NFT lending continues to moon as over 18k ETH borrowed in January

NFT

cryptoslate.com

18 February 2023 20:17, UTC

Studying time: ~2 m

In keeping with a brand new report by digital asset analytics agency eBit labs, NFT lending hit a file month in January, returning to numbers not seen because the sector’s earlier all-time excessive in Might 2022.

The report used on-chain information of loans backed by Bored Ape Yacht Membership (BAYC) and examined BAYCs in response to mortgage worth, length, liquidation worth, and market dominance.

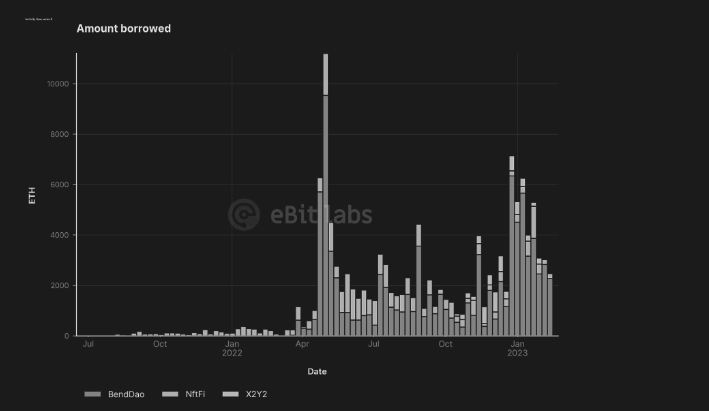

Moreover, eBit labs found that the quantity borrowed in Jan. 2023 had returned to peaks not seen since Might 2022. For the primary time in additional than 9 months, weekly mortgage quantity totaled greater than 6,000 ETH within the first week of Jan. Moreover, the full borrowed all through January reached greater than 18,000 ETH – or $30,516,660 as of press time.

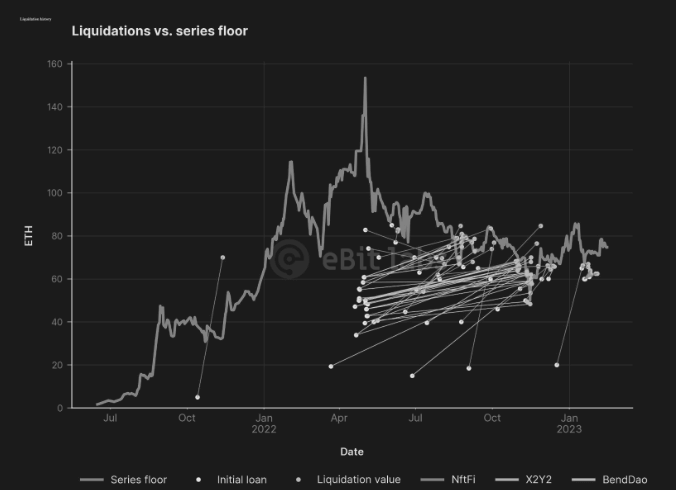

Within the midst of 2022, the lending trade gained widespread consideration because the declining ground worth of BAYC sparked market strain and heightened considerations about potential liquidation, finally resulting in a liquidity disaster, the report additionally discovered.

Competitors amongst platforms will get extra intense

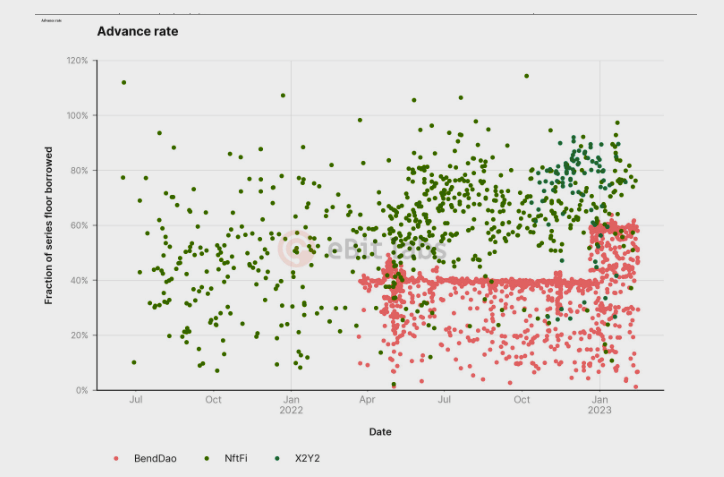

Since its launch, BendDao has maintained a constant most advance fee of 40%, notably decrease than the superior charges of as much as 80% provided by different peer-to-peer NFTfi platforms.

