XRP aims for a patterned breakout- Is a 7% hike likely?

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

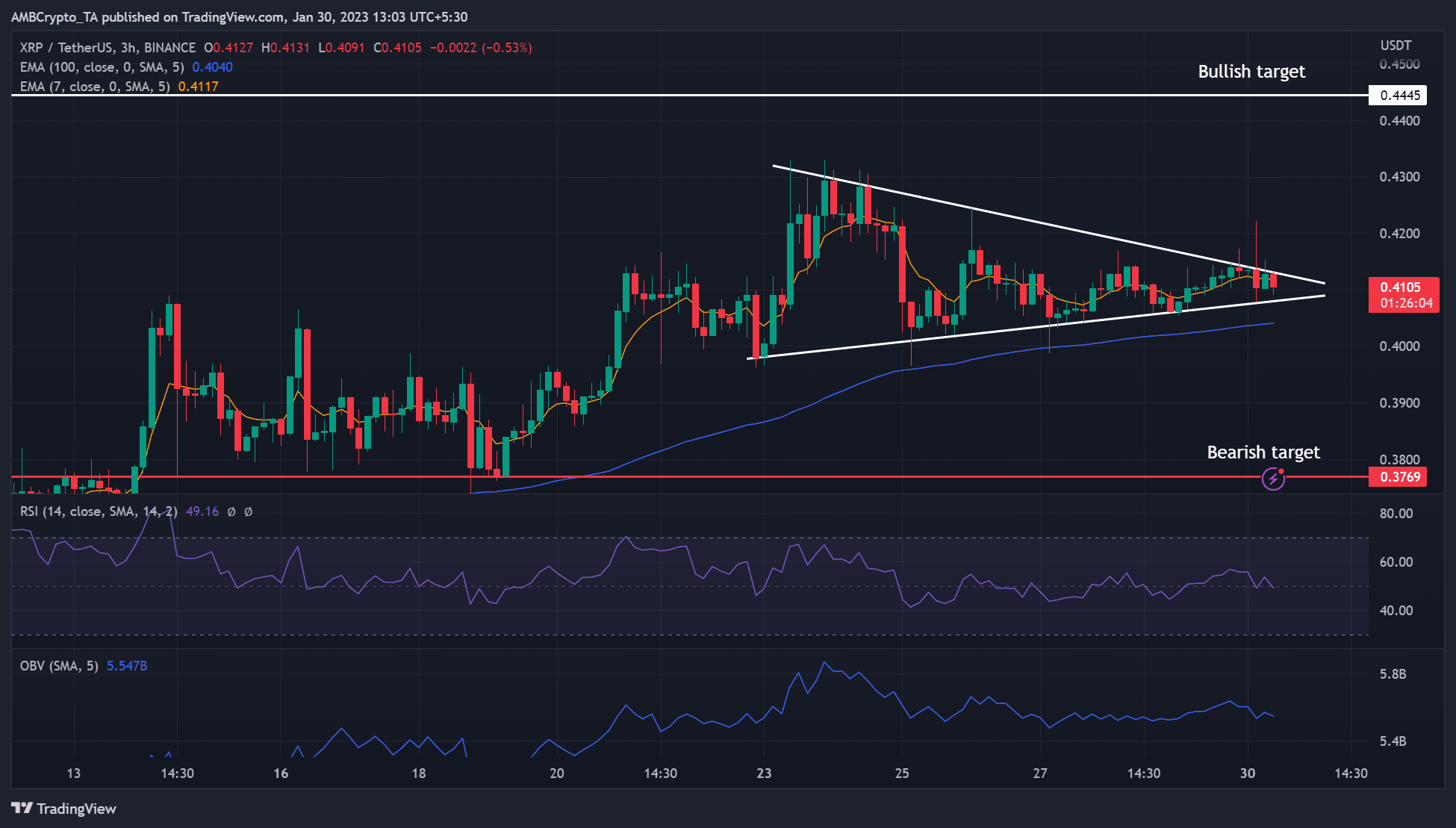

- Ripple [XRP] shaped a symmetrical triangle sample on the three-hour chart.

- A patterned breakout on the upside may provide extra good points.

Ripple’s [XRP] current rally slowed, ushering in short-term value consolidation. Since January 23, XRP’s value motion has shaped a symmetrical triangle sample. At press time, XRP’s worth was $0.4105 and was near inflicting a patterned breakout.

Learn Ripple [XRP] Value Prediction 2023-24

A symmetrical triangle sample -Is a bullish breakout probably?

