Floor Acquires WGMI.io to ‘Accelerate’ Expansion of NFT Portfolio App

NFT

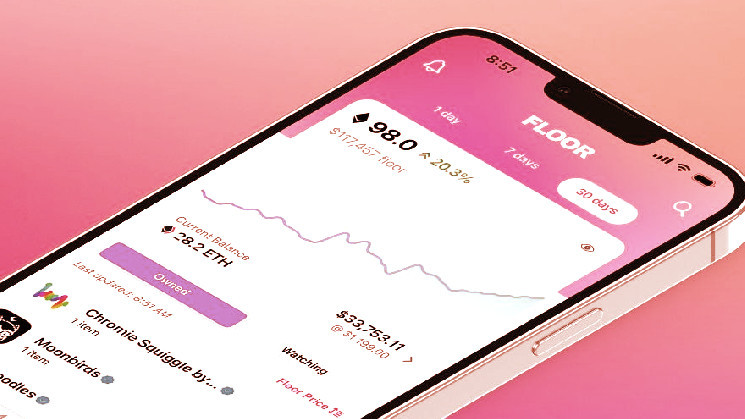

Flooring, the startup behind the NFT portfolio app of the identical title, raised $8 million final 12 months and claims sizable development for its token-gated app amid the NFT bear market. The agency has now unveiled the subsequent step in its plans to develop each its characteristic set and viewers, saying at this time that it has acquired NFT analytics platform WGMI.io.

Whereas Flooring delivers a streamlined manner for NFT collectors to view and monitor their holdings, WGMI.io is concentrated on analytics round market exercise and buying and selling developments. Collectively, they purpose to ship richer options for Flooring customers whereas bringing WGMI’s analytics options to a probably broader viewers.

“There have been huge chunks of what they do this we thought may assist speed up us,” Flooring CEO and co-founder Chris Maddern informed Decrypt.

Former Robinhood, Button, Venmo Execs Elevate $8M for NFT Firm Flooring

Maddern added that he noticed “an actual curiosity and keenness” from WGMI founder Thomas Mancini in increasing the platform’s options and performance past its comparatively small viewers of die-hard “degen” merchants, and that there was “a ton of alignment” on a united path ahead. Phrases of the deal weren’t disclosed, however Mancini has joined Flooring full-time.

Flooring debuted in October 2021 to an preliminary viewers of customers that minted its Technology I membership go NFTs, offering entry to the token-gated iOS and Android app. The platform expanded by way of word-of-mouth amongst merchants and thru subsequent NFT mints within the months that adopted.

In June 2022, Flooring introduced that it had raised $8 million in seed funding led by sixth Man Ventures, and that Christine Corridor (nee Brown)—beforehand the COO at Robinhood Crypto—had joined as COO and co-founder. Maddern and fellow Flooring co-founder and CTO Sid Dabral beforehand co-founded ecommerce startup Button.

Constructing within the bear

By the point Flooring’s funding was introduced, the NFT market was getting into what would show to be a precipitous decline in each buying and selling quantity and asset costs, in parallel with crumbling crypto costs and high-profile collapses. The NFT bear market situations solely worsened over the course of the 12 months, other than a slight uptick in gross sales in December.

At the same time as broader momentum and hype round NFTs diminished late final 12 months, Maddern and Corridor informed Decrypt that Flooring steadily grew its consumer base, even whereas remaining gated behind an NFT entry go. It partnered with main tasks like Doodles and Proof to supply NFT holders with entry, and let present customers airdrop passes to mates to onboard them into Flooring.

That led to what Flooring claims is a 700% improve in customers amid the bear market, with greater than 10,000 complete energetic customers which have to this point related over 22,000 complete crypto wallets to trace their property. The agency additional says that Flooring customers accounted for 8% of gross sales on main NFT market OpenSea in December, pointing to an viewers of plugged-in merchants.

Maddern mentioned that the WGMI.io deal offers “a chance to boost our heads” after a number of months of behind-the-scenes constructing, and to begin sharing its imaginative and prescient for Flooring’s roadmap ahead.

Why Christine Brown Left Robinhood for an NFT App

Within the brief time period, meaning tapping a few of WGMI’s performance to counterpoint Flooring’s choices. Customers can anticipate new options like buying and selling evaluation and trait pricing—that’s, monitoring demand for the person traits of NFT tasks, like the assorted visible particulars that make up a Bored Ape Yacht Membership profile image (PFP).

Maddern additionally envisions a characteristic that will let customers specify what sort of NFT they need from a sure mission (based mostly on particular traits) and at what value level, after which obtain an alert when a market itemizing matches these standards. It could be akin to what StreetEasy affords for actual property, he mentioned, however for digital property like Doodles and Apes.

Flooring’s path ahead

Flooring’s bigger imaginative and prescient is to in the end grow to be the go-to vacation spot for NFT collectors to not solely view their very own property and monitor developments, Maddern says, but in addition to remain related with tasks, obtain updates from the neighborhood, and take the temperature of market sentiment. In different phrases, an all-in-one hub for NFT house owners.

Corridor mentioned that in conventional markets, there’s “lots of formality” round the best way that corporations share info with buyers, because of centralized constructions and rules. The long-term objective with Flooring is to mixture and current info and “indicators from the neighborhood” alike to NFT collectors in a decentralized style—a shift she described in gaming parlance as going “from single-player mode to multiplayer mode.”

That’s additionally a shift for Corridor, who left the company world of public firm Robinhood for an NFT startup, however she mentioned that it’s been “in all probability essentially the most enjoyable 12 months of my profession up to now.” She’s having fun with the expertise of constructing within the open, experimenting, and “getting your fingers soiled.”

Flooring finally hopes to succeed in a a lot wider viewers, however the when and the way are nonetheless within the works. The invite-driven mannequin will stay intact for the foreseeable future, Maddern mentioned, as Flooring continues constructing within the bear market and making ready for what it expects can be one other development cycle for the NFT house forward.

“What’s enjoyable for us in a interval like that’s that we are able to actually perceive the core use instances of individuals which are right here, and who’re nonetheless engaged and energetic,” mentioned Corridor, “but in addition spend lots of time constructing for what we do consider would be the subsequent wave of development and adoption.”