As ETH is about to fall beneath support zone, here is what traders can expect

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought of funding recommendation

- The market construction was strongly bearish

- Ethereum perched precariously above a zone of demand

Ethereum [ETH] posted losses of 12.5% because the $1,351 excessive that it reached on 14 December. The bulls fought to defend the 12-hour order block close to $1,160. This space has acted as help since late November.

Learn Ethereum’s [ETH] Worth Prediction 2023-2024

A transfer under $1,150 might see ETH drop shortly to the $1072 stage. This marked the lows of a variety that Ethereum has traded inside because the first week of November. The technical indicators strengthened bearish sentiment as nicely.

The bullish order block has been defended to this point however the bears stay dominant

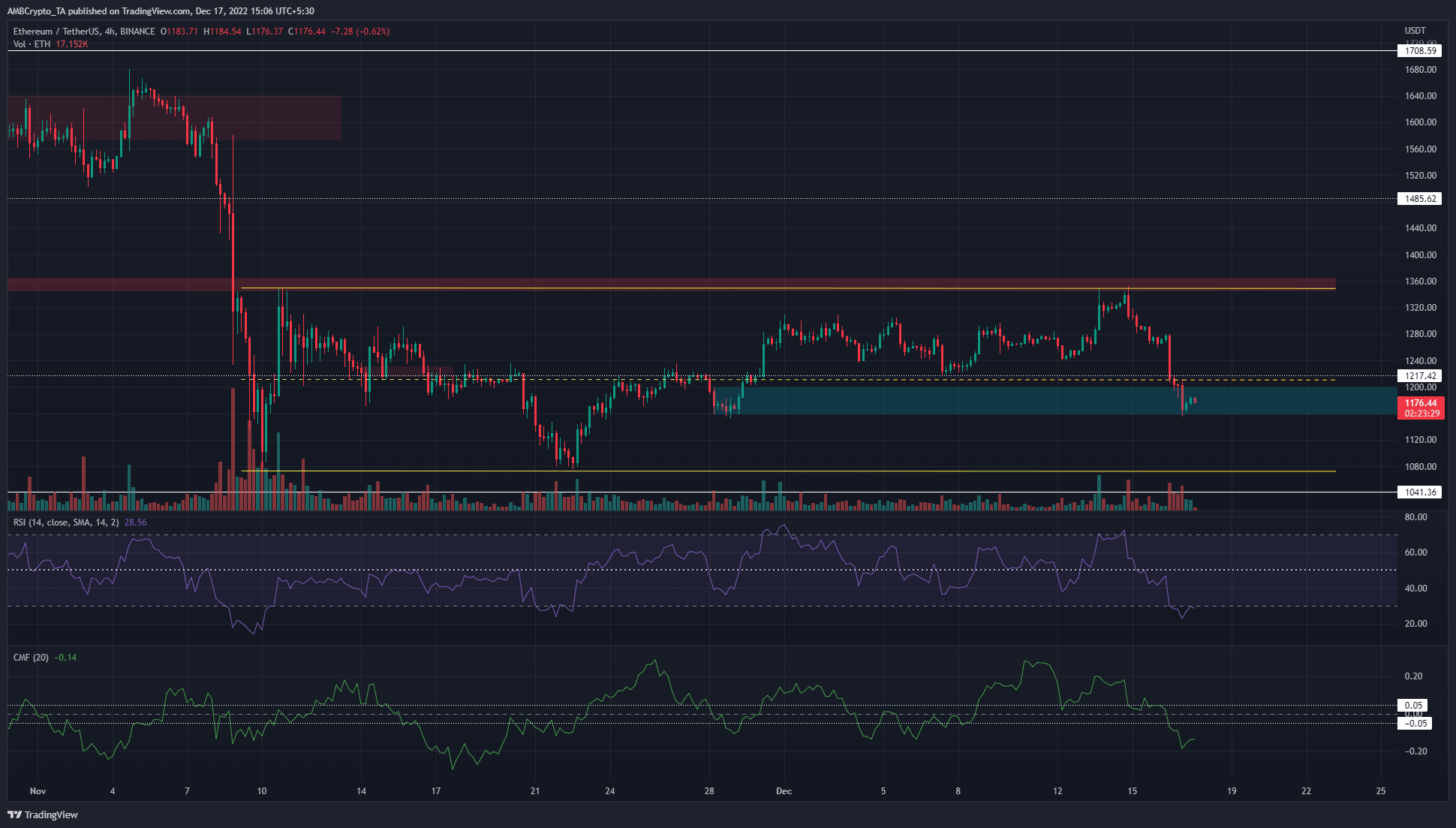

Supply: ETH/USDT on TradingView

The cyan field that ETH traded inside at press time represented a 12-hour bullish order block. To date, the 12-hour buying and selling session has not closed under this OB. The four-hour chart confirmed that momentum and promoting strain have been firmly within the bears’ arms.

