Reasons LTC carries lower risk of manipulation compared to most of its competition

- Litecoin has maintained decentralized operations all through

- Although LTC is bearish proper now, metrics appear bullish

The Litecoin [LTC] Basis took each probability to spotlight why LTC was a superior cryptocurrency. This included all of the Black Swan cases that occurred in 2020. It is because these incidents have highlighted cracks or vulnerabilities in lots of crypto initiatives.

Learn Litecoin’s [LTC] Worth Prediction 2023-24

One widespread attribute highlighting vulnerability was centralized operations. The Litecoin Basis’s managing director, Alan Austin, launched an replace confirming that they’ve maintained a decentralized strategy with their operations.

This included funding its operations utilizing donations and volunteers quite than sitting on a fats stack of money.

Not like many corporations within the crypto house, @LTCFoundation isn’t sitting on piles of cash. In reality, removed from it. The explanation for that is that in contrast to many initiatives and their respective tokens, Litecoin was pretty launched and didn’t have a premine or ICO to provide founders and

👇

— Alan Austin (@alangaustin) December 11, 2022

Austin additionally famous that one choice of the Litecoin Basis was community-based. Prior to now, there have been cases the place complete crypto organizations crumbled because of centralized or particular person choices.

Moreover, Litecoin was additionally endeavor steps to make sure simpler entry. For instance, the community has to this point expanded its ATM accessibility by as a lot as 7.8% within the final 12 months.

Litecoin accessibility on ATMs has grown by 7.8% within the final 12 months!

🥈 Most used #crypto for funds!

🥈 Most out there on ATMs!Discover yours: https://t.co/gx8yZW3M8H – #PayWithLitecoin #Litecoin #sundayvibes pic.twitter.com/ysvXChZPMY

— Litecoin Basis ⚡️ (@LTCFoundation) December 11, 2022

This growth emphasised Litecoin’s objective of guaranteeing that individuals may simply entry the cryptocurrency. In different phrases, the community was making gradual slides that may assist in adoption.

Litecoin worth motion recap

Final week, there was the next worth to RSI divergence setup noticed in Litecoin, a sample that’s typically related to a bearish outlook. Quick ahead to 12 December, and LTC tanked by over 9% from the $84.97 weekly excessive to its $74.98.

Supply: TradingView

Litecoin’s Cash Stream Index (MFI) registered outflows final week due to the promote stress. Nevertheless, this week kicked off with a manifestation of incoming purchase stress. If this development continued, then LTC’s draw back is likely to be restricted.

