Litecoin sharks may have the final say on LTC’s direction- Here’s why

- Litecoin’s $1 million transactions reached a January excessive.

- The LTC’s potential course could possibly be depending on continuous whale motion.

After hitting highs earlier in January, Litecoin [LTC] whales have stamped their authority out there once more as giant transactions hit peak ranges.

In accordance with Santiment, whale transactions across the $1 million area hit 2023 highest on 25 January. Particulars from the on-chain platform confirmed that there have been over 100 transactions inside the vary on the stated date.

⚡️🐳 #Litecoin‘s giant whale transactions have exploded with exercise, indicating a resurgence of transactions which can be valued at $1 million or extra. On the tail finish of the final two equally sized whale spikes, costs jumped +37% and +33% at their peaks. https://t.co/WD3Mc5QWKg pic.twitter.com/ruuIGXHEBQ

— Santiment (@santimentfeed) January 26, 2023

Learn Litecoin’s [LTC] Value Prediction 2023-2024

“In Litecoin we belief”

Nevertheless, the circumstances of this spike have been completely different from the final two occurrences. The earlier two instances Litecoin hit such a pinnacle, there have been notable will increase within the LTC value. In the meantime, the coin has solely gained 1.07% within the final 24 hours.

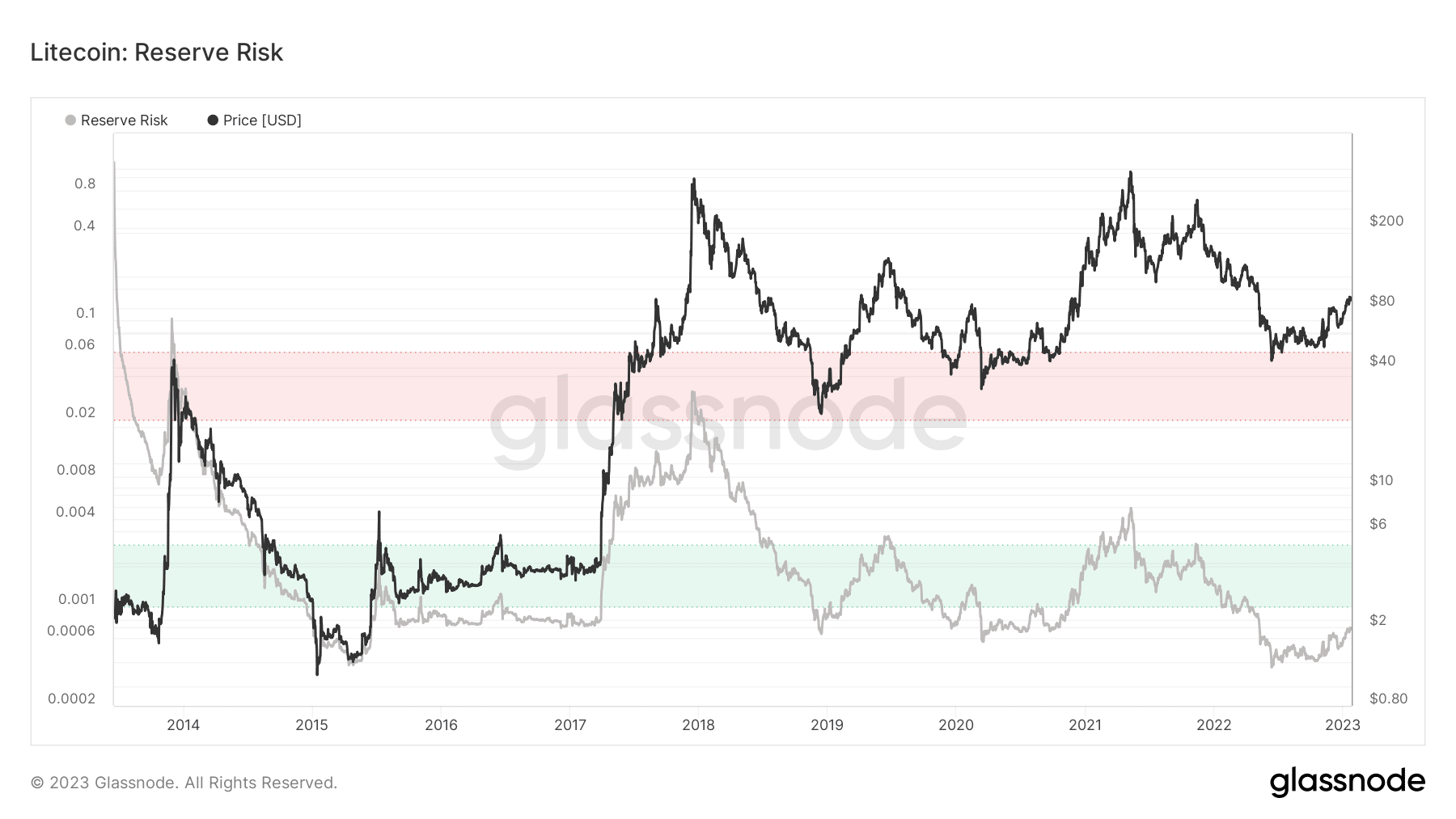

However, this has not deterred the boldness of its long-term holders. In accordance with Glassnode, the Litecoin reserve risk was 0.00069— a significantly low worth. The reserves danger measures the assumption that holders of an asset have in it.

For the reason that reserve danger was low, it depicted that confidence was excessive. With the LTC value extremely down from its all-time excessive (ATH), it matches the point of view of unwavering belief in holding the cryptocurrency.

Supply: Glassnode

The whales’ actions have been in distinction to what they have been concerned in a number of days again as most bought off a part of their holdings. Nevertheless, the resurgence in giant transactions may also not be bewildering.

This was because of the approaching Litecoin halving. In previous halvings, Litecoin whales had an angle of accumulating days earlier than the occasion. So, there’s a probability the current steps hyperlink to it.

