27 stats about NFTs in 2022

NFT

At the start of the 12 months, when the crypto market was crimson scorching, it was extraordinarily robust to grasp what was happening within the NFT business.

The huge inflow of collections, new marketplaces, and simple cash within the area created the proper mixture of incentives for fraudulent exercise. As we all know, I revealed an article in October about NFT wash buying and selling, a number of “OpenSea killers” had been constructed completely on pretend exercise, and never all the pieces was because it appeared whenever you checked out NFT assortment leaderboards. Because the market crashed, so did exercise throughout the board (each pretend and natural).

However not all was unfavorable. A number of extremely revolutionary NFT collections broke the mildew of zany PFP photos and proved a marketplace for digital, non-fungible artwork existed.

Whereas there was a proliferation of small collections and grassroots community-building in some corners of the business (e.g., Solana and Magic Eden), the 12 months additionally noticed consolidation with the beginning of the primary NFT megacorp in Yuga Labs.

As a substitute of telling you what to consider 2022 and the place the NFT world is heading in 2023, this text has the important stats from final 12 months so you possibly can create your individual evaluation.

9 Stats concerning the NFT Business

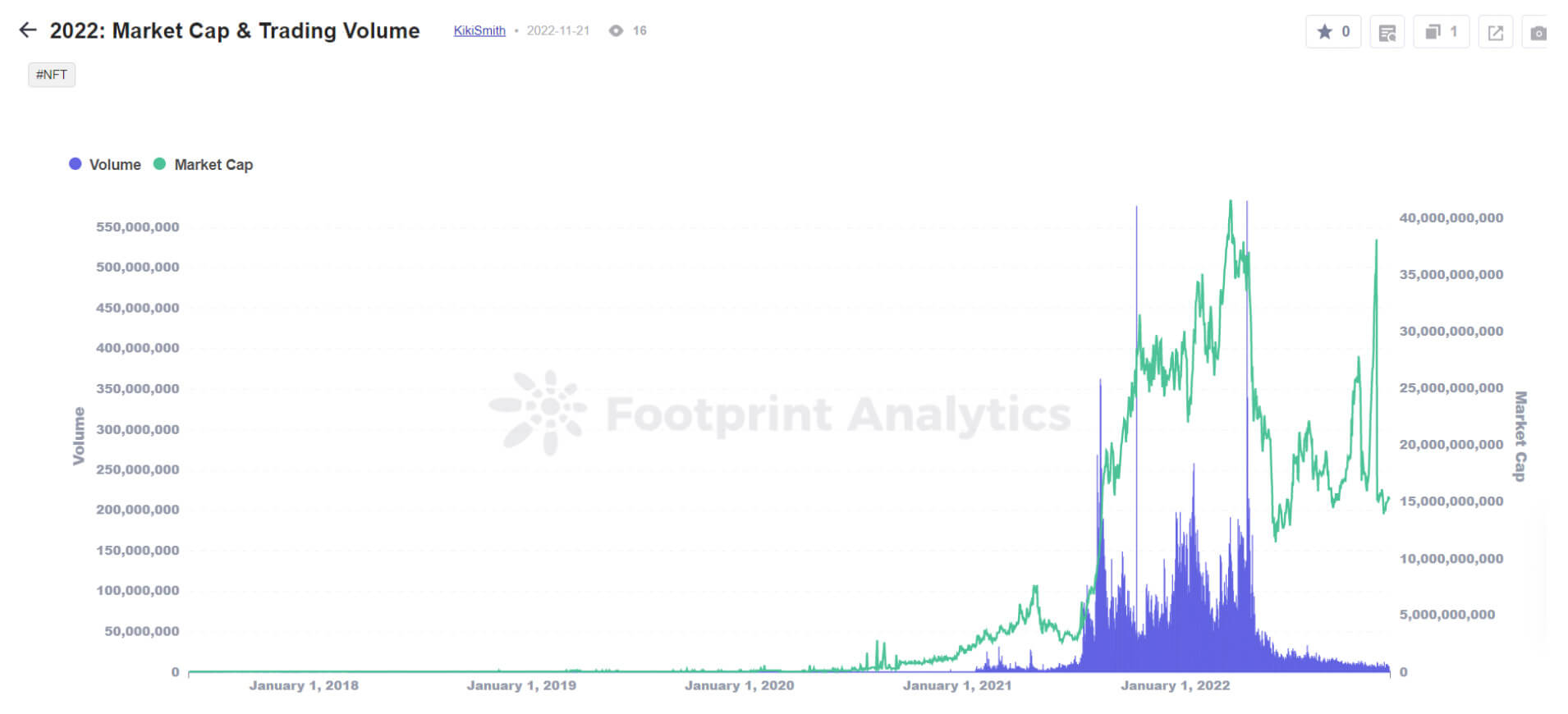

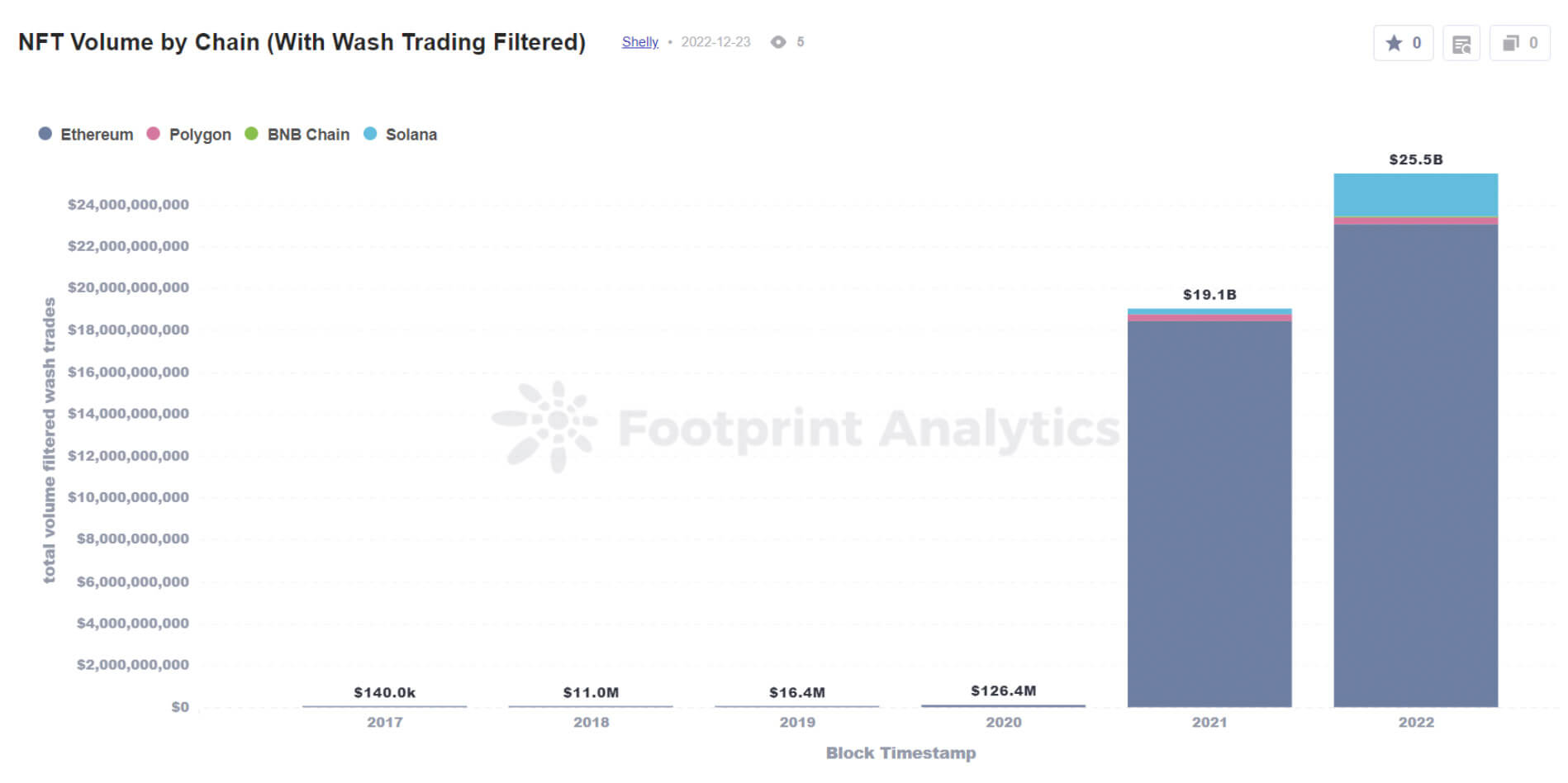

1. Whole gross sales of NFTs in 2022 was $55.5B

That is up 175% from $20.2B in 2021. While you evaluate 2020 to 2022 whole gross sales, it’s 390X extra.

”

2. The market capitalization of the NFT business peaked on April 4th at $41.5B

Market capitalization is calculated because the sum of every NFT valued on the larger of its final traded value and the ground value of the gathering, respectively. Suspected wash trades have been filtered out.

