Lido [LDO]: Ethereum’s Shanghai upgrade will impact the staking platform by…

- The Shanghai Improve can be launched in three days.

- On account of the improve, LDO has seen a surge in staking.

The approaching week is extraordinarily necessary for the Ethereum [ETH] group as a result of the Shanghai improve is scheduled to happen in three days, counting down from press time. There was a whole lot of hypothesis relating to the potential impression, particularly on Lido Finance [LDO]. It’s because one of many key parts of the improve can be enabling the unlocking of staked ETH.

Is your portfolio inexperienced? Try the LDO Revenue Calculator

As soon as the locked ETH is unlocked, there’s a probability that many holders will migrate to liquid staking platforms like Lido Finance. The latter just lately applied Lido V2 in readiness for the potential liquidity migration. The improve will reportedly permit for brand new node operators in addition to withdrawing from Lido at a 1:1 ratio.

How will the migration have an effect on Lido?

Since a lot of the locked ETH was staked as early as 2020, there are considerations that billions price of the cryptocurrency will make their means into the market. Nevertheless, LDO has skilled a surge in demand for liquid staking within the final six months. Therefore, there may be robust demand for staking companies.

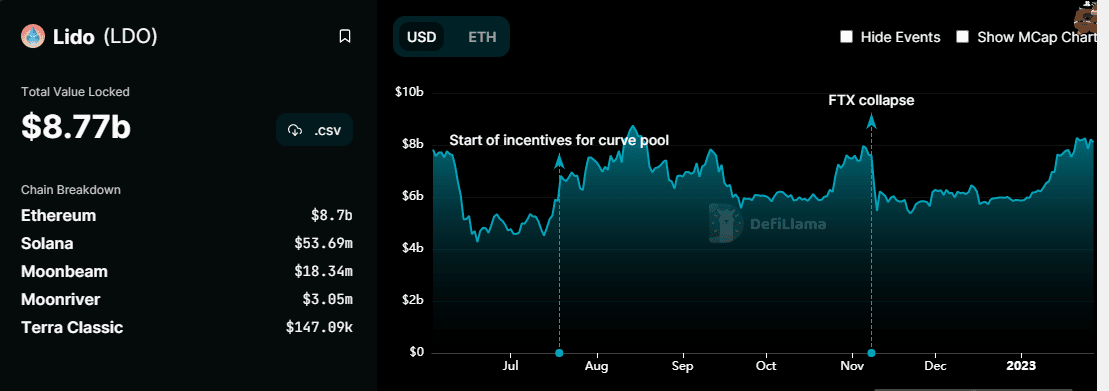

Supply: DeFiLlama

