How to Sell Large Amounts of Bitcoin? Tools to Cash Out Of Bitcoin In 2022

newbie

In terms of cashing out Bitcoin, there isn’t any one-size-fits-all strategy. After all, a poor alternative of the cash-out mechanism can influence the profitability of withdrawing each small and huge quantities of Bitcoin, however a large variety of Bitcoin multiplies the loss. That’s when it’s worthwhile to take your Bitcoin cash-outs much more severely.

Right here’s a information for individuals who are questioning tips on how to promote giant quantities of Bitcoin or different cryptos. Let’s take a more in-depth take a look at what the choices are.

Distinction Between Cashing Out Small and Huge Quantities of Bitcoin

You’ll want to perceive what giant and small quantities signify earlier than moving into the specifics of withdrawing Bitcoin.

Whereas the majority of merchants fall below the class of small fish and money out tens of hundreds of {dollars}, outstanding traders, whales, or early adopters are extra focused on withdrawing Bitcoin value thousands and thousands of {dollars}. Though all of us have a normal idea of what’s massive and small, the precise plan of action is what counts. Ranges of danger concerned, monetary restrictions, authorities laws, and taxation are some components that distinguish between cashing out giant and small portions of Bitcoin.

Additionally, whilst you’re right here, take a look at the record of the largest Bitcoin holders — it could shock you!

Why Is Bitcoin Withdrawal Even a Downside?

Up to now, the one technique accessible for changing cryptocurrency to money or vice versa was by way of web cryptocurrency exchanges. Because of the trade’s youth, there have been quite a few shortcomings, together with the absence of steady currencies and the lack to interface with a banking account.

New cures surfaced within the years that adopted, however none of them had been excellent. Withdrawal restrictions apply to pay as you go debit playing cards; nonetheless, native authorities are inclined to set their very own requirements which are continuously ignored. For example, when you promote Bitcoin for greater than $10,000 within the US, you have to notify the tax authorities, which is usually not possible as a result of not all suppliers preserve an entire file of operations.

These are a number of points within the crypto sphere described by fintech professional Steven Hatzakis, the World Director of On-line Dealer Analysis at ForexBrokers.com and StockBrokers.com.

Issues to Contemplate When Cashing Out Bitcoins

Though the process of promoting Bitcoin is pretty easy, there are some things it is best to contemplate beforehand.

Transaction Charges

In case you don’t select a conversion service appropriately, transaction prices might deplete your funds, so take note of them.

Crypto Trade Withdrawal Limits

It’s best to determine how a lot Bitcoin you want to withdraw upfront and make sure that the trade platforms you propose to make use of allow withdrawals of such sums in a single or a number of phases. Nearly all of on-line exchanges, for instance, have weekly limits of $15K–$50K, so that you would wish to promote constantly each week in an effort to promote giant volumes.

Place to Ship Your Funds

It’s best to determine beforehand the place you’re going to deposit your newly transformed funds: the vacation spot may very well be your checking account, PayPal, escrow account, and so on.

Processing Time

Some fee strategies, like financial institution wire transfers, might take longer than others. So take a look at how lengthy the cash-out transaction will take to know when your funds are to be credited.

Native Legal guidelines and Taxes

Pay shut consideration to the laws governing cryptocurrencies in your nation of residence. The 2 major choke factors the place regulators can assault if they think your conduct are anti-money laundering and tax evasion.

Some exchanges restrict the quantity of details about your buying and selling historical past that monetary watchdogs can see. You could incur fines and penalties as a result of it will likely be almost not possible to exhibit the supply of your cash.

Right here’s our article on how Bitcoin is taxed.

Financial institution Coverage

With so many legacy fee strategies, quantity restrictions in banks may very well be an issue. Anticipate vital restrictions from $100,000 to thousands and thousands or extra. The perfect plan of action if that is your first time withdrawing a big quantity of Bitcoins to a checking account is to fastidiously evaluation the financial institution switch coverage and familiarize your self with any potential challenges.

Moreover, in case your financial institution does allow transfers made utilizing Bitcoins, it’s a good suggestion to let the financial institution employees know forward of time that you’ll be receiving a large fee and to clarify the small print of the transaction.

Financial institution Accounts and Restrictions

The transaction is perhaps prohibited when you use SWIFT to withdraw fiat currencies to sure financial institution accounts. Authorities are required to take satisfactory safeguards when sizable sums of cash are despatched by unidentified customers.