Nonetheless, in September 2022, the entry of X2Y2 into the market disrupted this established order by providing advance charges exceeding 100%. Consequently, BendDao confronted intense competitors and consumer attrition, prompting it to boost its advance charges to 60% to stay aggressive. This adjustment was made throughout the winter vacation season.

Janusry 2023 peaks

A number of elements propelled January’s surge in NFT lending, the report says. One main issue was market exuberance and the Yuga Labs’ Dookey Sprint Information, which inspired customers to ramp up Yuga-related lending exercise. In keeping with analysis, the majority of loans issued throughout the three major lending platforms was towards Bored Apes, with short-term mortgage balances for BAYC hitting file highs in January 2023.

Insights

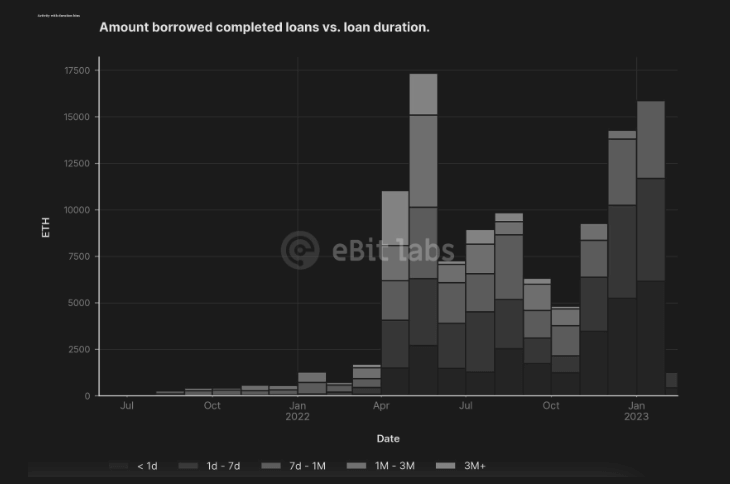

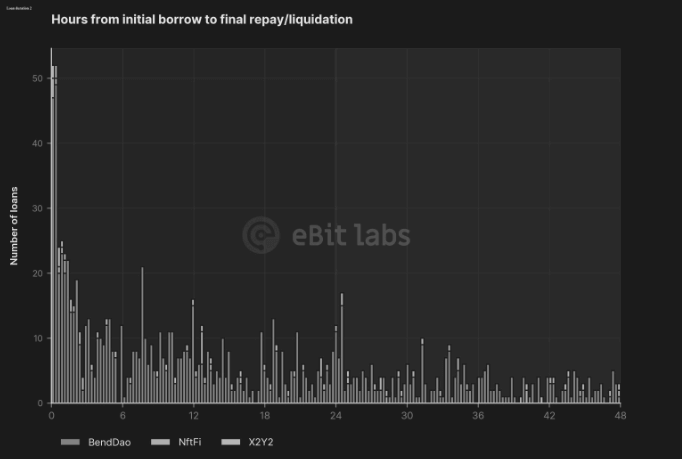

The information exhibits that the overwhelming majority of loans are both repaid or liquidated inside a single day, with longer-term loans constituting a a lot smaller portion of the full. This pattern means that probably many debtors are using these loans to deal with speedy liquidity necessities quite than as a hedge towards market-value fluctuations.

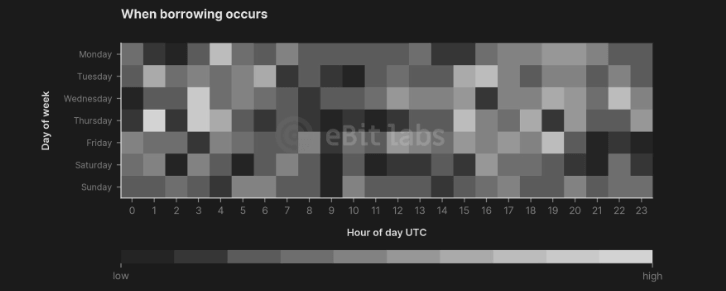

A lull in exercise between the sixth and 14th hour (UTC) on weekdays – outdoors the overall US waking hours – suggests {that a} substantial portion of the exercise happens inside america.

Total, the report concluded that:

“The provision of NFT lending meets a helpful market want and helps gas the continued growth and class of the complete NFT ecosystem. Drivers for the borrowing are seemingly wide-ranging, nevertheless it’s clear that these loans can meet each quick and longer-term liquidity wants and likewise present helpful market-value hedges.”