Roughly 48% of Ethereum NFT trades in October were fake

NFT

cryptoslate.com

23 November 2022 11:00, UTC

Studying time: ~4 m

World NFT gross sales in October clocked in at greater than $850 million over roughly 3 million complete transactions. I regarded into NFT wash trades final month and that analysis received me to take a look at the numbers extra intently.

The set off factors for me to say that transactions have gotten extra faux are as follows:

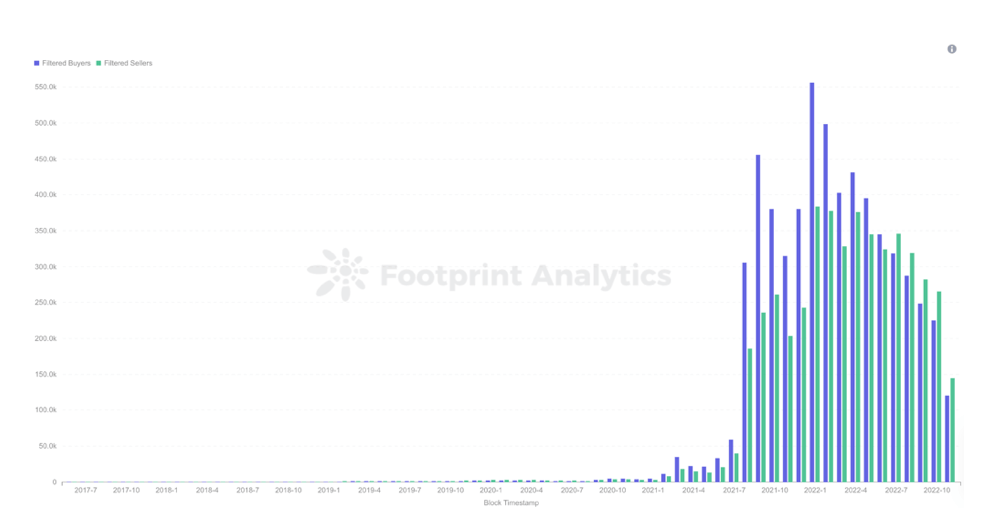

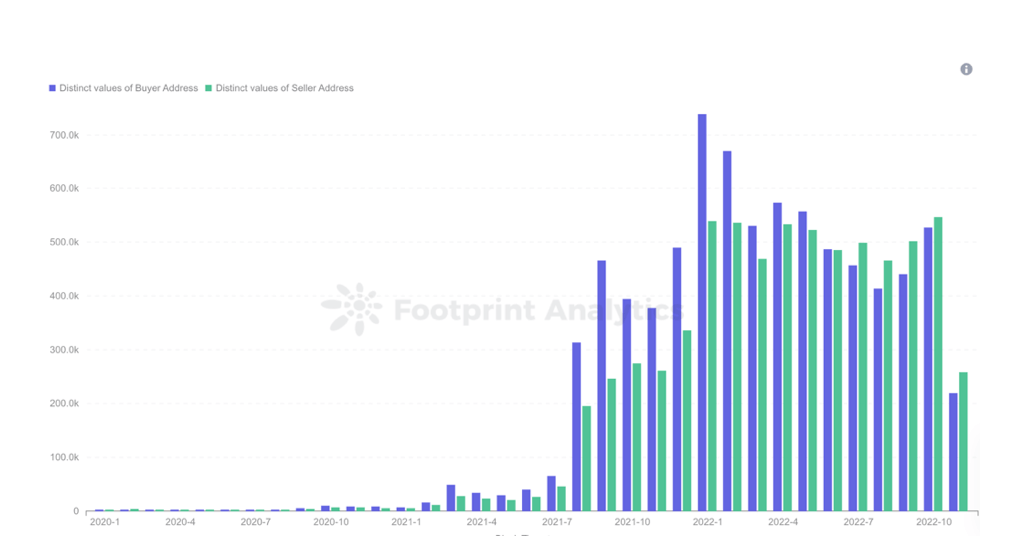

- Regardless of unhealthy market situations, we proceed to see a excessive variety of distinctive patrons and sellers. In October, we had over 1 million distinctive patrons and sellers. Each patrons and sellers have elevated in comparison with September.

