Report Shows Ethereum Supply Tanks By 5,500 ETH, What Does It Mean?

Ethereum accomplished one in all its historic upgrades in mid-September. The Merge created the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Sadly, the post-Merge occasions introduced deflationary conditions for the blockchain.

As predicted by some crypto consultants, the worth of Ethereum has dropped drastically following its transition to PoS. Additionally, the dynamics of ETH provide have modified after the improve.

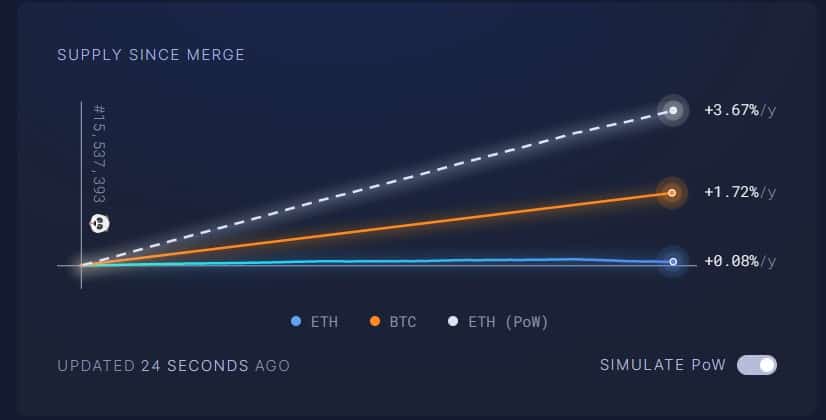

In keeping with knowledge from Ultrasound Cash, there’s a discount within the day by day quantity of ETH that hit the market. Moreover, the information revealed that the declining report was about 90% after the Merge. This modification could possibly be as a result of Ether is now not mined because it’s now a PoS community.

Burning Mechanism Reduces Ethereum Provide

A cautious examine of Ethereum provide indicated a discount over the previous 5 days. With such a development, the full provide for the second largest crypto asset plunged by about 5,500 ETHs since October 8.

The decline is linked to the implication of EIP-1559 and the burning mechanism for the token. This ensures {that a} proportion of charges paid for ETH transactions is burned.

Earlier than the transition to PoS, miners obtain about 13,000 ETH from the Ethereum community as rewards. The community makes funds day by day to safe the ecosystem and for processing transactions. However the Merge modified the sequence for the community.

The Ethereum community is now issuing a day by day reward of about $1,600 ETH to validators. It’s because the bottom charges for processing ETH transactions are burned. With such a apply, Ethereum can be deflationary, particularly when the utilization will increase.

In the present day, virtually 7,525 ETH has hit the market as a brand new token provide after the Merge. However compared with its operation as a PoW blockchain, the worth would have reached about 340,000 ETH.

XEN Crypto Challenge Performs A Function

The ETH burning mechanism should take extra tokens out of circulation. The ETH Basis calculated that ETH can be deflationary if the fuel worth reached 15 gwei.

On Sunday, XEN Crypto was launched on the Ethereum blockchain. Sadly, its undertaking operates as a brand new Ethereum fuel guzzler, and a few customers have already began minting the crypto XEN. The sudden exercise spiked Ethereum fuel charges over the weekend.

Since each tackle on the Ethereum community may mint XEN, this accounts for elevated Ethereum fuel costs. Minting XEN to promote instantly has an incentive. Additionally, customers obtain extra important quantities simply by locking the tokens. Therefore, the state of affairs with the airdrop is that of the gold rush. It locations XEN because the gold and Ether because the pickaxe for its mining.

Etherscan revealed that it took about 1,470 ETH as fuel charges to mint XEN in a day. This worth represents as much as 40% of the full fuel expenditure on the Ethereum community. Therefore, ETH provide is dropping as the quantity of burned ETH is extra important than what stakers achieve as a reward.

Featured picture from Pixabay and chart from TradingView.com