Uniswap’s strong uptick could witness a break if investors fail to do this for UNI

The Uniswap decentralized change skilled a rise in demand and utility within the final seven days. An inexpensive end result for the reason that market moved from a beforehand low quantity interval earlier in October to a excessive quantity section in direction of end-month. This efficiency might give insights into what buyers ought to anticipate transferring ahead.

Right here’s AMBCrypto’s worth prediction for Uniswap [UNI] 2022-2023

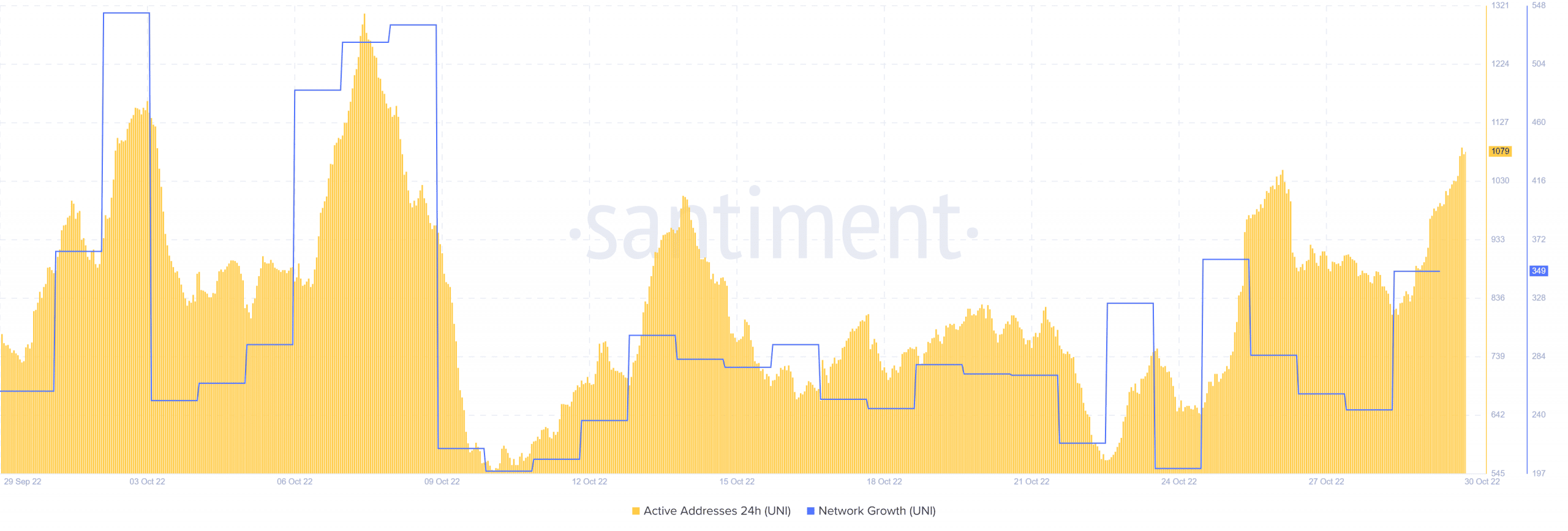

In principle, increased utility for Uniswap means extra demand for its native token UNI. Moreover, final week we noticed a rise within the variety of day by day lively addresses because the market began heating up. This enhance notably began happening on 23 and 24 October. Community progress additionally noticed an total enhance from across the similar time through the week.

