How Aave’s treasury will help it rise above MakerDAO and Uniswap

- Aave’s treasury funds noticed vital development.

- Different rivals additionally witnessed a surge of their treasury funds.

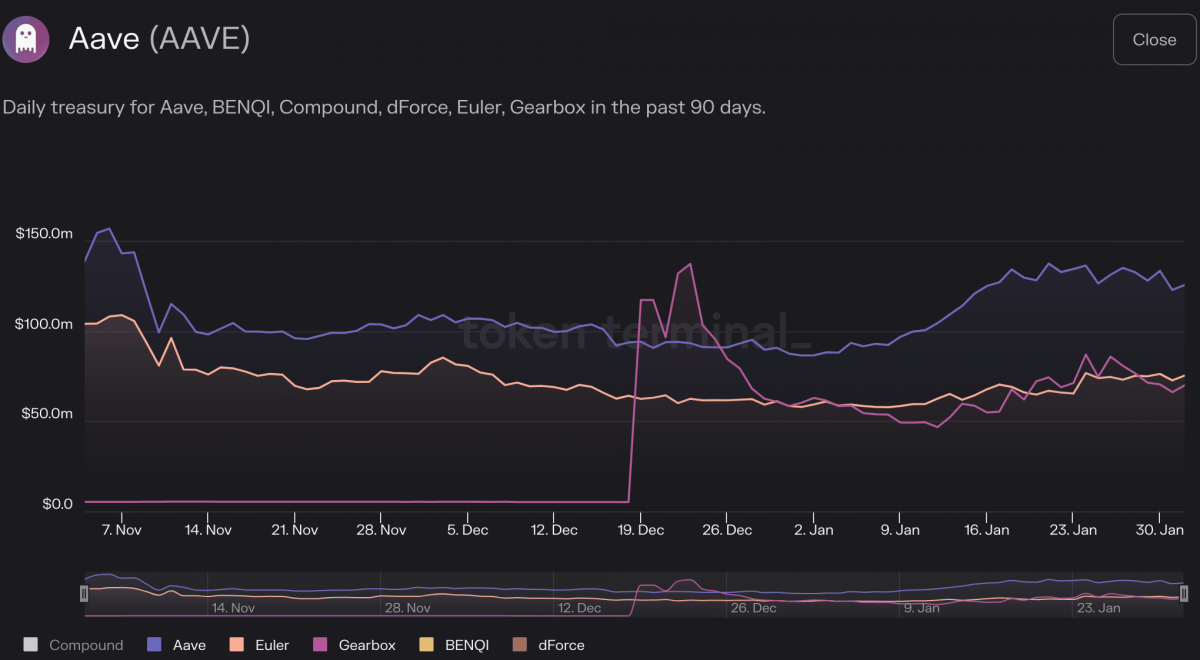

Decentralized lending protocol Aave [AAVE] has seen a development in its treasury funds, in accordance with a 1 February tweet from Delphi Digital. The expansion in treasury funds is an indicator of constant income era for the protocol, which can be utilized for varied initiatives, comparable to improvement, advertising and marketing, and strategic planning.

.@AaveAave has ~$143M in its treasury:

– $120M $AAVE

– $7M $USDC

– $5M $DAI

– $5M $USDT

– $2M $BAL

– $2M $WETH

– $2M misc.

– $739K $SHIB

– $631K $CRV pic.twitter.com/YNtSzJdcmw— Delphi Digital (@Delphi_Digital) February 1, 2023

Learn Aave’s [AAVE] Value Prediction 2023-2024

A powerful and rising treasury may present stability and assurance to traders and stakeholders, which may improve confidence within the protocol and result in elevated demand for its tokens.

Aave begins to offer powerful competitors

In comparison with its rivals comparable to BenQI and Compound, Aave‘s treasury funds grew materially within the final three months.

