Will Chainlink [LINK] continue its upward trajectory in the coming week?

- Chainlink registered unprecedented progress and information confirmed it was bullish

- LINK additionally obtained curiosity from the whales

- Metrics steered a pattern reversal was within the making

Chainlink’s [LINK] current worth motion has been fairly spectacular. As per CoinMarketCap, LINK registered 11% and over 25% each day and weekly good points, respectively. At press time, it was buying and selling at $7.44, with a market capitalization of over $3.7 billion.

Learn Chainlink’s [LINK] Value Prediction 2023-24

Moreover, LINK was on the record of the top-5 bullish developments on the BTC pair, suggesting that its worth may maintain rising within the coming days.

[Scan results – #KuCoin – 15m]

Prime 5 bullish developments on $BTC pair

1: $TEL

2: $LINK

3: $NEO

4: $FTM

5: $ETCPrime 5 bullish developments on $USDT pair

1: $DIA

2: $TRIAS

3: $LIT

4: $TIDAL

5: $OCEANAll KuCoin outcomes: https://t.co/3p6BeG9Ncd

Not purchase alerts. #DYOR— DYOR.web (@DYORCryptoBot) November 29, 2022

Chainlink additionally obtained curiosity from the whales, because it was probably the most used sensible contracts among the many prime 5000 ETH whales within the final 24 hours.

JUST IN: $LDO @lidofinance one of many MOST USED sensible contracts amongst prime 5000 #ETH whales within the final 24hrs🐳

We have additionally bought $BOBA & $LINK on the record 👀

Whale leaderboard: https://t.co/kOhHps9vr9#LDO #whalestats #babywhale #BBW pic.twitter.com/yXESQe3a3i

— WhaleStats (monitoring crypto whales) (@WhaleStats) November 29, 2022

Nonetheless, was all the pieces working within the token’s favor? A take a look at LINK’s on-chain metrics shed some mild on the present state of affairs.

Is a pattern reversal imminent?

CryptoQuant’s data revealed a large bearish sign as LINK’s stochastic was in an overbought place, opening a possibility for a pattern reversal quickly. LINK’s alternate reserve was additionally on the rise; it hinted at a better promoting strain.

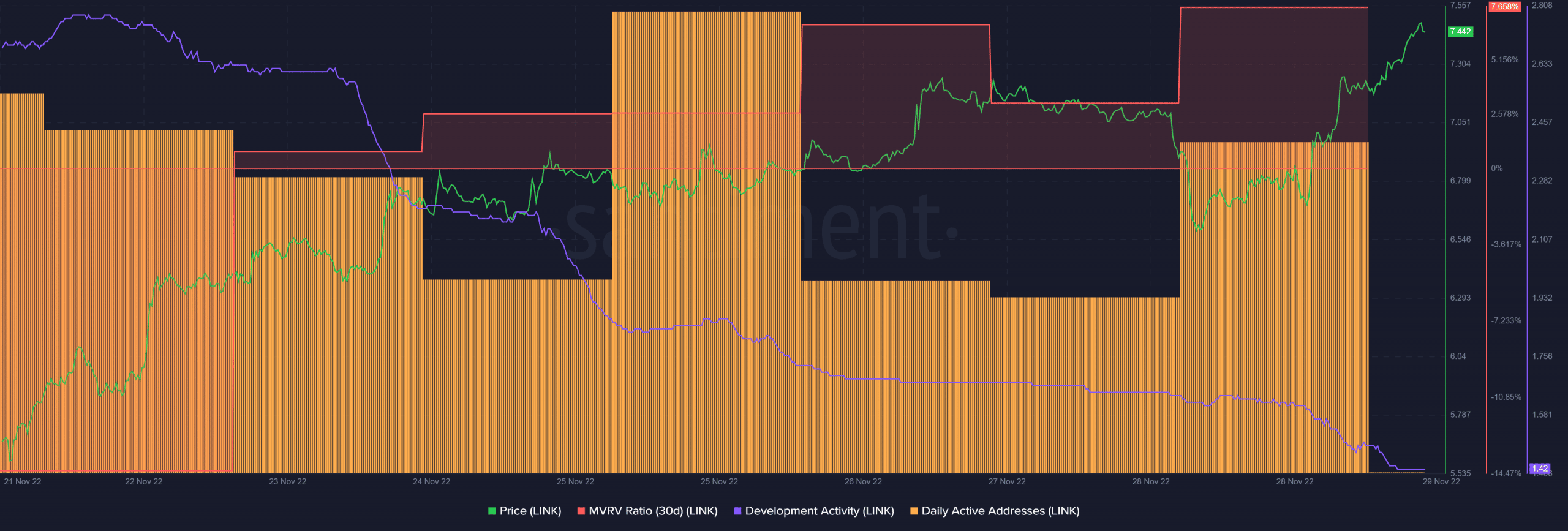

In keeping with Santiment, Chainlink‘s growth exercise decreased significantly over the previous week, which was a destructive sign for the community. After peaking on 25 November, LINK’s each day energetic addresses additionally registered a downtick. Nonetheless, LINK’s MVRV Ratio was up considerably, giving hope that the value surge may proceed for some time.

