ApeCoin’s short-lived staking hype could have this impact on APE and its holders

- The staking rewards for ApeCoin declined considerably

- The curiosity within the APE token decreased, and NFTs related to the token had been impacted as properly

The announcement of staking rewards for ApeCoin [APE] generated a whole lot of curiosity. There was an upsurge in shopping for the token itself, together with its related NFTs. Nonetheless, a number of days after the announcement, the curiosity in APE light away.

Learn ApeCoin’s [APE] Value Prediction 2023-2024

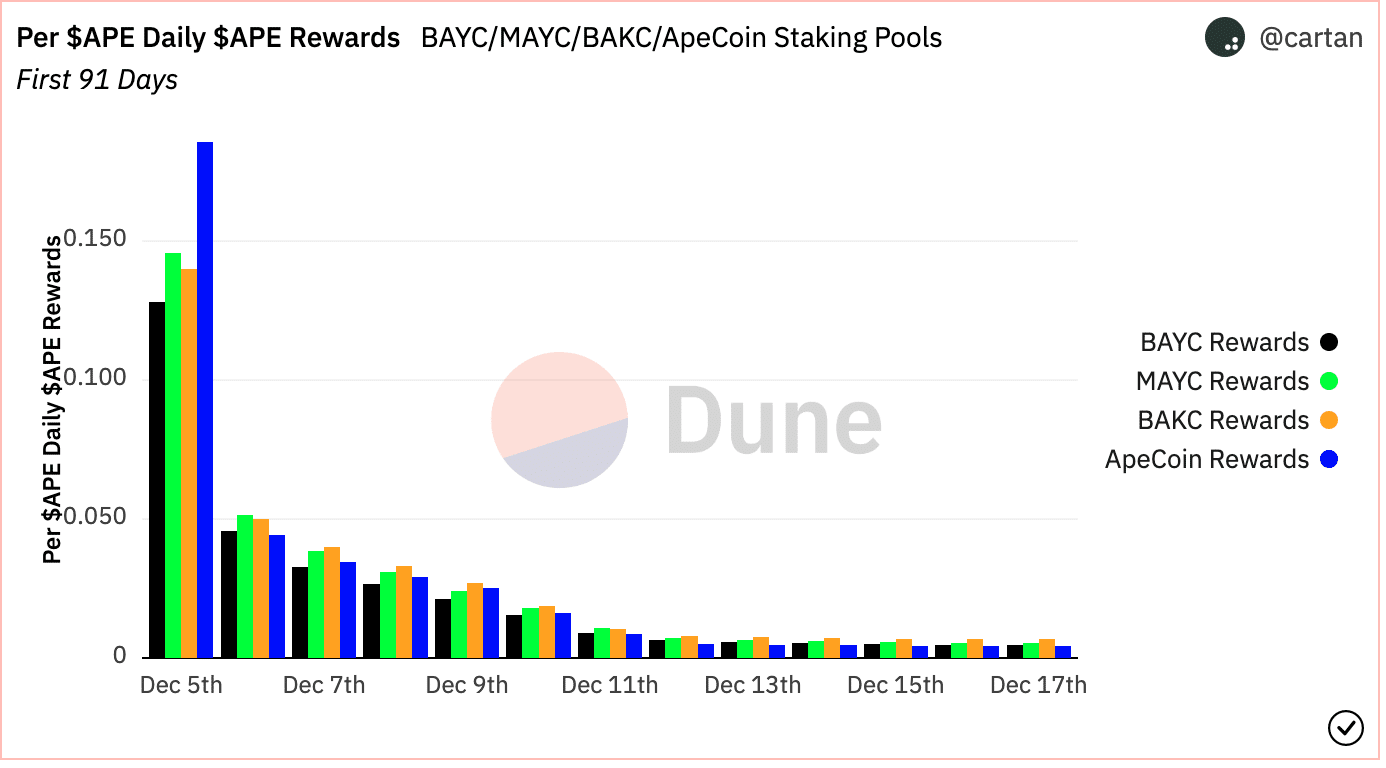

One motive for the declining curiosity in APE could possibly be the declining rewards being generated from staking swimming pools.

In response to information supplied by Dune Analytics, the rewards being given out to stakeholders dropped considerably.

