Will this positive Ethereum [ETH] observation boost its short-term outlook

Traders have had a detailed eye on Ethereum’s [ETH] efficiency for the reason that much-talked about Merge. The important thing focal point being an evaluation of whether or not community demand or utility would deteriorate, return to regular, or rise to new highs.

Right here’s AMBCrypto’s value prediction for Ethereum [ETH] for 2022-2023

Ethereum’s efficiency in the previous couple of weeks was sufficient to supply a tough thought of how the community faired. In accordance with a current Glassnode evaluation, ETH achieved a brand new all-time excessive for the entire worth of ETH in ETH 2.0 deposit contracts. In accordance with the evaluation, the worth on the time of writing stood at 14.78 million ETH.

📈 #Ethereum $ETH Complete Worth within the ETH 2.0 Deposit Contract simply reached an ATH of 14,785,543 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/D8pDEQTI99

— glassnode alerts (@glassnodealerts) November 6, 2022

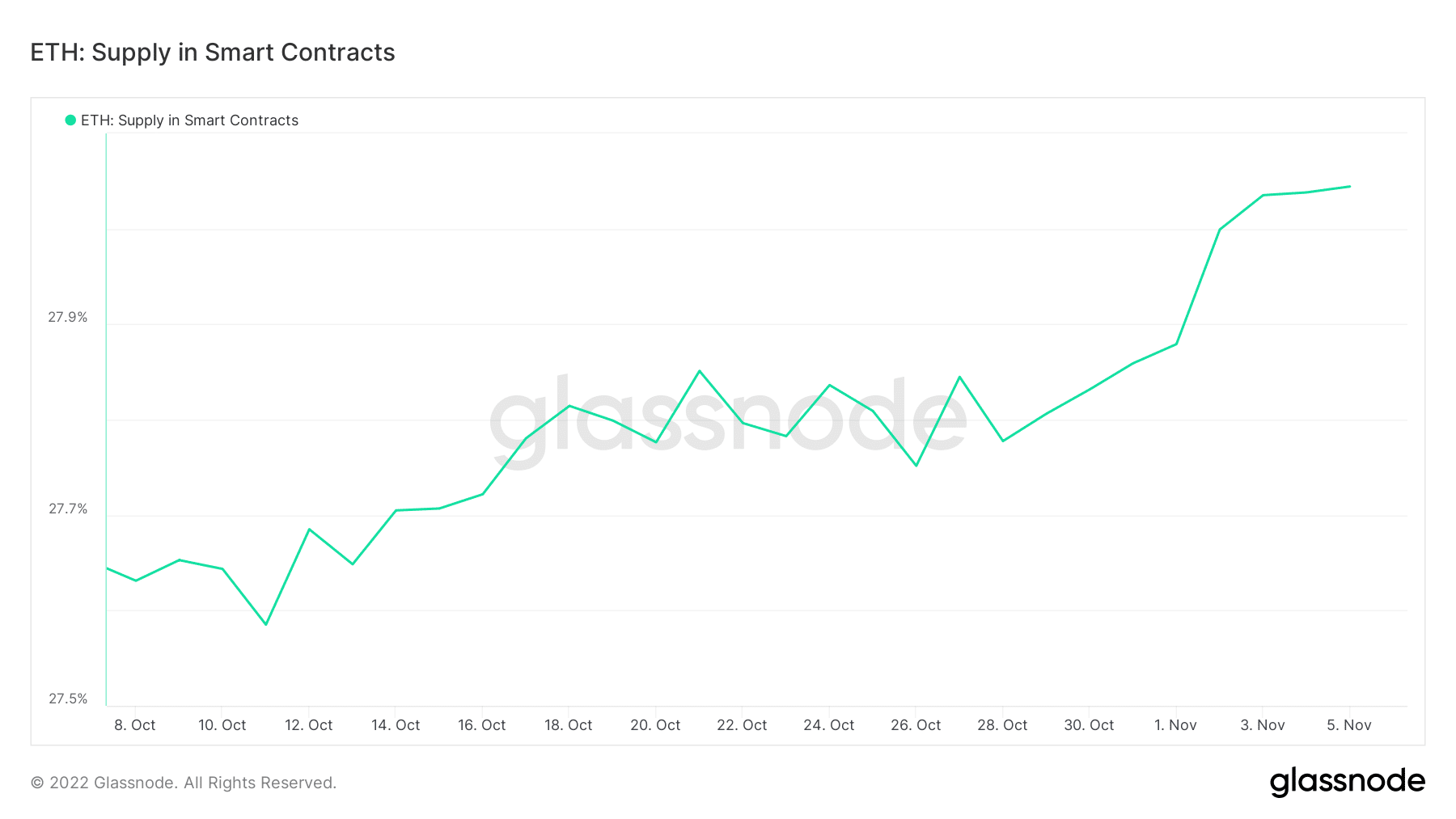

This statement urged that Ethereum’s utility in DeFi witnessed a big uptick. Moreover, quite a few different observations highlighted an identical final result. For instance, the availability of ETH locked in sensible contract simply achieved a brand new month-to-month excessive at 28.04%.

