Tracing Ethereum’s [ETH] potential to continue rising after its recent gains

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation.

- Ethereum’s latest reversal from its resistance highlighted ease in shopping for stress.

- The altcoin famous a considerable lower in its day by day lively customers over the past day.

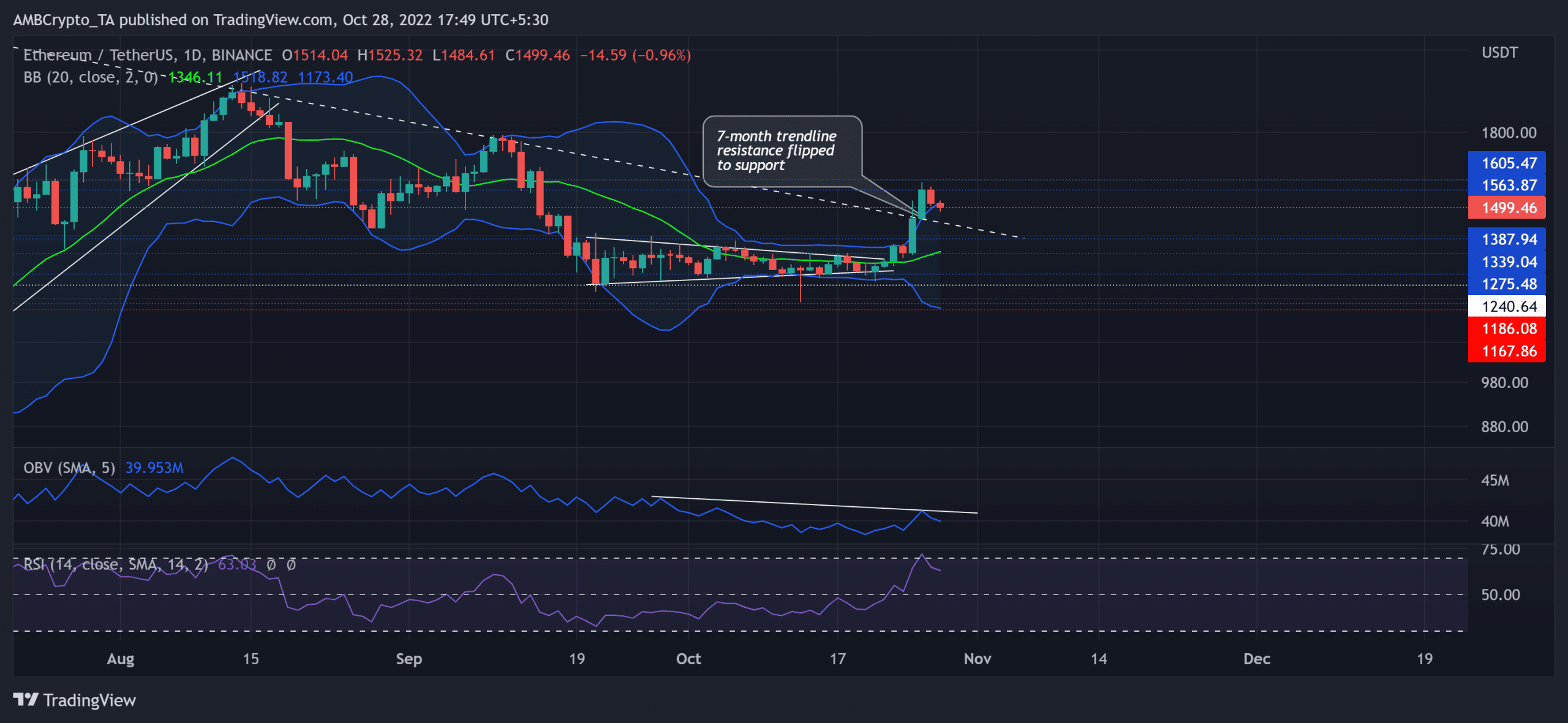

Ethereum [ETH] witnessed double-digit positive aspects over the past week after breaking out of its triangular construction. The resultant incline above the premise line (inexperienced) of the Bollinger Bands (BB) positioned the altcoin close to its higher band to depict a shopping for edge.

Right here’s AMBCrypto’s worth prediction for Ethereum [ETH] for 2023-24

Ought to the latest reversal from its quick ceiling proceed, ETH may see a near-term pulldown earlier than a probable reversal. At press time, ETH was buying and selling at $1,499.46, down by 3.1% within the final 24 hours.

