What Is It And How Does It Work?

newbie

There are a number of risks awaiting unsuspecting merchants within the crypto market: rip-off initiatives, pockets thieves, cryptojackers, and so, so many extra.

Wash buying and selling is a extra covert malicious exercise than those talked about above. As an alternative of stealing your cash outright, it goals to confuse you and chip away your funds little by little. Nonetheless, it may be simply as damaging because the precise prison acts — particularly within the crypto market, which is really easy to control.

What Is Wash Buying and selling?

Wash buying and selling is a sort of market manipulation that entails a dealer shopping for and promoting a safety for the aim of artificially inflating its value. Wash buying and selling is taken into account unlawful in most jurisdictions.

How Does Wash Buying and selling Work?

Wash buying and selling sometimes entails a dealer organising two accounts, one to purchase an asset and one other to promote it. The client first buys the asset from the vendor after which sells it again at the next value. This creates the phantasm of elevated demand and thus drives up the worth. The vendor then does the identical, making a steady cycle of wash trades. This exercise might be completed manually by merchants themselves or by automated software program packages.

Why Would Somebody Wash Commerce?

There are a couple of explanation why somebody would possibly have interaction in wash buying and selling.

First, they might be attempting to control the worth of a safety for their very own achieve. For instance, they might be attempting to artificially inflate the worth in order that they will promote their very own holdings at a revenue.

Second, they might be doing it to create market liquidity. By shopping for and promoting the safety steadily, they make it seem extra liquid than it really is. This will appeal to different merchants to this safety, which might later be bought at the next value. That is particularly profitable for an asset class like cryptocurrency.

Lastly, wash trades can be used to cover actual buying and selling exercise from regulators or exchanges. By participating in wash trades, merchants could make it troublesome for authorities to trace their precise buying and selling exercise and earnings. Traders can scale back their taxes by claiming losses on trades, so a few of them execute wash trades to seemingly incur a loss. For that motive, the IRS made it not possible to assert losses on trades the place the securities bought at a loss had been reacquired inside a month.

Instance of a Wash Commerce

Let’s think about that there’s an Investor A who actually needs to promote his 100 XMR at a revenue. This cryptocurrency has a comparatively low every day buying and selling quantity, so its worth will not be that onerous to control.

So, our Investor A units up two crypto wallets, one to purchase Monero and one other one to promote it. Then, they go to an trade and place a promote order at $180. As quickly because the order is accomplished, Investor A buys their very own 100 XMR again from the trade at the next value, like $182. After doing this a couple of instances, their actions get observed by different market members. They’ll seemingly assume this can be a signal there’s elevated curiosity in XMR and should resolve to execute a couple of transactions themselves. This may inflate Monero’s value, which is able to result in Investor A making the revenue they supposed to make.

Crypto Wash Buying and selling

Wash buying and selling is quite common in cryptocurrency markets as a result of quite a few exchanges typically record the identical cash, and it may be fairly difficult to trace the actual buying and selling exercise and costs.

For instance, a dealer would possibly purchase Bitcoin on one trade at $9,000 after which promote it on one other trade at $10,000, thus creating the phantasm of elevated demand and driving up the worth. Nonetheless, in actuality, the dealer has merely moved their Bitcoin from one trade to a different and made a revenue from the unfold.

Crypto isn’t regulated, so it’s simpler to turn into a wash dealer on this market. Traders largely solely have to fret about transaction and trade fee charges.

What’s NFT Wash Buying and selling?

NFT wash buying and selling is a sort of commerce that happens when an investor buys and sells a non-fungible token (NFT) in an effort to artificially inflate its value. This exercise sometimes takes place on marketplaces or different venues the place NFTs are traded.