Evaluating the potential for a bullish restoration

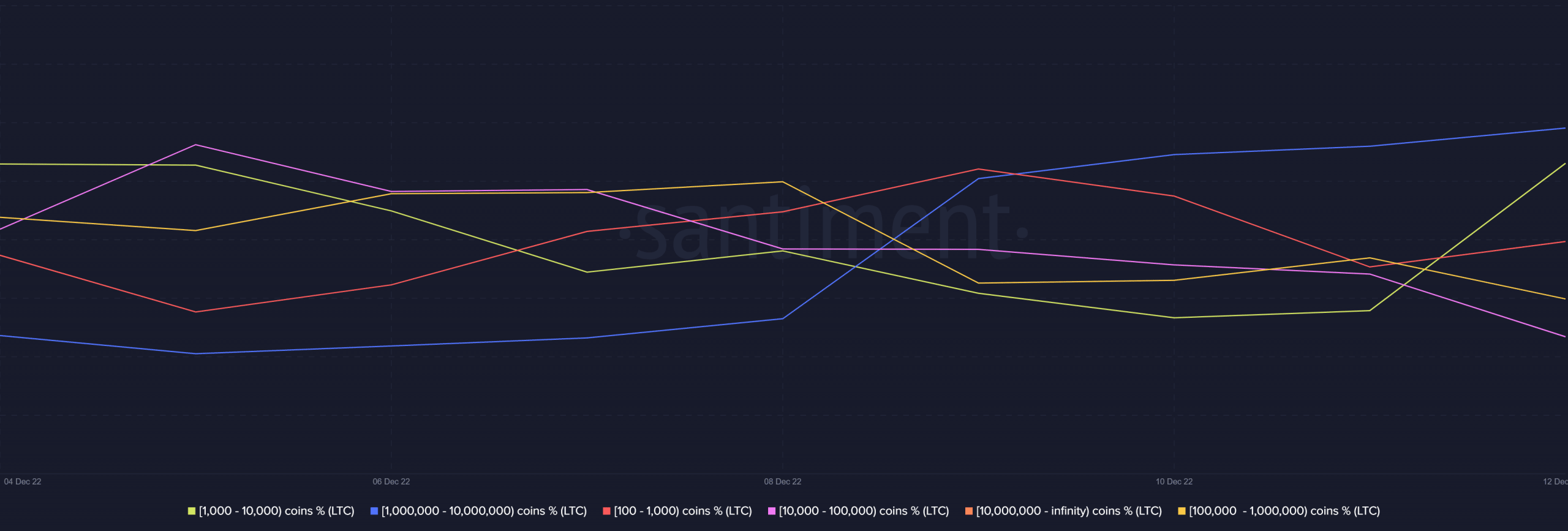

Litecoin’s capacity to bounce again from its present vary would depend upon whether or not it may drum up sufficient shopping for stress on the time of writing. Many of the promote stress was coming from addresses holding between 10,000 – a million cash.

Whales within the 1,000 – 10,000 LTC bracket and people holding over a million cash have been contributing to the purchase stress on the time of writing.

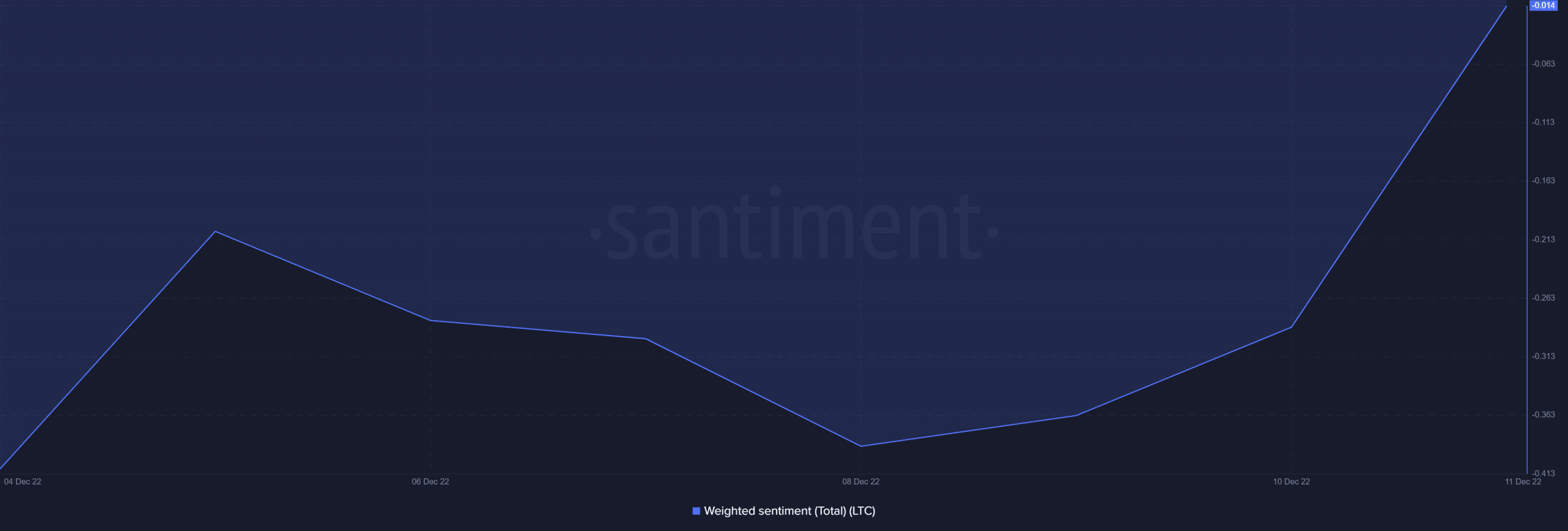

The dearth of uniformity among the many prime whales by way of purchase and promote stress additionally made it troublesome to ascertain whether or not the development would proceed or pivot. However, the present weighted sentiment remained bullish.

Supply: Santiment

The above evaluation revealed that demand or shopping for stress was returning at press time, though there was nonetheless some promote stress. Regardless, LTC’s efficiency within the coming week will largely depend upon the general state of the crypto market.