Grayscale’s GBTC drops to all-time low of $12.5K; conversion to spot ETF could trigger rebound

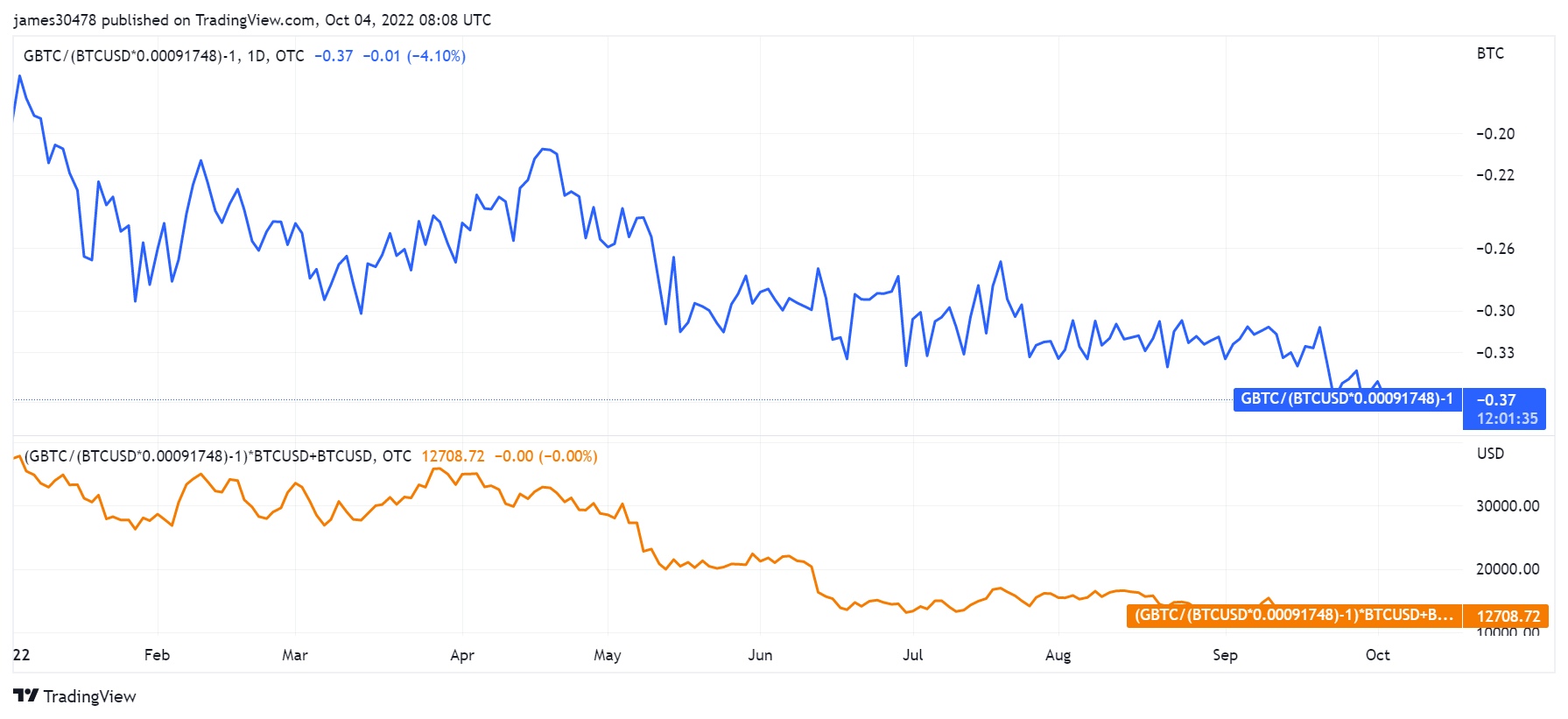

Grayscale’s bitcoin belief (GBTC) which began buying and selling at a reduction in Feb. 2021 has reached an all-time low of -36% when in comparison with the spot BTC worth of $19,000.

Grayscale launched the primary bitcoin belief in 2013, to offer institutional traders publicity to BTC by conventional devices.

As of date, property beneath administration within the bitcoin belief are roughly $12.3 billion. Grayscale holds 635,240 BTC representing 3.3% of BTC’s circulating provide, with every BTC per share value 0.00091748‡.

Previous to Feb. 2021, GBTC was buying and selling at a premium of as much as 20%. Nonetheless, the share worth has slipped into the low cost space with its present worth of $12,508 (priced with a -36.2% low cost), as of Sept. 30. 2022.

On the present 36.25% low cost, institutional traders’ curiosity in GBTC stays at an all-time low. Delphi Digital Analyst Andrew Krohn famous that the growing GBTC low cost might recommend a declining curiosity of institutional traders in bitcoin.

Some recommend that the growing low cost illustrates subsiding institutional curiosity in Bitcoin, whereas others level to a wider providing of ETFs or various autos for BTC funding.

The curiosity of institutional traders might stay low till $GBTC begins getting nearer to the online asset worth of $BTC.

Will a spot ETF approval set off the subsequent bull run?

GBTC shares accrue a 2% price yearly and are topic to a six-month lock-up. If costs fall inside the lock-up interval, traders cannot exit their place to chop the losses.

In latest occasions, cheaper bitcoin ETF choices have been launched throughout Canada, Europe, and the US. Administration charges for ETFs are comparatively cheaper and traders can enter and exit their place at will.

Grayscale moved to have its belief fund transformed to ETF, however the SEC rejected the appliance. The agency has refilled its utility for additional consideration.

In line with Krohn, the GBTC low cost pattern might reverse as quickly because the fund is transformed into an ETF.

“If the SEC approves Grayscale’s request to show the fund into an ETF, the low cost might be erased quite shortly.”

With bitcoin more and more reclaiming its status as digital gold, a spot ETF approval may imitate the same pattern as the primary gold ETF.

The launch of the primary Gold ETF “Gold Bullion Securities” in 2003, noticed the worth of Gold soar significantly over time and now trades above $1709, up by 368%, for the reason that first Gold ETF launch.

Expectedly, a spot bitcoin ETF approval will entice extra institutional and retail traders, resulting in elevated demand and worth for BTC, which may usher the crypto market into the subsequent bull run.