3LAU’s Royal Debuts Marketplace to Bring Music NFTs to the Masses

NFT

decrypt.co

17 November 2022 17:57, UTC

Studying time: ~6 m

Royal, one of many largest names within the burgeoning music NFT house, has lastly launched its long-promised market for fractionalized music royalty rights.

Began by digital musician and entrepreneur Justin “3LAU” Blau and Opendoor founder JD Ross, Royal raised $16 million in its seed funding spherical in August 2021. Final November, the Web3 music startup raised one other $55 million in funding from Andreessen Horowitz, Coinbase Ventures, and Paradigm, together with standard musicians like Nas and The Chainsmokers.

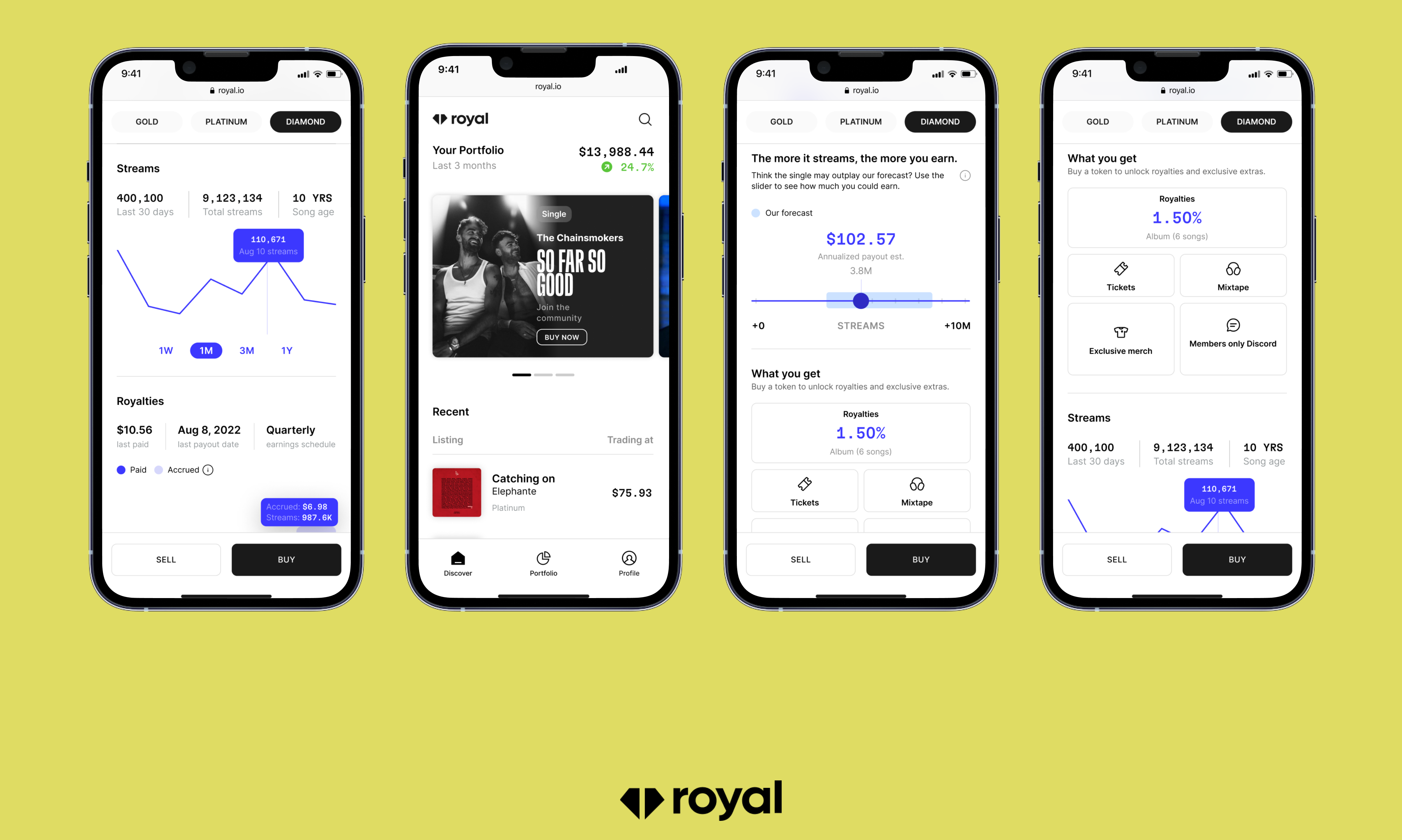

With that capital, Blau tells Decrypt that Royal has spent the previous 12 months growing its browser-based NFT market, the place customers can now uncover new artists, commerce Royal NFTs, and see detailed statistics on every asset.

Nas and The Chainsmokers Be a part of $55M Increase in NFT Music Platform Royal

The Royal market pulls bid knowledge and buy historical past from high total NFT market, OpenSea, plus its dashboard aggregates streaming knowledge from Spotify, Apple Music, Amazon Prime Music, Tidal, and SoundCloud Premium.

Because it started releasing NFTs, Royal has dropped music with heavy-hitters like Diplo, Nas, The Chainsmokers, Vérité, Elephante, and 3LAU himself. As part of at present’s market launch, Royal is releasing a brand new drop with digital musicians Bingo Gamers and Zookëper.