- The variety of distinctive patrons and sellers appears to be inconsistent with the expansion of gross sales worth and transactions. Round 1 million customers contributed greater than 4 million gross sales worth in Could versus lower than 250,000 in October. To me, it appears unlikely to have a rising market demand with much less gross sales worth traded.

To look into this additional, I spoke with two centralized exchanges that function NFT marketplaces. The exchanges stated that round 80% of recent patrons are protecting NFTs of their wallets, slightly than promoting them. With the market so unfavorable, holding these property appears to be the wise transfer.

So the place are all these distinctive patrons and sellers coming from? I had a phrase with Footprint Analytics and introduced up my factors. I spotted that the statistics I’m are method too large. It concerned a number of chains and it’s onerous to trace all the pieces. We agreed to work on solely Ethereum-based marketplaces for example to dive deep into since it’s the preferred.

Listed here are the findings:

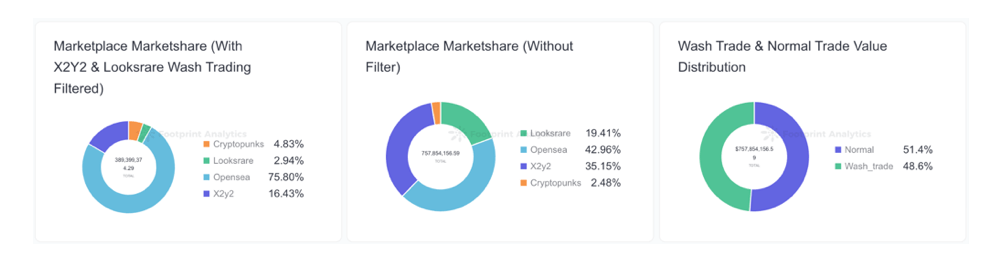

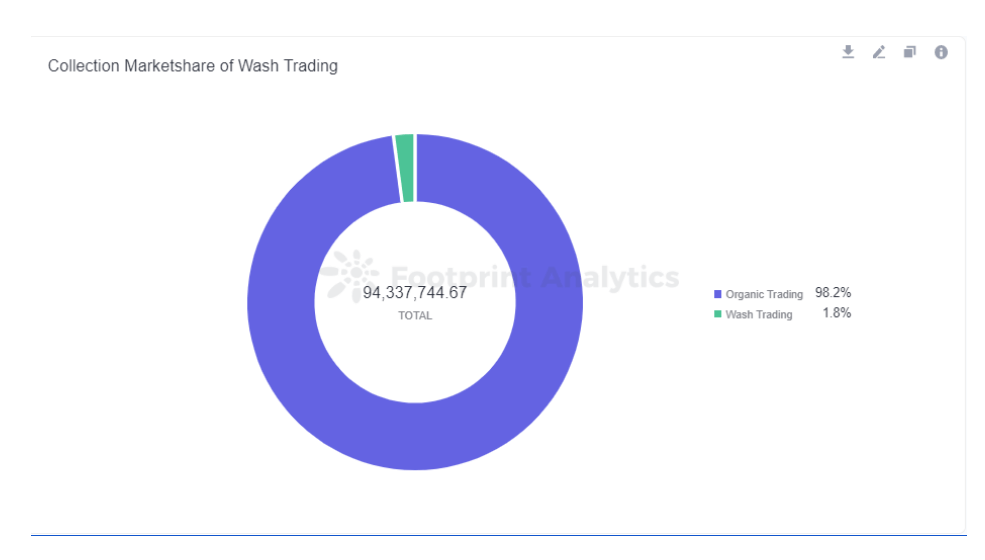

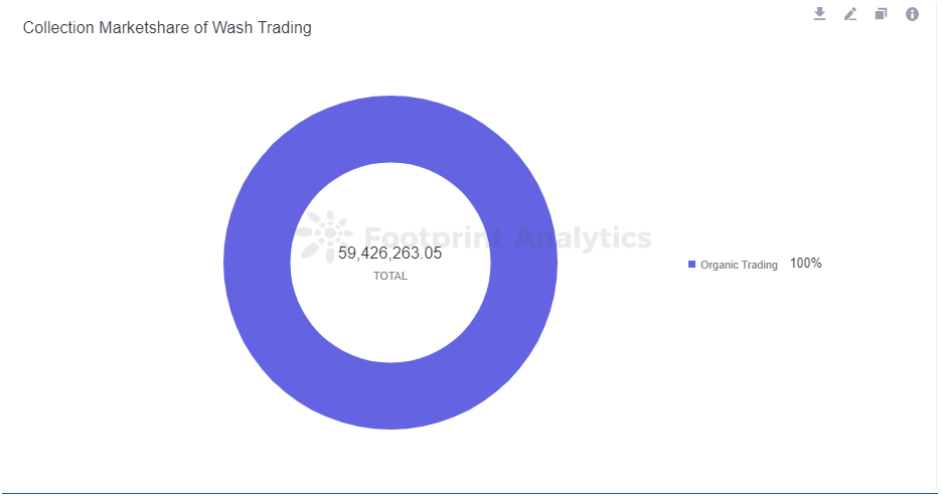

