Filecoin: Protocol Labs reduces staff by 21%: FIL gears up for price reversal

- The corporate behind Filecoin will cut back its workforce by 21%.

- FIL could also be because of a reversal as shopping for strain weakens.

In a press release printed on 3 February, Protocol Labs, the corporate behind decentralized file storage community Filecoin [FIL], introduced that it might layoff 21% of its workforce.

Citing “extraordinarily difficult financial downturn” as the explanation behind its transfer, CEO Juan Benet famous that the cuts have been made crucial in order that the corporate may climate the extended financial downturn and guarantee future sustainability.

Learn Filecoin’s [FIL] Value Prediction 2023-24

Per the press launch, the meant layoffs will result in the discount of Protocol Labs workforce by 89 roles and can affect people throughout:

“PL Corp, PL Member Companies, Community Items, PL Outercore, and PL Starfleet.”

It was not acknowledged if the layoffs impacted the Filecoin staff.

FIL due for a value drawdown

At press time, FIL traded at $5.60. Additionally impacted by the worth rally available in the market within the final month, FIL’s value has grown considerably by 86% because the 12 months began, returning it to its pre-FTX collapse degree, knowledge from CoinMarketCap revealed.

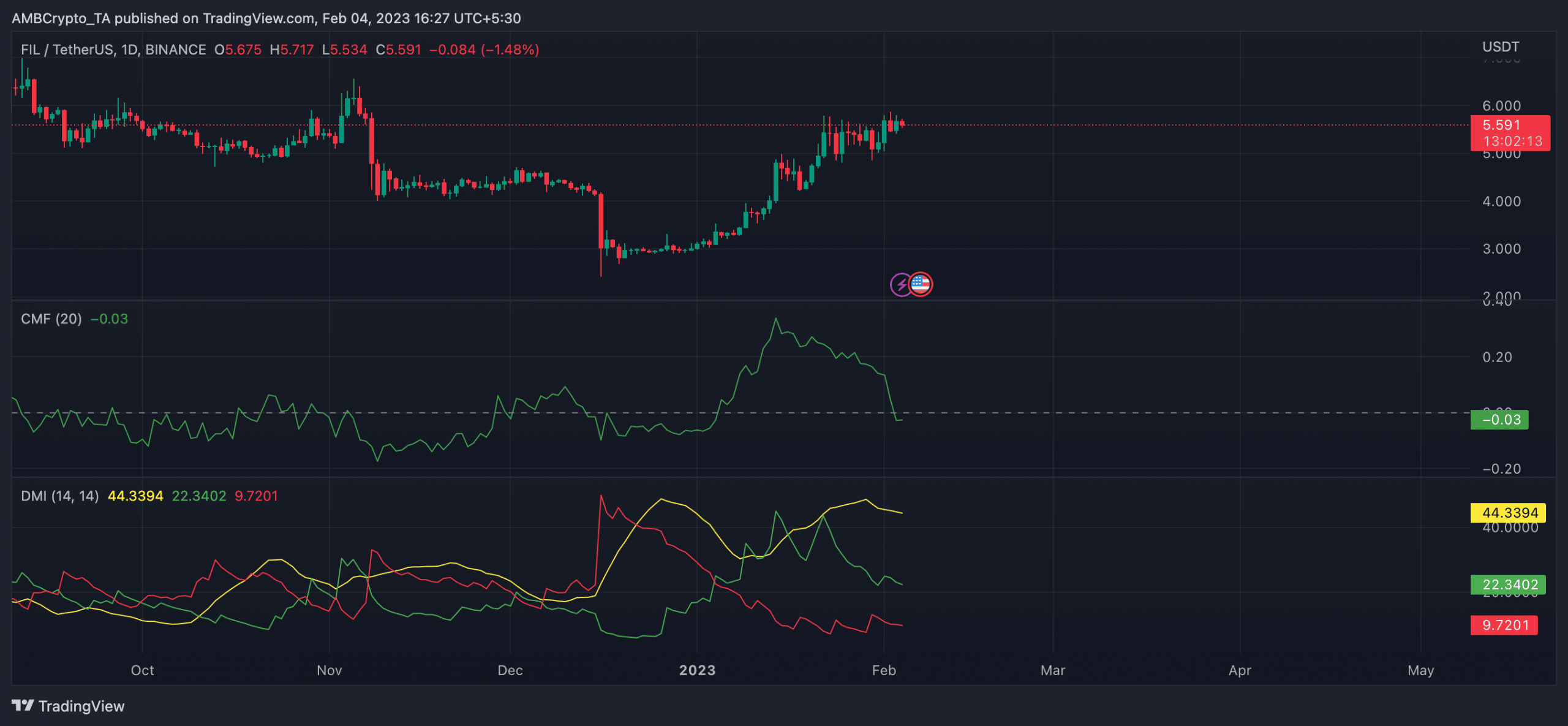

A take a look at the alt’s actions on a every day chart, nonetheless, revealed that FIL traded in a decent vary on 22 January and remained in that place at press time.

When an asset’s value oscillates inside a slim vary, this may point out indecision available in the market, the place each consumers and sellers have been reluctant to make a transfer. It may additionally point out an absence of market momentum or quantity, making it troublesome for the worth to interrupt out of the vary in both course.

Since this began, consumers misplaced management of the FIL market. A gentle decline within the alt’s Optimistic Directional Indicator line (+DI) confirmed this. At press time, this was at 22, gearing as much as intersect with the Adverse Directional Indicator (-DI) line. As soon as this occurs, the sellers would regain full management of the market, and a value reversal would start.

Real looking or not, right here’s FIL market cap in BTC’s phrases

Additional, an evaluation of the Chaikin Cash Stream (CMF) revealed {that a} bearish divergence between this indicator and FIL’s value had been in place since mid-January. Whereas FIL’s value rallied, its CMF fell.

One of these divergence is frequent in a market the place shopping for strain is weak, and the rally in value merely mirrors the overall market development. It’s a bearish sign and should point out a possible development reversal or a market correction.

Supply: FIL/USDT on TradingView