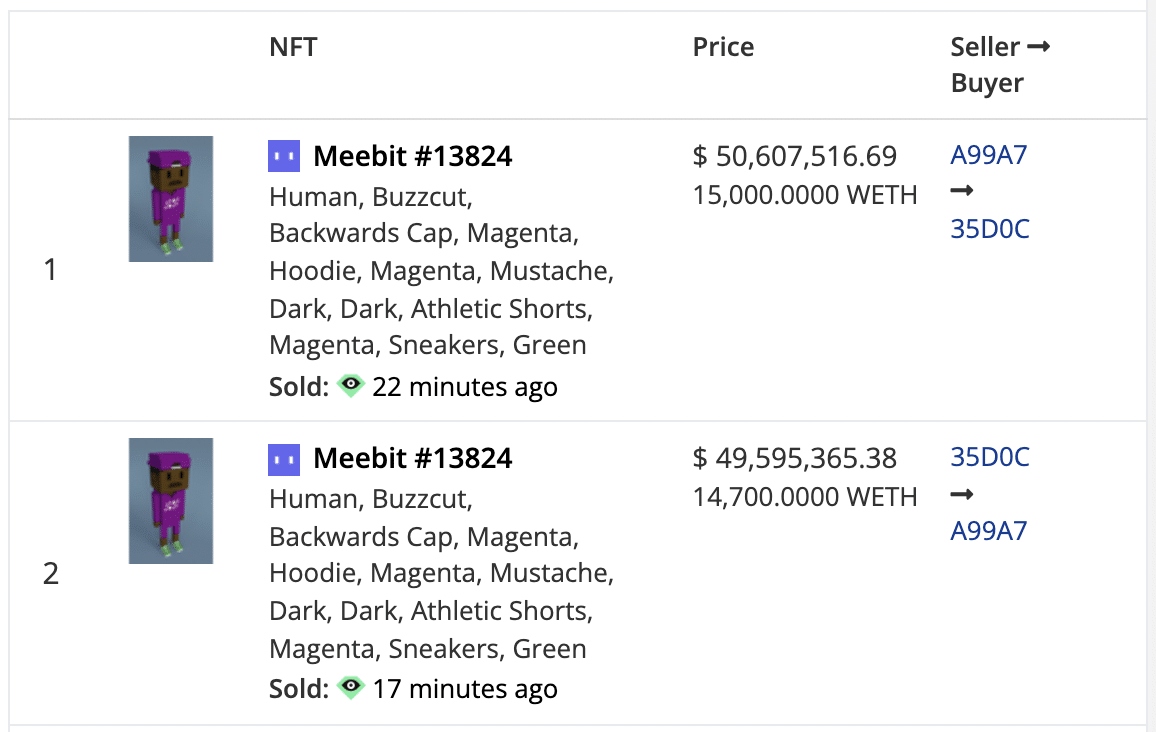

Wash buying and selling is a comparatively severe challenge within the NFT trade. Not solely does it serve to inflate costs for explicit belongings, it additionally makes the market much more standard than it really is. A number of studies have proven that there are a number of non-fungible tokens that get traded 25 and extra instances between only a handful of wallets. And this doesn’t even account for all of the buying completed with throwaway ETH wallets that may be created without spending a dime in a single minute!

How Does NFT Wash Buying and selling Work?

NFT wash buying and selling works the identical means common wash buying and selling does. A dealer units up a number of (or a number of) crypto wallets and makes use of them to purchase and promote the identical non-fungible token time and again. For the reason that NFT market is usually pushed by consumer curiosity and hype, this works very well to drive up the values of all these belongings. Not solely does it enhance the worth of a selected NFT, it additionally drives up the liquidity and capitalization of all the market. It creates synthetic hype that’s finally used to draw new market members.

Instance of NFT Wash Commerce

Let’s think about that the identical Investor A from our earlier instance now needs to make some cash from NFTs. First, they buy a newly minted non-fungible token on a market. Then, they purchase it from themselves for ten instances the worth. Ultimately, Investor A takes a screenshot of their revenue and posts it on social media. Individuals affected by FOMO or people who wish to make a fast buck then flock to the market, shopping for Investor A’s NFT or one other one from that assortment, considering it’s going to be the following huge factor. In fact, they find yourself shedding cash as an alternative.

What Is the Distinction between Wash Buying and selling and Fraud?

Whereas wash buying and selling is a sort of market manipulation, it isn’t essentially fraud as a result of wash trades are sometimes executed between two (or one) prepared members. Each events know that the commerce is going down solely for the aim of artificially inflating the worth. Nonetheless, if one get together is unaware that it’s a wash sale, then it may very well be thought-about fraud.

The Authorized Side of Wash Buying and selling

As wash buying and selling is taken into account a type of market manipulation, it has been outlawed by most jurisdictions, regulated exchanges, brokers, and so forth. In a means, wash buying and selling is just like insider buying and selling: it’s used to artificially inflate an asset’s liquidity and value, which will increase market threat and may result in losses for different traders keen on that asset.

Within the inventory market, wash buying and selling can also be typically used to decrease one’s taxes.

Penalties for Wash Buying and selling

The penalties for wash buying and selling range relying on the jurisdiction. In america, wash buying and selling is taken into account a type of securities fraud and might be punishable by as much as 20 years in jail. In different jurisdictions, penalties could also be much less extreme, however wash buying and selling remains to be sometimes thought-about a severe offense. Nonetheless, this relates solely to the inventory market: these penalties don’t apply to crypto.

Methods to Keep away from Wash Trades

To keep away from taking part in a wash commerce your self, attempt to solely trade crypto on the platform or with folks you’ll be able to belief. Moreover, be careful for some purple flags like requests to switch an identical quantity of crypto for a similar value backwards and forwards.

It’s a bit bit extra difficult in terms of avoiding the results of wash gross sales and purchases executed by different market members. You may lookup if the change within the variety of distinctive addresses used to commerce that coin correlates with the rise in quantity. Moreover, you’ll be able to instantly look by the trades executed prior to now few hours or days. Since blockchains are clear and have clear transaction historical past, this can be a lot simpler to do within the crypto market than with securities.

FAQ

What’s an instance of a wash commerce?

A wash commerce is a sort of commerce that happens when an investor buys and sells a safety for the aim of artificially inflating the worth. This exercise sometimes takes place on exchanges or different venues the place the safety is traded. Wash gross sales are thought-about unlawful in most jurisdictions.

How do you determine wash trades?

Some purple flags would possibly point out that it was a wash dealer who executed the transaction. For instance, if one sees a few transactions with an identical value unfold, buying and selling quantity, and time of execution coming in a row, this may very well be a wash commerce.

What’s a wash in day buying and selling?

A wash in day buying and selling is a sort of market manipulation that entails an investor shopping for and promoting a safety to artificially inflate its value.

Is wash buying and selling unlawful in crypto?

Not likely. Not like conventional inventory markets, the place this exercise and insider buying and selling are literally unlawful, crypto markets aren’t regulated.

Disclaimer: Please word that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.