In keeping with Footprint Analytics’ filters, wash buying and selling makes up practically half of all NFT buying and selling quantity.

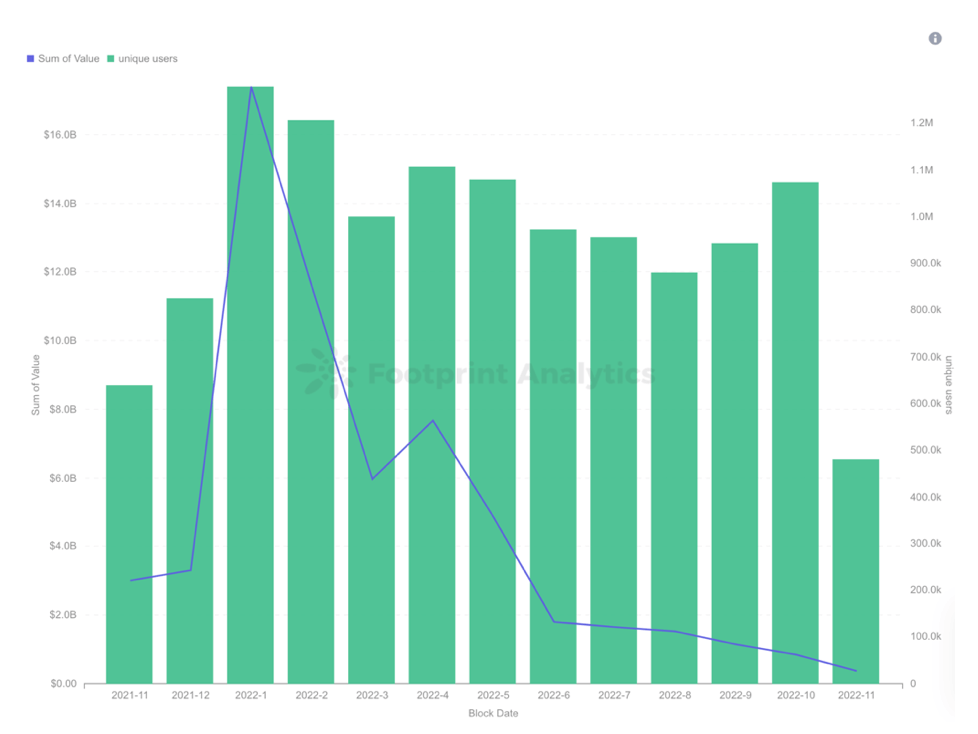

Footprint Analytics – ETH NFT Market Overview (With Wash Buying and selling Filtered)

Merchants searching for to artificially inflate the value of collections or earn market buying and selling rewards generated $389 million in wash trades out of October’s complete of $758 million in NFT buying and selling quantity — bringing the quantity of wash buying and selling within the NFT market near half that of natural buying and selling.The variety of wash buying and selling customers accounts for practically 46% of complete customers.

Wash buying and selling is a type of market manipulation the place an investor concurrently sells and buys the identical monetary devices to create deceptive, synthetic exercise within the market. It creates huge dissonance within the NFT business between what most individuals think about NFT buying and selling is i.e., somebody shopping for an NFT for hypothesis, and the habits which truly underlies the market — a whole bunch of insiders transferring NFTs between their very own wallets.

There are a number of indicators to establish suspicious buying and selling exercise.

