UNI traders willing to make major market moves may want to read this first

- Uniswap’s social dominance registered a rise over the previous week

- Nevertheless, market indicators and metrics revealed that UNI’s worth may do down additional

Your complete crypto market’s worth motion over the previous couple of days didn’t precisely align with buyers’ curiosity. Most cryptocurrencies didn’t handle to register an uptick, and Uniswap [UNI] wasn’t any totally different.

Regardless of its underperformance, LunarCrush revealed that UNI remained a sizzling subject within the crypto house as its social dominance went up this week. Thus, reflecting its excessive reputation.

Uniswap social dominance is up +443.6% to 4.28% this week! 📈

See all $UNI insights + extra with a degree 5 account.

👉 https://t.co/6ouSuI49Zc pic.twitter.com/PV5exUu8JT— LunarCrush (@LunarCrush) December 24, 2022

Are your UNI holdings flashing inexperienced? Test the Revenue Calculator

A protracted winter behind and forward

On the time of writing, UNI’s worth decreased by greater than 3% during the last week and was trading at $5.18 with a market capitalization of over $3.95 billion. Although UNI remained well-liked, market indicators revealed that buyers needs to be cautious as issues may worsen within the coming days.

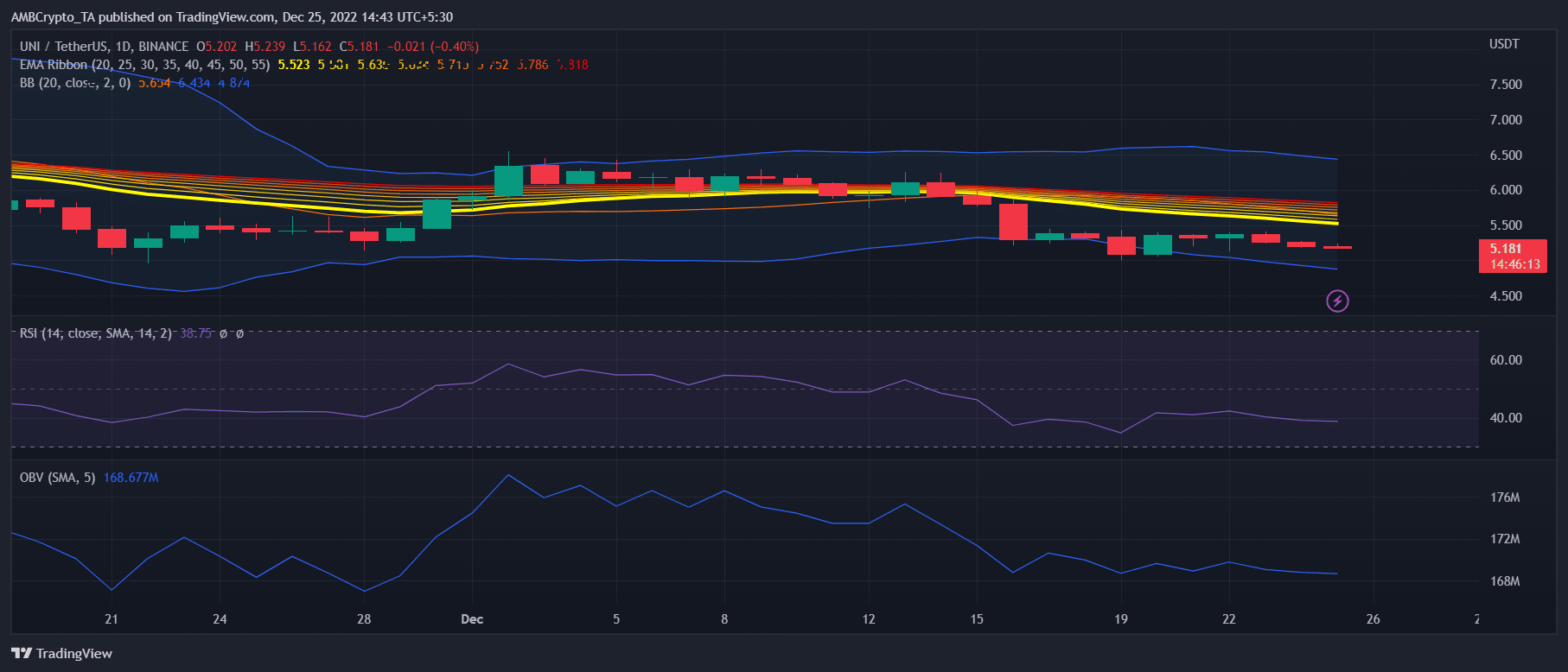

UNI’s Relative Power Index (RSI) registered a decline and was resting means under the impartial mark, which was a bearish sign. Moreover, UNI’s On Stability Quantity (OBV) additionally adopted the identical path, additional rising the probabilities of a continued worth decline.

