Fresh Bitcoin Long Positions Open Up On Exchanges As Funding Rates Turn Positive

On-chain knowledge exhibits Bitcoin funding charges have turned constructive, suggesting there have been some recent lengthy openings on spinoff exchanges.

Bitcoin Funding Charge Turns Inexperienced After By-product Change Inflows Spike Up

As identified by an analyst in a CryptoQuant post, the brand new lengthy positions can drive the worth up within the brief time period.

There are primarily two Bitcoin indicators of relevance right here, the spinoff alternate influx CDD, and the funding charges.

First, the “spinoff alternate influx CDD” is a metric that tells us whether or not outdated BTC provide is shifting into spinoff alternate wallets or not.

When the worth of this metric spikes up, it means a lot of beforehand dormant cash are getting into into these exchanges proper now.

Since traders normally deposit their BTC to derivatives for opening up new positions on the futures market, this type of pattern can result in greater volatility within the worth of the crypto because of the elevated leverage.

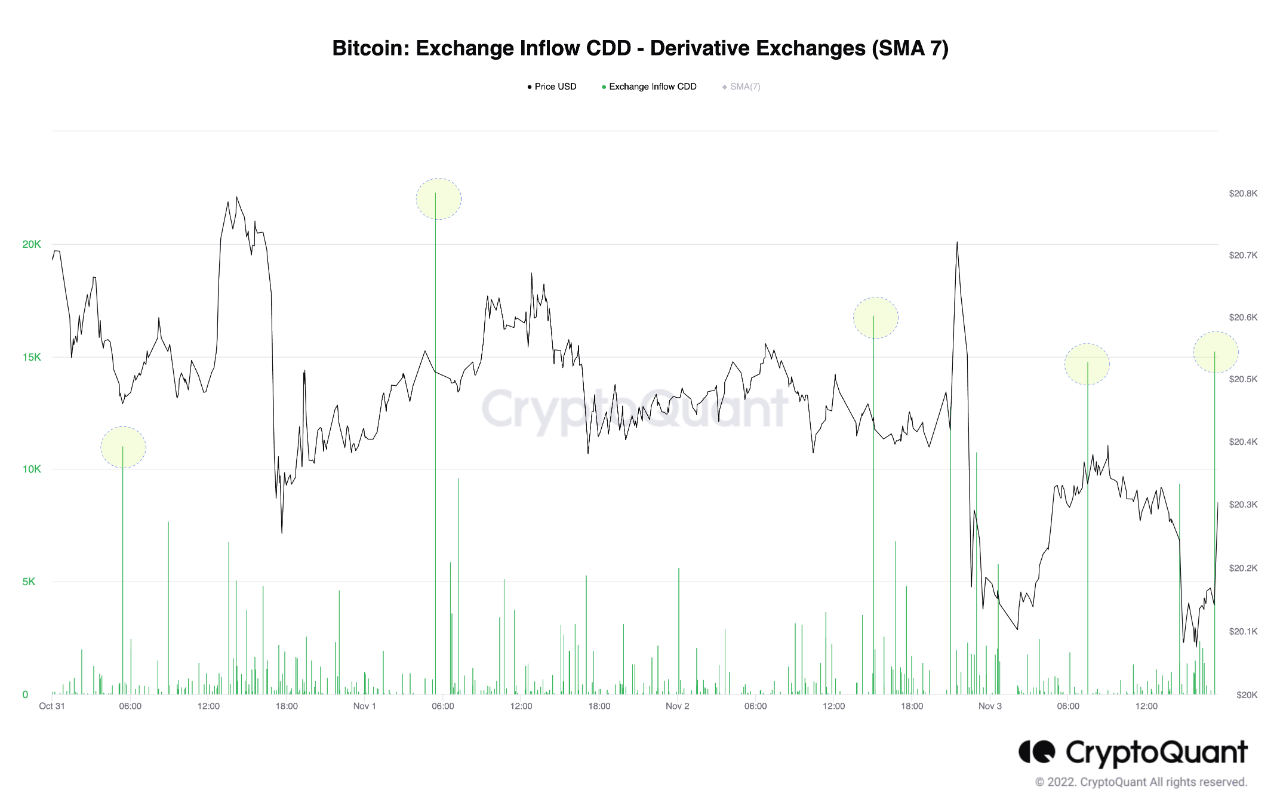

Now, here’s a chart that exhibits the pattern within the 7-day shifting common Bitcoin spinoff alternate influx CDD over the previous few days:

Appears to be like just like the 7-day MA worth of the metric has spiked up lately | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin spinoff alternate influx CDD has spiked up over the previous day, suggesting that some aged BTC provide has simply been deposited into these platforms.