Supply: Glassnode

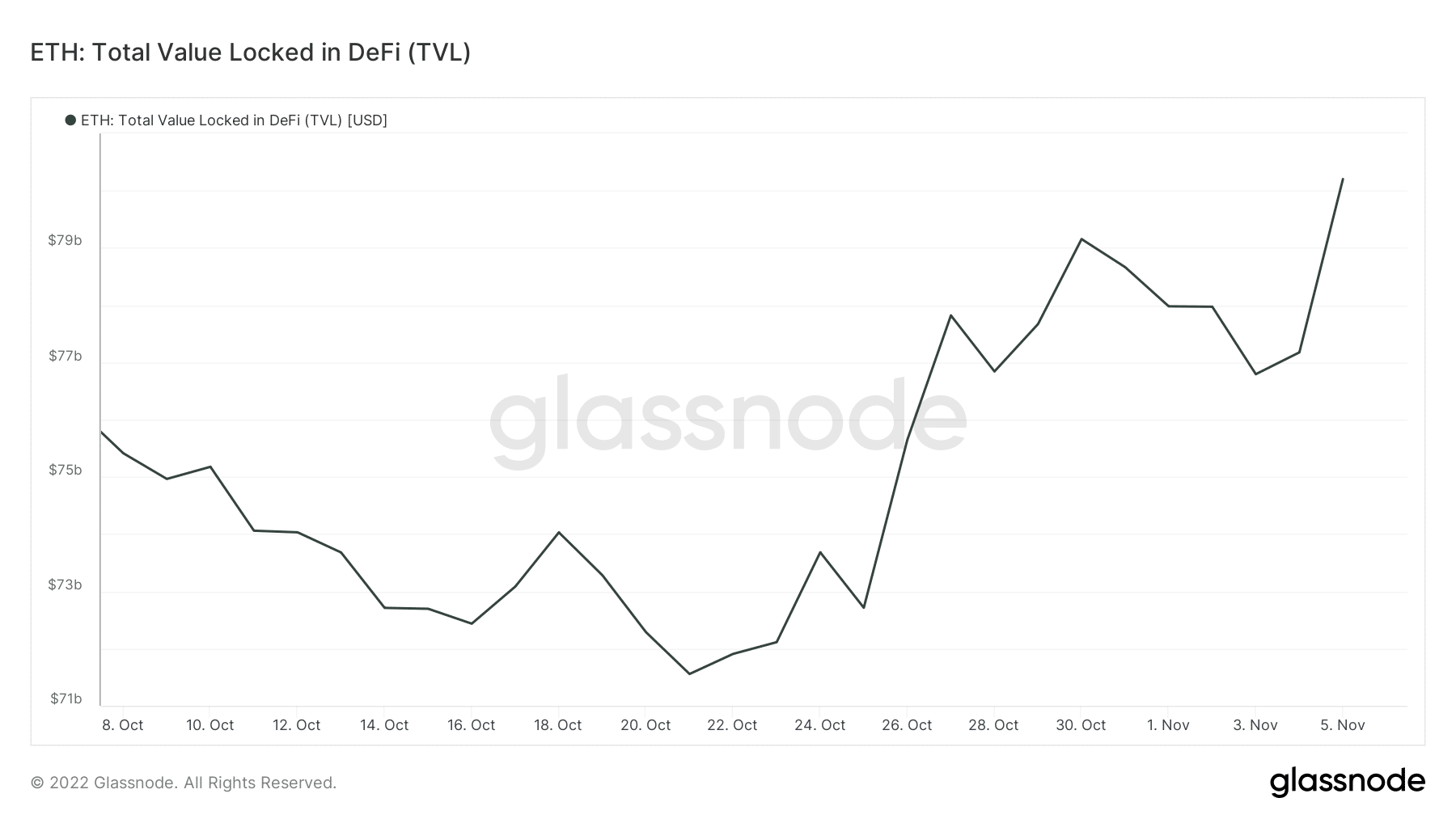

For context, the entire provide locked in DeFi dropped as little as 25.3% on the peak of the Merge. Equally, the entire worth locked in DeFi noticed a powerful surge within the final two weeks. It grew from a month-to-month low of $71.55 billion in October to over $80.2 billion this week.