Alerts and indicators embody:

- Overpriced NFT trades with 0% creators charges

- Particular NFT IDs which might be purchased greater than a traditional quantity of instances in a day

- NFTs purchased by the identical purchaser handle in a brief time period

The incentives for wash buying and selling are to earn platform rewards and to create an look of worth or liquidity for property. As a result of there isn’t a approach to stop or discourage wash buying and selling within the NFT market right this moment, folks have a vastly misguided image of the quantity of natural, real buying and selling exercise within the business.

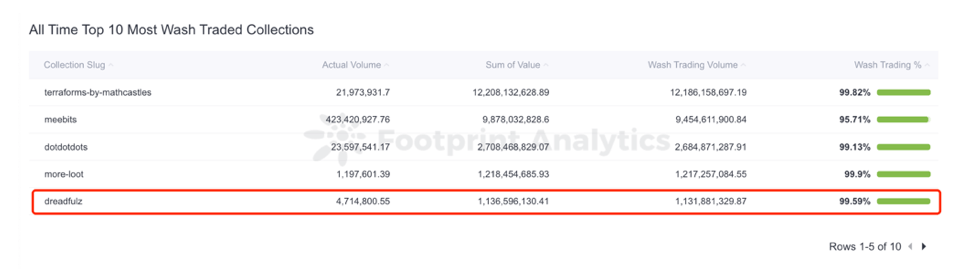

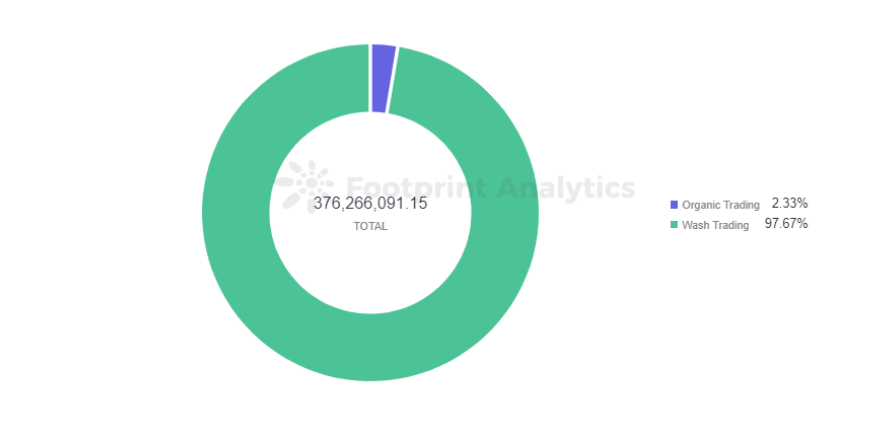

For instance, 81percentp.c of all trades on X2Y2, one of many prime 3 NFT marketplaces, had been wash trades in accordance with the filters utilized. The principle cause for X2Y2 wash buying and selling is volume-based day by day buying and selling rewards. The bigger the proportion of quantity a person contributes to X2Y2, the bigger the share of day by day buying and selling rewards the person will earn. The same breakdown may be noticed when particular person collections. For instance, of Dreadfulz’ $1.1 billionin complete quantity, $1.131 billionwas flagged as wash buying and selling.

An analyst or author who doesn’t perceive this wash buying and selling dynamic dangers grossly misunderstanding the present market. For instance, right here’s what Business2Communitywrote on Oct. 12 about Terraforms by Mathcastles:

“Non-fungible token collections proceed exhibiting robust resilience amid the present normal crypto market downturn to this point this yr. Listed here are a few of the top-selling NFT collections this week: 1. Terraforms Reclaim The Prime Spot. Terraforms, a non-fungible token (NFT) assortment from Mathcastles, has reclaimed the highest spot after flipping under our ten top-selling lists final week. Terraforms has a 24-hour gross sales quantity of 1,814 ETH.”

The following collections the article listed had been BAYC and CryptoPunks, which have practically no wash buying and selling. This might give a reader the impression that Terraforms extra of a well-liked assortment than these blue chip collections when in actuality there have been nearly no natural trades.

By filtering trades for wash buying and selling, merchants, analysts and buyers can extra precisely consider NFT property and the business. Having correct datasets and utilizing them are two separate issues. My function right here is to not whistleblow or break the NFT myths, I’m right here to share my information and inform my aspect of the story to everybody.

Utilizing this text, I want to make a request to investigate CEX NFT marketplaces’ knowledge. Binance or Bybit NFT Market can be splendid.