Leverage Ratio Is Still Very High

On-chain knowledge exhibits the Bitcoin leverage ratio nonetheless has a really excessive worth, an indication that has normally confirmed to be bearish for the crypto in latest months.

Bitcoin Change Leverage Ratio Has Been Going Up In Current Weeks

As identified by an analyst in a CryptoQuant post, the BTC all exchanges leverage ratio remains to be fairly excessive, suggesting that the crypto may nonetheless see additional downtrend.

The “leverage ratio” is an indicator that’s outlined because the ratio between the open curiosity and the all derivatives trade reserve.

Right here, the “open curiosity” is a measure of the full quantity of Bitcoin futures positions at present open within the derivatives market.

And the “derivatives trade reserve” is simply the full variety of cash at present saved in wallets of all derivatives exchanges.

What the leverage ratio tells us is how a lot leverage customers are taking over common within the BTC futures market proper now.

When the worth of this indicator is excessive, it means customers are taking a considerable amount of threat within the type of leverage in the mean time. An extra of leverage normally results in increased volatility available in the market.

Associated Studying | Bitcoin On-Chain Information: Miners Deposit Large To Derivatives Exchanges

Alternatively, decrease values of the ratio may end up in lesser relative volatility within the crypto’s value since customers aren’t taking a lot threat.

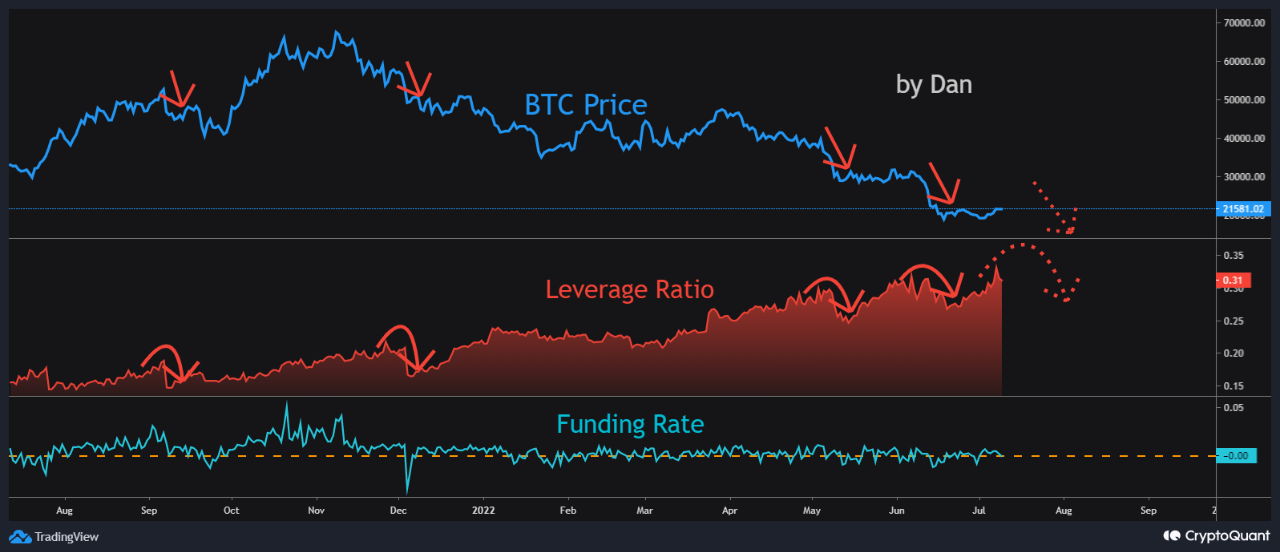

Now, here’s a chart that exhibits the pattern within the Bitcoin all exchanges leverage ratio over the past 12 months:

The worth of the metric appears to have been fairly excessive in latest days | Supply: CryptoQuant

As you’ll be able to see within the above graph, each time the Bitcoin leverage ratio has hit a steep worth over the past a number of months, each the indicator and the coin’s value has subsequently plunged down.

Mass leverage flushes like these are referred to as “liquidation squeezes.” Throughout such occasions, liquidations cascade collectively and amplify the worth transfer that triggered the squeeze.

Associated Studying | Why Bitcoin Is Undervalued In accordance To This Skilled’s “Conservative” Mannequin

Because the value moved in the identical route because the squeeze in these cases, they have been all examples of a “lengthy squeeze.”

It seems to be just like the ratio’s worth is as soon as once more excessive proper now. If the same pattern as in the previous couple of months follows this time as nicely, then an extended squeeze could also be coming quickly and taking Bitcoin in for an additional plummet.

BTC Value

On the time of writing, Bitcoin’s value floats round $20.5k, up 4% within the final week. Over the previous month, the crypto has misplaced 30% in worth.

Seems like the worth of the crypto has been taking place over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com