Why Bitcoin Could Take Another Bite At $17K

Bitcoin is again above $20,000 after seeing some reduction in the course of the weekend. The primary crypto by market cap dropped beneath its 2017 all-time excessive as promoting strain elevated pushed by the present macro-economic atmosphere.

Associated Studying | Bitcoin Derivatives Alternate Reserve Surges Up As BTC Continues To Plunge

On the time of writing, Bitcoin (BTC) trades at $20,500 with a 6% revenue within the final 24 hours. The final seven days file a unique story with a 24% loss.

Former BitMEX CEO Arthur Hayes claims an institutional compelled vendor triggered the rise in promoting strain. An entity that was compelled to liquidate its positions as BTC’s worth trended additional draw back.

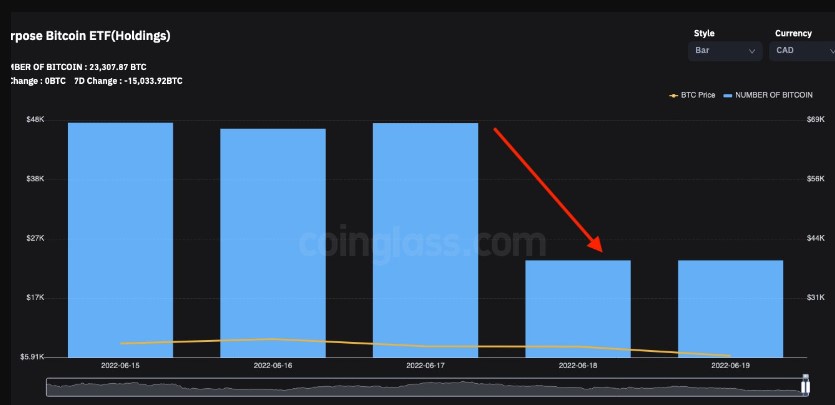

Hayes believes that Canada’s Bitcoin Goal Alternate Traded Fund (ETF) was probably liable for the draw back worth motion. The funding car is settled by bodily BTC and, according to Purpose, when a shopper buys the ETF, they’re shopping for “actual Bitcoin”.

The previous BitMEX CEO claimed he’s unfamiliar with this ETF’s redemption course of. Nevertheless, the funding car seems to have dumped 24,500 BTC into the market, as seen beneath.

This represents virtually 50% of the ETF’s belongings, if the BTC was bought in a rush, it appears logical that Bitcoin misplaced assist at round $20,000 and was compelled to commerce decrease with the remainder of the crypto market. Consumers confirmed up and absorbed the draw back worth motion.

This enabled Bitcoin to reclaim the $20,000 space and confirmed that Bitcoin will get bough shortly beneath these ranges. Hayes mentioned the next concerning the situations that took BTC’s worth to contemporary lows, and why it skilled reduction:

Over the weekend, whereas the fiat rails are closed, $BTC dropped to a low of $17,600 down virtually 20% from Friday on good quantity. Smells like a compelled vendor triggered a run-on stops. After the sellers dumped their luggage, the market shortly rallied on low quantity.

Why Bitcoin May See Extra Ache

The preliminary response to the draw back strain was good, however as Hayes defined, it occurred throughout a low weekend with low quantity throughout alternate platforms. The crypto market might see BTC’s worth taking one other swing on the lows. The previous CEO mentioned:

Given the poor state of danger administration by cryptocurrency lenders and over beneficiant lending phrases, count on extra pockets of compelled promoting of $BTC and $ETH because the market figures out who’s swimming bare.

Associated Studying | TA: Bitcoin Restoration Stalls Close to Key Juncture, Key Resistance Intact

As this construction, which contributes to spikes in promoting strain, stays intact bears might proceed pushing B’C’s worth down. Within the meantime, long-term gamers have a chance to extend their holdings, Hayes concluded:

Is it over but … I don’t know. However for these expert knife catchers, there might but be further alternatives to purchase coin from those that should whack each bid regardless of the value.