Supply: Glassnode

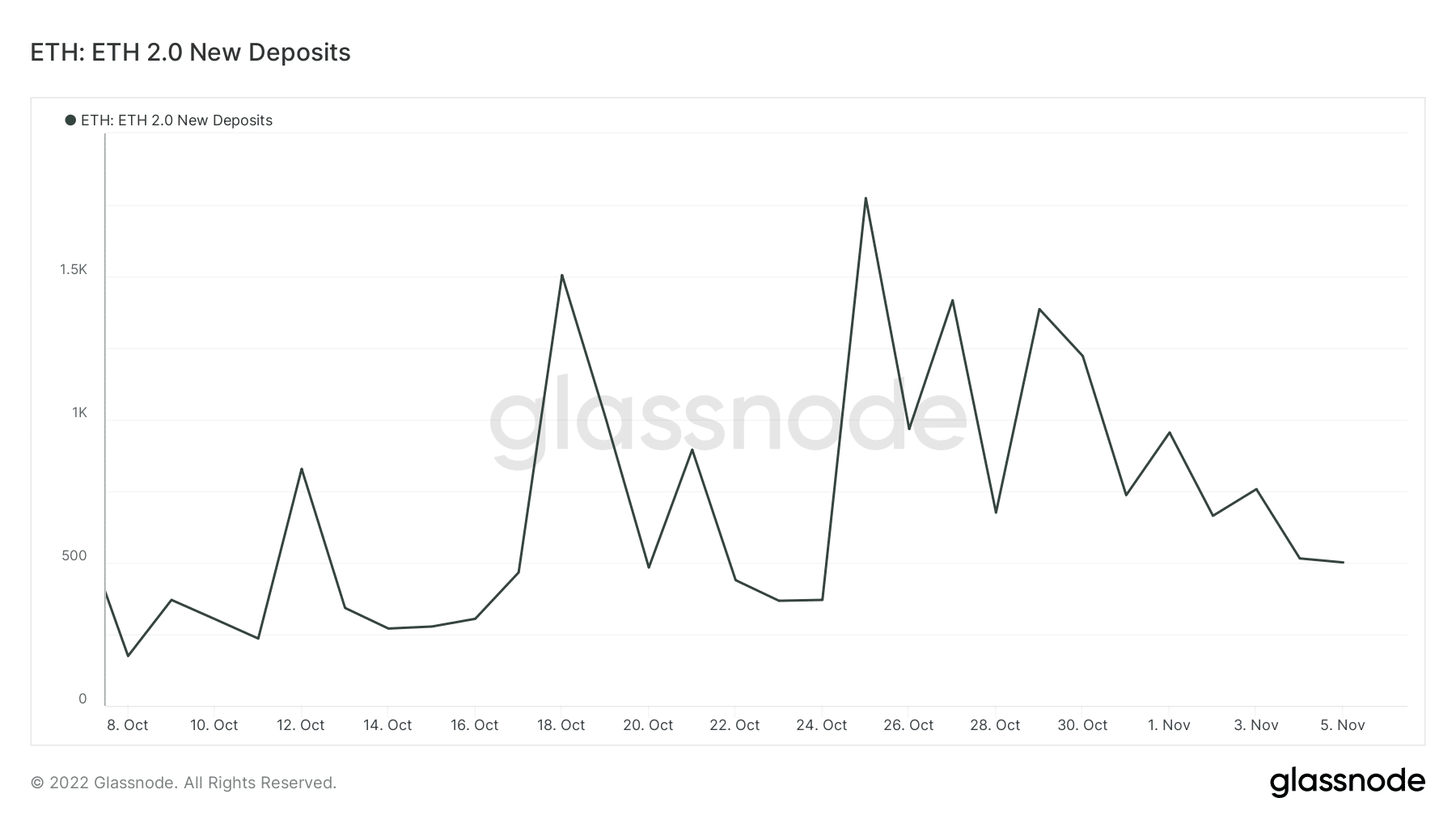

The newest bullish wave contributed considerably to the quantity of ETH locked in DeFi in ETH 2.0. A powerful spike was additionally noticed in ETH 2.0 new deposits at first of the week. Nonetheless, the tempo at which new deposits had been coming in dropped, depicting a tapering bullish momentum.