Dormant provide normally belongs to probably the most resolute holders available in the market, so any motion from them can have noticeable impacts on the crypto.

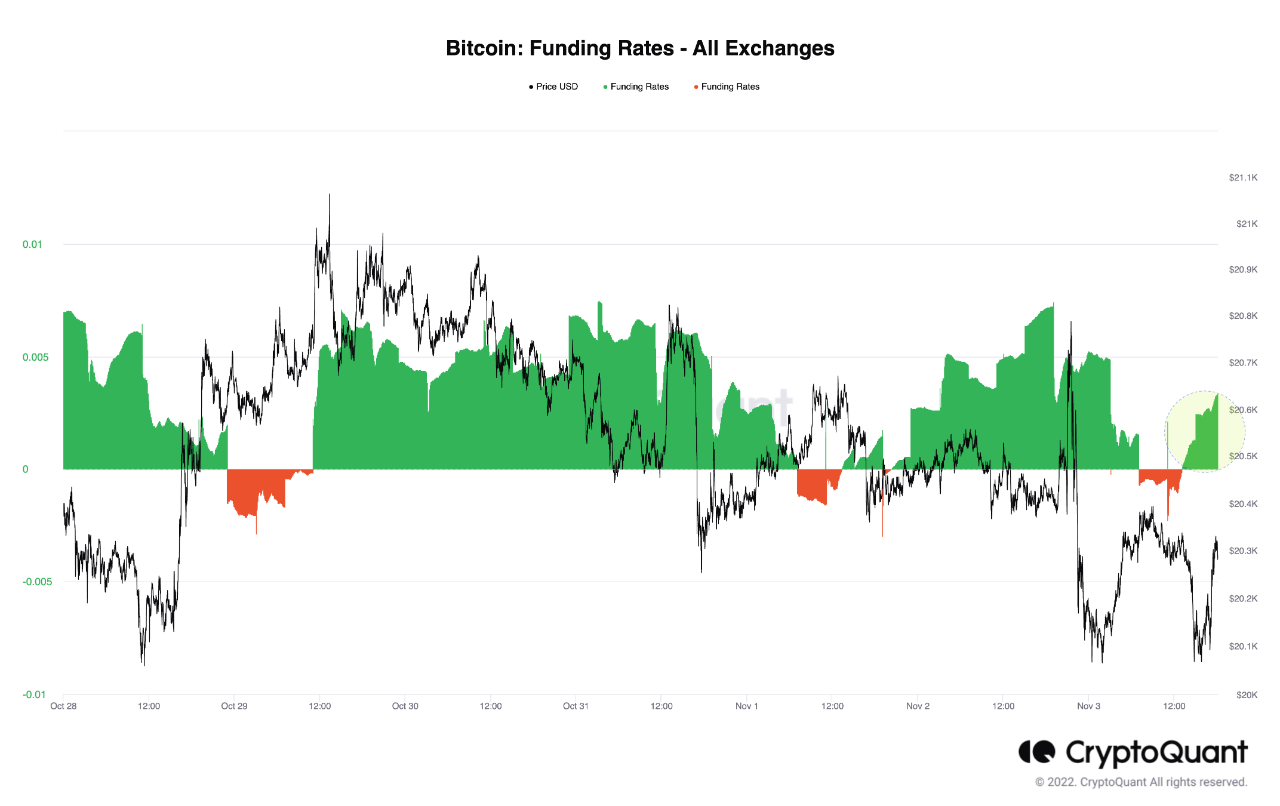

The opposite metric of curiosity right here is the “funding charge,” which measures the periodic payment being exchanged between merchants on the futures market.

When this indicator has constructive values, it means there are extra lengthy positions open than shorts proper now. Alternatively, damaging values suggest shorts are overwhelming the longs in the meanwhile.

The beneath chart exhibits the latest pattern within the Bitcoin funding charges.

The worth of the metric has turned constructive over the previous day | Supply: CryptoQuant

From the chart, it’s obvious that following the newest inflows, the funding charges have turned turned again to constructive after being barely damaging yesterday.

This might recommend that the HODLers who transferred these cash have opened new lengthy positions within the futures market.

The quant notes within the put up that these recent lengthy positions may assist Bitcoin within the brief time period.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $20.5k, up 2% within the final week.

Appears to be like like BTC has surged up a bit prior to now day | Supply: BTCUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, CryptoQuant.com