Ethereum changed allegiance but will the proceeds of the transition reflect in 2023

- The Ethereum Merge was profitable, with follow-up upgrades anticipated in 2023

- Staking withdrawals are anticipated to start within the first quarter after OFAC compliance enchancment

The Ethereum [ETH] mainnet transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) was the first motive the second largest blockchain was within the highlight in 2022. The Merge, because it was named, marked the most important mechanism change in crypto historical past.

Nevertheless, it wasn’t an all-year easy trip for the blockchain as traders’ expectations dampened. Furthermore, the blockchain’s validators wanted assist adapting to OFAC compliance insurance policies. However earlier than we dive deep into all that, let’s do a fast run again of how Ethereum fared in 2022.

Learn Ethereum’s [ETH] Worth Prediction 2023-2024

The Merge: A change lastly completed

Previous to the Merge, the crypto ecosystem was confronted with a number of challenges which in flip, negatively affected the crypto market. Exploits, scams, and notably the Terra [LUNA] collapse despatched the general market capitalization into dilapidation.

So, on account of the Ethereum Merge occurring in September, the neighborhood stuffed their hearts with hope of stability within the sector.

On 15 September 2022, the Ethereum group publicly introduced that the Merge was profitable round 6:43 a.m UTC. This was after Ethereum recorded triumphs with the Ropsten, Rikenby testnets, and Bellatrix upgrades.

And we finalized!

Blissful merge all. It is a huge second for the Ethereum ecosystem. Everybody who helped make the merge occur ought to really feel very proud right now.

— vitalik.eth (@VitalikButerin) September 15, 2022

We’re good. It is performed. We Merged. Holy shit. Superb work everybody 🥂🐼! https://t.co/bhbNS8LkZR pic.twitter.com/zx1d3L7Iox

— timbeiko.eth (@TimBeiko) September 15, 2022

Though the Merge helped scale back Ethereum’s power consumption by 99.5%, it didn’t lend a serving to hand to the excessive gasoline charges on the community. Through the occasion, the Ethereum Basis hosted a digital Merge viewing social gathering with revered co-founder Vitalik Buterin in attendance.

Through the occasion attended by 1000’s of individuals, Vitalik shared particulars of some “going ahead” plans. In the midst of the social gathering, the co-founder famous that the PoS transition was solely part of a protracted roadmap that may spur into 2023. He identified that plans have been additionally in place for the surge, verge, purge, and splurge improve.

In the meantime, the Ethereum growth group already put one foot ahead with its 2023 targets. Earlier in December, it communicated concerning the Shanghai improve, propelling it towards processing staking withdrawals.

