NFT Trading Surges to Over $945,000,000 in January Amid Crypto Market Bounce: DappRadar

The buying and selling quantity of non-fungible tokens (NFTs) skyrocketed in January because the crypto markets mounted a restoration from a months-long bear market.

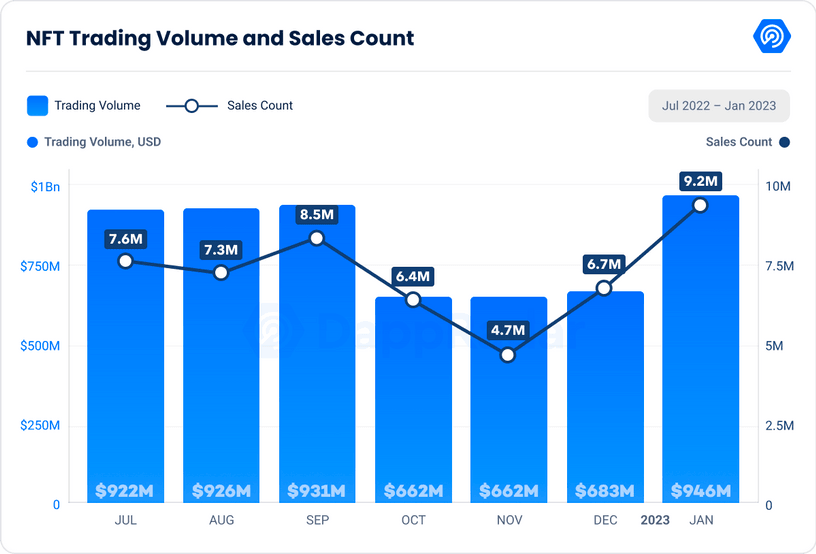

In accordance with new knowledge from market intelligence platform DappRadar, NFT gross sales jumped up by 38% on a month-to-month foundation to $946 million in January, the very best buying and selling quantity recorded since June 2022.

It additionally finds that NFT gross sales soared 42% from December 2022.

“The NFT market appears to be recovering with the surge of NFT buying and selling volumes and gross sales counts in January 2023. The NFT buying and selling quantity recorded a 38% improve from the earlier month, reaching $946 million. That is the very best buying and selling quantity recorded since June 2022. The gross sales depend of NFTs additionally elevated by 42% from the earlier month, reaching 9.2 million.”

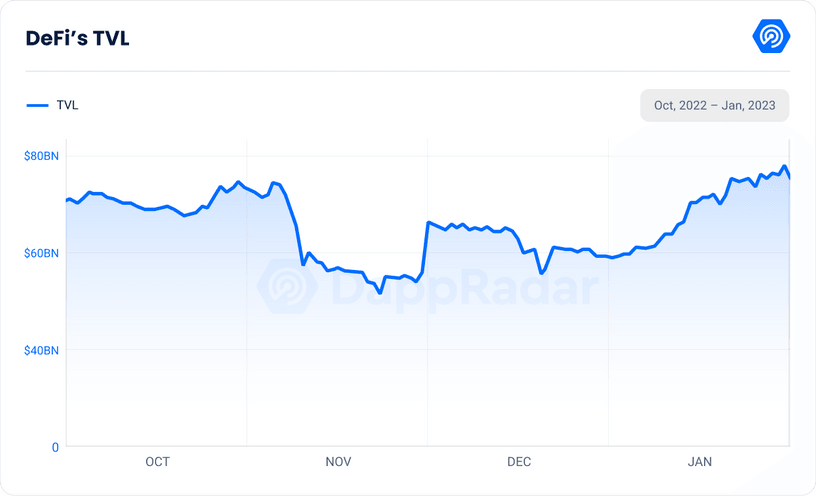

DappRadar additionally finds that the decentralized finance (DeFi) sector of the business can be regaining power as the whole worth locked (TVL) on DeFi has risen 26.8% from December to January.

“The DeFi market confirmed indicators of restoration in January 2023 because the [TVL] elevated by 26.82%, reaching $74.6 billion from the earlier month. Whereas this metric has been extremely benefited from the rally in crypto costs, different on-chain indicators sign a bull pattern.”

The analytics platform additionally brings up statistics associated to liquidity supplier Lido Finance and the main sensible contract platform Ethereum (ETH) as additional proof for DeFi recuperating.

In accordance with DappRadar, Lido has surpassed Maker DAO, the creators of stablecoin DAI, to grow to be the biggest DeFi protocol because of the rising reputation of liquid staking protocols attributable to ETH’s change to a proof-of-stake consensus mechanism final September.

“Lido Finance has grow to be the biggest DeFi protocol by toppling Maker DAO this month. This has been largely pushed by the rising reputation of liquid staking spinoff (LSD) protocols, with Ether up by a major 33% over the previous 30 days.

Ethereum’s shift to proof-of-stake (PoS) has been a catalyst for the rising curiosity in LSDs. Lido has been fast to capitalize on this, and its charge income has been instantly proportional to Ethereum PoS earnings, because it sends acquired Ether to the staking protocol.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney