USDT transaction volume drops to monthly low, but what’s the Chinese connection

- USDT quantity slows down because the depth of the bear market reveals indicators of a decline.

- Robust USDT worth is extra fascinating in China because the stronger greenback pushes previous essential historic CNY ranges.

The Cryptocurrency market simply concluded an total bearish week marking the second retracement to date this yr.

Observing stablecoins could present insights into how and the place liquidity flows are headed. USDT, one of many greatest stablecoins by market cap and quantity demonstrates some fascinating observations.

In response to the most recent Glassnode information, USDT dropped to its lowest month-to-month transaction quantity ranges within the final 24 hours.

The final time the transaction quantity was this low was initially of the second week of January. This was proper across the identical time that the crypto market began experiencing a surge in volatility.

📉 $USDT Transaction Quantity (7d MA) simply reached a 1-month low of 132,693,185.339 USDT

View metric:https://t.co/7oXBoR4C4j pic.twitter.com/pwvQFFc0h3

— glassnode alerts (@glassnodealerts) February 25, 2023

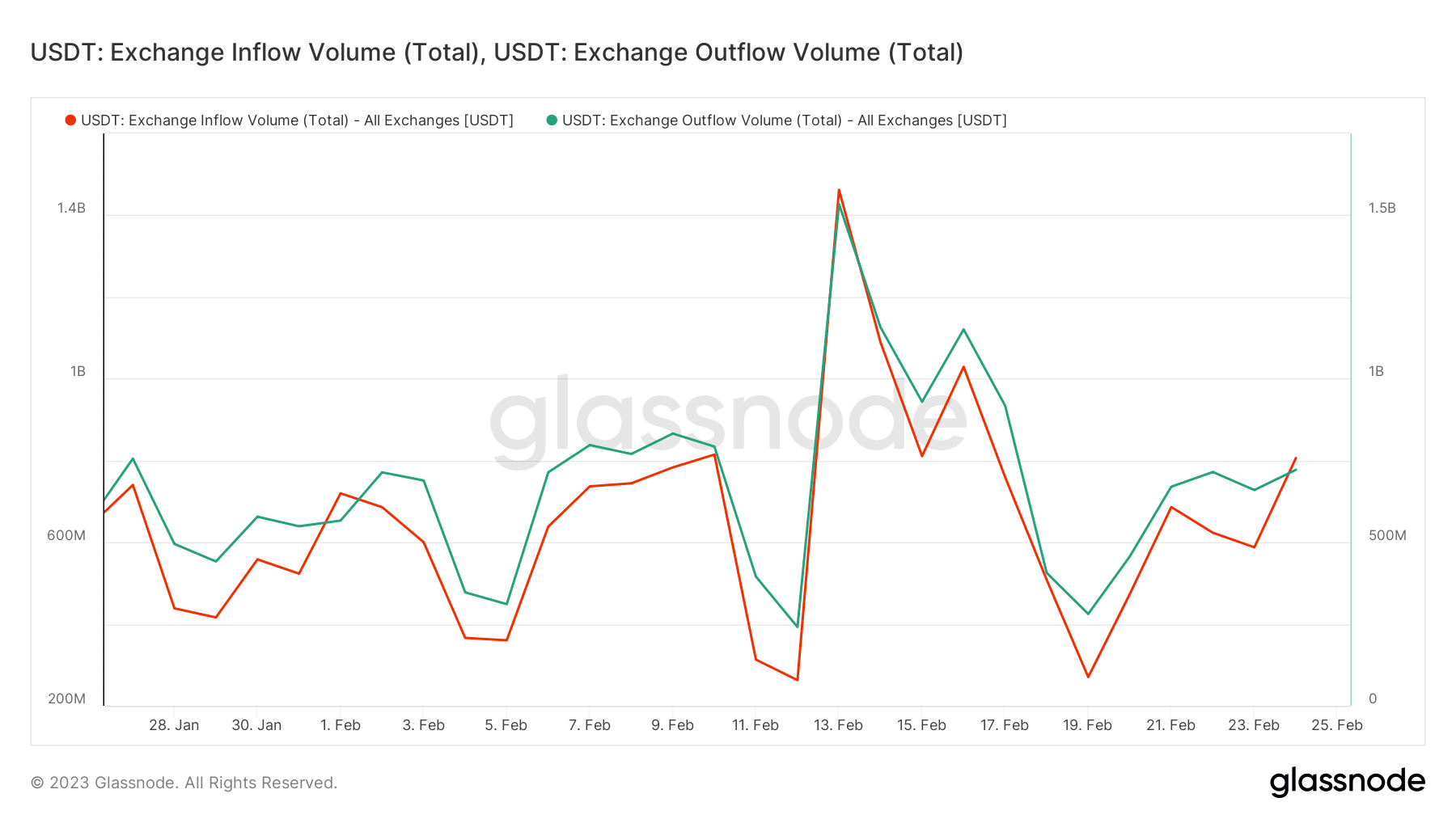

USDT was nonetheless concerned in important buying and selling exercise regardless of the drop in transaction volumes. The most recent on-chain change flows reveal that USDT had a internet circulation of +$84.4 million. This implies it had a better liquidity influx than outflows within the final 24 hours at press time.