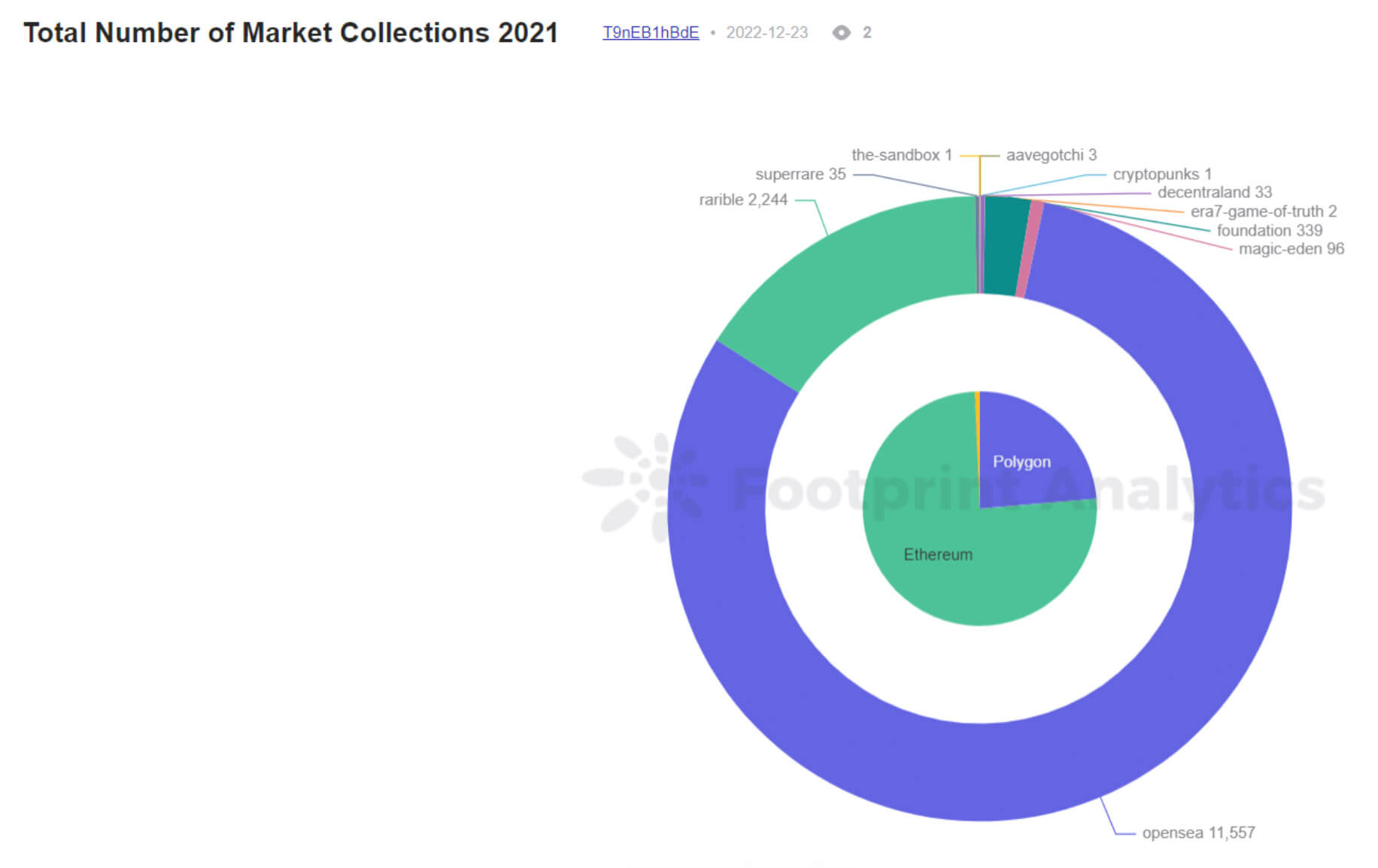

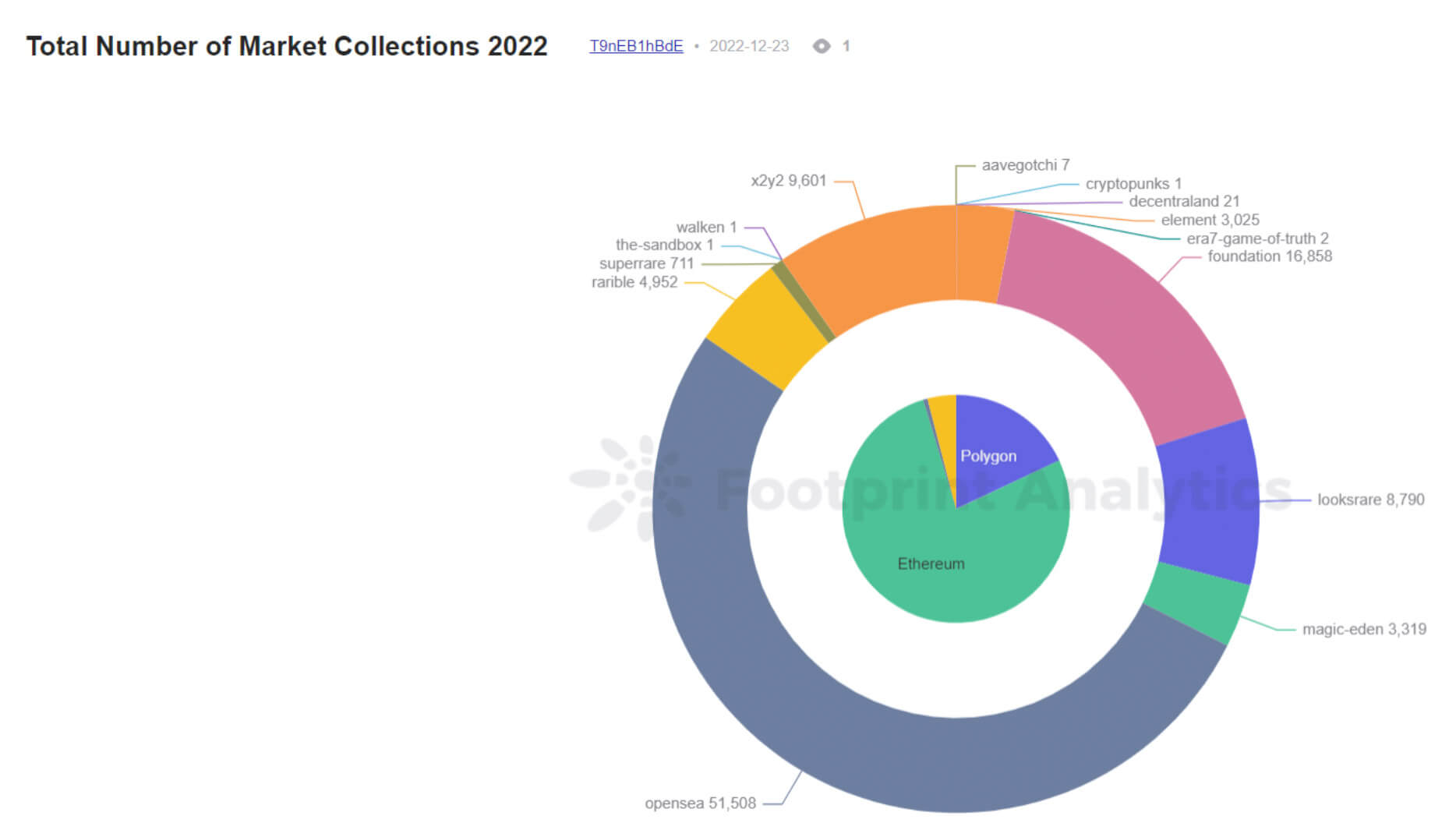

3. Roughly 85K NFT collections had been launched final 12 months

In 2021, there have been round 14.5K collections, whereas the quantity almost reached 99K by the tip of 2022. Discover that Opensea stays the chief in each years.

4. About 7,700 collections had buying and selling quantity over $100K

Do word that almost all of this exercise didn’t come from a reliable, natural curiosity within the mission based mostly on the date collected.