ETH noticed a bullish risky break, can the consumers maintain their edge?

Supply: TradingView, ETH/USDT

After breaking down from its rising wedge within the day by day timeframe, ETH bears persistently exhibited their willingness to counter the shopping for efforts on the seven-month trendline resistance (white, dashed).

Because of this, ETH seemed south whereas struggling to sway above the $1,560-$1,600 vary. The latest worth actions chalked out a symmetrical triangle breakout after a steep uptrend. Whereas the resistance vary stood sturdy, the king alt may see a string of crimson candles.

This decline may open gateways for a retest of the $1,440 stage within the coming occasions. Any decline beneath this stage may propel the sellers to drag ETH towards the $1,380 assist. The consumers may then try to search for a near-term rebound.

Alternatively, a direct rebound above the higher band of the BB would affirm a bearish invalidation. For this, the consumers should break the bounds of the $1,600 ceiling.

The On Steadiness Quantity (OBV) depicted a bearish edge after its decrease peaks bearishly diverged with the value motion. Moreover, the Relative Power Index (RSI) reversed from its overbought area to depict ease in shopping for stress.

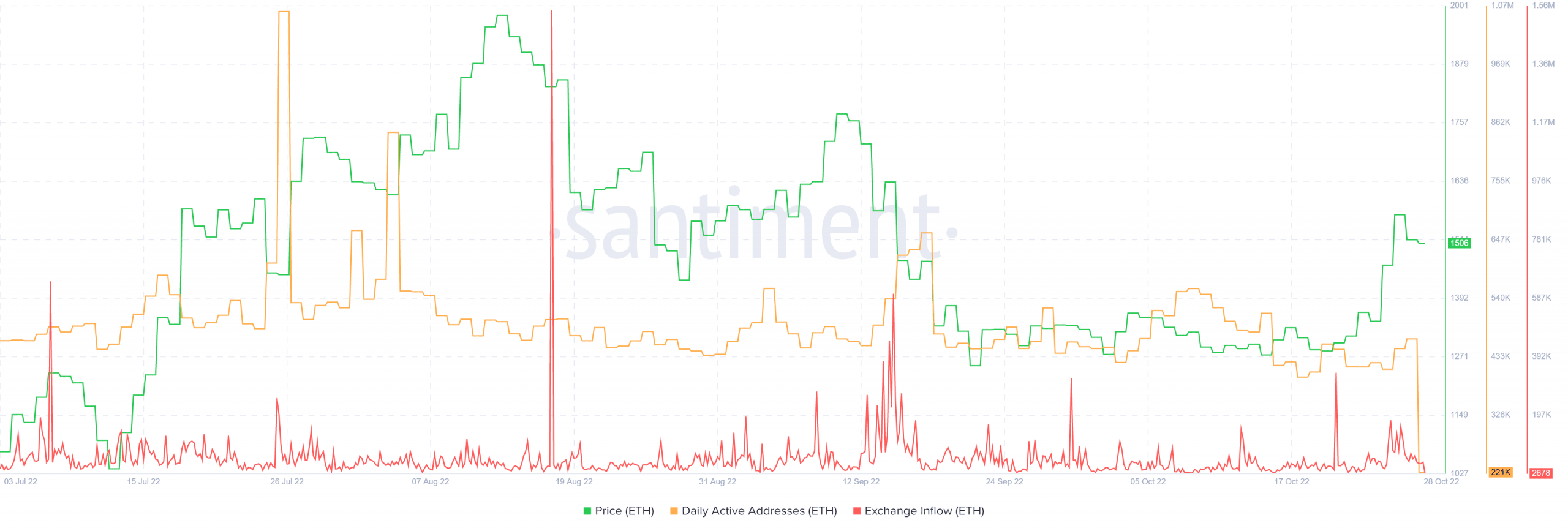

A decline in alternate inflows alongside the day by day lively addresses

Supply: Santiment

The king altcoin’s day by day lively addresses marked a considerable plunge within the final 24 hours. The final time the lively handle depend fell to such lows was in October 2020.

Moreover, the value motion usually tends to mark a decline after a spike in alternate inflows. However after the latest spike on this metric, ETH noticed a quite improve in its worth over the previous few days.

Ought to these readings characterize an underlying promoting edge, the value motion may see an prolonged decline earlier than reversing. Lastly, buyers/merchants should be careful for Bitcoin’s [BTC] motion. It is because ETH shared an 89% 30-day correlation with the king coin.