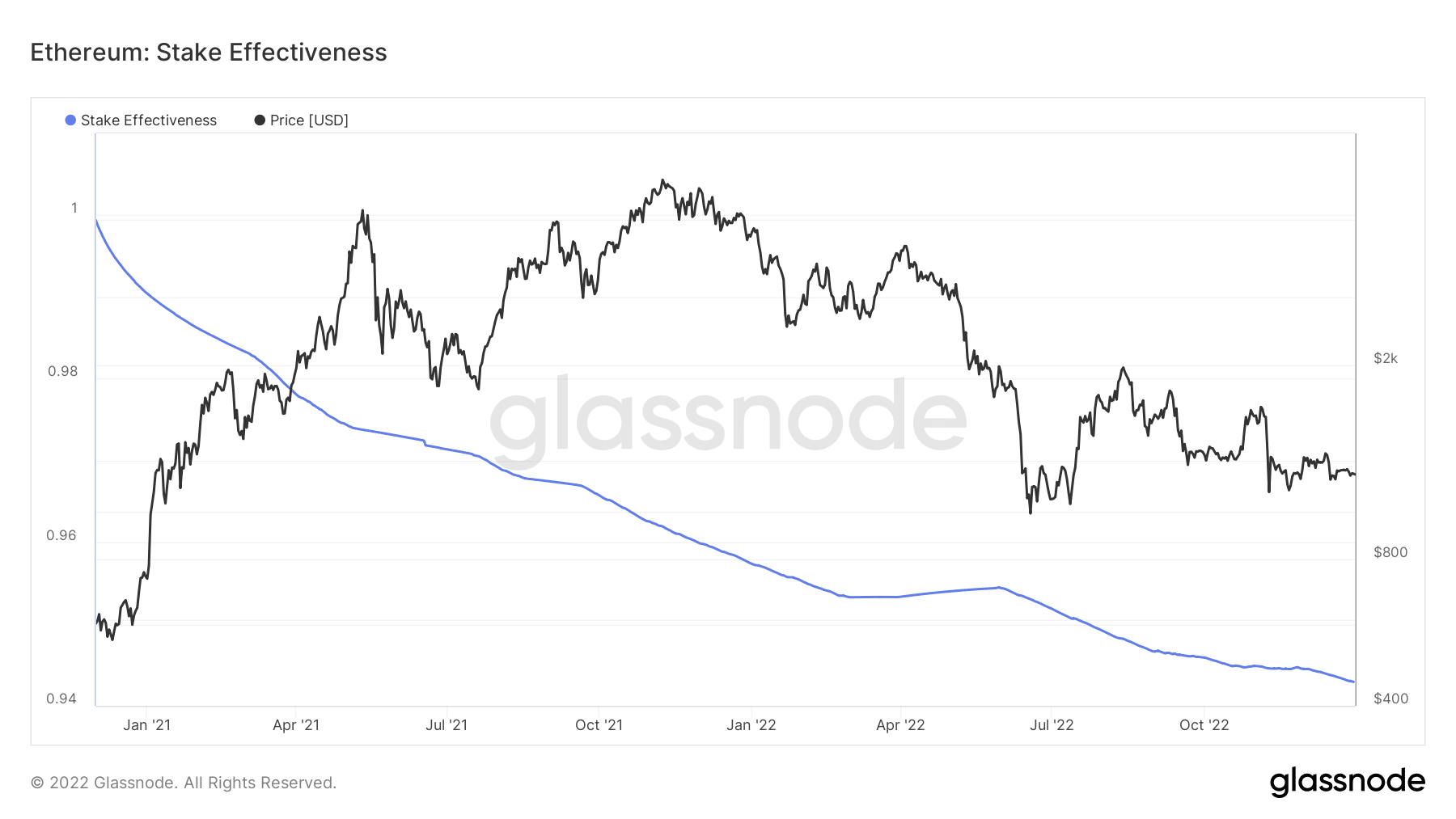

Regardless of the push, Ethereum struggled to enhance adoption for staking actions. In fact, it would nonetheless be early days, however Glassnode data revealed that efficiency on this facet has been largely unimpressive.

According to Glassnode, the Ethereum stake effectiveness has been in free fall. At press time, it was 0.942. The lower indicated that just a few validators have been collaborating in placing up their staked Ether [stETH] to work.

Supply: Glassnode

ETH: Fatigue within the midst of optimism

When it comes to its market efficiency, ETH traders have been optimistic that the historic occasion would deliver some respite to the ailing cryptocurrency. The rationale for the keenness was not far-fetched.

Within the lead-up to the Merge, Ethereum’s exhausting fork, Ethereum Traditional [ETC], constantly carried out excellently as its hashrate regularly spiked. In keeping with CoinMarketCap, the ETC price increased from $14.41 to $43.53 between July and September.

It was much like Ethereum’s staking protocol, Lido Finance [LDO]. In distinction, ETH traders have been left hanging even after CNBC called the times earlier than the Merge “the final likelihood” to build up ETH. Days after the occasion, ETH’s value decreased by about 15%, because it introduced conversations about shopping for the rumor and promoting the information.