Every Royal NFT provides consumers a fractionalized share of royalty funds as artists’ songs are performed on streaming companies. Earlier this month, Royal introduced that its partnered artists had paid out over $100,000 in royalties throughout greater than 9,200 NFT collectors since launch.

After at present’s payout, artists have shared greater than $100k in streaming royalties with collectors by Royal. pic.twitter.com/NRuc86iW4y

— royal (@join_royal) November 4, 2022

This milestone exhibits that collector royalties, whereas at present modest, generally is a actual incentive for followers to purchase NFTs from their favourite musicians. The share varies by artist and/or tune, however it permits followers to spend money on artists whereas betting on their future success.

Whereas holders received’t make again what they paid for every Royal NFT instantly, there are potential advantages for long-term collectors relying on which artist(s) they help. Royal NFTs aren’t nearly music rights and royalties—some NFTs are eligible for bonus real-world perks, like entry to meet-and-greets or listening events.

Who’s it for?

Royal’s market launches into an NFT house that already has loads of established platforms for purchasing and promoting digital property, though many are broadly designed and never targeted particularly on music. There’s additionally numerous Web3 music platforms competing for customers’ consideration, like Audius and OurSong (Blau is an advisor to Audius).

Even with so many different NFT platforms within the house, Blau stated that there’s a necessity for a devoted platform that may onboard new customers, as Royal isn’t focusing on Web3 natives.

{The marketplace} additionally has new portfolio options. Picture: Royal.io

“The explanation why we constructed our personal is as a result of we felt that plenty of music followers do not know the best way to arrange a pockets,” Blau advised Decrypt. “We principally arrange a approach for everyone to pay and commerce in {dollars}. So if you happen to’ve by no means used crypto earlier than, and also you join Royal, we generate a pockets for you. You’ll be able to deposit USDC into that pockets out of your checking account. You by no means should see Ethereum if you happen to do not need to.”

Royal’s market leverages Ethereum sidechain Polygon’s community for its NFT property, however doesn’t see self-custody crypto wallets or dealing with ETH as a required a part of the Web3 expertise. Royal merely desires to leverage the idea of blockchain-verifiable possession whereas making it mainstream.

“We wanted to construct a bit of bit higher of a bridge,” Blau stated of Royal’s resolution to deploy its personal market.

Royal’s purpose for {the marketplace} is to be extraordinarily user-friendly and preserve its crypto parts minimal. This technique could show profitable: Audius just lately hit 7.5 million customers partly as a result of, as CEO Roneil Rumburg beforehand advised Decrypt, “the typical Audius consumer is just not even conscious the crypto is there.”

“We’re not essentially constructing it for the prevailing customers of crypto,” Blau stated of Royal’s market. “We’re constructing it for all the new ones.”

Royalty debates

Royal’s music royalties for collectors aren’t fairly the identical because the idea of creator royalties within the broader world of NFTs.

Royalties have change into a controversial subject currently as marketplaces like OpenSea and Magic Eden debate whether or not to implement creator royalties—a price, usually set from 5% to 10% of the sale value, paid by secondary market sellers. Many platforms have made them non-compulsory, though OpenSea opted to maintain them following creator backlash.

“I by no means actually understood why we name them royalties within the first place,” Blau advised Decrypt. “Royalties sort of suggest that one thing is consumed—that there is some kind of proper that’s getting paid out on—and what we name secondary royalties are actually secondary commissions.”

Chainsmokers Share New Album Royalties With Followers through NFT Drop in Music Business First

Royal’s payouts are royalties within the conventional sense of the phrase: rights homeowners obtain a proportion of income when a bit of content material is consumed. In Royal’s case, these rights homeowners are the NFT homeowners. In the remainder of the NFT world, royalties might maybe extra precisely be renamed creator charges or, as Blau prompt, “secondary commissions.”

“My basic opinion is the concept of secondary commissions into perpetuity has product market match, insofar as individuals get actually enthusiastic about it,” he stated. “Its enforceability sadly requires a level of centralization.”

How UMG Is Constructing Out Its Bored Ape Metaverse Band, Kingship

A principal cause that Blau began Royal was to disrupt the normal music business and permit musicians to earn a bigger share of the whole income pie, the place they at present take house roughly 12%.

“At Royal, we clearly imagine that creators ought to receives a commission without end,” he defined. “We are also delicate to basic price buildings. Like, 10% each time one thing trades is simply sort of irrational. However there’s some in-between that we predict is truthful.”

Royal stated that it’s protecting its platform charges and artist charges on its market till 2023, whereas its secondary commissions price for artists shall be 2.5%.

The way forward for Royal

So what’s subsequent for the Royal workforce? Blau advised Decrypt {that a} cell app model of {the marketplace} is within the works. “It is likely to be quickly,” he stated of an iOS app.

However Blau isn’t frightened about Apple’s strict NFT insurance policies or its 30% in-app buy charges for any NFTs bought. Apple’s insurance policies have divided NFT advocates. Some see these charges as incompatible with Web3 enterprise fashions, whereas others say that the mainstream viewers is important, and Web3 builders will merely must get extra inventive with how they monetize merchandise.

“We now have a direct contact with Apple that we’re working with on ensuring that we assess the proper parameters for launching,” Blau stated. “These charges received’t get in the best way of our imaginative and prescient.”