Supply: Glassnode

It’s not all unhealthy right here…

Whatever the drop within the tempo at which new ETH 2.0 deposits had been going down, the opposite metrics highlighted a positive final result. One can conclude that community utility and demand for ETH have resumed. The worth of ETH additionally went up particularly within the final two weeks. Though, it had extra to do with the general crypto market. Nonetheless, natural demand might have contributed to ETH’s upside.

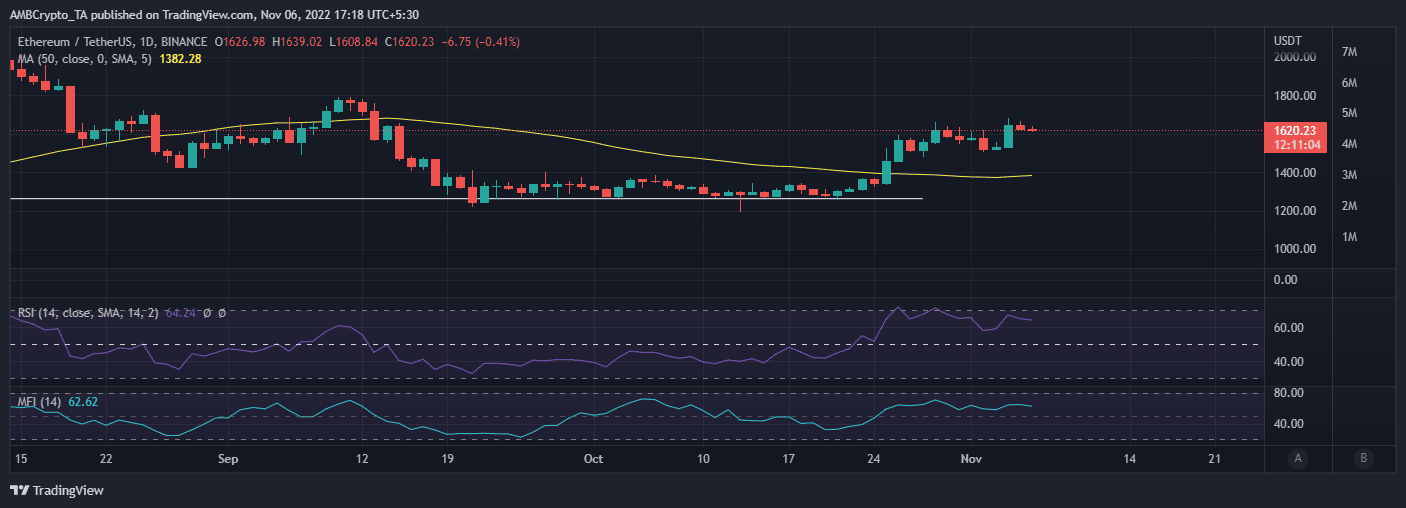

Moreover, a rise in ETH’s relative energy was additionally witnessed within the final two weeks. Extra importantly, the value managed to get well again above $1,600 and had a $1,620 press time value.

Supply: TradingView

ETH demonstrated an affinity for the upside within the final two weeks and the identical theme continued this week. This was accompanied by restricted promote stress. This will even have some relation with the truth that ETH nonetheless wasn’t overbought and was comparatively near its decrease vary.

Can Ethereum’s recovering demand gasoline extra ETH upside?

The noticed greater demand for ETH within the DeFi surroundings was already excellent news for crypto traders. It confirmed that the community managed to get well nicely put up the Merge. These observations may assist ETH shied itself from a harsh value drop within the short-term and place favor Ethereum progress. Nonetheless, this isn’t essentially a assure for the reason that retail market nonetheless has the largest impression on ETH demand.