Supply: Dune Analytics

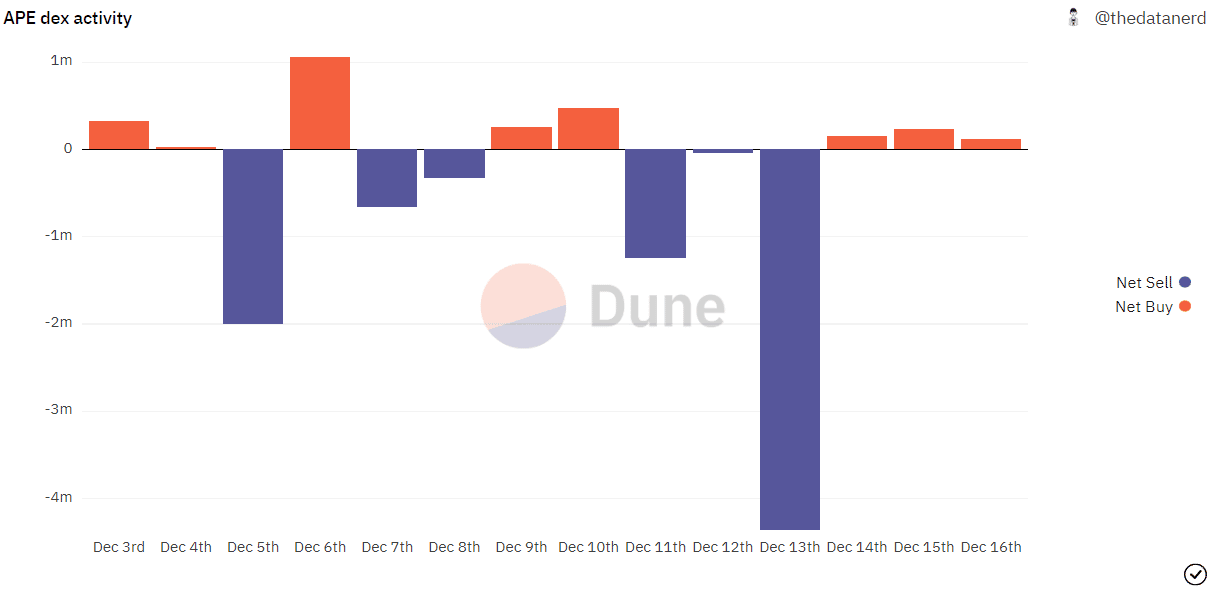

Moreover, one more reason for the declining curiosity in ApeCoin could possibly be the influence brought on by the Binance FUD.

In response to DEX information, APE was dumped closely since 11 December. Despite the fact that the immense quantity of promoting had stopped, the spike in shopping for wasn’t sufficient to revive a lot confidence within the token.

Supply: Dune Analytics

Monkey enterprise

It wasn’t simply the token that was impacted. NFT collections related to ApeCoin, corresponding to Bored Ape Yacht Membership (BAYC) and Mutant Ape Yacht Membership (MAYC) had been additionally affected.

One space that was affected was the typical ground value of the BAYC assortment. As evidenced by the chart beneath, the ground value declined by 4.85% over the past seven days. The common value at which an NFT was being bought additionally decreased by 2.37% throughout the identical interval.

The MAYC assortment was affected on this sector as properly. Its ground value had depreciated by 3.7% and its common value had declined by 2.19% over the past seven days, in response to NFTGO.