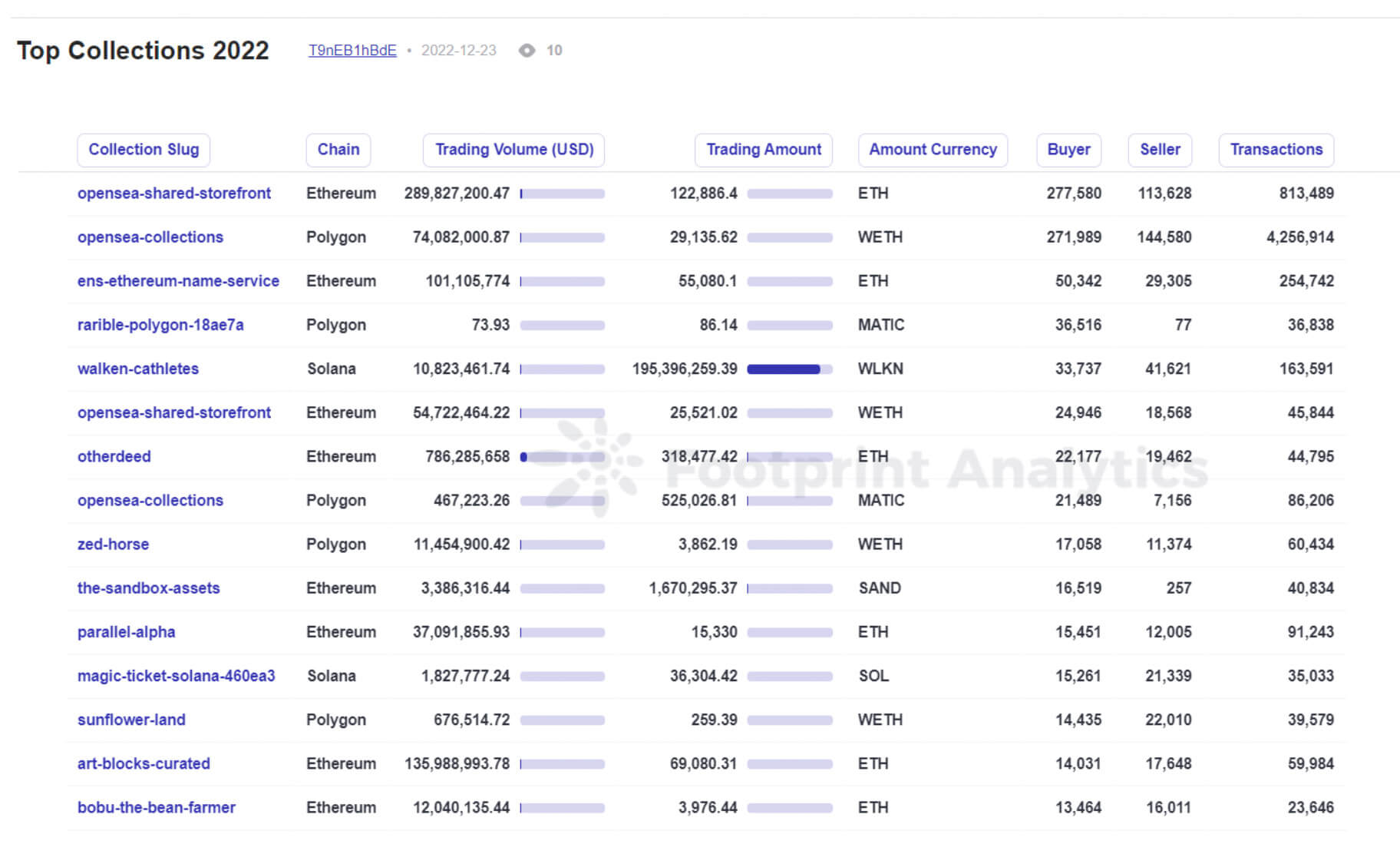

5. Solely 2,623 collections had greater than 1000 distinctive consumers

As with all stats within the NFT business, this one ought to be taken with a grain of salt because of the vital quantity of wash buying and selling, particularly through the 12 months’s first half.

Reference: Prime Collections 2022

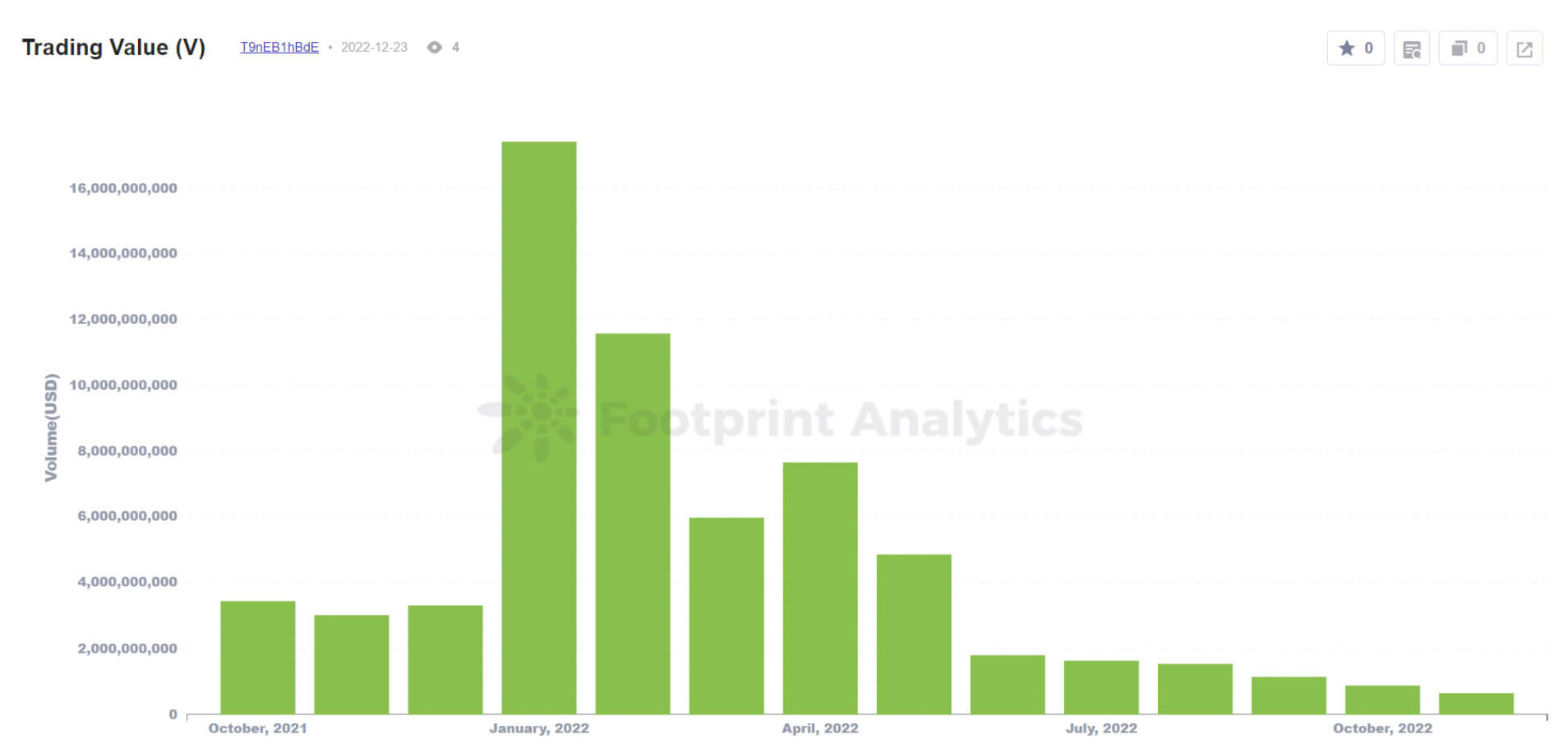

6. NFT buying and selling quantity reached its 2022 peak in January, with $17.4B in worth

This was greater than a 4x soar from the earlier month (December 2021). This was additionally the month when Google searches for the key phrase “NFT” reached their all-time excessive.