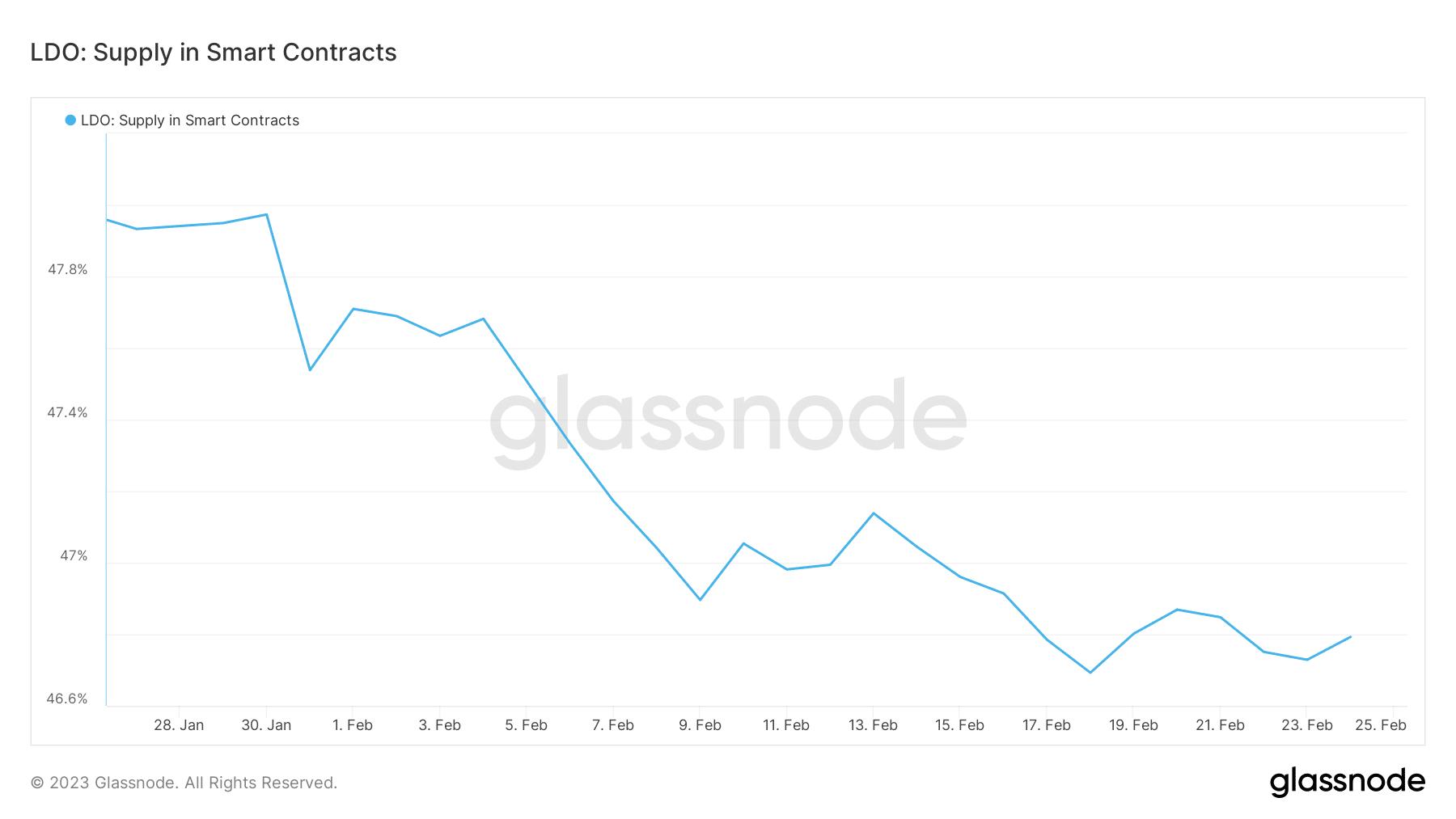

The TVL surge, particularly since December 2022, recommended {that a} migration was extra seemingly, versus promote stress. Regardless of this, there was a drop within the quantity of LDO provide in sensible contracts, which declined within the final 30 days. Nevertheless, we see a little bit of an uptick since 18 February, suggesting {that a} potential pivot could also be in place.

Supply: Glassnode

LDO skilled a little bit of promote stress this week, which was in step with the promote stress noticed within the crypto market. Its $2.77 press time value represented a 16% pullback from its present month-to-month excessive, however regardless of this, LDO remains to be holding on to most of its latest good points.

Supply: TradingView

What number of are 1,10,100 LDOs price in the present day?

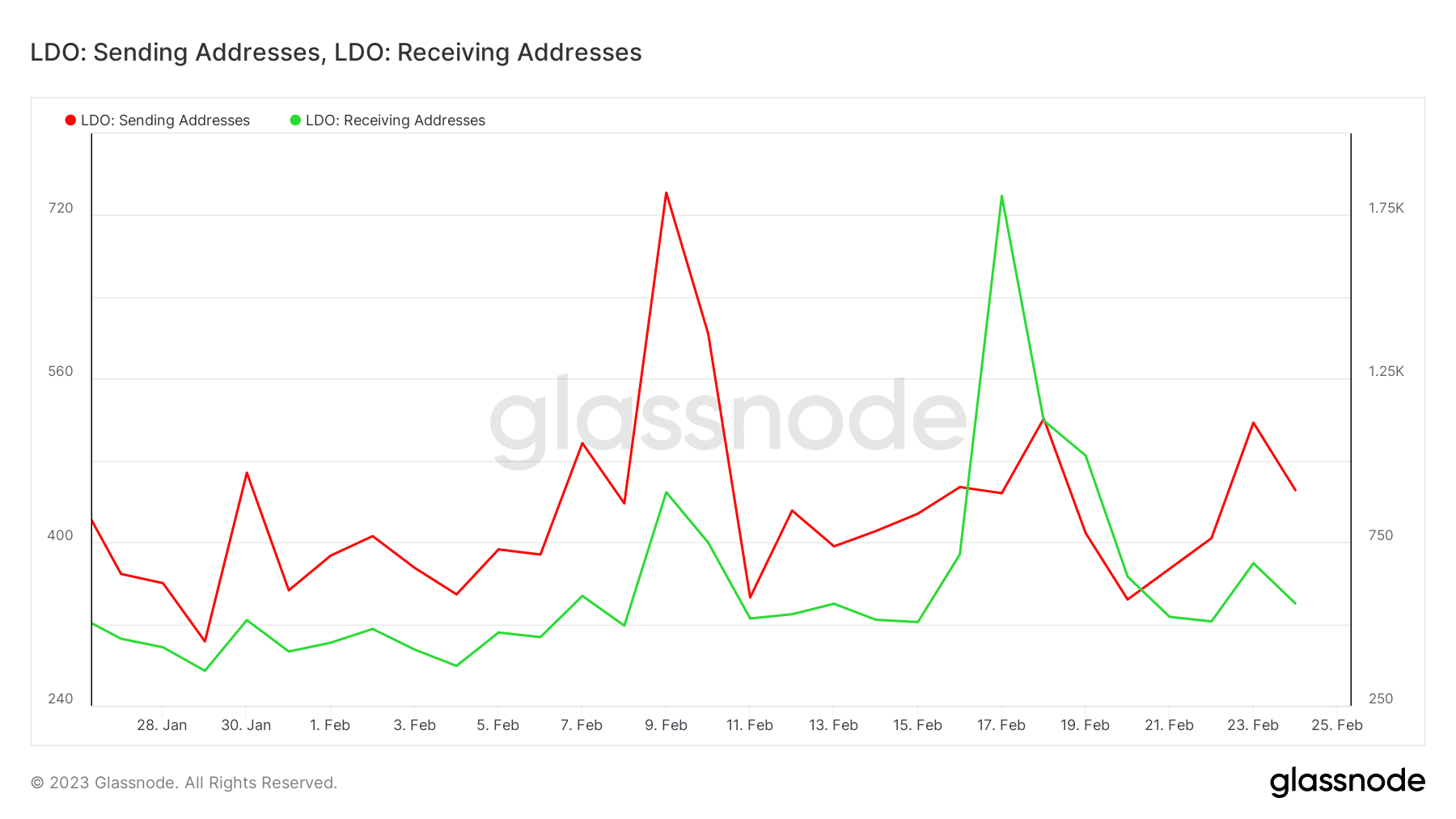

The shortage of a stronger pullback is obvious that there’s not a lot promote stress going down. That is in step with handle flows on Glassnode. The variety of receiving addresses has been notably increased than sending addresses in the previous few months, regardless of a slowdown in market situations.

Supply: Glassnode

Whereas the following few days can be crucial, affordable volatility can be to be anticipated. Some promote stress for each ETH and LDO may happen, however a migration to Lido might increase LDO demand within the mid to long run.