Do you discover this text helpful? Then don’t hesitate to subscribe to Changelly’s weekly e-newsletter!

Greatest Methods to Money Out Huge Quantities of Bitcoin

The query is, tips on how to money out giant sums of crypto?

On the finish of the day, you’ve gotten 5 choices: a cryptocurrency trade, an OTC brokerage, peer-to-peer exchanges, Bitcoin ATMs, and crypto present playing cards. These are probably the most generally used strategies, and finally, the easiest way to money out Bitcoin will rely in your particular wants and circumstances.

Centralized Crypto Exchanges

The obvious alternative for buying and selling cryptocurrencies might appear to be one of many well-known centralized exchanges like Binance, Huobi, Kraken, and so on. They’ve been round for some time and have made a reputation for themselves as a secure and reliable choice for traders and merchants. They usually settle for a variety of digital belongings, and the charges related to platform transactions are according to trade requirements.

One factor to remember when promoting Bitcoin on fashionable exchanges is that you’ll typically have to undergo a know-your-customer (KYC) and anti-money laundering (AML) processes earlier than you’ll be allowed to withdraw fiat foreign money on such platforms. This implies that you’ll want to supply some private data, comparable to your title and tackle. Whereas this is probably not excellent for everybody, it does supply a better diploma of safety than promoting Bitcoin instantly to a different particular person.

Right here’s the record of fashionable centralized exchanges that may enable you to with promoting crypto.

Binance

The utmost quantity of cryptocurrency funds that may be withdrawn from the Binance account is topic to 2 restriction levels. Stage 1 accounts are restricted to a 24-hour withdrawal restrict of two BTC. Verified accounts are at Stage 2 and have a day by day withdrawal restrict of 100 BTC. You possibly can withdraw your Bitcoin from Binance utilizing a bank card or a wire switch.

KuCoin

KuCoin is one other trade the place you may promote your Bitcoins. Unverified and KYC1 degree prospects are solely permitted to withdraw as much as 5 BTC day by day, whereas totally verified KYC2 degree customers are permitted to withdraw 200–3000 BTC day by day.

One other professional of selecting KuCoin is low charges: whenever you withdraw BTC, KuCoin assesses a withdrawal charge of 0.0004 BTC — lower than the trade customary.

Coinbase

It’s all the time preferable and extra reasonably priced to make use of Coinbase Professional for deposits and withdrawals when coping with Coinbase. For Coinbase Professional account holders, there’s a day by day withdrawal cap, too — $50,000.

BitPanda

This platform lets you commerce utilizing quite a lot of fiat currencies, together with the Euro, the US greenback, the Swiss franc, and the British pound. Much like different exchanges, Bitpanda permits as much as €5 million (with the SEPA technique) or €100,000 (with on-line funds) in withdrawals every day, relying in your verification standing and most well-liked fee technique.

Kraken

Nearly all of Bitcoin-to-Euro transactions are dealt with by Kraken.

Changelly

Changelly has top-of-the-line charges within the trade. The platform additionally provides you the very best safety requirements and a 24/7 consumer assist heart.

Others

Cex.io and Gemini are a few of the different fashionable crypto exchanges you could contemplate.

Trendy on-line exchanges are handy and user-friendly. Nonetheless, small and midsize traders and sellers make up the majority of those platforms’ goal market. That’s why it can take one to 5 days for the cash to reach in your checking account.

After promoting your BTC on a cryptocurrency trade, a typical strategy to transform Bitcoin into money is to withdraw the cash to a checking account utilizing a wire switch or automated clearing home (ACH) switch.

As a substitute, cash will be transmitted utilizing SEPA, the Single Euro Funds Space, which facilitates euro funds. It’s a technique created to extend the effectiveness of worldwide transfers between EU international locations. This technique of switch is accepted by some European Bitcoin exchanges.

Peer-to-Peer (P2P)

Gross sales on a peer-to-peer foundation permit you to partially circumvent the standard banking system by accepting money funds, utilizing PayPal or completely different fee strategies, or settling the transaction with items or companies. You should purchase Bitcoin instantly from somebody you understand who needs to promote it. Alternatively, quite a lot of platforms function matchmaking companies, aiding sellers to find consumers and vice versa. Then, peer-to-peer trade negotiations between digital asset consumers and sellers comply with.

