Tron’s performance of Q3 can tell investors this about TRX’s Q4 price trajectory

With the latest common market worth rally, Tron [TRX] traded at a five-day excessive of $0.06382 on 5 November as per knowledge from CoinMarketCap. The cryptocurrency stood at rank #15 by market capitalization. Moreover, TRX exchanged fingers at a 1.5% drop within the final 24 hours, at a press time worth of $0.06351.

Right here’s AMBCrypto’s worth prediction for Tron [TRX] for 2023-2024

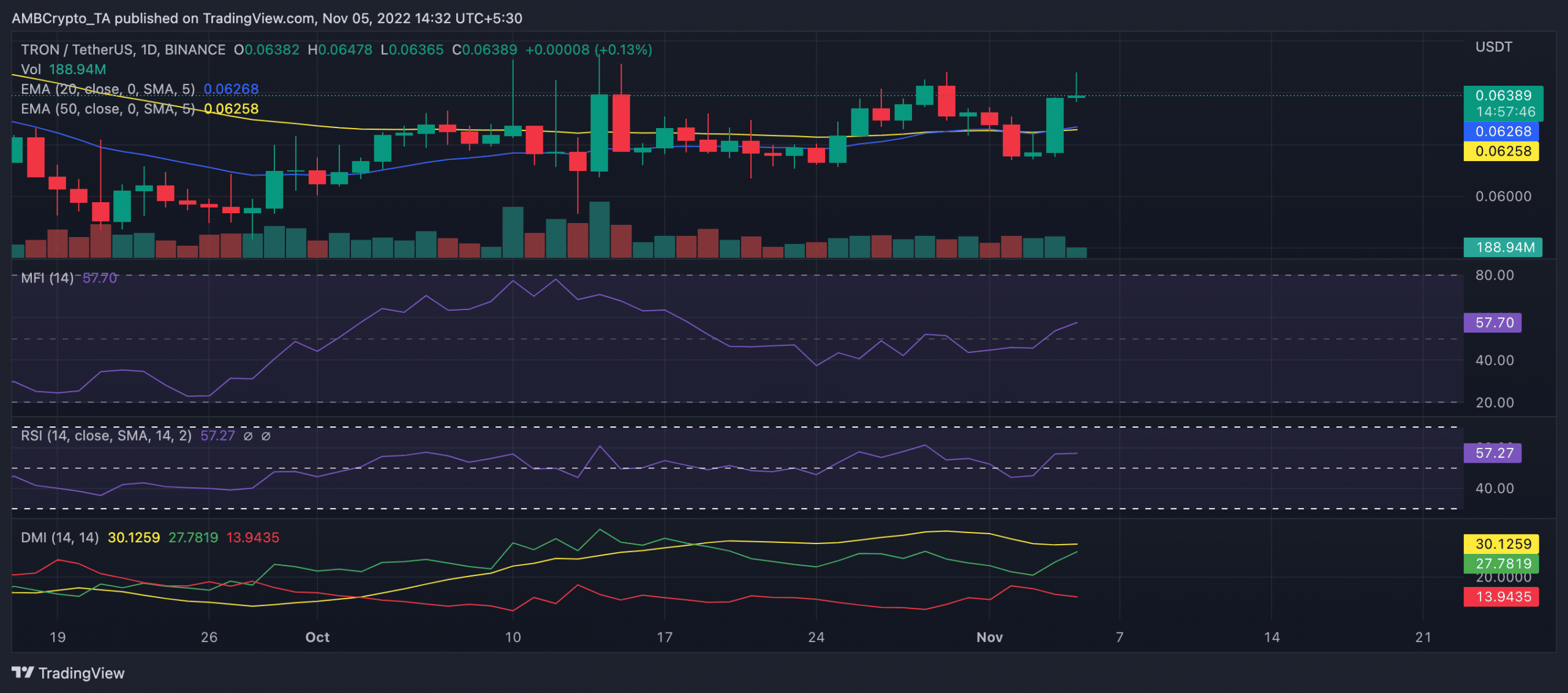

A consideration of the asset on a each day chart revealed that TRX patrons had management of the market on 5 November. This was gleaned from the place of the Directional Motion Index (DMI). The DMI confirmed that the patrons’ energy (inexperienced) at 27.78 was positioned solidly above the sellers’ (pink) at 13.94.

This was additional confirmed by the place of the Exponential Transferring Common (EMA). On the time of writing, the 20 EMA (blue) was proper above the 50 EMA (yellow), indicating that patrons have pressured sellers out of market management.

As well as, key indicators such because the Relative Energy Index (RSI) and Cash Move Index (MFI) have been positioned above their respective impartial areas in uptrends. As of 5 November, TRX’s RSI was 57, whereas its MFI was 57. This indicated a gradual development within the coin’s shopping for stress.

Supply: TradingView

Tron in Q3

Cryptocurrecy analysis platform Messari revealed its assessment of Tron Community’s efficiency in Q3. It was discovered that the community’s utilization remained secure whereas its quarterly income inside the three-month interval dropped.

