Shorting Uniswap [UNI] in 2023? Well, as per metrics, you might be…

- The each day energetic customers on Uniswap declined, together with UNI’s NFT transaction quantity.

- The income generated by Uniswap additionally declined, whereas whales continued to point out curiosity.

New knowledge from Santiment advised that the each day exercise on Uniswap declined considerably. This might foreshadow a damaging outlook for the DEX within the close to future.

📊 A number of #altcoins are seeing large upticks in deal with exercise and dormant wallets awakening to maneuver their funds proper now. Others are staying caught within the mud, and usually tend to fall behind. Learn our quick tackle $YFI, $REN, and $UNI. https://t.co/MI1HQaLUpy pic.twitter.com/sRSyiDvqVe

— Santiment (@santimentfeed) December 15, 2022

Learn Uniswap’s [UNI] Worth Prediction 2023-24

After the launch of Uniswap’s NFT market, there was a spike in exercise within the energetic addresses. Nevertheless, it appeared that customers misplaced curiosity within the DEX protocol shortly after the launch was introduced.

The NFT angle

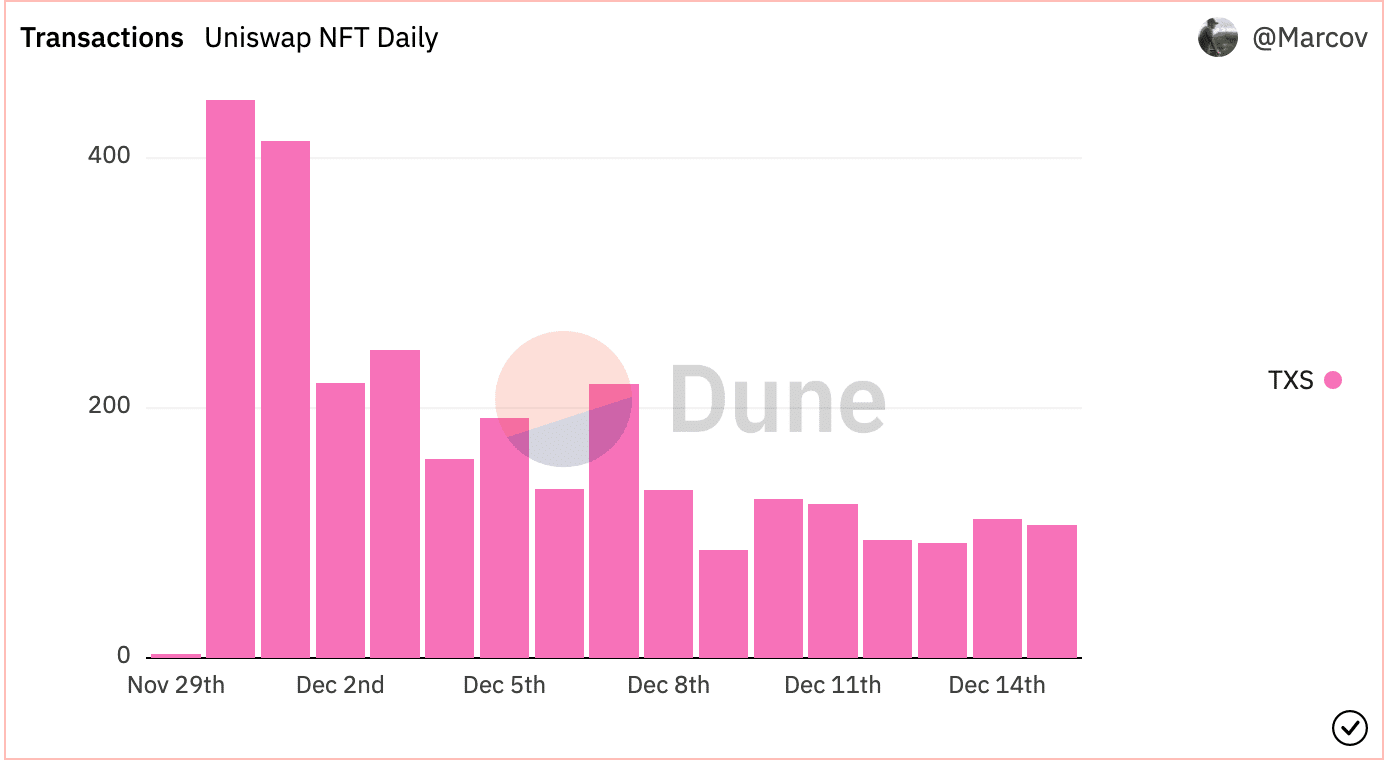

One cause for the declining exercise could possibly be the lowering each day NFT transactions on Uniswap. Based on knowledge from Dune Analytics, the variety of NFT transactions declined because the launch of Uniswap’s NFT protocol.

