Fantom: The ‘but’ in FTM’s recent rally and why traders should maintain caution

- Fantom has a brand new proposal to cut back its present burn fee

- FTM’s worth has rallied by 30% within the final week

Fantom’s [FTM] witnessed a 30% rally within the final seven days following the publication of the proposal to cut back the community’s present burn fee.

Learn Fantom’s [FTM] Value Prediction 2023-24

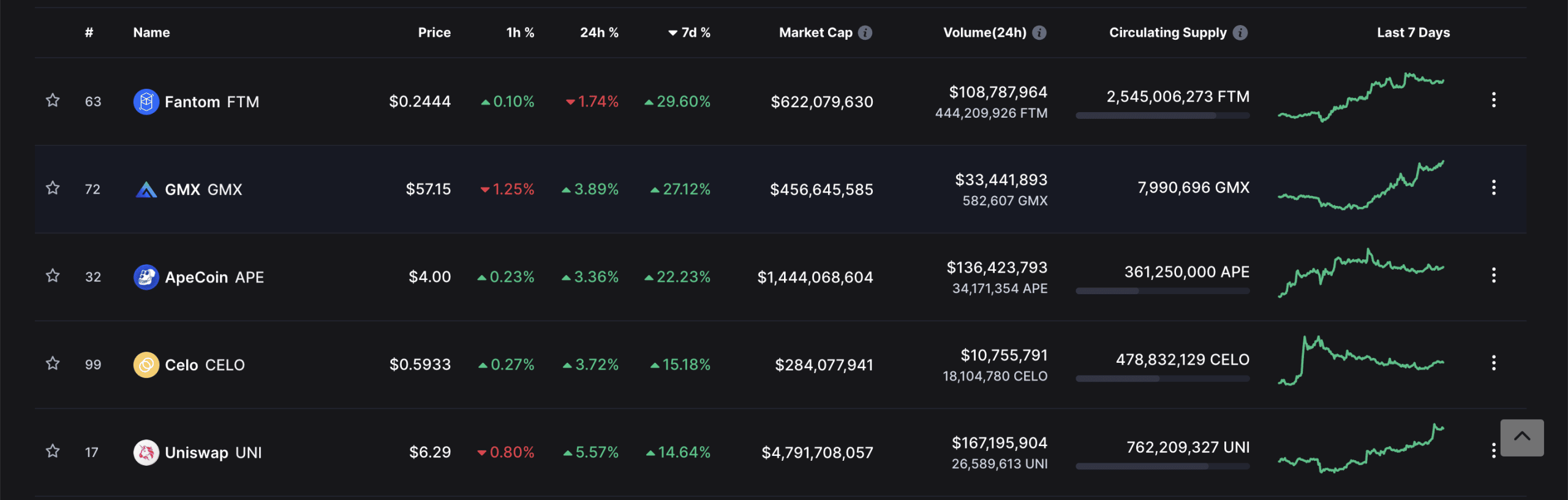

Per knowledge from CoinMarketCap, FTM traded at $0.2449 at press time. Every week in the past, the altcoin exchanged arms at $0.19. The 30% rally in worth put FTM above different property comparable to GMX, APE, CELO, and UNI, which rose by 27.12%, 22.23%, 15.18%, and 14.64%, respectively.

Supply: CoinMarketCap

Via its new governance proposal, titled “dApp Fuel Monetization Program,” Fantom sought to cut back its present burn fee. It deliberate to take action by redirecting its payment on to the decentralized purposes (dApps) housed throughout the community.

In response to the proposal, if the identical is handed, the “implementation will cut back Fantom’s burn fee of 20% to five% and redirect this 15% discount in the direction of fuel monetization.”

Moreover, the fuel monetization “will reward high-quality dApps, retain gifted creators, and assist Fantom’s community infrastructure.”

What Fantom has in retailer

At its present worth, FTM traded at its Might worth degree. On a year-to-date foundation. FTM misplaced 91% of its worth. Because the cryptocurrency market tried to regain stability following FTX’s sudden collapse, FTM’s worth launched into an uptrend since 19 November. As noticed on a day by day chart, FTM accumulation since climbed considerably.

