Reasons AVAX investors must tread carefully despite probable short-term gains

- Avalanche’s TVL reached 270,611,568 AVAX

- Metrics additionally favored an optimistic outlook for AVAX

After weeks of decline, Avalanche’s [AVAX] complete worth locked (TVL) lastly registered an uptick. This might be thought of as an optimistic replace for the blockchain.

AVAX Each day, a Twitter deal with that posts updates concerning the Avalanche blockchain, posted its weekly stats on 19 November. The replace said that AVAX’s TVL reached 270,611,568 AVAX. Moreover, a chart from DeFiLlama corroborated the identical.

Avalanche Subnet Weekly Stats

Whole Subnets: 29

Whole Blockchains: 21

Whole Validators: 1305

Whole Stake Quantity: 270,611,568 AVAXOverview🧵👇#AVAX #Avalanche $AVAX pic.twitter.com/QlkILEhLCt

— AVAX Each day 🔺 (@AVAXDaily) November 18, 2022

The weekly stats additionally revealed a couple of different notable updates across the blockchain within the final seven days. As an example, Avalanche’s complete validators reached 1,305 whereas the whole variety of subnets stood at 29.

Learn Avalanche’s [AVAX] worth prediction 2023-2024

These developments had been mirrored on AVAX’s chart as its worth elevated by over 3% within the final 24 hours. In line with CoinMarketCap, AVAX, at press time, was buying and selling at $13.01 with a market capitalization of over $3.9 billion.

Apparently, a couple of on-chain metrics revealed the potential of a continued worth surge, which could excite buyers.

AVAX buyers can rejoice

CryptoQuant’s data revealed that AVAX’s Relative Power Index (RSI) and stochastic had been each in oversold positions. This might be thought of as a large bullish sign, and a sign {that a} worth surge might happen within the days to comply with. Santiment’s charts additionally regarded fairly favorable.

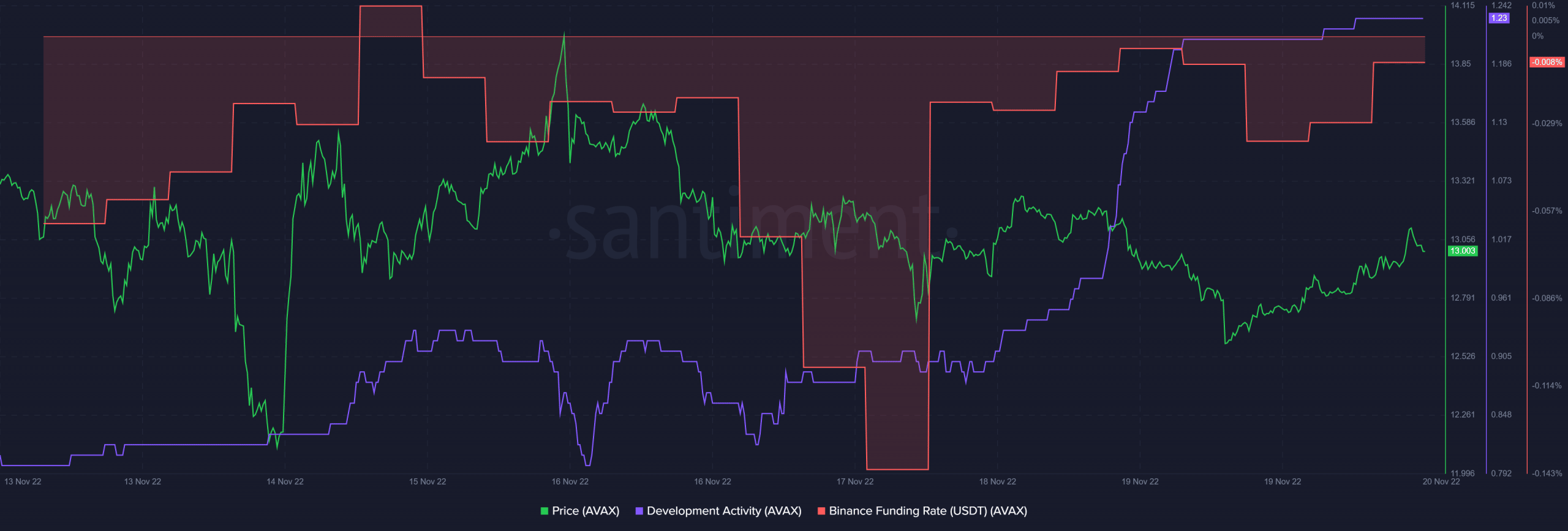

AVAX’s growth exercise elevated within the final week, which was a constructive signal. A surge within the growth exercise represented the efforts of builders in direction of bettering the community. AVAX additionally gained curiosity from the derivatives market, as its Binance funding fee registered an uptick.