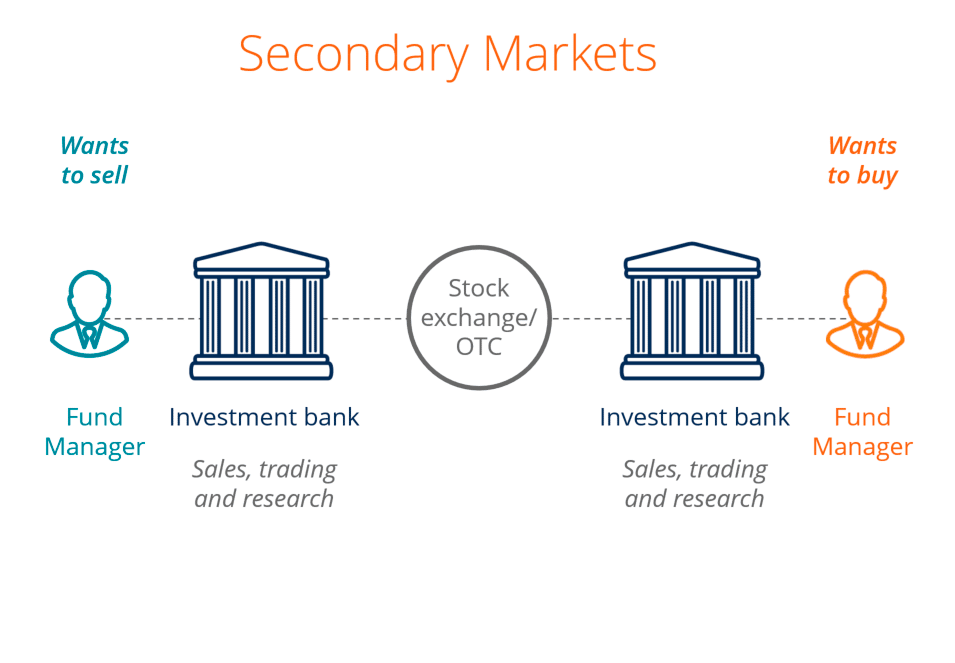

OTC Brokers

In case you’re focused on shopping for Bitcoin however don’t wish to undergo the trouble of establishing a digital Bitcoin pockets tackle, you could be contemplating utilizing an over-the-counter (OTC) Bitcoin dealer.

OTC refers to companies or individuals working with cryptocurrency withdrawals and transactions outdoors of buying and selling platforms. OTC brokers supply a handy means to purchase and promote Bitcoin with out inflicting worries about safety upon customers.

Nonetheless, there are some things it is best to take note earlier than turning to an OTC dealer. First, be sure that the dealer is respected and has a very good observe file. There have been instances of fraud when brokers took benefit of unsuspecting traders. Second, concentrate on the charges charged by the dealer. Some brokers cost excessive commissions, so it’s necessary to check charges earlier than making a call. Lastly, keep in mind that OTC brokers aren’t regulated by any authorities company, so there isn’t any assure that your investments will probably be secure.

Regardless of these dangers, OTC brokers is usually a handy means to purchase and promote Bitcoin, particularly for brand spanking new traders and cryptocurrency customers who aren’t comfy with the know-how concerned in digital wallets. Moreover, utilizing OTC exchanges is without doubt one of the few (if not the one) nameless and authorized methods to money out your BTC.

Kraken

One of the well-known centralized exchanges, Kraken, includes a desk with OTC companies particularly designed for large asset withdrawals.

P2P Platforms

LocalBitcoins

Paxful

Two of probably the most well-known platforms of this sort are LocalBitcoins (this one helps solely Bitcoin) and Paxful. Whereas they had been as soon as nameless, they now additionally demand an intensive KYC. In case your promoting bid is accepted, you should use this method to promote a variety of Bitcoin.

You possibly can trade digital foreign money valued at a whole lot of {dollars} and even hundreds of {dollars} utilizing peer-to-peer techniques. Nonetheless, peer-to-peer platforms even have extraordinarily low transactional restrictions. Moreover, their transaction prices are exceedingly hefty. This may eat a large portion of 1’s transaction, irrespective of whether or not one is exchanging Bitcoin value thousands and thousands of {dollars} or means much less.

Again Alley Buying and selling

This isn’t the perfect strategy to money out your Bitcoins, even if you wish to keep away from charges and evade taxes. Again alley dealing attracts dishonest merchants and unregistered distributors who put your crypto belongings at risk. To money out in your cash, you may wish to take into consideration the opposite choices listed above.