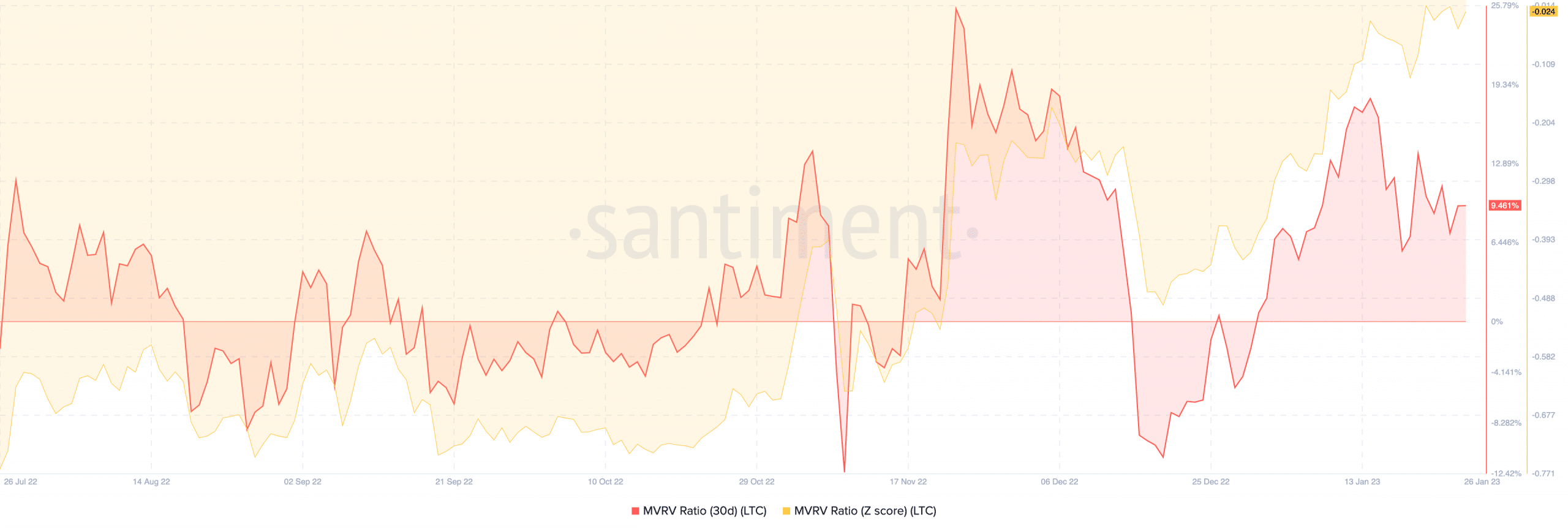

Curiously the exercise appeared to have affected the worth of LTC held by traders. On the time of writing, the Market Value to Realized Value (MVRV) ratio had revived to 9.461%. The ratio acts as a measure of a cryptocurrency’s worth out there with respect to merchants’ shopping for and promoting habits.

The present stance implied that LTC holders edged additional towards income fairly than losses. Alternatively, the MVRV z-score trended significantly greater than it has been. Nonetheless, it was unfavorable that means that Litecoin was doubtless undervalued heedless of its 26.97% 30-day achieve.

