Here is why MATIC traders can expect selling pressure to increase at $1.03

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

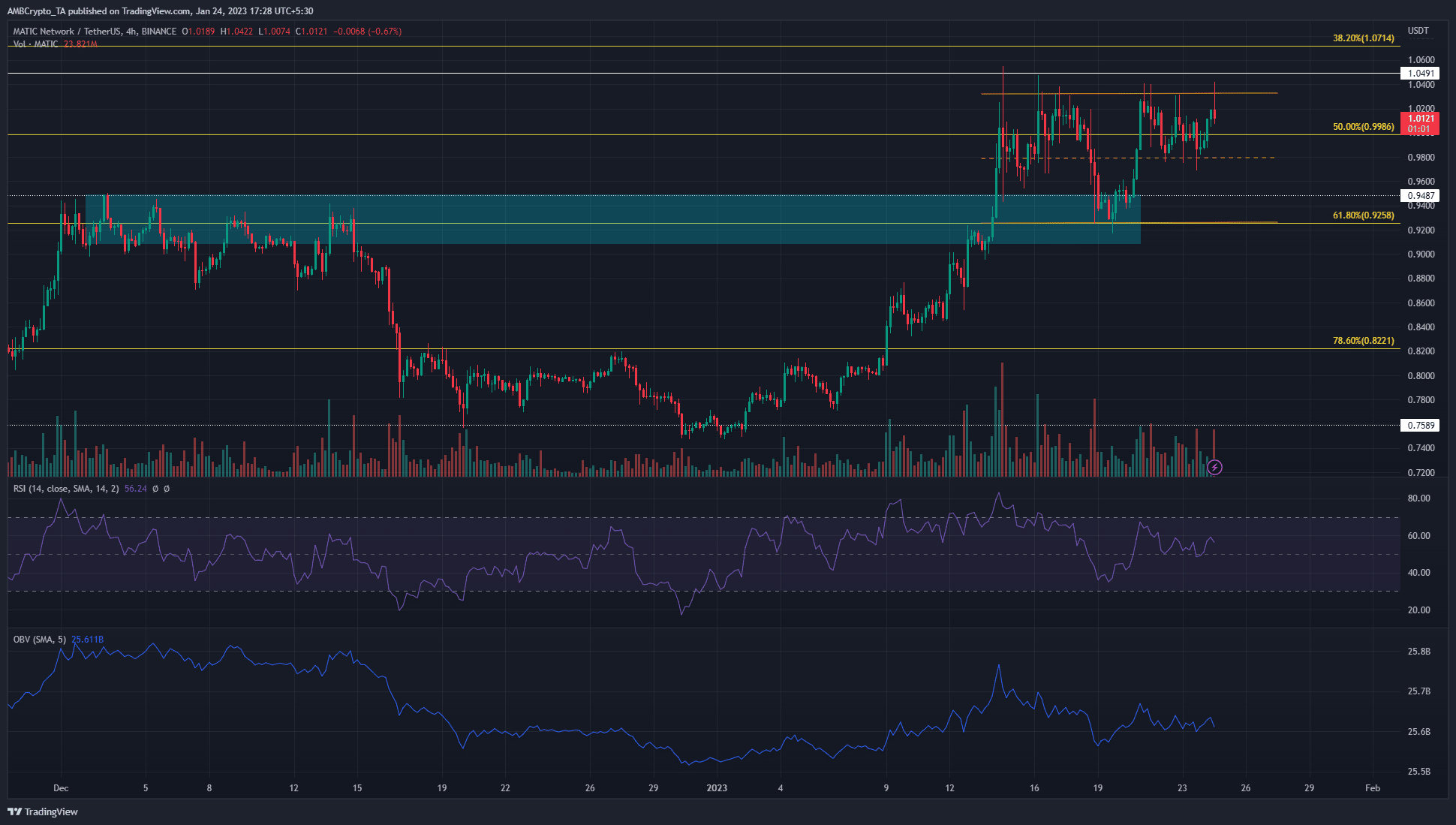

- The $1.05 has posed stern resistance prior to now two weeks.

- A revisit to the 12-hour bullish breaker and Fibonacci retracement stage might be anticipated.

Polygon [MATIC] noticed bullish sentiment rise in current weeks. On-chain metrics confirmed a big uptick within the variety of new customers, and the value motion of the native asset additionally highlighted sturdy demand behind the rally.

Learn Polygon’s [MATIC] Worth Prediction 2023-24

Whereas the upper timeframe bias remained bullish, MATIC shaped a decrease timeframe vary. On the time of writing, it approached the highs of this vary, making one other rejection possible.

The ten-day vary has been revered to date, merchants can look to enter quick positions

Supply: MATIC/USDT on TradingView

A variety between $0.92 and $1.03 was highlighted in orange. MATIC has traded inside this vary for the previous 10 days. The decrease excessive of the vary coincided with a bullish breaker (cyan) from early December on the 12-hour chart.