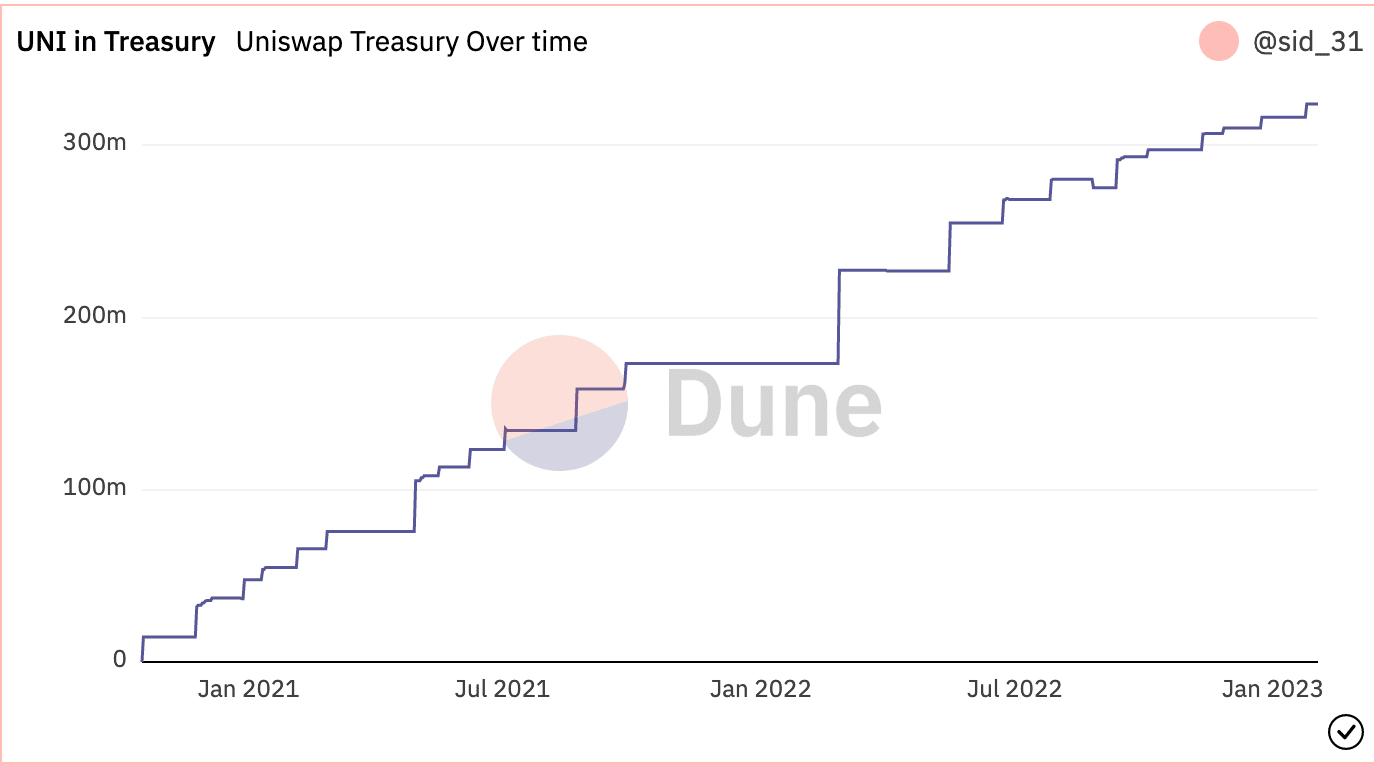

Nonetheless, different DEXes comparable to Uniswap [UNI] and MakerDAO [MKR] additionally witnessed development on this space.

In accordance with Dune Analytics, Uniswap’s treasury funds elevated over the previous couple of months regardless of the volatility noticed within the crypto market. Equally, MakerDAO weathered the storm and noticed development when it comes to the belongings being held by the protocol.