Supply: Santiment

Life like or not, right here’s LTC’s market cap in BTC’s phrases

No present for LTC?

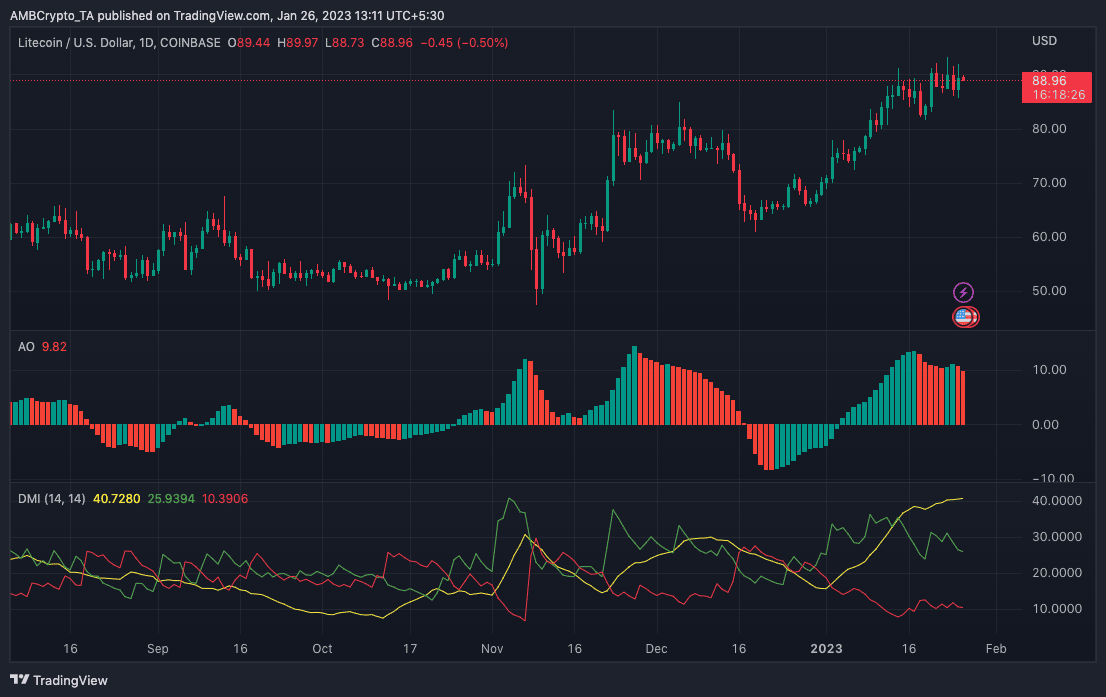

Indications from the day by day chart displayed inconsistency with the Litecoin momentum. Based mostly on the Superior Oscillator (AO) development, the coin didn’t facet with a bullish or bearish edge because the inexperienced and pink bar interchanged turns.

The Directional Motion Index (DMI) obeyed the studying of AO. Whereas the Common Directional Index (ADX) confirmed vital energy at 40.72, the help was neither for the optimistic DMI (inexperienced) nor the unfavorable DMI (yellow).

Supply: TradingView