This Bitcoin Metric Suggests Selling Pressure May Be Reaching Exhaustion

On-chain knowledge exhibits the Bitcoin binary CDD has been taking place lately, an indication that promoting strain could also be getting exhausted available in the market.

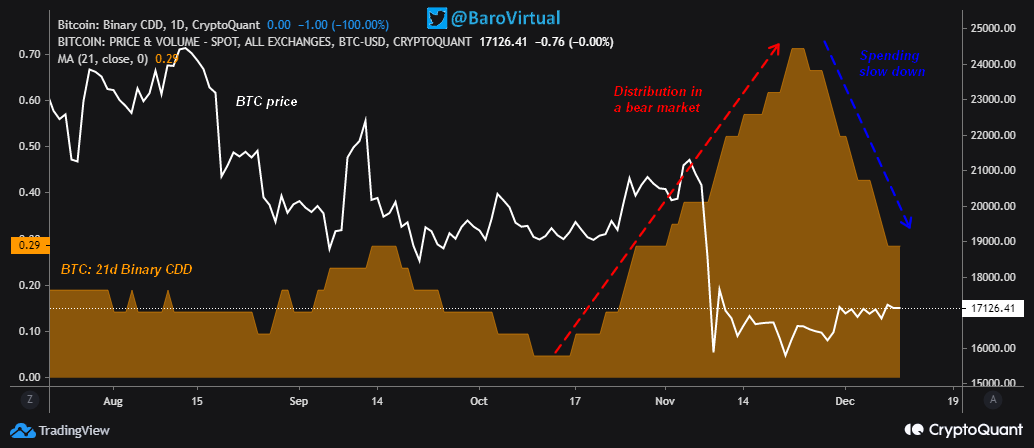

Bitcoin 21-Day MA Binary CDD Has Been Observing Downtrend Just lately

As identified by an analyst in a CryptoQuant post, there was some heavy distribution happening available in the market only a whereas in the past. The related indicator right here is “Coin Days Destroyed” (CDD). A coin day is the quantity that 1 BTC accumulates after sitting nonetheless in a single tackle for 1 day.

When a coin that was beforehand dormant (and was thus carrying some coin days) makes some motion on the chain, its coin days counter resets again to zero, and the coin days it had collected are stated to be “destroyed.” The CDD metric measures the entire quantity of such coin days being destroyed throughout the community on any given day.

When this indicator has a big worth, it means long-term holders are presumably shifting or promoting their cash as this cohort tends to stack up big numbers of coin days. “Binary CDD,” the model of the metric getting used right here, tells us whether or not the supply-adjusted CDD is kind of than the common supply-adjusted CDD.

Associated Studying: Bitcoin Backside Or Extra Ache? Right here’s What BitMEX Founder Arthur Hayes Thinks

Because the title already implies, this indicator can have solely two values, 0 and 1. It’s 0 when the Bitcoin CDD is lower than the common, whereas it’s 1 when it’s extra. Here’s a chart that exhibits the development within the 21-day shifting common worth of this metric over the previous couple of months:

Seems just like the 21-day MA worth of the metric has been on the way in which down in current days | Supply: CryptoQuant

As you’ll be able to see within the above graph, the 21-day MA Bitcoin binary CDD had been climbing up between mid-October and late November, suggesting that the long-term holders had been dumping. The BTC value took a big hit whereas this development was happening. Nevertheless, within the final couple of weeks or so, the indicator has been quickly taking place as a substitute.

This could possibly be an indication that the promoting strain that was beforehand current within the BTC market is now getting exhausted, which is one thing that may pave approach for a backside formation within the value.

BTC Worth

On the time of writing, Bitcoin’s value floats round $17k, down 1% within the final week. Over the previous month, the crypto has gained 1% in worth.

Under is a chart that exhibits the development within the value of the coin during the last 5 days.

The worth of the crypto appears to have dipped down within the final twenty-four hours | Supply: BTCUSD on TradingView