Reference: Buying and selling Worth (V)

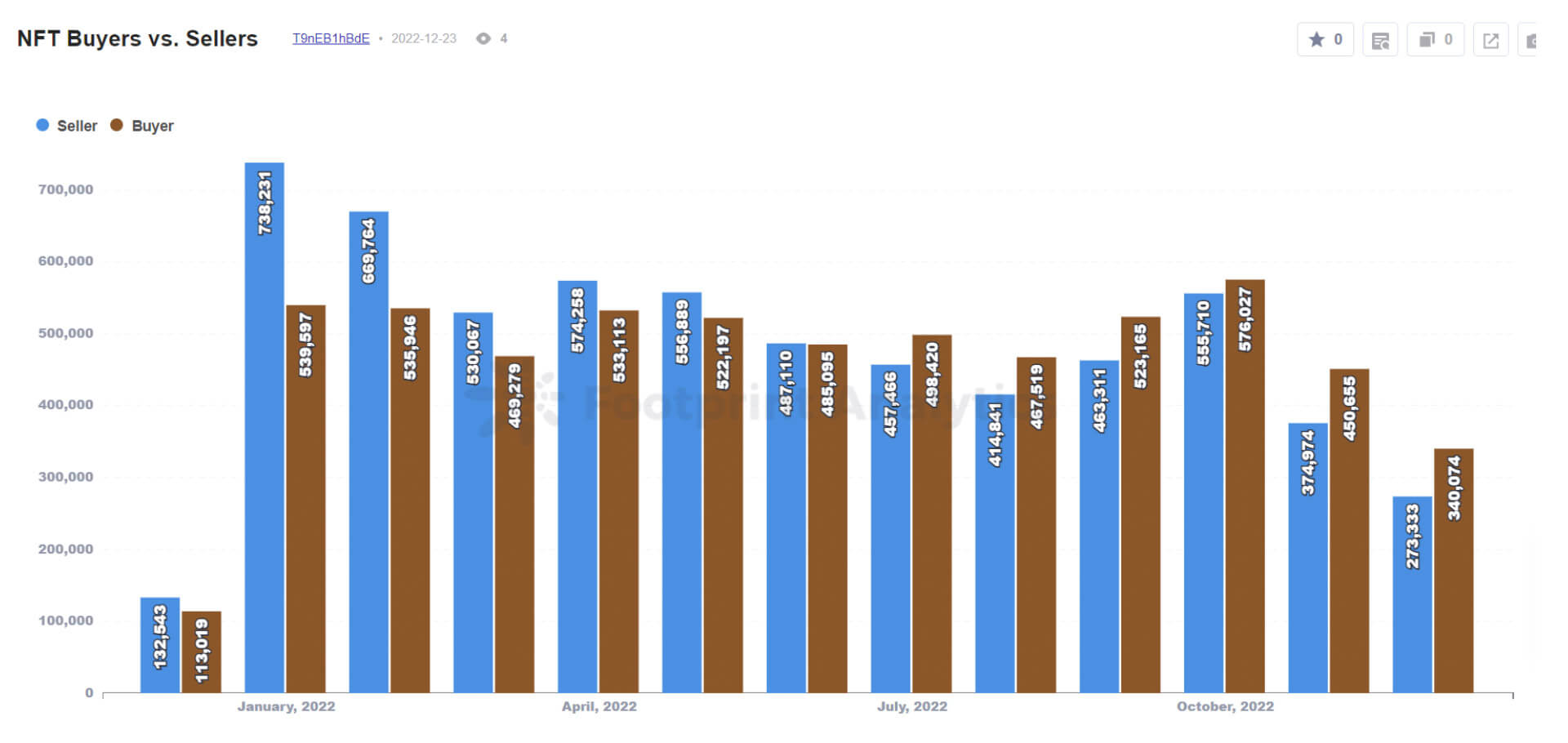

7. The most important hole between the variety of sellers and consumers was in January, with about 200K extra sellers than there have been consumers.

But January was additionally the most well liked month for NFT costs for many main collections, indicating that utilizing these metrics as an analog for provide and demand has flaws.

Reference: NFT Consumers vs. Sellers

8. Final 12 months, 46% of whole NFT buying and selling quantity was prone to be brought on by wash buying and selling

There are a number of indicators and filters to detect suspicious exercise. To determine most of these transactions, I exploit Footprint Analytics’ filters to separate transactions to the next components:

- a.) Overpriced NFT trades (10x OpenSea Common Worth)

- b.) Collections with 0% royalties (besides CryptoPunks and ENS)

- c.) An NFT purchased greater than a traditional quantity of instances in a day (at the moment filtered for greater than 3+)

- d.) An NFT purchased by the identical purchaser deal with in a brief interval (at the moment filtered for 120 minutes)

6 Stats about NFT Collections

9. The gathering with the biggest market cap by the tip of the 12 months was CryptoPunks at $1.1B

Crypto Punks, launched by Larva Labs in 2017, was the primary NFT assortment to change into a family identify and have the very best ground value within the business. Yuga Labs acquired the IP of the gathering in March 2022.

Reference: 2022: Prime Collections by Market Cap

10. Buying and selling quantity of main collections within the Yugaverse—Yuga Labs’ portfolio of merchandise—was $3.1B

This sum consists of Bored Ape Yacht Membership, Mutant Ape Yacht Membership, Bored Ape Kennel Membership, Otherside, and CryptoPunks. It excludes Meebits, which had extra buying and selling quantity than all of those mixed,

Reference: Yuga Labs (Buying and selling Quantity in 2022)

11. Yuga Labs’ portfolio accounts for about 20% of the full market cap of the complete NFT business

This sum consists of Bored Ape Yacht Membership, Mutant Ape Yacht Membership, Bored Ape Kennel Membership, Otherside, CryptoPunks and Meebits.