Supply: Santiment

Not all sunny in spite of everything?

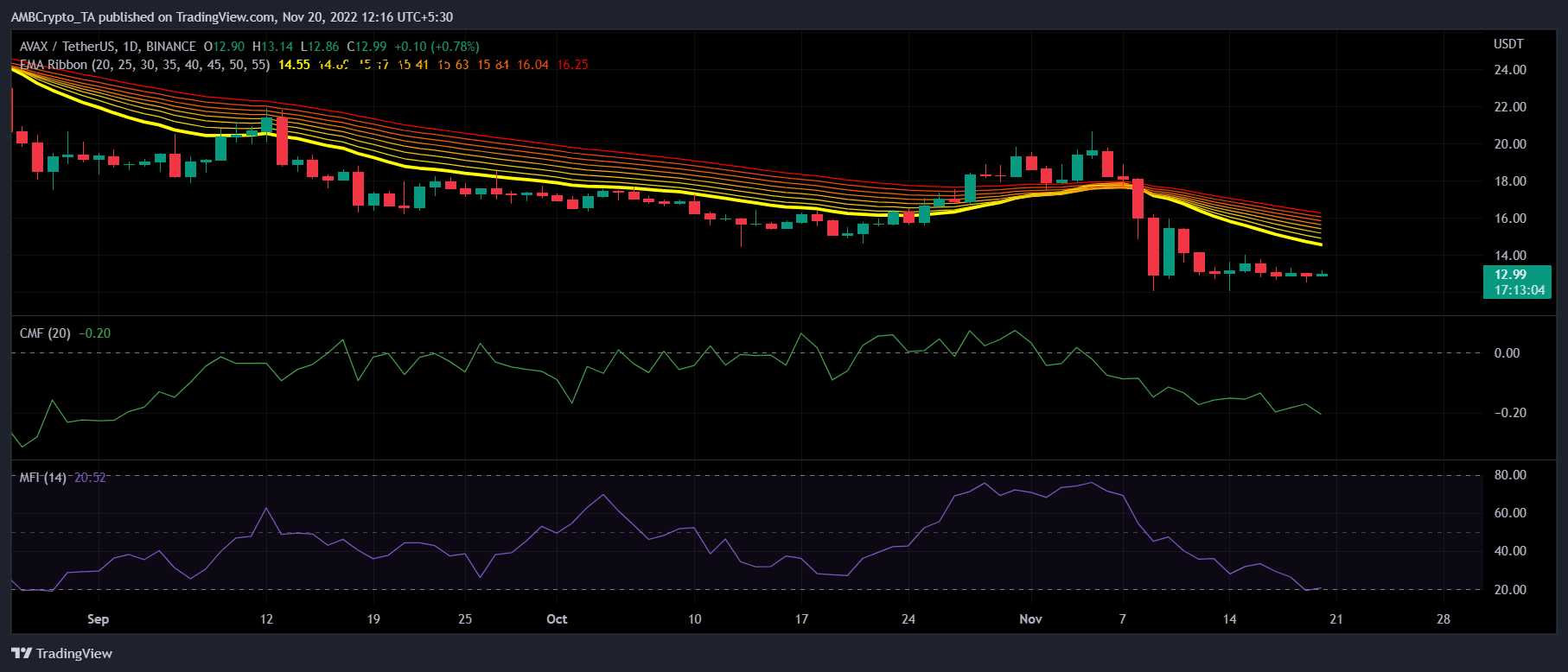

Whereas the metrics advised an extra improve in AVAX’s worth, the market indicators advised a unique story. The Exponential Shifting Common (EMA) Ribbon revealed that the bears had the higher hand out there. This might deliver hassle when it comes to a worth hike.

One other bearish sign was the Chaikin Cash Circulate (CMF), which was nicely under the impartial stage. Nonetheless, the Cash Circulate Index (MFI) was hovering proper close to the oversold zone, giving buyers hope for higher days forward.

Supply: TradingView