Supply: Santiment

Some promising updates for Chainlink

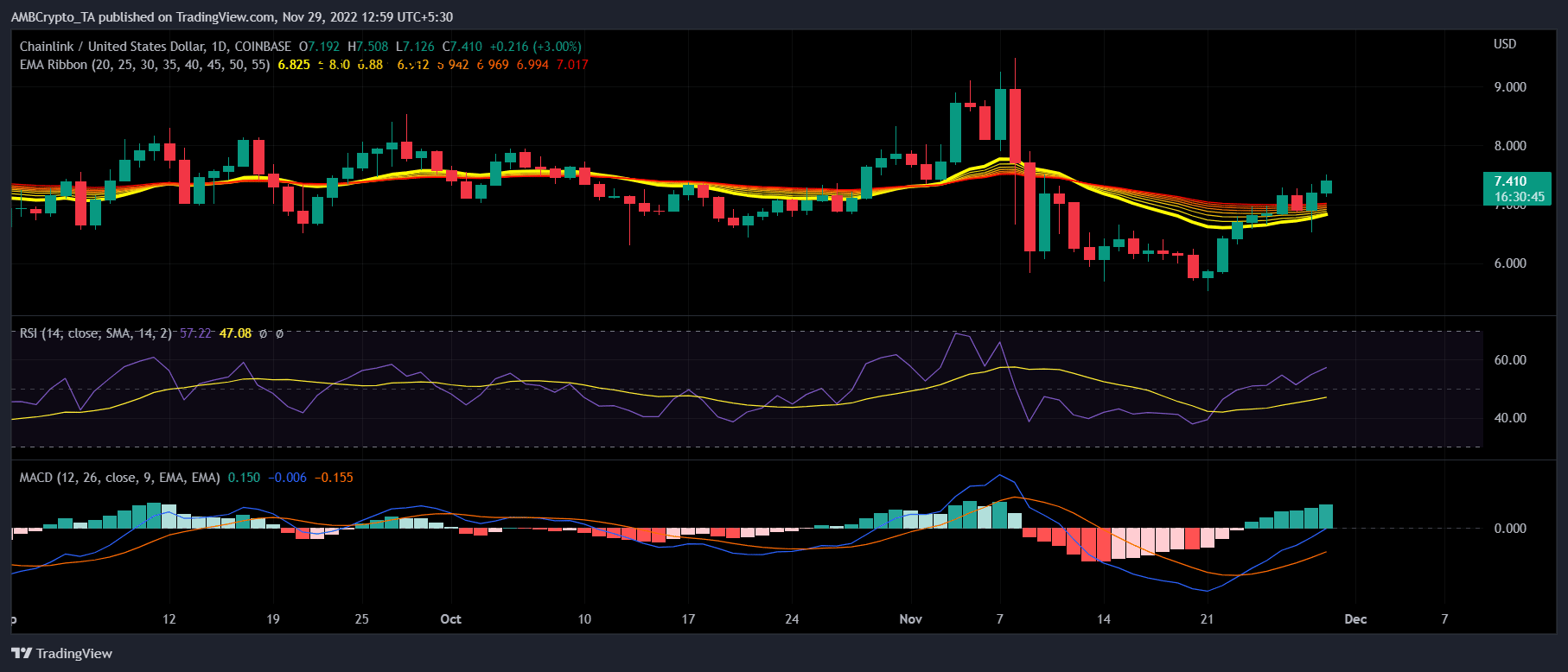

Surprisingly, whereas the metrics had been principally bearish, the market indicators had been on the facet of the consumers. As an illustration, LINK’s Relative Power Index (RSI) registered an uptick and headed additional up, indicating a continued worth hike. The MACD additionally displayed a bullish crossover.

As per the Exponential Transferring Common (EMA) Ribbon, the 20-day EMA was quick approaching the 55-day EMA, additional rising the possibilities of sustained progress.

Supply: TradingView