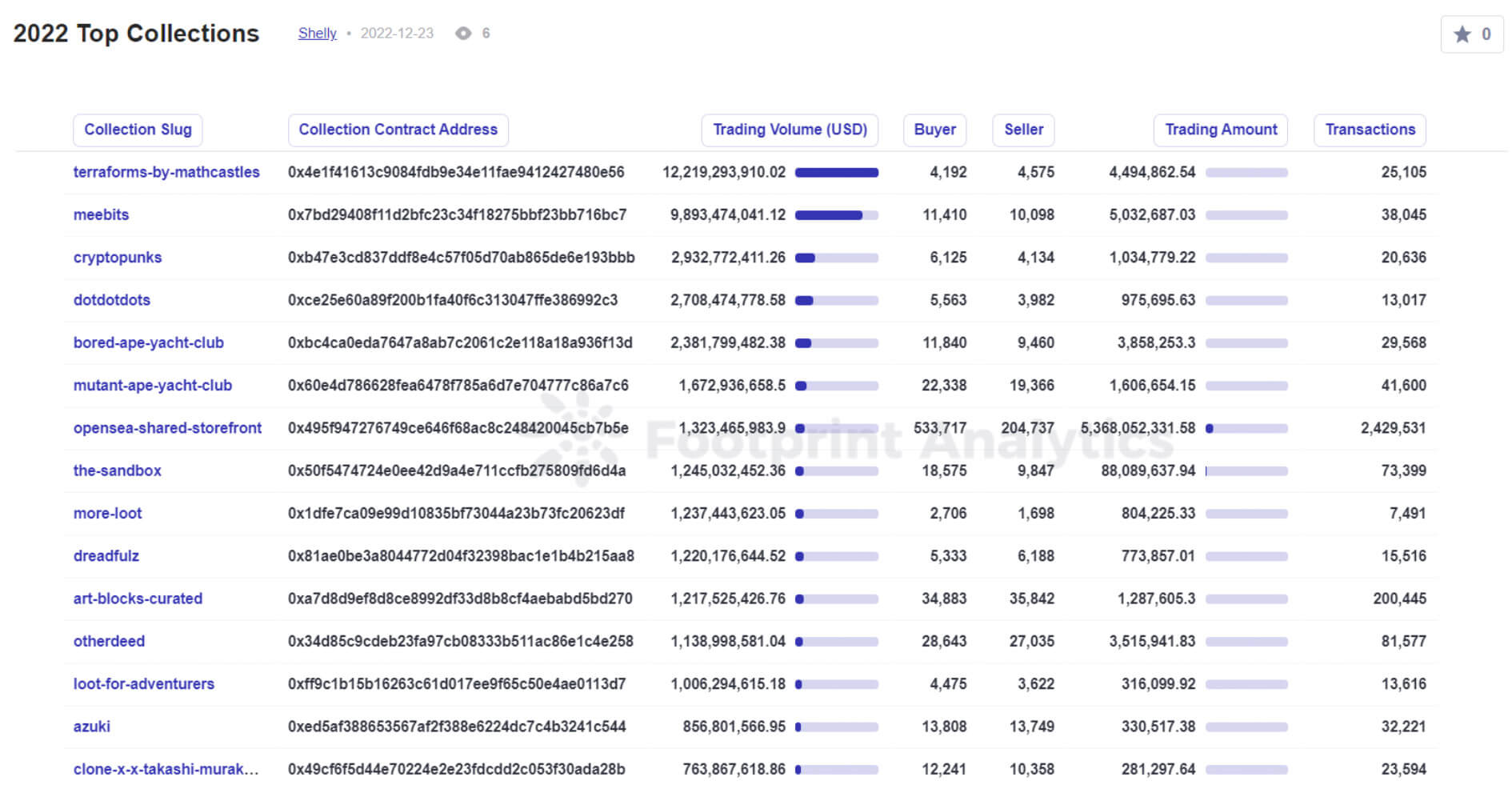

12. With none wash commerce filtering, Terraforms by Mathcastles had an astounding $12B in buying and selling quantity, greater than another assortment, throughout 11,341 transactions

Nonetheless, 99.8% of the quantity and 46.3% of transactions had been detected as wash buying and selling.

Reference: NFT – Collections

13. When filtering out wash buying and selling, CryptoPunks had the very best quantity ($2.9B) adopted by Bored Ape Yacht Membership ($2.3B)

Reference: 2022: Prime Collections by quantity

14. ArtBlocks Curated was the 4th most traded assortment by quantity and amassed a market cap $325M

ArtBlocks demonstrated that there’s a marketplace for high-end creative NFTs—it stands out amongst Yuga PFP tasks, and metaverse land NFTs on the high of the rankings

