Tron [TRX]: Short-term investors should be cautious with this supply zone

- TRX bulls had reached a key provide zone.

- If the bulls maintained momentum within the quick time period, they might hit $0.05557.

- A break under $0.05429 will invalidate the bullish forecast.

TRON [TRX] not too long ago ranked the second highest in complete worth locked (TVL), with Ethereum taking the primary spot. Due to this fact, it shouldn’t be shocking that its native token, TRX, has made 6% good points since 17 December.

Learn TRON’s [TRX] Value Prediction 2023-24

Nevertheless, at press time, TRX had hit a big provide zone that restricted its capability to supply extra good points to traders. It was buying and selling at $0.05496 and will face intense opposition from the additional uptrend, given the promoting stress that might come from this short-term provide zone.

If the bulls go previous the provision zone’s higher boundary at $0.05538, they may very well be blocked by the impediment at $0.05557. However can they bypass the provision zone?

Can the TRX bulls bypass this provide zone?

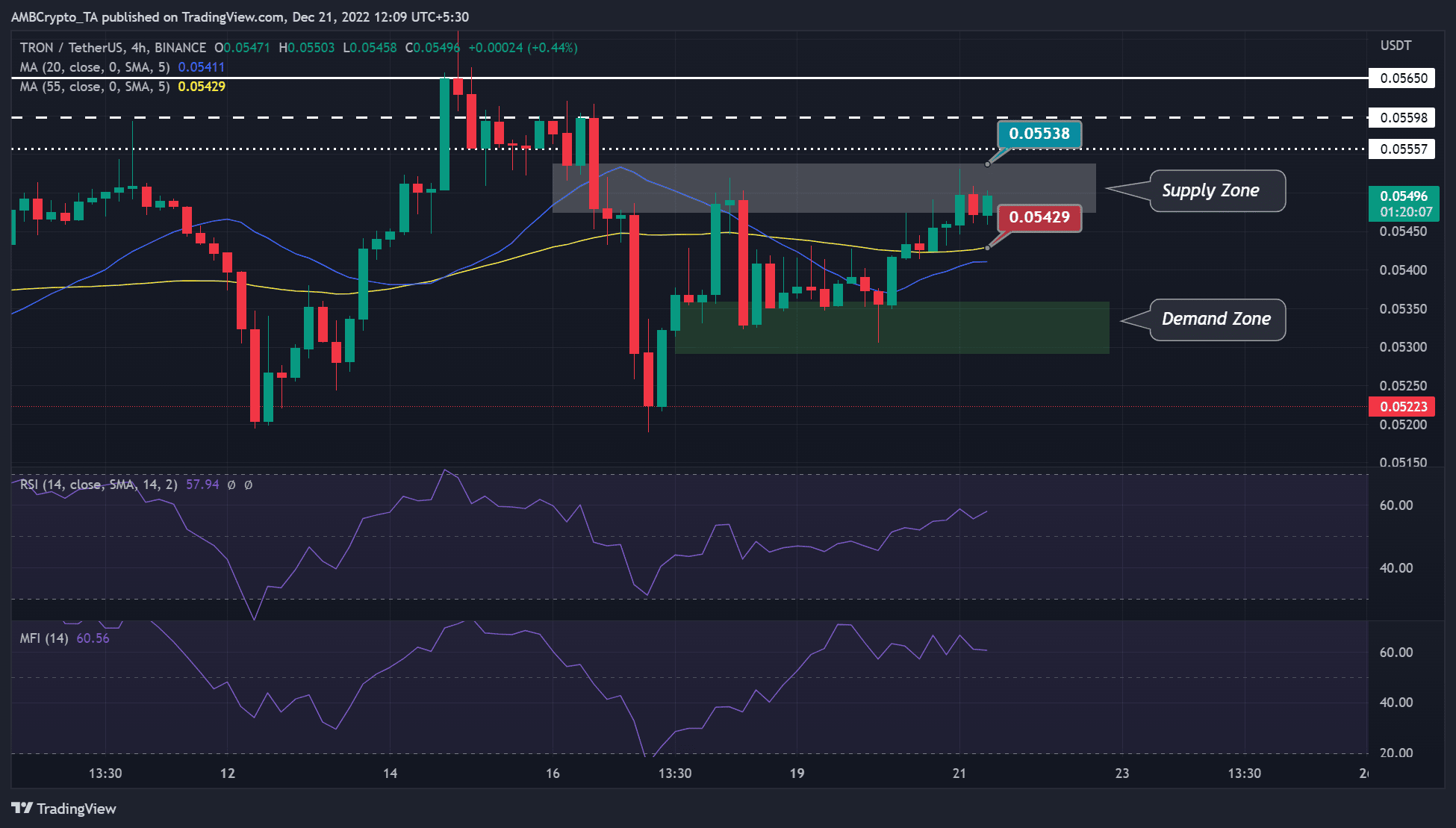

Supply: TRX/USDT on TradingView

The 4-hour chart confirmed attention-grabbing traits from technical indicators price noting. First, the Relative Power Index (RSI) had made greater highs and was shy of the 60 items degree, above the 50-neutral mark by 10 factors. This confirmed that bullish momentum had elevated prior to now few hours.

