Is the NFT Boom Over? Trading Volumes Hit 12-Month Lows

Key Takeaways

- NFTs are struggling to take care of the parabolic development they skilled through the bull market.

- OpenSea buying and selling volumes have plummeted, dropping from $3.1 billion in Might to $826 million in June.

- Regardless of the dearth of NFT buying and selling exercise, some established initiatives have held their worth in ETH phrases.

Share this text

Curiosity in NFTs has fallen in tandem with the broader cryptocurrency market as buying and selling volumes hit their lowest ranges in a yr.

OpenSea NFT Buying and selling Stagnates

NFTs haven’t escaped the crypto bear market, buying and selling knowledge reveals.

The non-fungible token market is struggling to take care of the parabolic development it skilled through the bull market of 2021. Knowledge from prime NFT buying and selling venues equivalent to OpenSea reveals that buying and selling volumes have fallen off a cliff in latest months, now at their lowest ranges since July 2021.

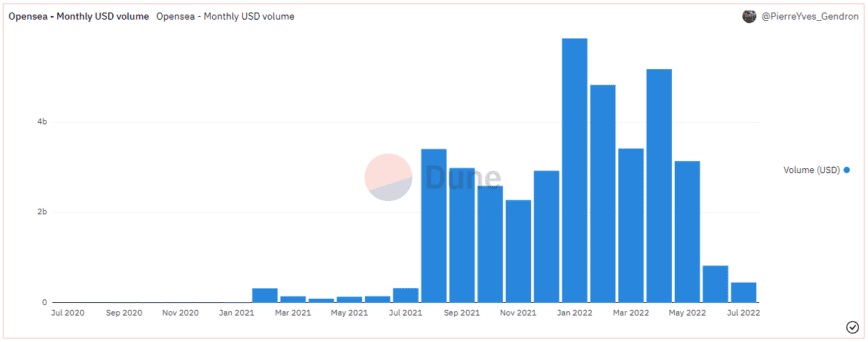

Based on Dune data compiled by PierreYves_Gendron, OpenSea’s buying and selling quantity hit a peak of round $5.8 billion in January. Nonetheless, buying and selling on the platform has steadily declined all through the primary two quarters of the yr, sliding to $3.1 billion in Might. June noticed essentially the most important drop within the trade’s historical past in comparison with earlier months as buying and selling volumes plummeted 74% to $826 million. Extending the slide, OpenSea has seen $456.9 million to date this month with 4 full days remaining.

OpenSea’s each day buying and selling quantity reveals a better decision decline in exercise. After registering $543 million value of trades on Might 1, days after Yuga Labs’ highly-anticipated Otherside drop went stay, each day volumes all through June and July have are available nearer to $20 million. The variety of distinctive NFT transactions on OpenSea additionally reinforces the decline in curiosity. In Might and early June, transactions often exceeded 150,000 per day. Now, they haven’t managed to interrupt previous 75,000 in over a month.

Whereas OpenSea has confronted sturdy competitors from different newer exchanges, it’s clear that general buying and selling volumes are nonetheless in decline. The latest buying and selling volumes from X2Y2 and LooksRare, the highest two exchanges behind OpenSea, should not practically sufficient to make up the distinction. Based on Dune data compiled by cryptuschrist, X2Y2 at the moment handles about $27 million in each day buying and selling quantity, whereas LooksRare sees round $9 million. Moreover, as each exchanges provide token incentives to merchants, it’s been speculated that a lot of their general quantity comes from wash trades from market manipulators trying to money in on the tokens (the exchanges reward their most energetic customers).

High-Tier Collections Maintain Sturdy

Regardless of the dearth of NFT buying and selling exercise, the ground costs of established initiatives have held in latest weeks, and in some circumstances elevated in ETH phrases. Dune knowledge compiled by hildobby reveals that the NFT avatar originator CryptoPunks has seen a 62% price increase in flooring worth from 45 ETH to 73 ETH over the previous two months, whereas the entry worth to the Bored Ape Yacht Membership has ranged between 80 and 90 ETH over the identical interval. Although each collections proceed to commerce down from their highs, their skill to carry above six figures in greenback phrases factors to ongoing curiosity within the NFT market.

Elsewhere, a number of NFT traits have gained traction regardless of low buying and selling volumes. Ethereum Identify Service, a protocol that lets customers register human-readable Ethereum domains as NFTs, noticed its buying and selling quantity explode in Might and June as fans rushed to safe uncommon 3-digit and 3-letter ENS domains. Sure generative artwork collections have additionally weathered the decline in buying and selling exercise. Like the highest NFT avatar collections, extremely sought-after Artwork Blocks units equivalent to Tyler Hobbs’ Fidenza and Dmitri Cherniak’s Ringers have soared in ETH phrases over the previous two months.

The relative success of ENS domains and generative artwork reveals {that a} devoted neighborhood of NFT fans stays regardless of the NFT market experiencing a steep decline. The drop in buying and selling exercise might be attributed to extra informal individuals shedding curiosity in cryptocurrencies and NFTs as a result of plummeting costs of prime cryptocurrencies equivalent to Bitcoin and Ethereum.

Whereas some NFT collections are nonetheless attracting consideration via the hunch, the general pattern is detrimental. After a wild run fueled by an explosion of mainstream curiosity in 2021, the so-called “vacationers” have left, with the market now predominantly propped up by crypto diehards. The latest knowledge signifies that the crypto area of interest has an extended strategy to go earlier than it reclaims the dizzying heights it hit final yr.

Disclosure: On the time of writing, the creator of this piece owned ETH, some NFTs, and a number of other different cryptocurrencies.