Supply: XRP/USDT on TradingView

XRP’s construction was nearly impartial, as indicated by the Relative Power Index (RSI) worth of 49. XRP bulls may very well be tipped to interrupt above the symmetrical triangle if Bitcoin [BTC] secures the $23.5K zone and surges upwards.

Such a bullish breakout may goal on the $0.4445 goal degree, providing a possible 7% hike.

Is your portfolio inexperienced? Take a look at the XRP Revenue Calculator

Nonetheless, bears may inflict a bearish breakout concentrating on the $0.3769 degree and invalidate the above bullish inclination. Nonetheless, the drop may very well be checked by the 100-EMA (exponential shifting common) line.

Up to now, two false bearish breakouts have retested the 100-EMA (blue line). An analogous pattern may see one other false breakout retest the road earlier than dropping all the way down to the bearish goal.

Subsequently, traders and merchants ought to monitor Bitcoin’s value motion, particularly on key value ranges of $23.5K and $22K.

XRP’s volumes declined, however short-term holders noticed income

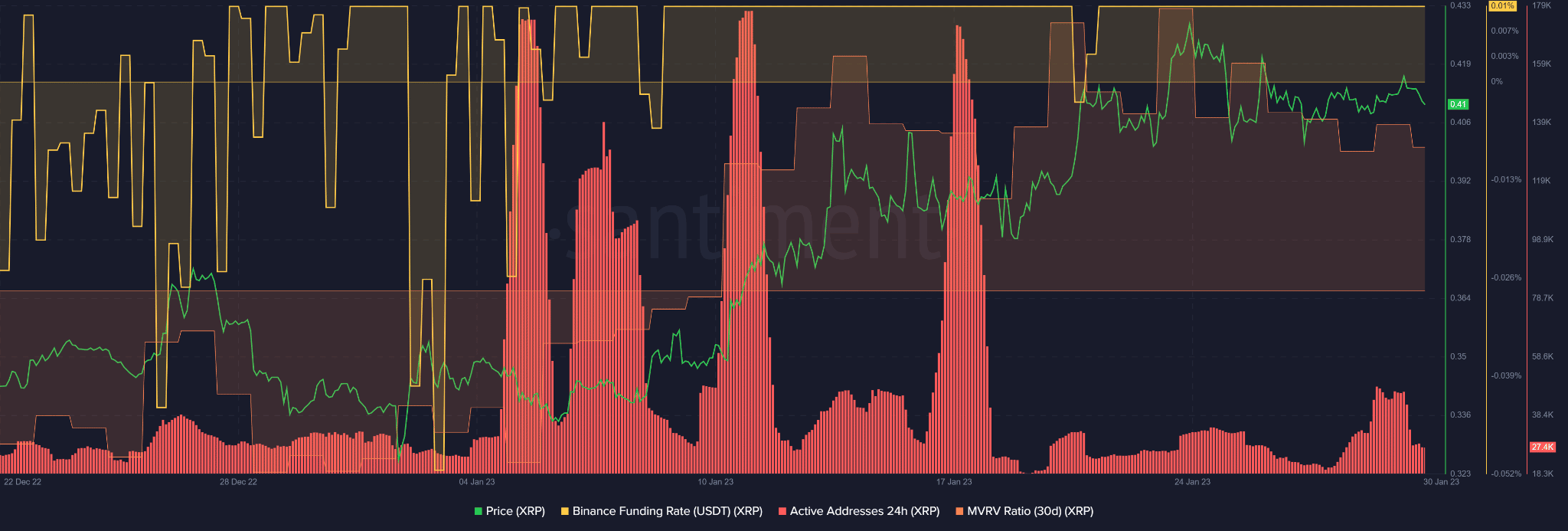

Supply: Santiment

As per Santiment knowledge, XRP each day lively addresses spiked lately however recorded a drop by press time. This means that the variety of addresses exchanging XRP fell sharply, undermining the buying and selling volumes wanted to spice up the shopping for strain and uptrend momentum.

Subsequently, a bullish breakout on the symmetrical triangle sample may very well be delayed barely.

Regardless of the low buying and selling volumes, XRP’s Funding Fee remained constructive, indicating that there was a requirement for XRP within the derivatives market by press time. It’s a bullish sentiment that would bolster XRP’s upward pattern if BTC maintains the $23.5K help.

As well as, short-term HODLers noticed income as evidenced by the constructive 30-day MVRV (Market Worth to Realized Worth). Subsequently, a bullish breakout may provide short-term holders additional good points.

Nonetheless, if BTC drops under $23.5K, a bearish breakout may very well be in play. Subsequently, merchants must be cautious and think about making lengthy entry positions after a convincing breakout above the triangle and subsequent affirmation of the uptrend above the sample.