Aptos [APT]: At overbought highs, here’s how profit-taking might affect you

- APT’s worth went up by over 90% within the final week.

- The altcoin was severely overbought at press time, and a worth correction could be imminent.

Aptos [APT] rallied by 92% within the final week, making it the crypto asset with probably the most beneficial properties within the final seven days, knowledge from CoinMarketCap confirmed. Throughout the intraday buying and selling session on 21 January, APT’s worth rose by 56% to commerce above $12. This represented a four-fold enhance from its lowest worth of $3 in December 2022.

How a lot are 1,10,100 APTs value right this moment?

With a ten% soar in worth within the final 24 hours, APT ranked because the asset with probably the most beneficial properties throughout that interval.

Whereas APT had been on an upward development for the reason that starting of the 12 months, the astronomical surge in worth within the final 48 hours was attributable to the launch of two new APT liquidity swimming pools on Binance Liquid Swap on 20 January.

Main cryptocurrency change Binance, by way of a blog post revealed on 20 January, introduced the launch of 4 new liquidity swimming pools consisting of APT/BTC, APT/USDT, HFT/BTC, and HFT/USDT.

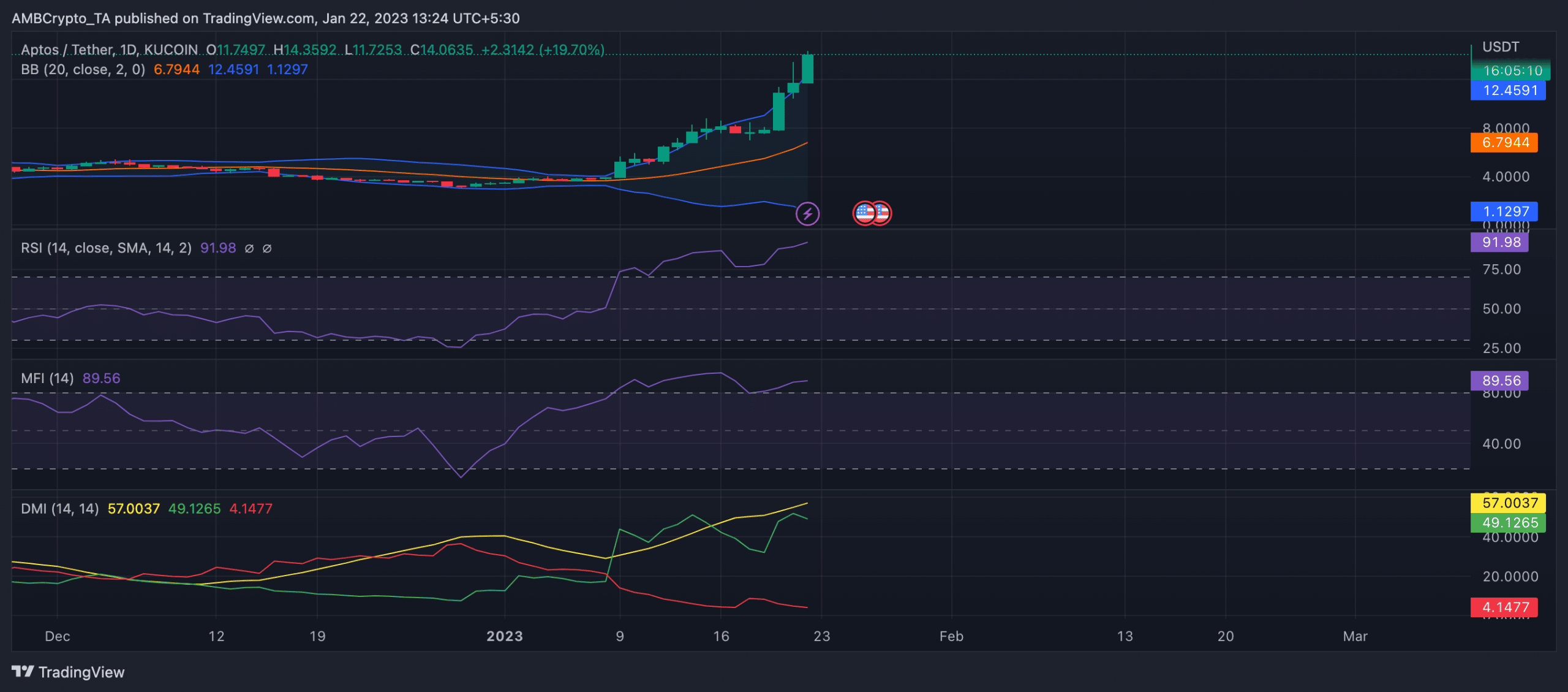

APT on a every day chart

At press time, APT traded at $14.07. Severely overbought as of this writing, the alt’s Relative Energy Index (RSI) rested at 91.98. Equally, its Cash Circulation Index (MFI) was at 89.56.

It’s key to notice that when an asset’s RSI or MFI is “considerably overbought,” it signifies that the asset’s current worth will increase have been substantial and fast, and the indications are indicating that the asset is changing into overvalued. It is a sign that the asset’s worth could also be due for a correction as many will search to take revenue at these ranges.

Nevertheless, sellers would possibly discover it tough to revoke the consumers’ management of the market within the meantime; a have a look at APT’s Common Directional Index (ADX) revealed this. The ADX line (yellow) oscillates between 0 and 100, with readings above 25 indicating a robust development and readings under 20 indicating a weak development.

Is your portfolio inexperienced? Verify the Aptos Revenue Calculator

At press time, the alt’s ADX was 57, indicating that the present bullish development available in the market was robust.

Additional, APT’s worth was severely risky on the time of writing and has so been since 9 January. An evaluation of the asset’s Bollinger Bands (BB) revealed a large hole between the higher and decrease bands of the indicator.

This sometimes signifies that the volatility of an asset is excessive, and the value is fluctuating considerably. This could point out that the asset is experiencing excessive volatility ranges, making it harder to foretell future worth actions. Therefore warning is suggested.

Supply: APT/USDT on TradingView