The Relative Energy Index (RSI) dropped under impartial 50 in current days and retested it as resistance. Though it stood at 28.5, indicating oversold situations, that didn’t imply additional losses couldn’t comply with for Ethereum. The Chaikin Cash Movement (CMF) was additionally nicely under -0.05 and confirmed vital capital movement out of the market.

Brief sellers can anticipate a transfer beneath $1,160 and a retest of the $1,160-$1,200 space to position promote orders focusing on the vary lows close to $1,080. For a bullish bias to materialize, ETH bulls need to haul the costs again above the mid-range mark at $1,211.

MVRV ratio drops as holders expertise drawdown as soon as extra

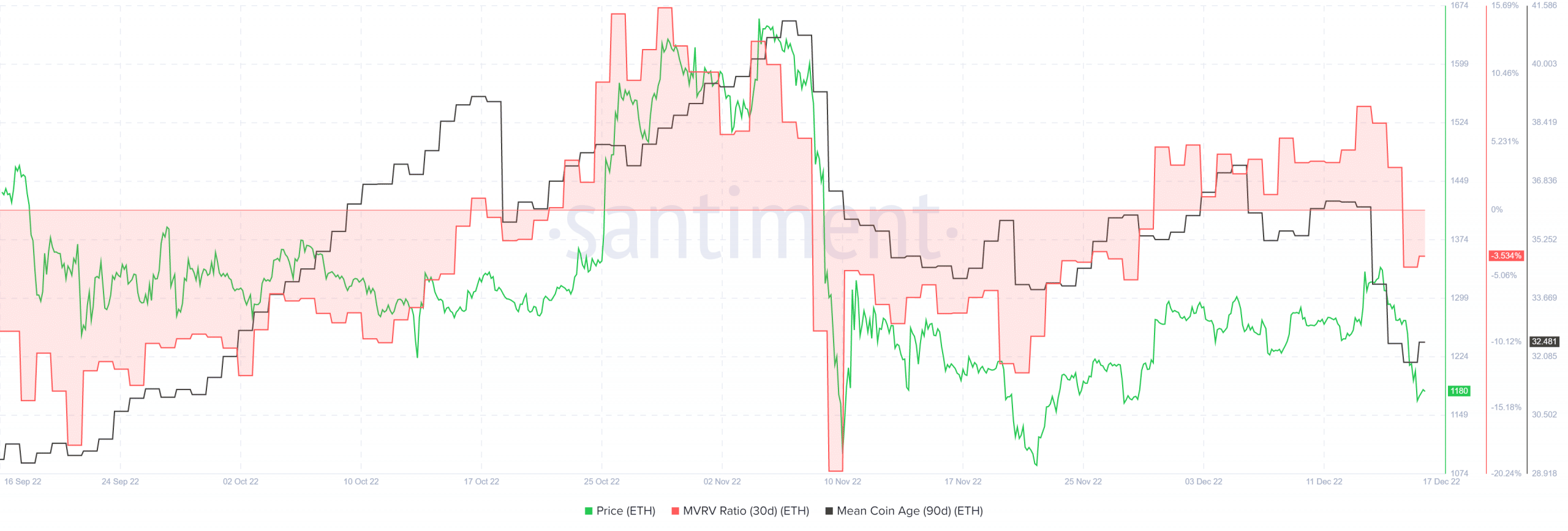

Supply: Santiment

The Market Worth to Realized Worth (MVRV) (30-day) picked up above the 0 mark early in December. It stayed above for almost two weeks and signaled that short-term holders have been at a revenue. Nonetheless, the current wave of promoting noticed Ethereum rejected on the vary highs at $1350. Alongside the drop in worth, the MVRV additionally dropped to point out holders noticed their income worn out.

The imply coin age (90-day) metric made feeble makes an attempt to ascertain an uptrend from mid-November to early December. The previous few days noticed the imply coin age drop swiftly as nicely, indicating elevated ETH motion between addresses.