15. There have been 7 main collections whose quantity was over 95% wash buying and selling

For this stat, “main” means having over $1M in actual buying and selling quantity. Terraforms by Mathcastles, Extra Loot, dotdotdots, Dreadfulz, Audioglyphs, CryptoPhunksV2, and Meebits.

6 Stats about Chains and Markets for NFT Initiatives

16. Ethereum had 95% % of quantity, 47% of transactions, and 71% of protocols

These figures are nearly the identical as in 2021. Based mostly on the info, Ethereum continues to be essentially the most broadly used for NFT.

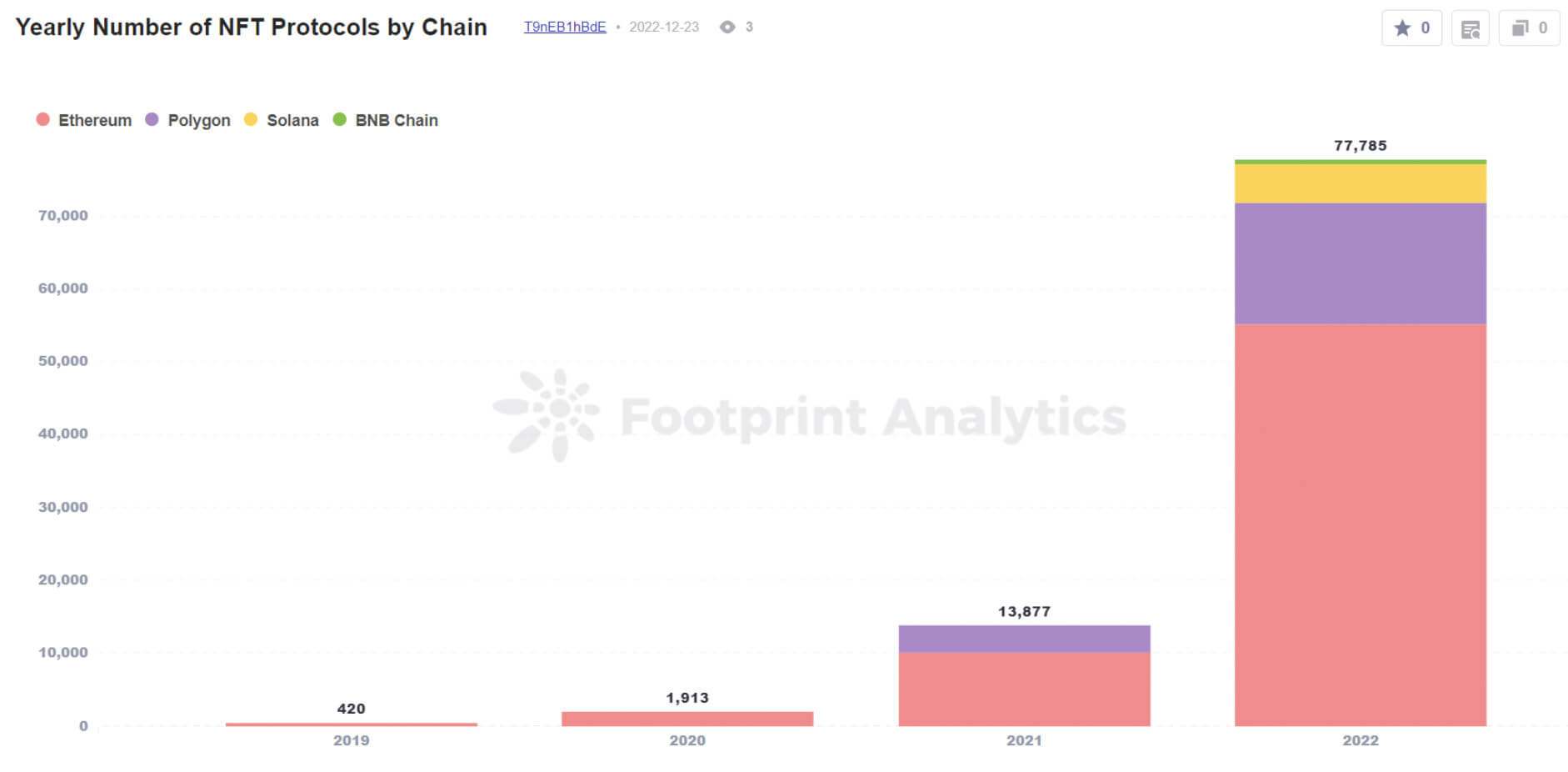

Reference: 2022 Market Share of Transactions by Chain and 2022 Market Share of Buying and selling Quantity by Chain and Yearly Variety of NFT Protocols by Chain

