ApeCoin reaches a stiff resistance zone, should traders look to go short

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought of funding recommendation

- ApeCoin has been bullish prior to now two weeks

- It reached the next timeframe resistance zone close to $4.5, can the bulls break above it?

Learn ApeCoin’s [APE] worth prediction 2023-24

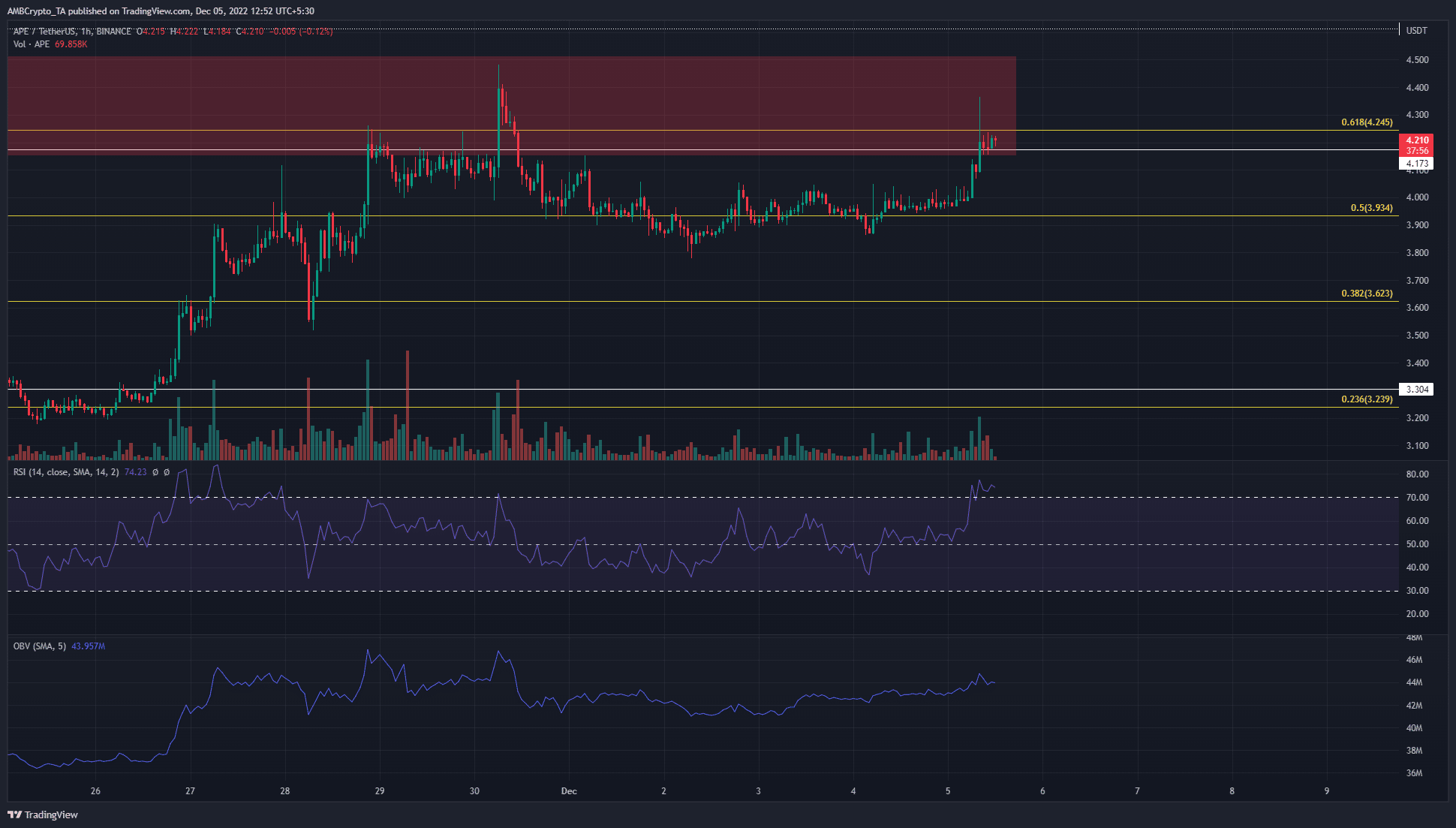

As talked about in a earlier article, ApeCoin noticed vital resistance within the $4.2-$4.5 area. Open Curiosity behind the asset leaped upward as the worth rallied previous the $3.2 mark, however has waned considerably prior to now few days. On shorter timeframes, APE continued to have a bullish bias.

The 12-hour bearish breaker looms giant as bulls attempt to advance previous $4

Supply: APE/USDT on TradingView

On the decrease timeframes, ApeCoin had impartial to bearish momentum within the first couple of days of December. Solely on 5 November did APE start to see a renewed push from the consumers to drive costs previous $4.2.

The area highlighted by the purple field on the worth chart represented a 12-hour bearish breaker shaped on 2 November. It was a bullish order block on the time, however it was damaged by the decisive promoting on 8 November.

Since then it has represented a area of robust resistance. APE confronted a rejection there on 30 November. ApeCoin slid from $4.47 to $3.78 on December 2. This bearish breaker additionally has confluence with the 61.8% and 78.6% Fibonacci retracement ranges (yellow).

Bitcoin has resistance within the $17.6k-$18k area additionally. It was unclear how BTC or APE may transfer within the coming days. However, a rejection from the $4.2-$4.5 area was a chance. The $4 mark was essential psychologically. It was additionally a major liquidity pocket prior to now week.

Therefore, a drop beneath it and a subsequent retest can supply a promoting alternative. In the meantime, consumers can look ahead to a breakout previous $4.6 and a retest of the $4.5-$4.6 area earlier than trying to get in.

Open Curiosity is on the rise as soon as extra alongside the worth

From 19 November until 30 November, the Open Curiosity was in an uptrend. The value of ApeCoin was additionally in an uptrend in the identical interval as APE appreciated from $3.15 to $4.4. This confirmed that consumers have been fairly assured within the asset regardless of the market situations in current weeks.

Early December noticed the OI flatted as APE dropped to $3.88. At press time, each the Open Curiosity and the worth have been in an uptrend as soon as extra. This prompt the probability of additional features. But, consumers have to be cautious because of the increased timeframe resistance current at $4.5.