Though the depend of newly activated accounts on Tron dropped by 21.7% within the final quarter, Messari discovered that each day energetic accounts on the community remained secure. Moreover, this metric witnessed a 0.3% development inside the similar interval. Evaluating Tron’s Q3 community utilization to that of Q2, Messari mentioned,

“On common, whole account exercise appears to have settled all the way down to ~2.6 million per day. The each day common of two.6 million over Q3 was not primarily based on an uptrend or bursts of utilization as in Q2. Q3 each day exercise was comparatively extra secure. The exercise in Q2 was a interval of excessive development primarily supported by the burst in Might, after the launch of USDD, TRON’s decentralized, overcollateralized stablecoin.”

Supply: Messari

As for income on the community, Messari discovered that this declined by 21% over the quarter. The full quarterly income made by Tron inside the interval beneath evaluation was $38 million. In Q2, this was $48 million. On the reason for the income decline, Messari acknowledged that this was on account of a 33% decline in “common transaction charges on the community.

Supply: Messari

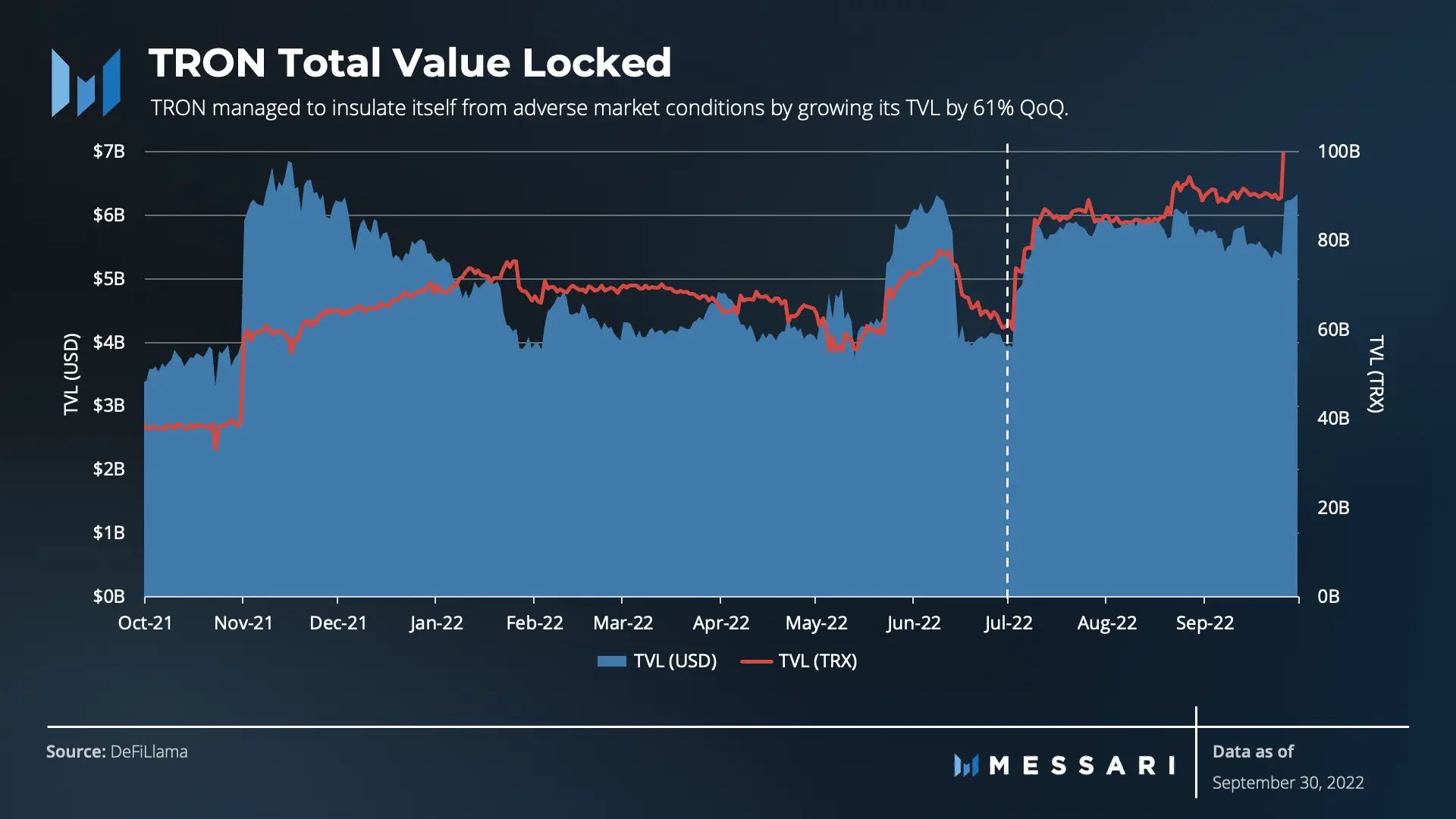

Whereas the vast majority of L1 blockchains suffered a fall in DeFi TVL, Messari discovered “Tron managed to insulate itself from antagonistic market situations by rising its TVL by 61% QoQ.”

Supply: Messari