The Exponential Shifting Common (EMA) Ribbon additionally appeared bearish. This was was additional augmented by the Bollinger Band’s information because it revealed that UNI’s worth was getting into a excessive volatility zone.

Supply: TradingView

Learn Uniswap’s [UNI] Worth Prediction 2023-24

Are the metrics supportive?

Regardless of the poor efficiency, UNI managed to be well-liked among the many whales, because it turned some of the used sensible contracts among the many high 500 Ethereum whales on 23 December.

JUST IN: $UNI @Uniswap one of many MOST USED sensible contracts amongst high 500 #ETH whales within the final 24hrs🐳

We have additionally received $BONE, $SHIB, $BAL, $LINK & $AURA on the listing 👀

Whale leaderboard: https://t.co/tgYTpOm5ws#UNI #whalestats #babywhale #BBW pic.twitter.com/OclWOAhjVu

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 23, 2022

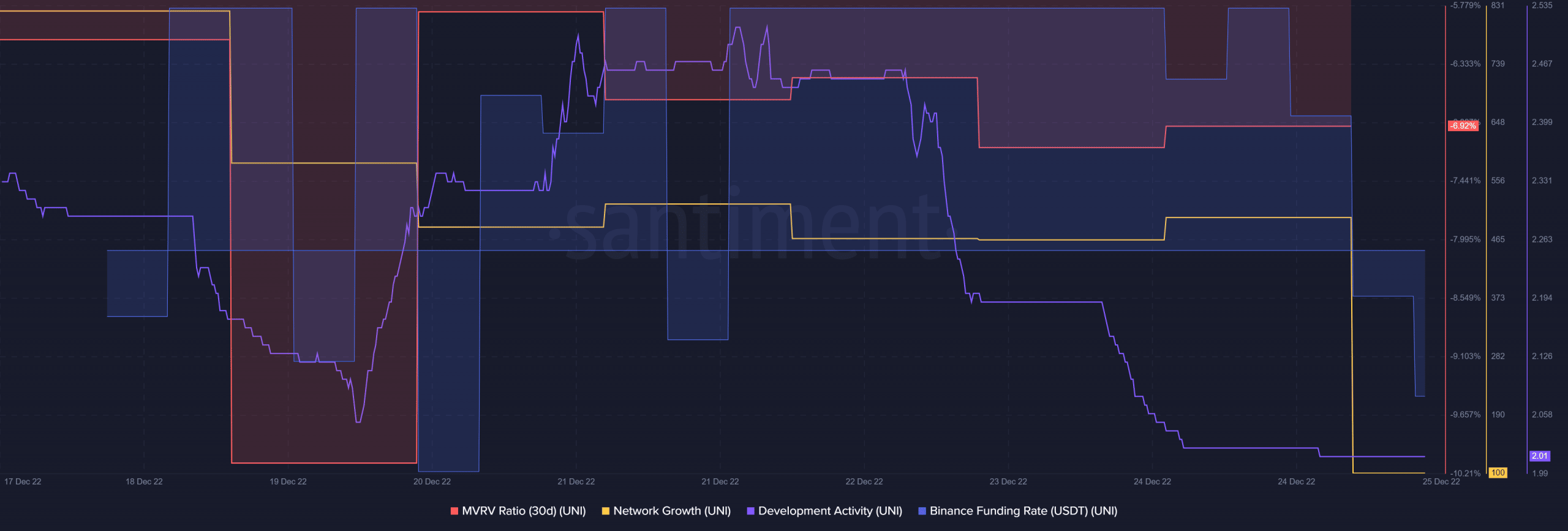

By the way, a number of of the on-chain metrics have been additionally unsupportive of a worth surge. This may very well be a matter of concern for buyers. As an illustration, UNI’s improvement exercise went down, which by and enormous is a unfavorable sign.

UNI’s community progress additionally decreased during the last week, together with a slight lower in Binance funding price. This recommended that UNI’s worth may go down additional. Nonetheless, the Market Worth to Realized Worth (MVRV) Ratio went up, giving hope to the buyers.

Supply: Santiment