DEXs

Cryptocurrencies are sometimes traded on decentralized exchanges, that are exchanges that permit direct peer-to-peer exchanges of crypto belongings. Decentralized exchanges are completely different from conventional crypto exchanges in that they normally don’t require KYC or AML compliance. In addition to, they don’t maintain consumer funds. This makes them a preferred alternative for crypto merchants who worth privateness and safety.

You possibly can promote your Bitcoins utilizing these companies below your individual circumstances. Nonetheless, decentralized exchanges will be tougher to make use of than conventional crypto exchanges, so that they is probably not appropriate for everybody.

Bisq, LocalCryptos.com, and hodl hodl are all fashionable DEXs. Changelly DEX can also be a very good choice.

Bitcoin ATMs

One other technique for withdrawing Bitcoins is by way of ATMs. They’re a unbelievable choice for buying Bitcoins, however on the subject of cashing out, they’ve a decrease day by day restrict, sometimes between $3,500 and $5,000, and cost excessive transaction charges, so that they aren’t one of the best for cashing out giant sums. Nonetheless, it is best to contemplate them as a second payout choice.

Changelly has a information on tips on how to use Bitcoin ATMs.

Crypto Present Playing cards

Potential fiat cash-out options that we mentioned above continuously suggest excessive prices and lengthy processing instances, particularly on the subject of the financial institution switch technique (financial institution wire). Money-out to digital present playing cards provides purchasers extra freedom, discretion, and management over how they make the most of their tokens. Moreover, these playing cards are despatched instantly.

There are a number of companies coping with cryptocurrency withdrawals to present playing cards. The most well-liked of them is Tillo. In case you are planning to make use of this technique, you’ll want to completely analysis the matter your self.

Recommendations on The way to Promote Bitcoin and Different Cryptocurrencies

To begin with, keep in mind that the quantity of Bitcoin you’ve gotten will make an enormous distinction in how one can money out. For small quantities of Bitcoin, you may merely promote it on an trade or to an individual you understand who can also be focused on cryptocurrency. Nonetheless, for bigger quantities of Bitcoin, you could want to make use of a specialised service that may enable you to convert your Bitcoin into money with out incurring excessive charges. Along with selecting the best service, there are a number of extra tricks to make your Bitcoin cash-out expertise as clean as potential when coping with larger sums.

Break the Whole Quantity of Bitcoin into Smaller Batches

Ending every thing in a single transaction will not be suggested. It’s preferable to divide the full quantity of Bitcoin into smaller batches for safety causes in case issues come up. There might often be points with the crypto trade networks, the financial institution might halt your transaction whereas it awaits additional data, or perhaps a hacker assault might provide you with bother.

DYOR

There are a variety of exchanges on the market, and so they all have completely different charges and phrases. So take your time and store round earlier than you determine which one to make use of. Additionally, don’t neglect safety measures, and attempt to hold your crypto pockets data below management. You must also be sure to perceive the tax implications of cashing out crypto. In some instances, you could be topic to capital beneficial properties taxes. So once more, do your individual analysis and discuss to a tax skilled earlier than you proceed. By taking these precautions, you make sure that you get probably the most out of your crypto holdings.

Get the Greatest Worth

Moreover, it’s value remembering that the worth of Bitcoin can fluctuate fairly a bit, so timing your sale fastidiously also can make a distinction in how a lot cash you find yourself with.

FAQ

Do you’ve gotten a query? No worries, we’ve acquired you coated.

How a lot Bitcoin are you able to promote directly?

Each service has its personal limitations.

Are you able to money out thousands and thousands in Bitcoin?

Sure, you may, however there are a lot of issues it’s worthwhile to research and contemplate earlier than doing so.

Is it exhausting to promote Bitcoin?

No, most trendy exchanges make this course of easy and quick.

The place can I promote my Bitcoin quick?

You possibly can promote Bitcoins on CEXs, DEXs, P2P markets, and in over-the-counter buying and selling organizations.

How a lot do you get charged to promote Bitcoin?

Most companies will ask you to pay a small fee, sometimes between 0% and 1.5% of the sum per commerce. Changelly is known for its low charges — test it out your self.

Can I money out Bitcoin to my checking account?

Sure, you may switch the cash to your checking account after promoting Bitcoin.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.