NEAR Protocol [NEAR] could go with the bulls next week, if…

- NEAR’s worth pullback might go decrease to $1.584.

- NEAR recorded a drop in weighted sentiment, buying and selling quantity, and improvement exercise.

- A candlestick shut above 61.8% Fib stage ($1.678) will invalidate this bearish forecast.

NEAR Protocol (NEAR), the unmatched blockchain platform, hasn’t supplied many positive aspects to buyers holding its native token (NEAR) lately. However there may very well be a short-selling alternative at $1.584 if NEAR’s downtrend continues for a day or two.

Technical indicators and on-chain metrics recommend that NEAR’s downtrend might proceed. Ought to NEAR bears maintain regular, buyers might maximize on short-selling at $1.584.

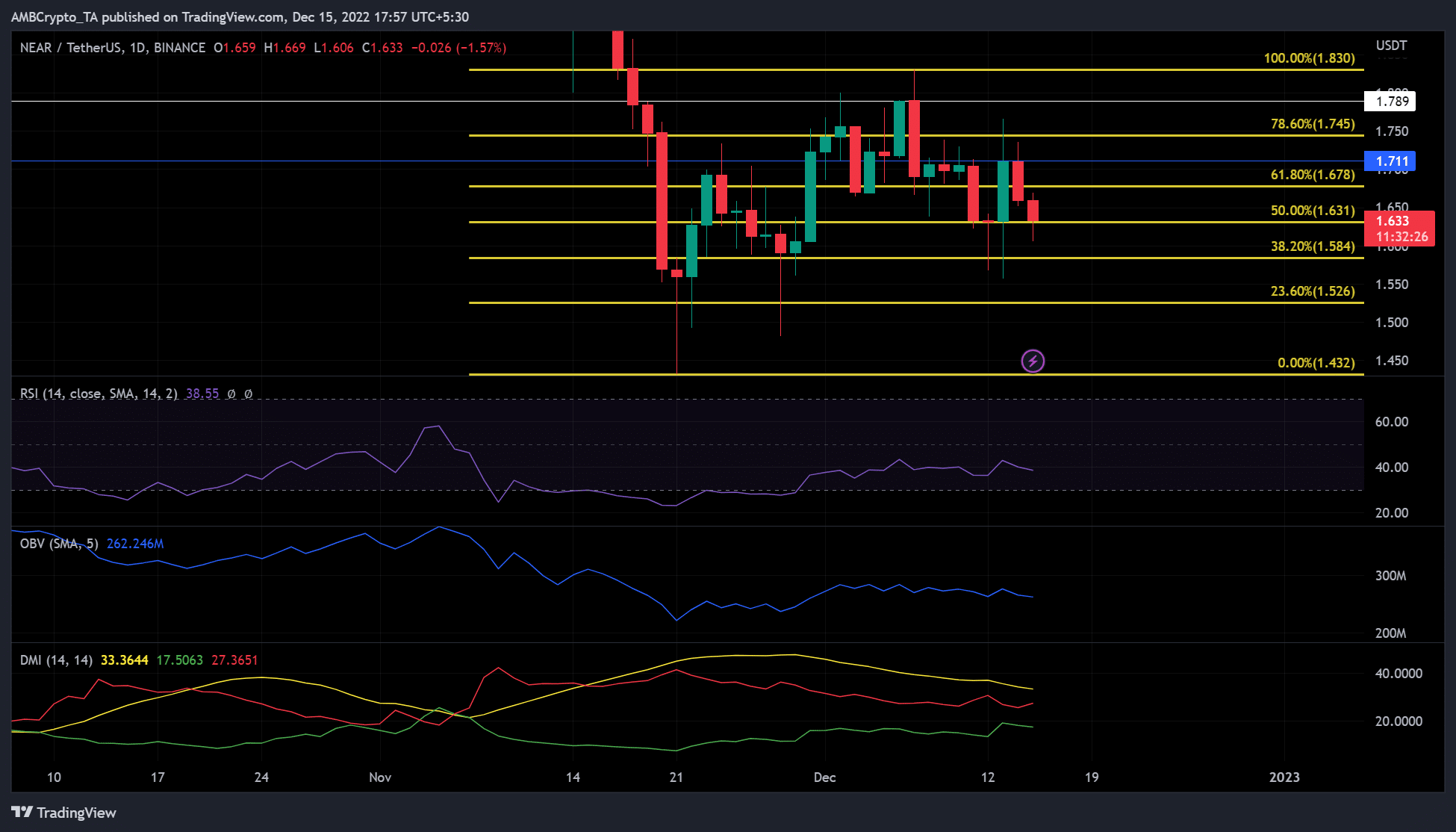

NEAR on rapid assist at 50% Fib stage ($1.631): will bears push downwards?