MakerDAO’s treasury consisted principally of stablecoins, which accounted for 59% of its general belongings. Regardless of this, it was MakerDAO’s Actual World Property (RWA) that generated essentially the most income for the protocol.

It stays to be seen whether or not MakerDAO will proceed to extend its income and add worth to its treasury.

Supply: Dune Analytics

Wanting on the tokens

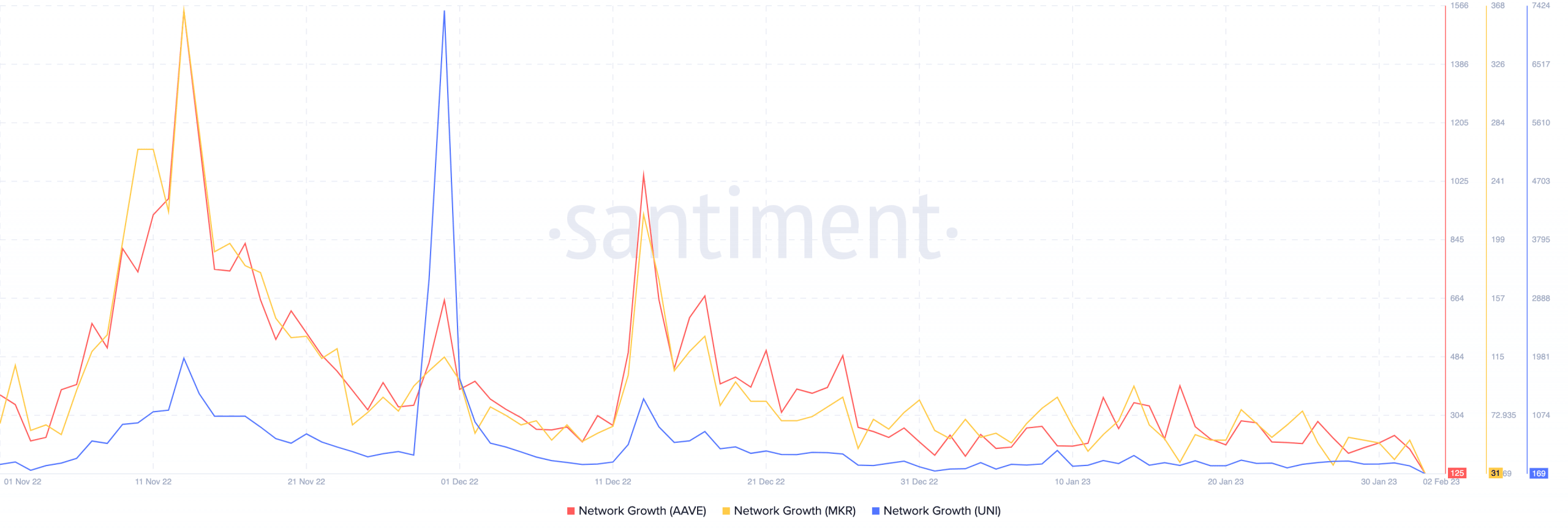

Regardless of the rising funds of those protocols, the tokens couldn’t generate curiosity from new addresses.

In accordance with knowledge from Santiment, the community development for UNI, MKR, and AAVE declined. UNI took a major hit on this area. Nonetheless, AAVE outperformed the opposite protocols on this space regardless of the declining community development.

Is your portfolio inexperienced? Take a look at the Aave Revenue Calculator

Supply: Santiment

In conclusion, Aave’s rising treasury fund is a optimistic signal for the protocol, because it showcases constant income era and offers stability and assurance to traders. Its development, in comparison with rivals like Uniswap and MakerDAO, highlighted its monetary energy.

Nonetheless, the decline in community development for all three protocols confirmed a scarcity of curiosity from new addresses. This may very well be a possible roadblock sooner or later development and adoption of those protocols and their tokens. Nonetheless, the massive treasury funds of those protocols may drive development for his or her respective ecosystems.