Supply: NFTGO

The on-chain metrics of ApeCoin

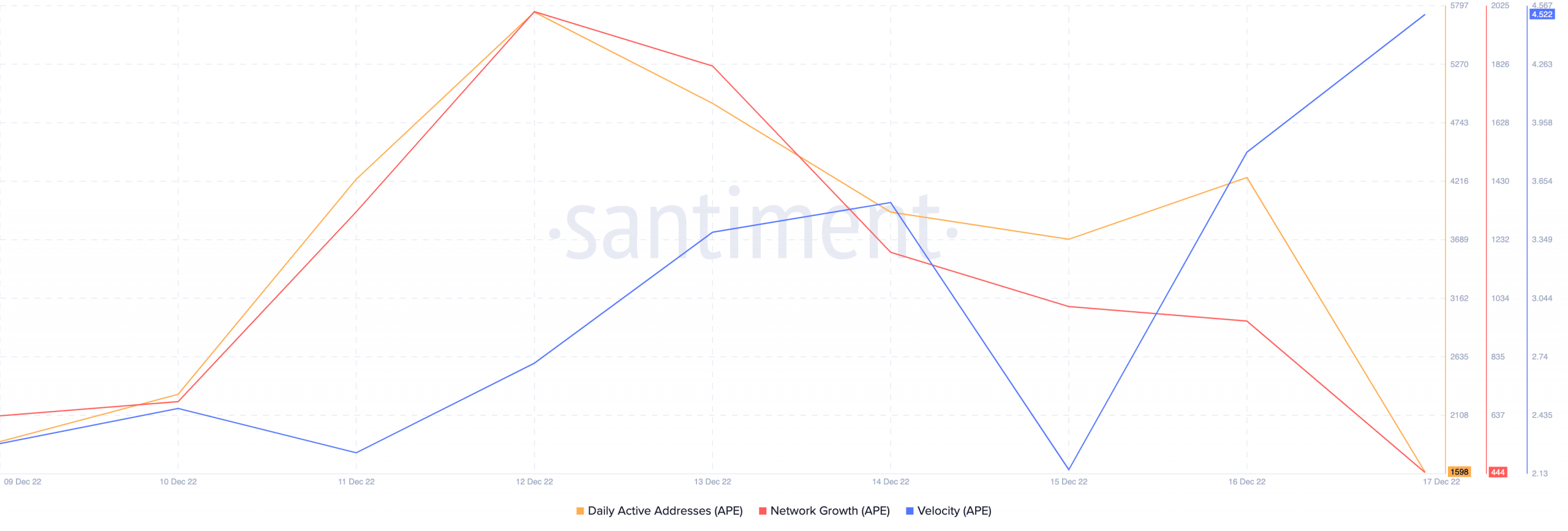

ApeCoin regarded glum, even when it comes to on-chain metrics.

Its every day energetic addresses declined, signaling the truth that exercise on the ApeCoin community had decreased. In a similar way, its community development additionally fell. A shrinking community development implied that the variety of new customers transferring APE for the primary time dropped materially.

Nonetheless, APE’s velocity witnessed a spike, which indicated that the variety of new addresses transferring APE had waned.

Supply: Santiment

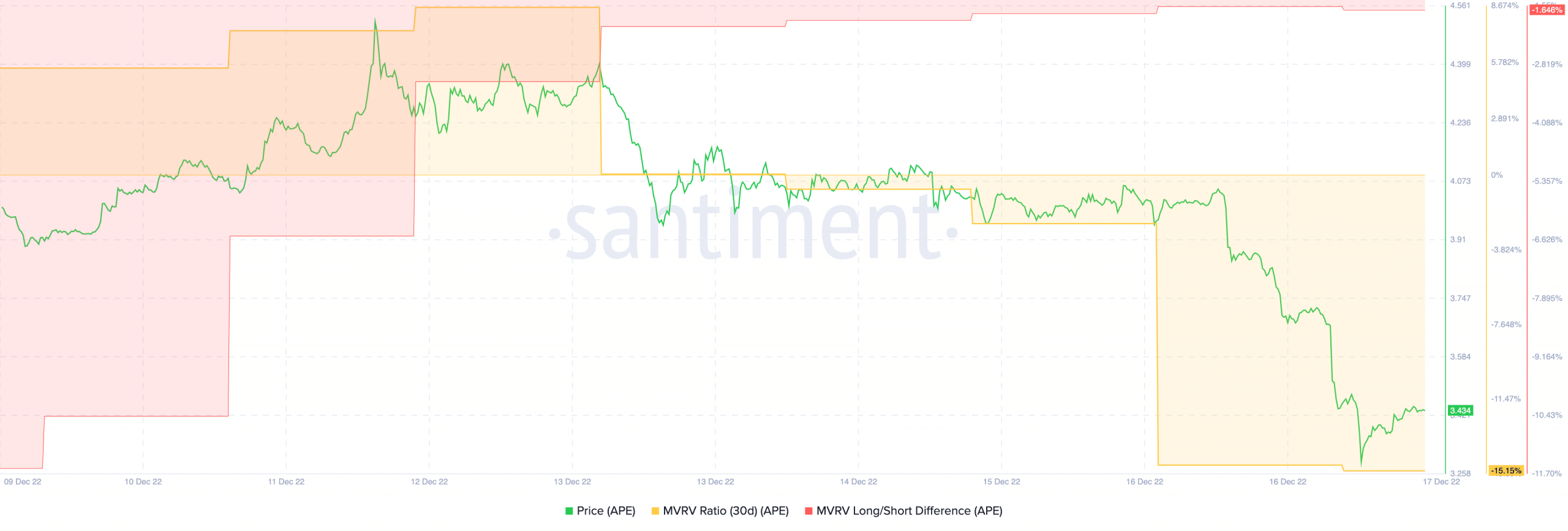

These components contributed to the declining value of APE. As a result of decline in costs, the Market Worth to Realized Worth (MVRV) ratio additionally fell. A low MVRV ratio urged that if most holders bought, they might accomplish that at a loss.

Nonetheless, the lengthy/brief distinction of APE rose. This implied that outdated HODLers who’ve had the token for an extended interval might nonetheless make a revenue in the event that they bought their tokens.

Supply: Santiment

It stays to be decided whether or not long-term APE holders would succumb to the promoting strain or whether or not they would experience out the storm.