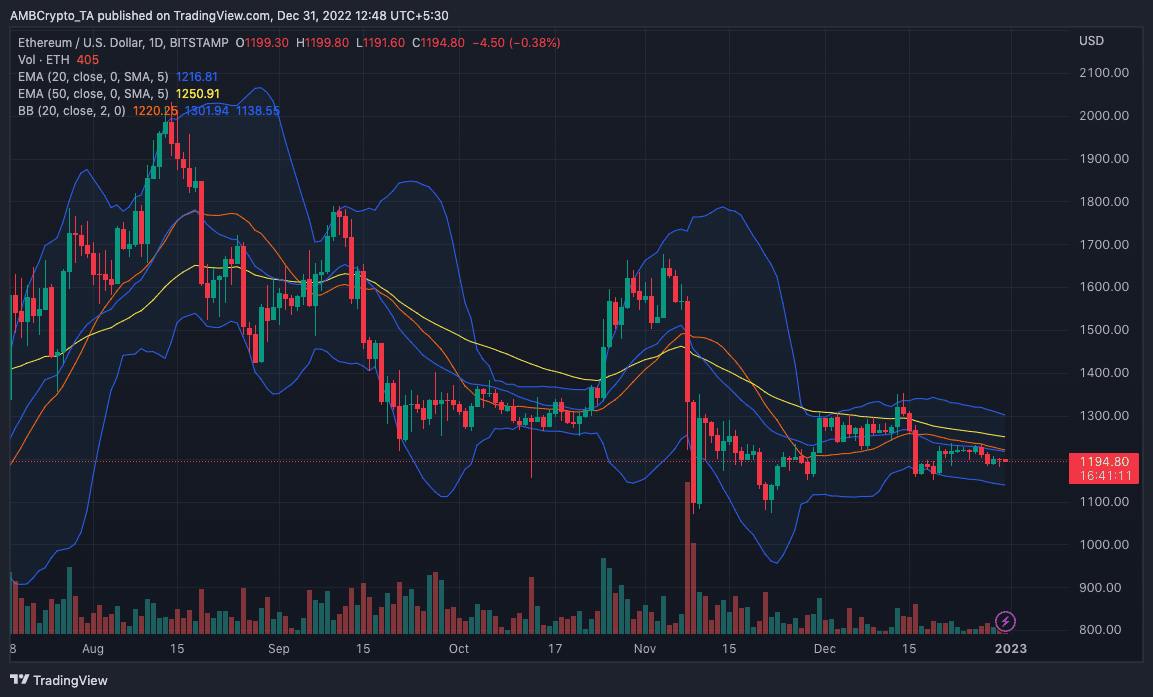

On the time of writing, ETH was changing hands at $1,195. Nevertheless, ETH would possibly fall under the present worth heading into 2023. Indication from the Exponential Shifting Common (EMA) steered this potential.

Primarily based on the day by day chart, the 20 EMA (blue) positioned under the 50 EMA (yellow). This commentary meant {that a} worth lower was possible, and a drop under $1,000 could possibly be imminent. Per its volatility, the Bollinger Bands (BB) didn’t replicate excessive ranges. So, because the worth touched neither the higher nor decrease bands, ETH was not oversold or overbought.

Supply: TradingView

Layer-Two (L2) to the rescue

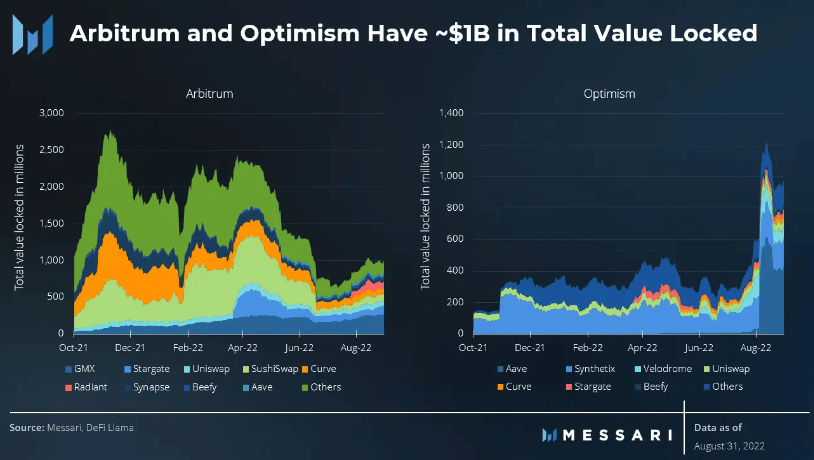

Whereas Ethereum struggled with optimistic post-Merge outcomes, L2 protocols like Arbitrum and Optimism [OP] stuffed in for the downturn. Within the third quarter (Q3), Messari reported that transactions on each protocols grew tremendously.

Transactions on Arbitum grew from 39,000 in January 2022 to 115,000 in August; Optimism loved a 3.5x hike from 41,000 to 142,000 throughout the identical interval. This progress additionally impacted the Whole Worth Locked (TVL) of the L2 gems to $1 billion.