📊 Each day On-Chain Alternate Movement#Bitcoin $BTC

➡️ $763.0M in

⬅️ $702.3M out

📈 Internet circulation: +$60.7M#Ethereum $ETH

➡️ $567.4M in

⬅️ $415.8M out

📈 Internet circulation: +$151.6M#Tether (ERC20) $USDT

➡️ $806.2M in

⬅️ $721.7M out

📈 Internet circulation: +$84.4Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) February 25, 2023

A key level to notice is that there was nonetheless a big quantity of change outflows. The final recorded change inflows averaged barely over $806 million whereas the change outflow quantity amounted to $721.65 million.

Supply: Glassnode

A possible cause for this consequence is that the market maintained an total bearish sentiment, therefore many merchants have been exiting their positions in favor of stablecoins.

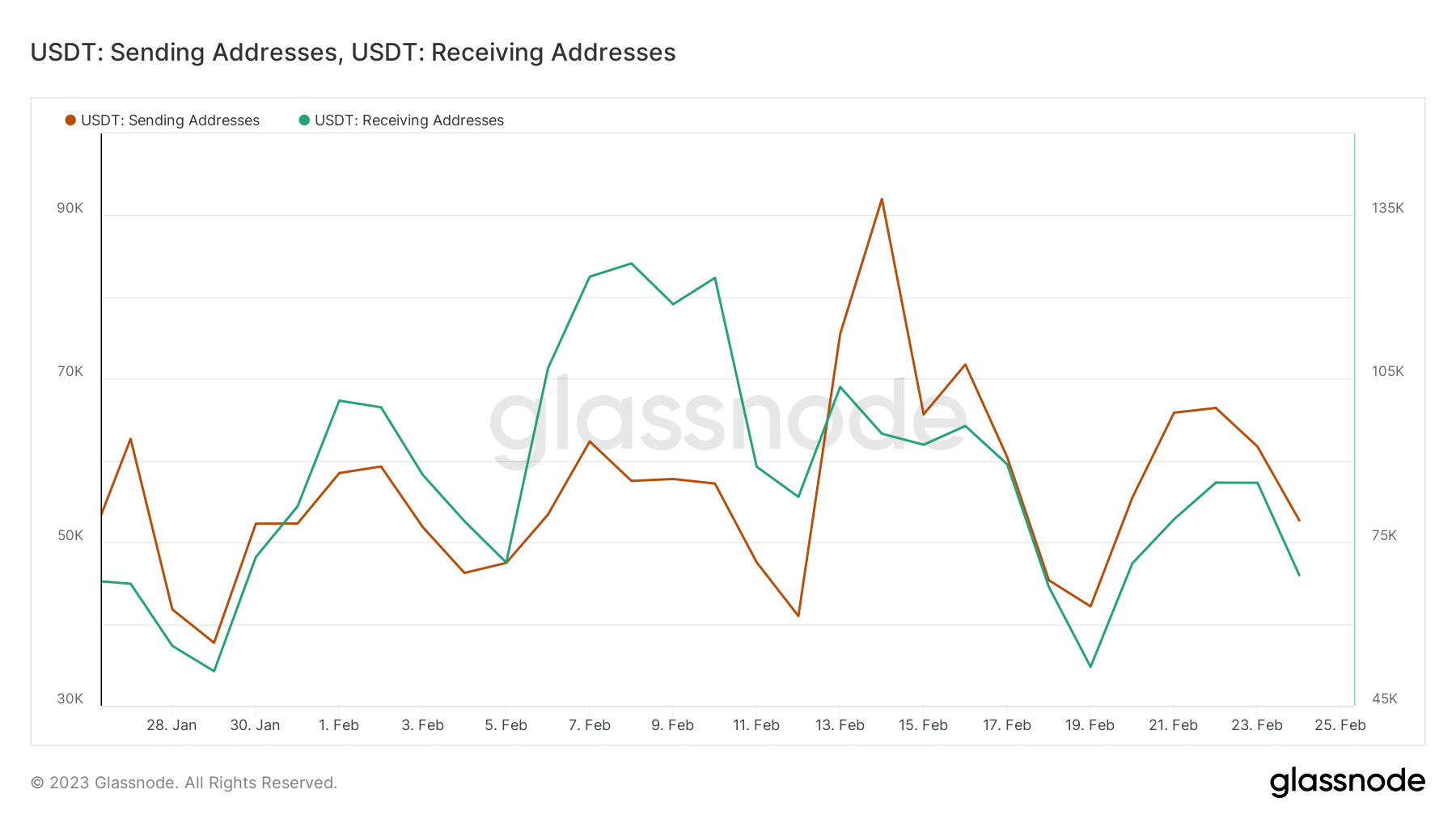

As such, there was an elevated demand for USDT on and off exchanges. Tackle flows provide a greater image of the extent of demand for USDT available in the market.

Demand for USDT stays excessive

The variety of receiving addresses was greater within the final 24 hours at 68,969 addresses. Compared, sending addresses got here in at 52,675.

As anticipated, throughout a bear market, the upper variety of receiving addresses confirms that extra merchants are opting to carry stablecoins. instance of that is the sturdy demand for the USDT in China.

USDT’s fiat foreign money buying and selling worth in China has damaged by 7 CNY. Because the market’s expectations for a slowdown within the Fed’s rate of interest hike have weakened, the U.S. greenback index has lately strengthened in phases.

— Wu Blockchain (@WuBlockchain) February 25, 2023

USDT’s worth lately crossed above the 7 CNY worth stage. This was largely courtesy of the upper greenback power which makes the equivalently valued USDT extra fascinating to carry particularly throughout a bear market.

Supply: Glassnode

A key level to notice is that there’s additionally quite a lot of promote strain for USDT. This means that there’s noteworthy re-accumulation going down at discounted costs.