Nevertheless, the Cash Circulation Index (MFI) additionally recorded a steep rise, adopted by a zig-zag with a mild slope upwards. This confirmed that accumulation had elevated prior to now few hours however was adopted by minor distribution classes (zig-zag half).

Due to this fact, the market leaned towards consumers at press time, however promoting stress was additionally imminent, given the provision zone. Thus, TRX bulls can hit the outer boundary of the zone at $0.05538 or barely push above $0.05557.

Nevertheless, if sellers push bulls out of the provision zone, it would invalidate the above bullish bias. Such a downward stress might see TRX settle on the 55-period Shifting Common (MA) degree of $0.05429.

TRX recorded a decline in improvement exercise and buying and selling quantity

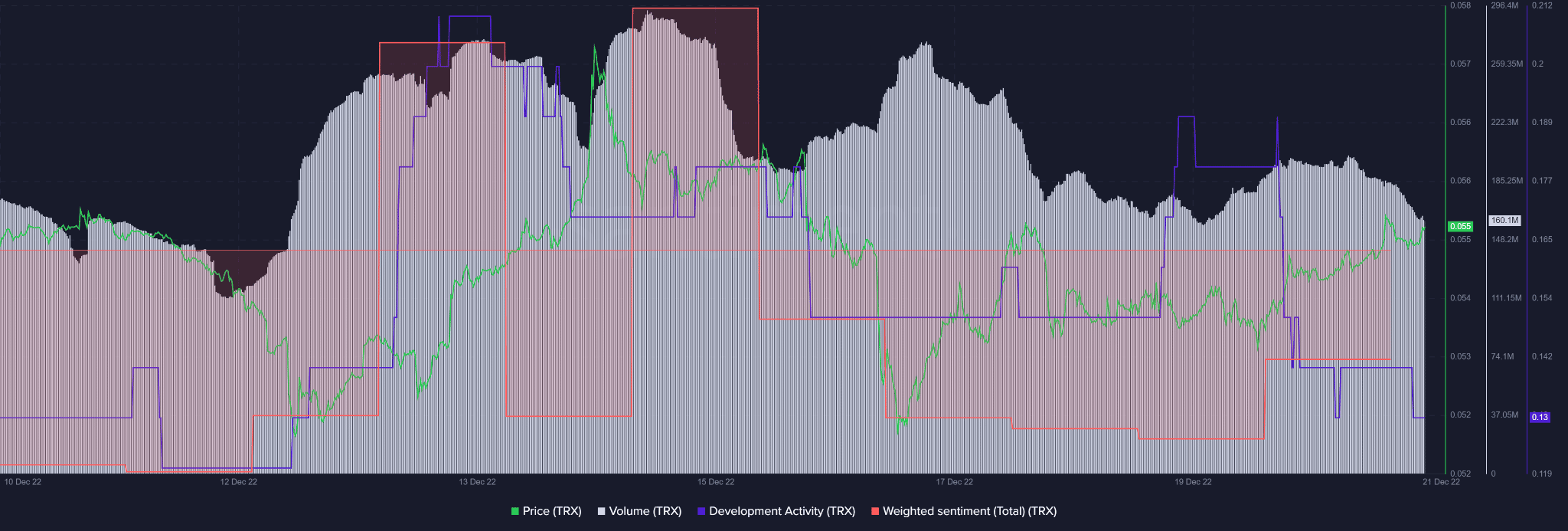

Supply: Santiment

In keeping with Santiment, TRX’s improvement exercise declined sharply, as did the traders’ confidence within the asset- proven by damaging weighted sentiment.

Nevertheless, it’s price noting that the sentiment improved barely with the current rally and elevated costs.

What number of TRX are you able to get for $1?

Nonetheless, the event exercise dropped even deeper by the point of publication. As well as, the buying and selling quantity declined, too, indicating a price-volume divergence. The decline in buying and selling quantity might undermine additional shopping for stress and provoke a worth reversal.

Might these situations undermine additional uptrend previous the short-term provide zone? Solely time can reply.