In flip, Arbitrum and Optimism scaling meant that Ethereum’s rollup scalability was totally operational. If improved, it may translate to elevated adoption throughout the Ethereum blockchain within the coming 12 months. As with attainable traction, the roll-up providing transactions at a less expensive value may additionally drive consideration.

Supply: Messari

Censorship persists nonetheless

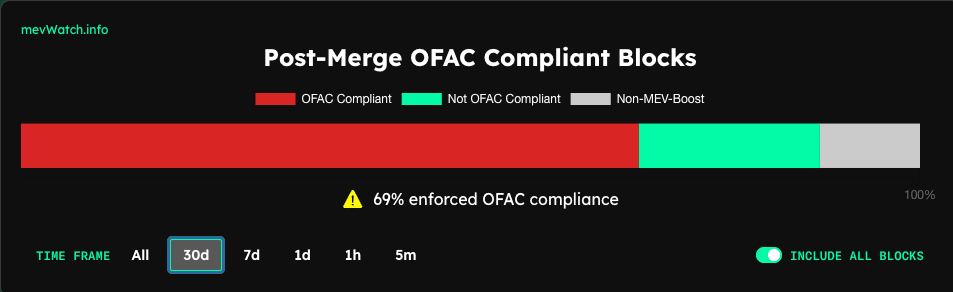

Amid the backwards and forwards, the Workplace of Overseas Asset Management (OFAC) in the US punished an Ethereum decentralized protocol, Twister Money. The sanctions got here as allegations of seemingly unlawful actions utilizing the crypto combine platform.

This was a wake-up name for Ethereum validator because it had struggled to turn into OFAC compliant amid the chance of censorship. In the meantime, validators from the Ethereum finish responded to the duty with efforts to enhance Miner Extractable Worth (MEV).

On the time of writing, Ethereum’s post-Merge OFAC criticism block had hit 69% within the final 30 days. In keeping with MEV Watch, solely 11.14% have been within the non-MEV enhance area. Though they recorded progress, Ethereum validators would possibly must do extra to flee the hammer from the authorities.

Supply: MEV Watch

As for its opponents, Solana [SOL] has been badly hit because the FTX contagion, particularly as Sam-Bankman Fried (SBF) was a infamous shiller of the cryptocurrency.

In latest instances, energetic growth on the Solana chain was virtually nonexistent. SOL additionally misplaced about 97% of its worth in 2022. Cardano [ADA], however, had been on the forefront of growth exercise. However for its token, it was not a superb 12 months, similar to the broader market.

Going into the brand new 12 months, what awaits Ethereum?

As 2023 begins, Ethereum builders introduced that the neighborhood ought to anticipate extra upgrades to the blockchain. In keeping with its protocol developer. Tim Bieko, activating staking withdrawals is a precedence for the group.

To recap:

– Shanghai/Capella’s scope has been finalized: withdrawals are precedence #1️⃣ , together with the flexibility for validators to replace their withdrawal credentials. EOF, and some different minor adjustments are anticipated on the EL aspect. The replace has all the small print 👀— timbeiko.eth (@TimBeiko) December 13, 2022

He famous additional that the EIP-4844 could be important in serving to validators with the withdrawal course of. Billed to start out from the primary quarter in 2023, Ethereum may expertise a hike in demand resulting from staking participation.

“Blobspace is coming .oO! With Shanghai/Capella centered round withdrawals, EIP-4844 would be the foremost focus of the next improve”.

In addition to, the trade expects Ethereum to have a busy schedule within the coming 12 months. Nevertheless, there was no certainty that ETH would react positively to the anticipated developments.

In a recent video posted on his YouTube Web page, crypto analyst Nicholas Merten inspired his subscribers to keep away from getting too enthusiastic about ETH in 2022. Citing an incoming collapse, Merten stated,

“Our goal vary for Ethereum is someplace round $300 to $500. I don’t assume it’s going to stay there for lengthy, but it surely has to do with the truth that proper now, there’s a huge skeleton closet that’s over $1.5 billion of cumulative liquidations that may doubtlessly occur within the DeFi [decentralized finance] ecosystem.”