The higher boundary has seen many candlewicks as excessive as $1.05, however no four-hour session closed above it prior to now two weeks. Though a breakout was nonetheless potential, it was higher to commerce throughout the vary than to hunt a breakout.

Is your portfolio inexperienced? Test the Polygon Revenue Calculator

The RSI has shaped decrease highs prior to now week, as has the OBV. This indicated muted shopping for power. Till the liquidity pocket at $1.03-$1.05 is damaged by a session shut above $1.05, merchants can look to quick MATIC in that space. The revenue targets are the mid-range mark at $0.98 and the vary low at $0.92.

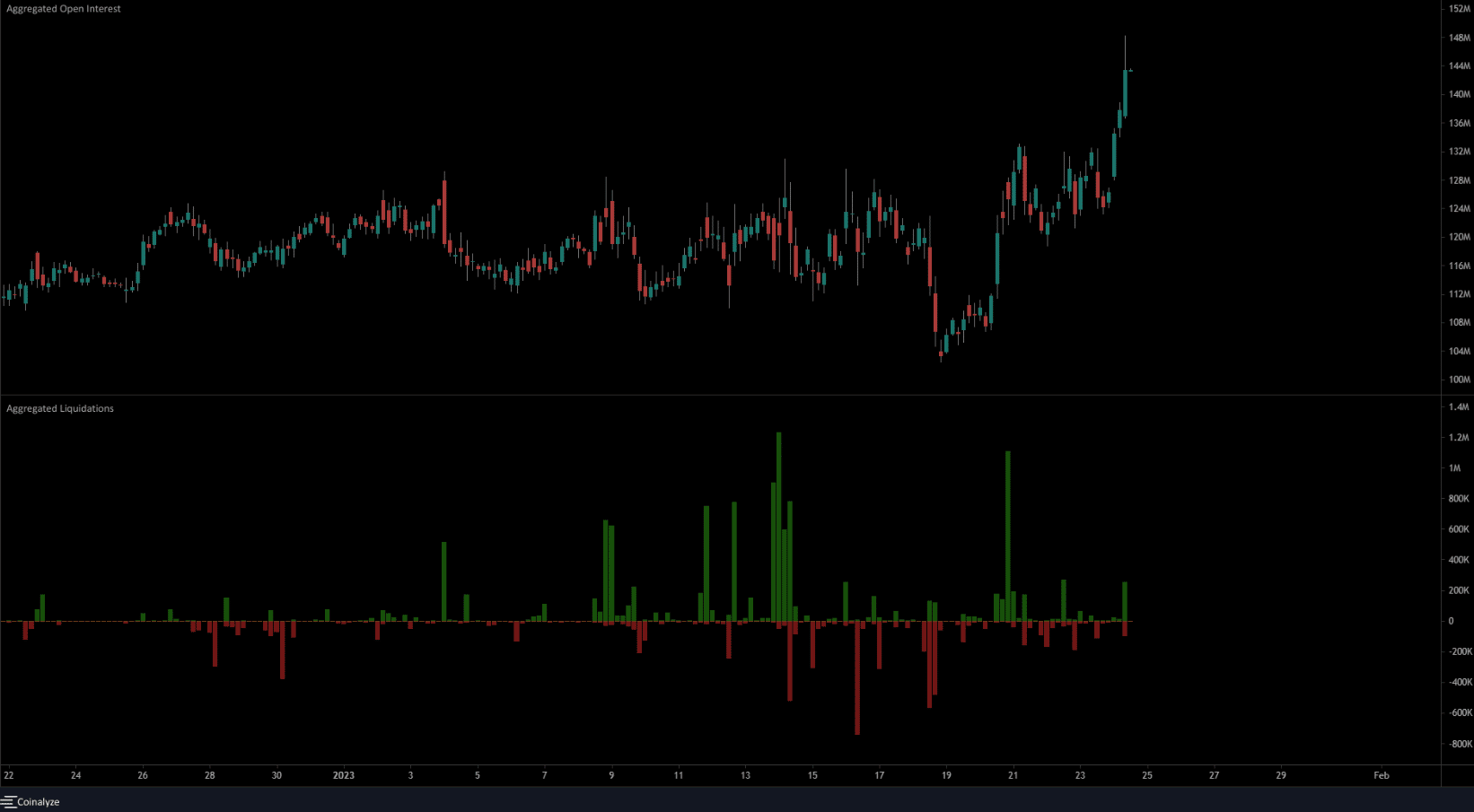

Futures market individuals stay bullish

Supply: Coinalyze

On 19 January, the value revisited the vary lows and the 12-hour bullish breaker at $0.92. The very subsequent day, MATIC bounced to the vary excessive and brought on quite a few quick positions to be liquidated. Coinalyze’s information confirmed that $1.11 million price of quick positions liquidated inside a four-hour session on January 20.

The inference was that the transfer south to $0.92 invited plenty of bearish consideration. The violent surge upward that adopted wiped them out. This additionally bolstered the power of the vary extremes. A retest of the $0.92-$0.93 ranges may thus be used to purchase MATIC.