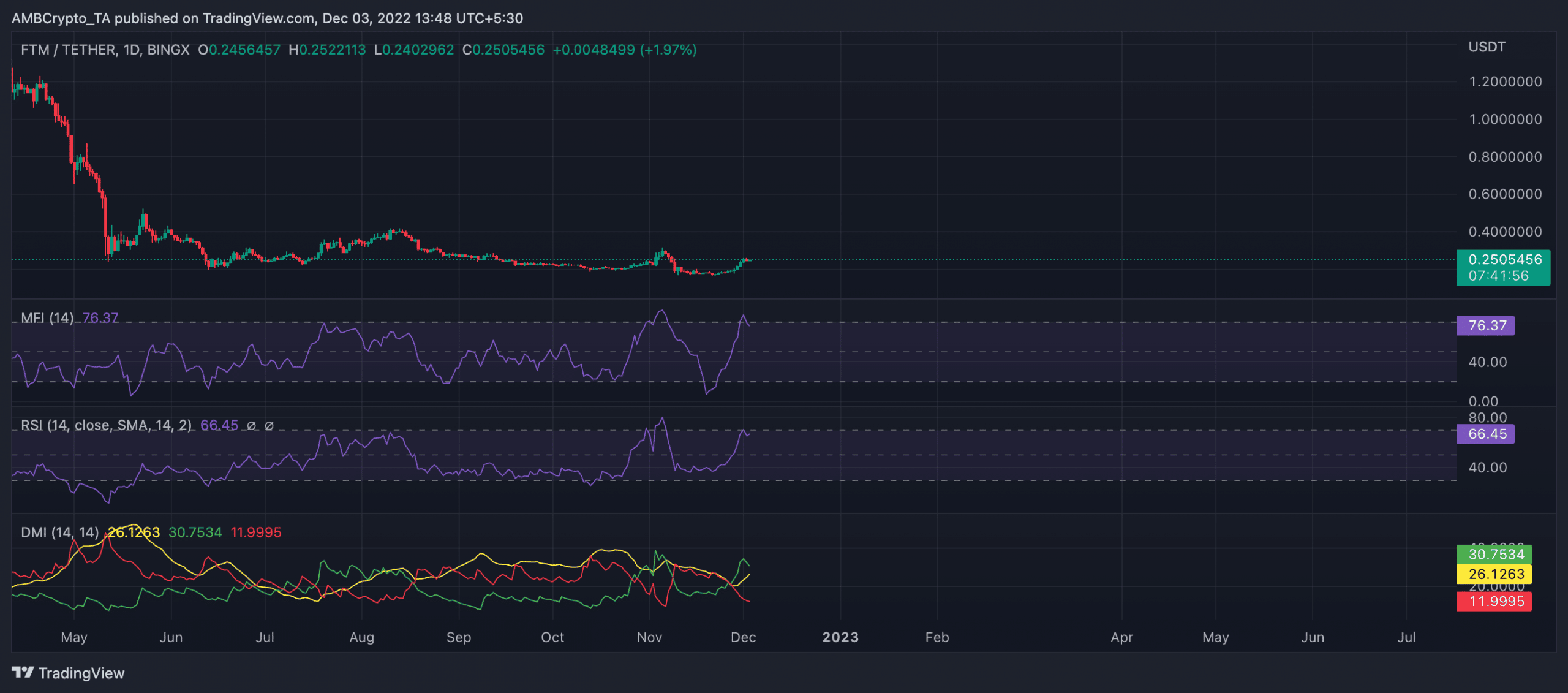

Within the final two weeks, FTM went from being severely oversold to being overbought at press time. As of 19 November, FTM’s Cash Movement Index (MFI) rested at 6.71, indicating large sell-offs. Nevertheless, because the bulls re-entered the market and started accumulation, the MFI proceeded on an uptrend and marked its spot at 76.37 at press time.

Toeing the same development, the Relative Energy Index (RSI) additionally rallied from a low of 38 on 19 November to relaxation above the 50-neutral spot at 66.45 at press time. This confirmed that FTM accumulation has surged up to now few weeks, therefore the rally in worth, per knowledge from CoinMarketCap.

Additional, consumers had management of the market at press time. FTM’s Directional Motion Index (DMI) confirmed that the consumers’ energy (inexperienced) at 30.75 was solidly above the consumers’ (purple) at 11.99.

The Common Directional Index (yellow) at 26.12 confirmed that the consumers’ energy was a stable one which sellers may discover unimaginable to revoke within the quick time period.

It’s, nevertheless, vital to notice that overbought highs are usually not sustainable. Additionally, with the extreme volatility within the present market, most market capitalize on a worth rally to make income. Therefore, sell-offs may start as quickly as buyers start profit-taking.

Supply: TradingView