Supply: NEAR/USDT on TradingView

Bears might push NEAR’s worth decrease based mostly on three key technical indicators on the every day chart.

First, the Relative Power Index (RSI) was at 35, resting on the vary bordering the oversold space. This means that purchasing strain declined as sellers stepped in.

Second, the On Steadiness Quantity (OBV) confirmed a downtick, indicating a drop in buying and selling quantity. This exhibits that purchasing strain might lower additional, including one other leverage to sellers.

Third and closing, the Directional Motion Index (DMI) confirmed sellers led the market on the press time. The pink line (sellers) was at 27, above 25, indicating that sellers had a lot affect available in the market.

Collectively, these indicators reinforce that promoting strain is powerful sufficient to push NEAR to the earlier assist on the 38.2% Fib stage ($1.584).

Nonetheless, an intraday candlestick shut above 61.8% Fib stage ($1.678) will invalidate the above bearish forecast.

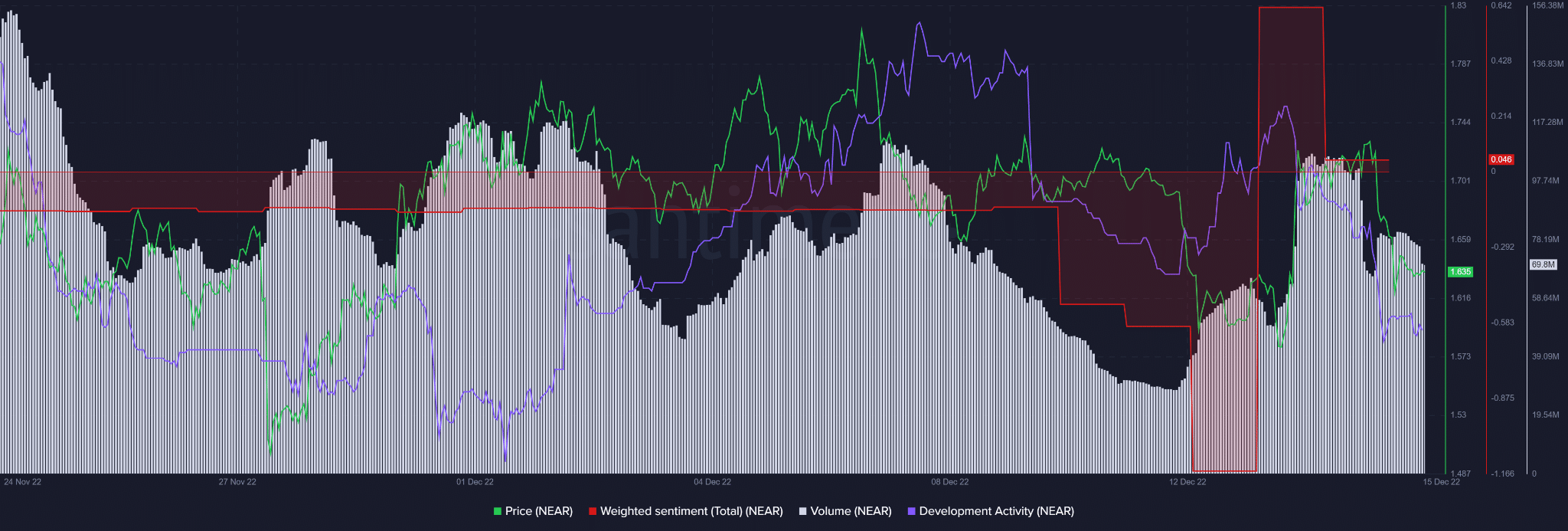

NEAR’s sentiment and improvement exercise declined

Supply: Santiment

We noticed that NEAR Protocol improvement exercise instantly impacted its native token worth. At press time, the blockchain platform’s improvement exercise had declined, bringing down the token’s worth. As such, a continued drop in improvement exercise might possible push the value decrease.

As well as, buying and selling quantity and sentiment dropped with falling costs, indicating declining shopping for strain as buyers develop into bearish on the token. So, NEAR’s downtrend might proceed for just a few days earlier than a worth reversal providing short-selling alternatives.

Nonetheless, bullish sentiment on NEAR will result in worth reversal, spoiling the occasion for sellers and invalidating the above forecast.