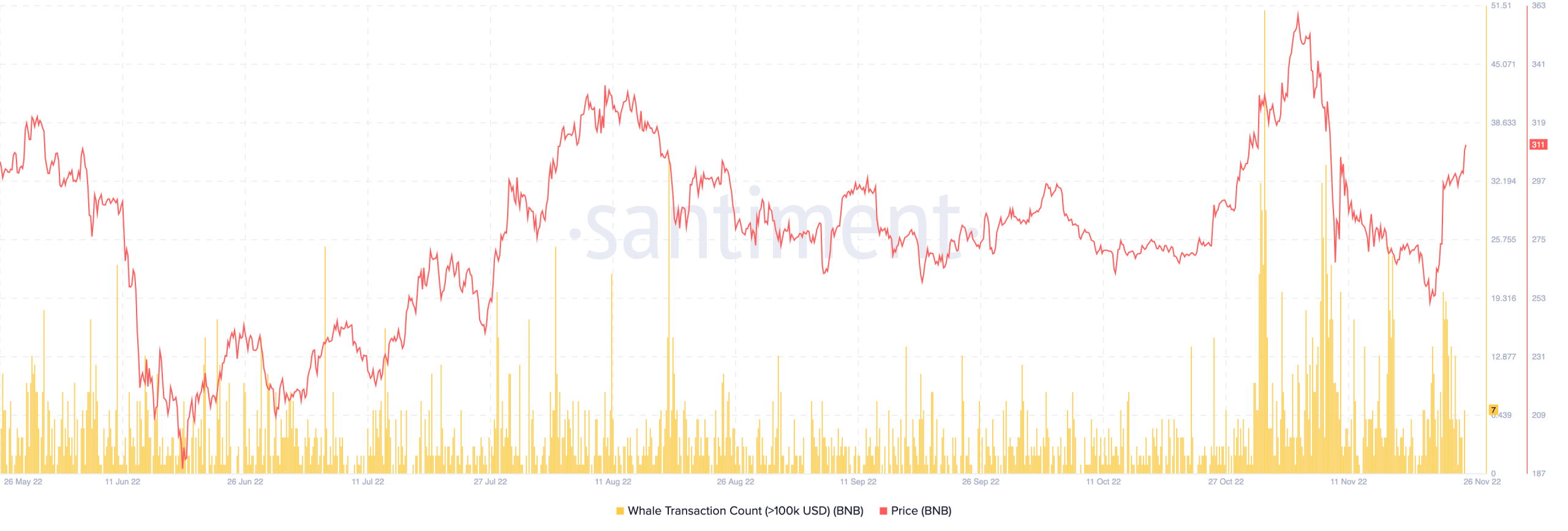

Additional evaluation of BNB’s on-chain place revealed that the trade coin whales most well-liked to not go all in accumulation. Based mostly on Santiment’s information, there have been solely seven whale transactions price $100,000 or extra.

This quantity wasn’t sufficient to drive a rally. Actually, a worth reversal might be within the works. This was as a result of BNB, buying and selling at $311, misplaced 0.08% of its worth previously hour at press time.

Supply: Santiment