Bored Ape Yacht Club NFTs Ethereum Floor Price Drops to 8-Month Low

NFT

decrypt.co

20 August 2022 14:56, UTC

Studying time: ~4 m

The Ethereum ground worth of the Bored Ape Yacht Membership (BAYC) NFT assortment has dropped to its lowest degree for the reason that begin of the 12 months, amid a continued NFT market droop and wider crypto market crash.

At 65.68 ETH, the ground worth of Bored Ape Yacht Membership NFTs has fallen to ranges not seen since January 2, 2022. Based on knowledge from CoinGecko, it has been on a downtrend since reaching an all-time excessive of 153.7 ETH on Might 1.

BAYC stays the most important NFT assortment by market capitalization, at 656,800 ETH—simply above its nearest rival, CryptoPunks, with a complete market cap of 655,000 ETH and ground worth of 65.5 ETH.

Nonetheless, it’s not all unhealthy information for Bored Ape holders. Ethereum’s fluctuating worth signifies that in greenback phrases, the BAYC ground worth is round $107,000 right this moment; considerably decrease than firstly of the 12 months, when it was slightly below $256,000, however up from a low of slightly below $87,000, recorded in June.

BAYC faces liquidations on BenDAO

So as to add gasoline to the flames, Bored Apes acquired utilizing loans on peer-to-peer lending service BenDAO might face being liquidated, as a result of assortment’s plummeting ground worth.

BenDAO, which permits clients to borrow ETH in alternate for NFTs, allows customers to take out loans as much as 40% of an NFT’s ground worth. Ought to the ground worth of the NFT drop to a degree the place the NFT-backed mortgage’s “well being issue” is beneath 1, the NFT is positioned in a 48-hour public sale and offered to the very best bidder if the mortgage isn’t repaid.

The well being issue is outlined as a “numeric illustration of the protection of your deposited NFT towards the borrowed ETH and its underlying worth.”

There are presently 72 Bored Ape Yacht Membership NFTs on the platform within the “hazard zone,” outlined by NFT dealer Cirrus, who broke the information of the potential liquidations, as having a well being issue of beneath 1.2—the place they’re prone to a drop within the worth ground triggering a liquidation.

A well being issue beneath 1.2 means you might be within the hazard zone.

A 17% drop of your NFTs ground triggers a liquidation.

Here is the terrifying half.

There are presently 45 BAYC with a well being issue at or beneath 1.2 pic.twitter.com/f9EwAbcB1l

— Cirrus (@CirrusNFT) August 17, 2022

BenDAO states in its FAQ that “short-term fluctuations in NFT ground worth are regular,” and that, “Consensus on bluechip NFTs wasn’t in-built a day, and it’ll not be collapsed in a brief time frame.”

Its documentation additionally notes that “the platform solely has a short lived floating loss and no precise losses,” however leaves open the query of what occurs if no purchaser steps in, and the worth of the NFT falls beneath that of the interest-accruing debt.

With the BAYC ground worth down 57% from its all-time excessive recorded in Might, and a couple of.57% of the BAYC assortment linked to BendDAO, it’s a query that would turn into urgent.

NFTs monitor crypto market droop

NFTs like BAYC that function on the Ethereum community and are offered for Ether (ETH) are likely to shadow the worth of Ethereum.

Following the collapse of Terra’s algorithmic stablecoin UST in Might and the chapter filings of hedge fund Three Arrows Capital and crypto-lender Celsius Community in June, Ethereum misplaced 43% of its worth.

The ground worth of BAYC correspondingly dropped by 36%, from 116 ETH to 65.5 ETH throughout the identical interval from Might to June.

Nonetheless, as traders put together to capitalize on Ethereum’s upcoming Merge, NFTs have damaged step with the second-largest cryptocurrency by market capitalization.

Between June 19 and August 20, Ethereum rose from an eight-month low of $995 to $1,634, whereas BAYC’s ground worth has continued to drop.

Zooming out, the NFT market as an entire has not fared properly over the previous 12 months.

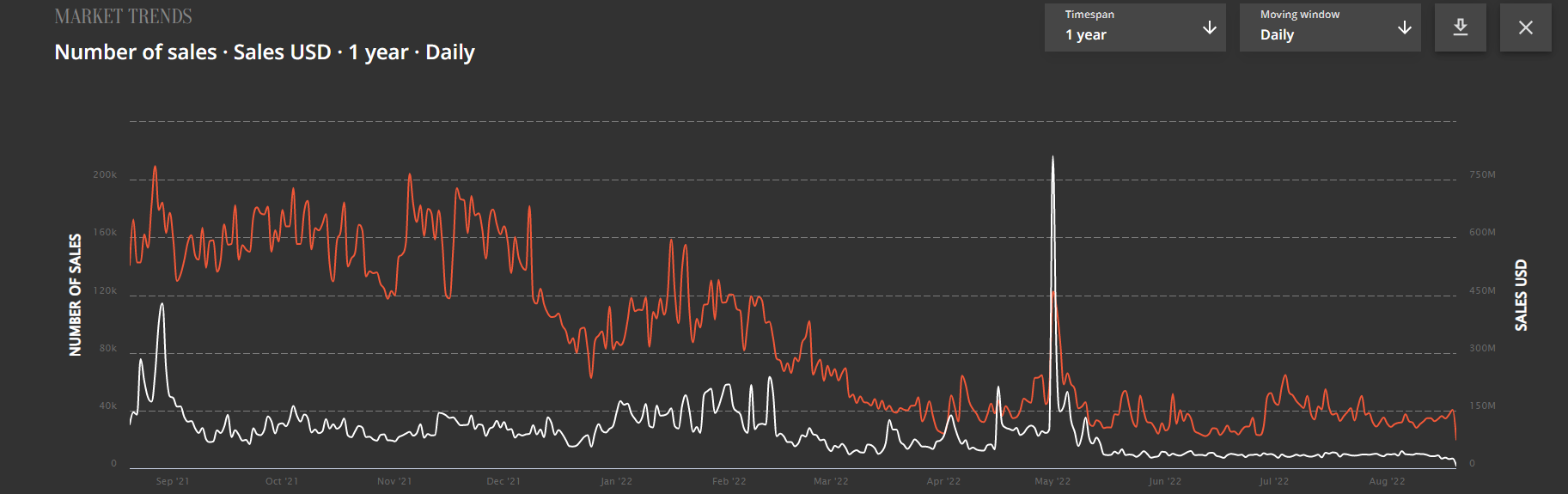

Variety of NFT gross sales vs. gross sales in USD. Supply: NonFungible.com

Each day gross sales numbers (orange) have declined whereas the greenback worth of the gross sales (white) stays stagnant.

Based on NonFungible.com’s Q2 2022 trade report, “curiosity has dropped” in NFTs, with “geopolitical issues” hampering the market.

“The liquidity of most collections has decreased significantly, thus decreasing the speed of launch on the secondary market”, the report suggests.