17. Solana went from having no NFT protocols in 2021 to five,335 in 2022

Solana is ranked third globally on the level of writing.

One other factor to notice is that Ethereum grew from 420 in 2019 to 55,144 in 2022.

18. OpenSea hosted 53% of all whole collections

OpenSea remained {the marketplace} of selection for Ethereum and Polygon. Nonetheless, Magic Eden capitalized on its Solana first-mover benefit to be {the marketplace} of selection for collections on this chain (OpenSea began itemizing them in April.) Word: a set can checklist on a number of marketplaces.

Reference: 2022: Variety of Market Collections by Chain

19. Solana had extra lively customers in October, with 411K, than Ethereum, with 392K

Whereas many of the blue-chip collections and collectors transact on OpenSea and Ethereum, Solana constructed up a large neighborhood of NFT lovers in 2022. Solana’s lively customers hovered between 20-45% of the full market share—October was the one month it overtook Ethereum for this metric

Reference: Chain Month-to-month Lively Person

20. OpenSea had 96,459 distinctive wallets make a transaction on the protocol on Feb. 2

That is extra transactions than another market on another day.

Reference: 2022 Market Every day Lively Person

21. Over $903M in platform charges had been generated on OpenSea, going to each {the marketplace} and creators

This made OpenSea essentially the most worthwhile market when it comes to charges generated from buying and selling (which went to the platform and are disbursed to creators.)

Reference: Prime Marketplaces

6 Stats about NFT Funding & Fundraising

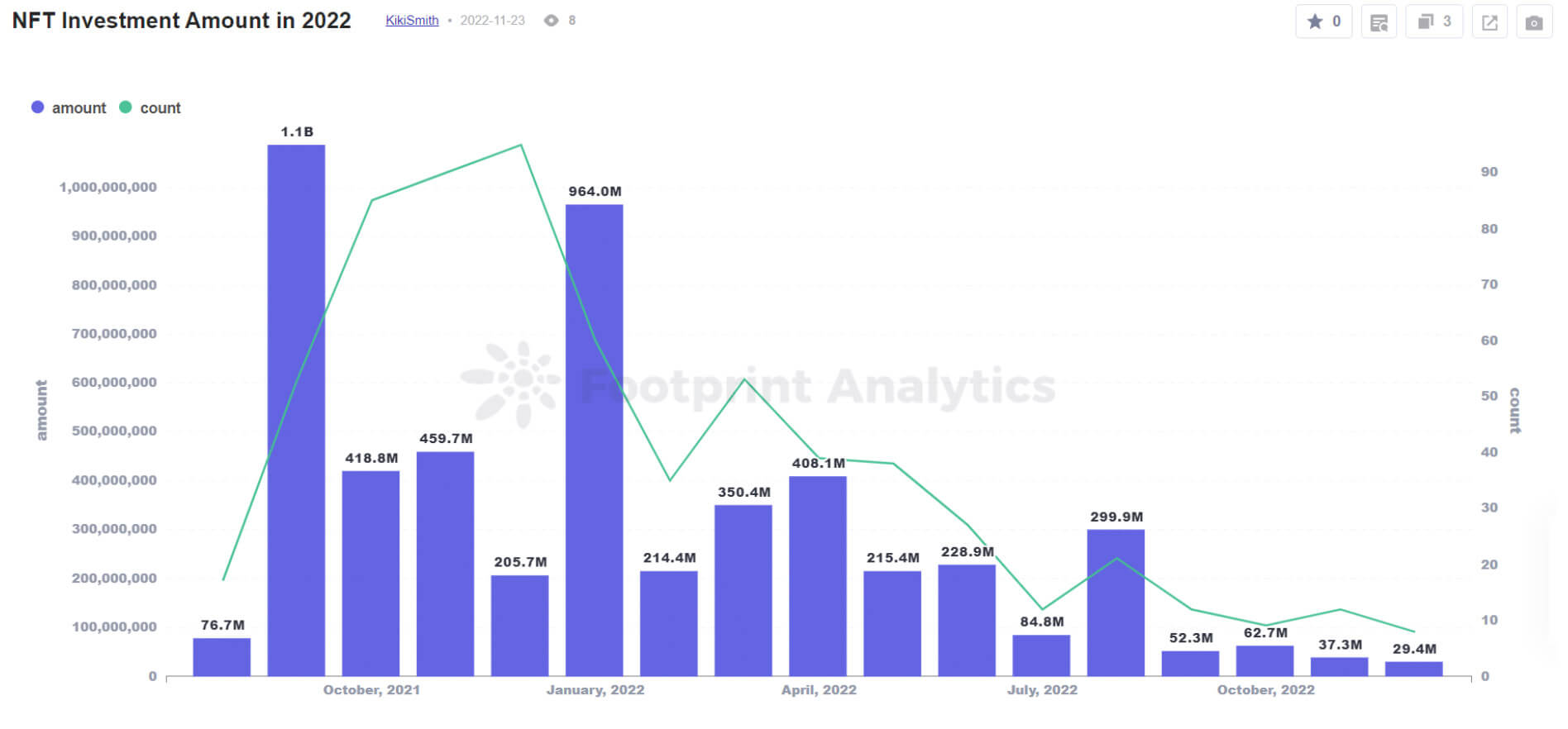

22. The NFT business acquired a complete of $2.98B in fundraising in 2022

The very best was in January 2022 at $964M. The bottom is in December at $29.4M.

23. Animoca Manufacturers closed the biggest spherical of the 12 months, $358M led by Liberty Metropolis Ventures

Animoca has mentioned it should use the funding for strategic acquisitions and investments, develop its video games and metaverse merchandise, and purchase licenses for widespread mental properties.