Supply: Santiment

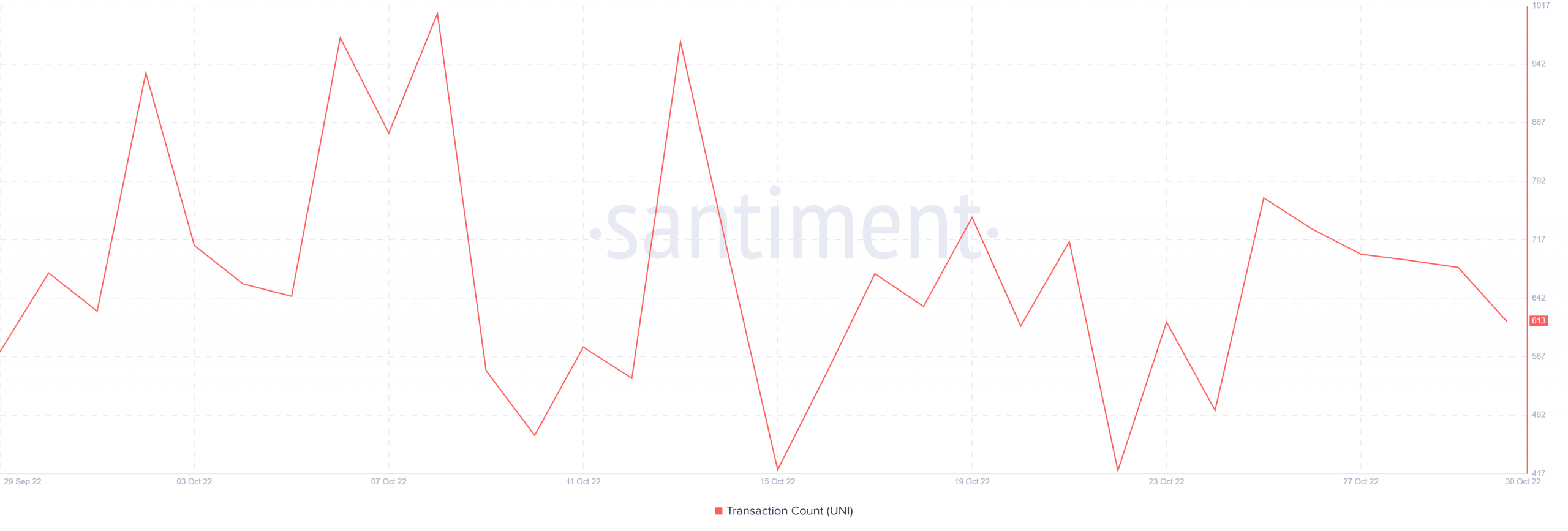

The upper lively addresses represented extra community utility as crypto bulls took over following a earlier interval of relative dormancy. Uniswap’s community transaction rely registered a pointy enhance between 23 and 25 October, earlier than slowing down since then.

Supply: Santiment

The drop within the transaction rely could not essentially mirror decrease demand. It did, nevertheless, affirm that a lot of the demand was concentrated firstly of final week. Whereas these metrics confirmed elevated community exercise and community progress, they weren’t the one motive for the UNI demand.

The sudden swap to a bullish market sentiment could have additionally fueled demand for the UNI token. This will clarify why it continued to rally even because the community transactions slowed down.

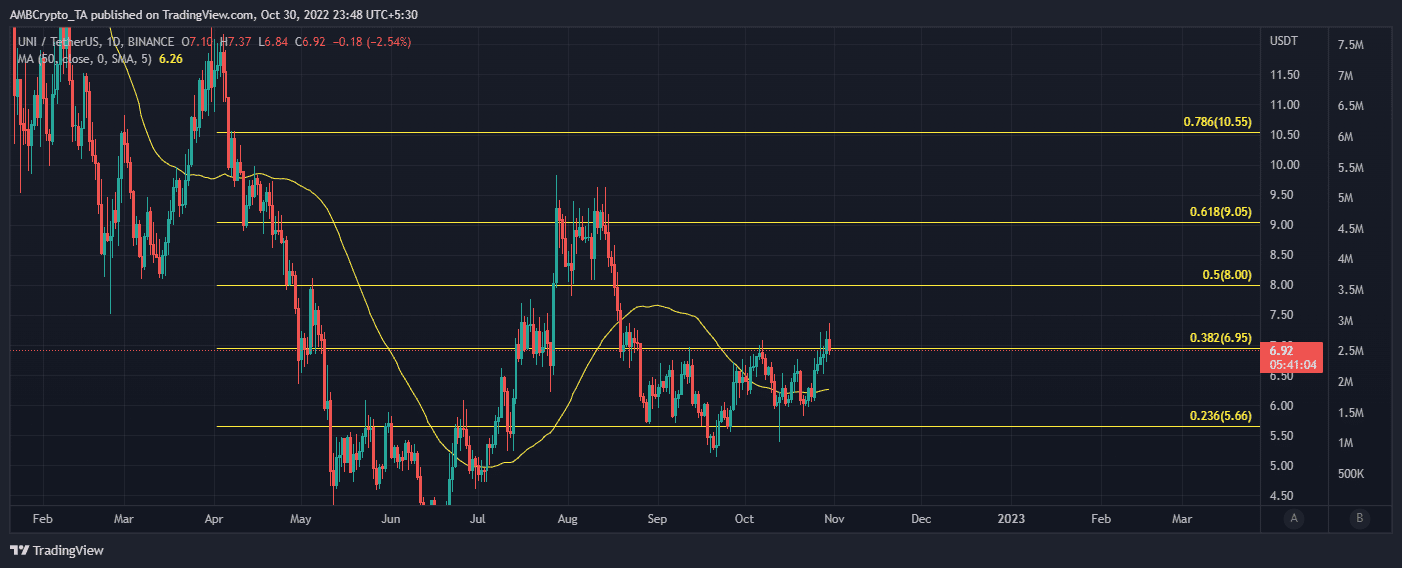

Supply: TradingView

UNI managed to rally by barely over 20% within the final seven days. It achieved a brand new two-month excessive of $7.37 earlier than retracing to its $6.96 worth of 30 October. Its newest worth motion managed to push previous a key resistance stage on the talked about worth stage. This resistance stage lied on the 0.382 Fibonacci retracement line.

What to anticipate from Uniswap this week

The final two makes an attempt on the similar resistance stage demonstrated much less momentum in comparison with the most recent retest. This indicated that the worth was certainly gaining relative power in favor of the bulls. This has been the case for the reason that RSI crossed above the 50 stage.

Supply: TradingView

We’d see UNI proceed on its upward trajectory within the subsequent few days. It is because it nonetheless has some floor to cowl earlier than reaching the overbought zone. It stays to be seen whether or not the upper relative power will enable the bulls to beat any draw back and proceed on their upward match.

Traders must be eager to watch is whether or not a rise in promote strain may have a constructive impact on UNI. Maybe the ensuing natural demand for UNI will take in the market promote strain. If not, we’d see UNI give in to the present resistance vary.