Negative CPI Report Causes Bitcoin Market Cap To Lose $15 Billion In 10 Minutes

For the month of June 2022, the US Bureau of Labor Statistics revealed its Shopper Value Index. The Destructive CPI was discovered to be 9.1%, the biggest inflation improve within the US within the earlier 40 years. The Federal Reserve’s financial coverage is decided by the CPI, which is a dependable indicator of inflation.

Destructive CPI Report Causes Bitcoin To Tumble

Previous to the discharge of U.S. inflation statistics on July 12, the value of Bitcoin (BTC) settled right into a strong holding sample, which finally added extra unfavourable volatility.

Based on the newest CPI report for June, inflation in america reached 9.1%, which is the very best degree since November 1981. This information solely served to speed up the downward pattern in Bitcoin and the cryptocurrency market.

Following the discharge of the CPI, BTC falls by round 4% inside ten minutes. Conventional market gauges just like the S&P 500, Dow Jones, and NASDAQ are all sharply decrease.

Based on TradingView information, Bitcoin is at the moment buying and selling at $19,180, down 3.45% on the day and 4.70% for the previous week, with a complete market cap of $366 billion. Notably, the flagship digital asset misplaced $15 billion from its market capitalization, dropping from $379.91 billion to $364.55 billion.

Bitcoin market cap at $374 Billion. Supply: TradingView

The CPI for the earlier month revealed a rise in inflation of 8.6% yr over yr, the very best degree since 1981. The Fed applied quantitative tightening financial insurance policies in response to extraordinarily excessive inflation.

All the crypto trade noticed a extreme downturn on account of the Fed’s hardline financial coverage. The final ten years’ worst monetary quarter for Bitcoin was skilled.

Associated Studying | Wall Road Traders Count on Bitcoin To Hit $10,000, Is This Doable?

This revelation could have extreme results for the cryptocurrency markets, if final month’s CPI is any indicator.

Traders took a collective deep breath because the time for the discharge of the inflation statistics ticked down. The worldwide markets remained calm, however as many outstanding crypto buying and selling analysts had hinted firstly of the week, an announcement—constructive or unfavourable—could be mentioned to have a major affect on the value of digital belongings.

America Federal Reserve can be beneath much more strain to lift rates of interest on account of the inflation statistics, which was a lot larger than anticipated.

Extra Strain

Since Bitcoin has thus far been unable to behave as an inflation hedge, it has skilled a substantial loss in worth this yr, plummeting by round 72%. Together with different threat belongings, Bitcoin has been severely impacted by the Fed’s financial insurance policies as a result of it has at all times existed in a low-interest charge surroundings.

The Federal Reserve would be capable to pull off a mushy touchdown, so avoiding a recession whereas considerably elevating rates of interest, based on sturdy job numbers that had been reported final week. Even if rates of interest have been sharply climbing, this was the case.

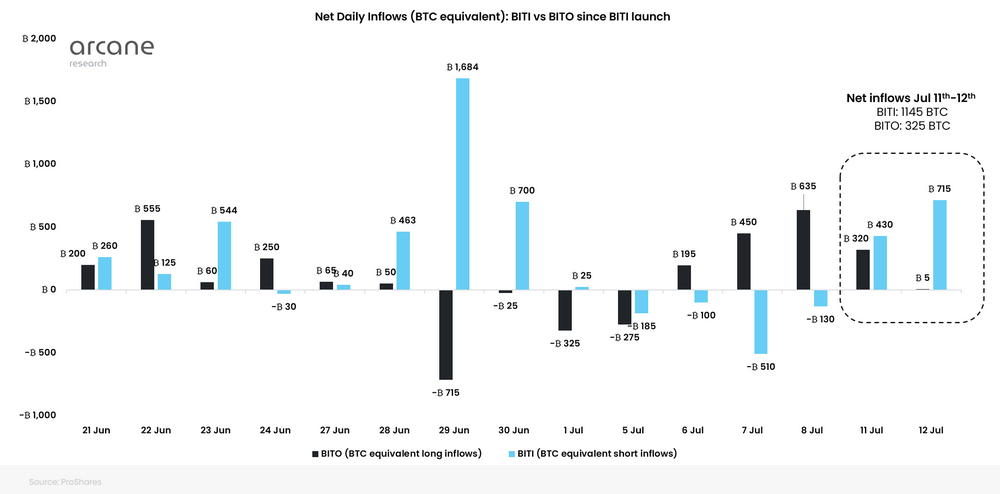

Crypto merchants and buyers had been closely shorting Bitcoin and different cryptocurrencies earlier than to the long-awaited information’s launch as a result of netflow to exchange-traded funds that give buyers publicity to brief Bitcoin reported roughly $15 million in inflows in solely someday.

Supply: Arcane Research

The founding father of Eight International, Michal van de Poppe, stated that the CPI will decide whether or not or not Bitcoin succeeds. The help degree of $19.5K and resistance degree of $19.8K current a major take a look at for BTC. Relying on the CPI, BTC is anticipated to expertise a major decline.

Associated Studying | Glassnode: Bitcoin LTHs Who Purchased Throughout 2017-2020 Aren’t Promoting But

Featured picture from Shutterstock, charts from TradingView.com and Arcane Analysis