The amount of transactions on the DEX declined as effectively. It went from $246,565 to $70,313 on the time of writing, primarily based on data from Dune Analytics.

Supply: Dune Analytics

Together with its declining transaction quantity, Uniswap fell quick by way of improvement exercise as effectively.

Different rivals

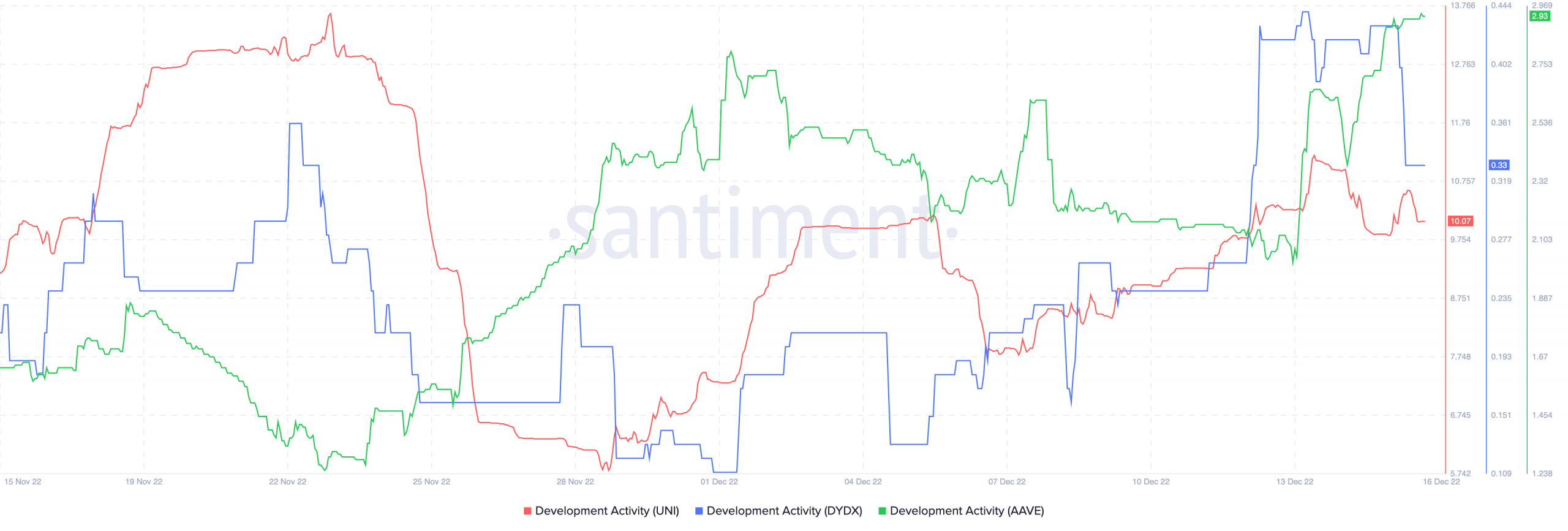

Based on knowledge supplied by Santiment, Uniswap wasn’t in a position to compete with different DEXes by way of improvement exercise. Over the previous couple of weeks, different DEXes akin to Aave and dYdX outperformed Uniswap by way of improvement exercise.

A decline in improvement exercise implied that the variety of contributions being made by Uniswap’s crew to its GitHub had decreased.

Supply: Santiment

However that was not all. The income generated by Uniswap additionally decreased over the past month.

It was found primarily based on Messari’s knowledge that the income generated by Uniswap declined by 30.35% within the final 30 days. At press time, the general income collected by Uniswap throughout this era was 3.02 million.

Regardless of the declining income and lowering curiosity from NFT merchants, Uniswap continued to be of curiosity to crypto whales.

Based on knowledge supplied by WhaleStats, a company devoted to monitoring crypto whales, UNI was the second most-held token by the highest 500 Ethereum whales. The whales had collectively held $43.72 million price of UNI throughout press time.

🐳 The highest 500 #ETH whales are hodling

$53,876,200 $SHIB

$43,720,652 $UNI

$37,255,400 #UnknownToken

$37,008,930 $BIT

$35,781,056 $BEST

$35,262,456 $LOCUS

$29,672,434 $MOC

$21,326,370 $MATICWhale leaderboard 👇https://t.co/tgYTpOm5ws pic.twitter.com/Rbv9FiTSn7

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 15, 2022

It stays to be decided whether or not the curiosity from whales could possibly be adequate for Uniswap to beat its challenges.

On the time of writing, UNI was buying and selling at $5.81. Its worth fell by 2.18% over the past 24 hours, whereas its quantity plummeted by 30.74% throughout the identical interval.