Reference: 2022 NFT Fundraising Particulars

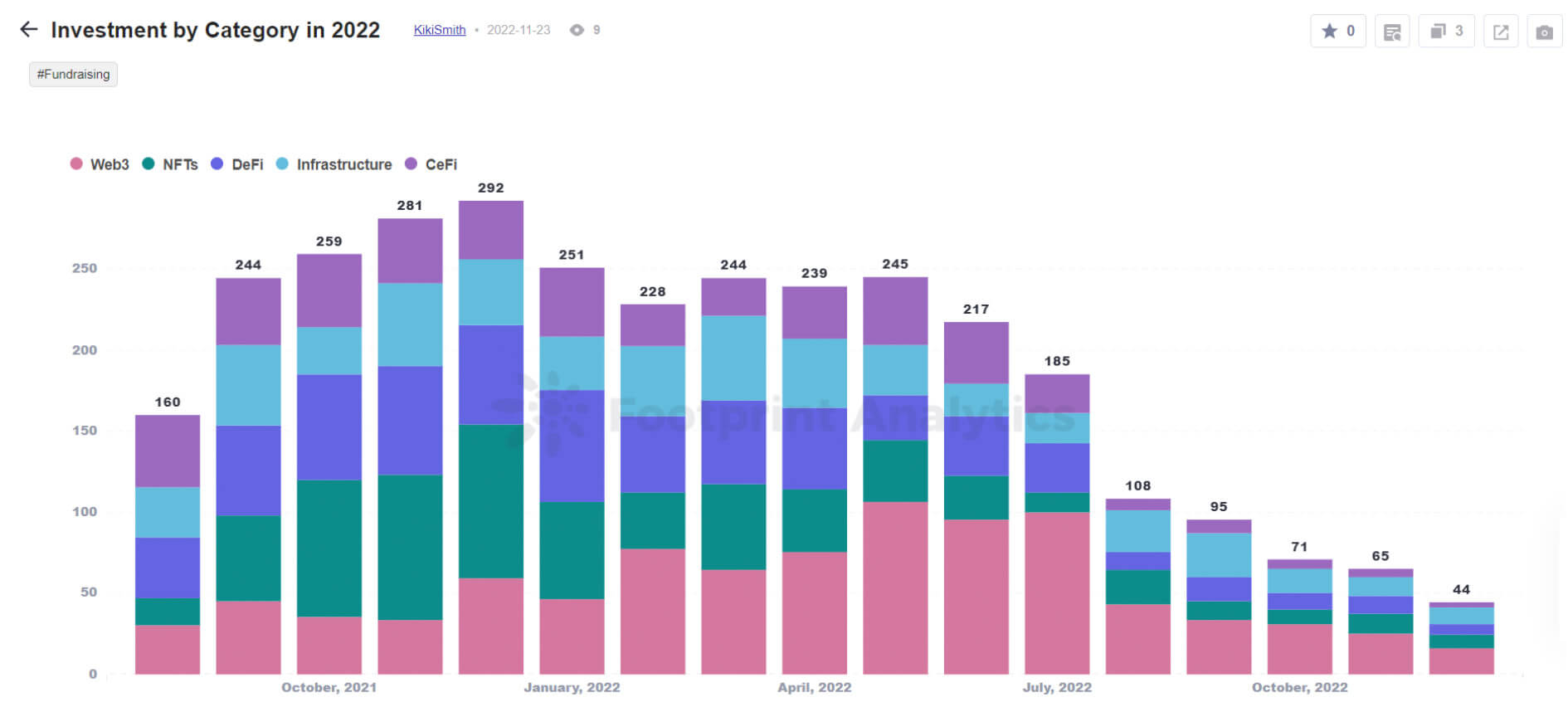

24. There have been 1,992 whole fundraising rounds in 2022, 756 greater than in 2021

Reference: Funding by Class in 2022

25. Whereas NFT-related tasks had been the preferred class amongst VCs by the variety of rounds, they had been the 2nd-least widespread in 2022

In 2022, basic Web3 tasks closed essentially the most rounds (711), adopted by DeFi (362), infrastructure (331), NFTs (326), and, lastly, CeFi (257).

26. Seed rounds made up 81% of whole NFT funding rounds

Reference: NFTs Funding Rounds

27. The two largest rounds for pure NFT tasks went to OpenSea ($300M) and Dapper Labs ($250M)

The OpenSea spherical was certainly one of solely 5 Collection C or D rounds in 2022. Dapper Labs is the studio behind the NBA Prime Shot assortment.

Key Takeaways

As we will see, Net 3.0 is proliferating. NFT is undoubtedly a part of the entire Net 3.0 ecosystem. Within the Net 3.0 ecosystem, NFTs are sometimes used to facilitate the shopping for and promoting of distinctive digital property on decentralized platforms. These platforms use good contracts to allow transactions with out the necessity for intermediaries. They’ll facilitate the shopping for and promoting of NFTs and permit NFT holders to earn passive revenue by lending out their NFTs. There are various use instances to showcase.

Net 3.0 will proceed to attract extra funding in 2023 based mostly on a number of the deal flows I see out there. OKX Ventures and GSRV co-lead a $2 Million seed spherical for a Net 3.0 decentralized Identification platform. Binance Labs launched a $500M fund to assist promising Net 3.0 tasks and start-up companies with nice potential earlier this 12 months. Du Jun, the co-founder of cryptocurrency trade Huobi World, runs ABCDE Capital, a $400M Net 3.0 enterprise capital fund is devoted to investing in web3 builders.

Aside from the crypto firms-led companies, it’s additionally true that conventional funding corporations are starting to take discover of the Net 3.0 ecosystem and are beginning to put money into corporations and tasks which can be engaged on decentralized applied sciences, akin to blockchain and non-fungible tokens (NFTs).

There are a number of the reason why conventional funding corporations is perhaps enthusiastic about investing in web3 applied sciences. One motive is that the Net 3.0 ecosystem continues to be in its early levels and has a lot progress potential. Decentralized applied sciences have the potential to revolutionize many various industries, from finance and actual property to artwork and collectibles.

One more reason is that the Net 3.0 ecosystem is comparatively uncorrelated with conventional monetary markets, which may provide diversification advantages for buyers. This may be particularly interesting in instances of financial uncertainty, when conventional monetary markets could also be extra unstable.

Ending with a quote:

“Net 3.0 brings limitless alternatives to many individuals, adjustments lives in Kenya, removes limitations in India and empowers builders in China to service international audiences through the COVID lockdown interval. Your gateway to Net 3.0 is only one click on away. Let’s innovate.” – Anndy Lian.