Goblin Sax DAO to offer instant NFT-backed loans

NFT

www.theblock.co

02 November 2022 13:55, UTC

Studying time: ~2 m

Goblin Sax, a decentralized autonomous group for NFT finance, is launching an prompt loans service. It acquired prompt loans app Fluid, which it would rebrand as Goblin Lend, to construct out the product alongside its already current peer-to-peer NFT lending service.

Previously often called Gringotts DAO, Goblin Sax is considered one of a number of NFT mortgage platforms which have popped up over the past yr that targets NFT holders trying to unlock liquidity with out promoting their nonfungible tokens.

Amongst them, South African firm NFTfi raised a $5 million seed spherical late final yr. In November, it issued a mortgage for $1.4 million over 30 days at 9.69% APR. The collateral was a uncommon NFT from the generative artwork collation Autoglyphs.

Goblin Sax was initially a lender on NFTfi however has been on the lookout for methods to evolve.

“The moment loans app will allow customers to click on a number of buttons and take a mortgage immediately”, the DAO’s head of integrations, who goes by “Arentweall,” instructed The Block. They defined that “the bottom layer is utilizing NFTfi, however I feel the consumer expertise could be very completely different from the one on NFTfi, the place you first put out your NFT after which wait for somebody to give you a mortgage.”

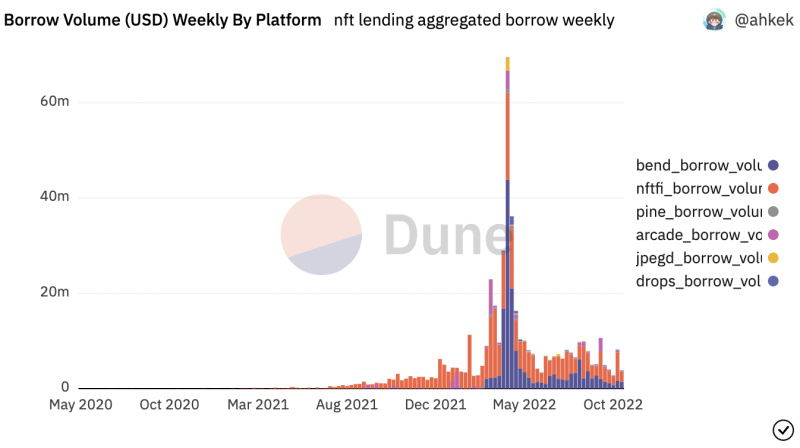

Supply: @ahkek by way of Dune Analytics

As ground costs decline, NFT lending platforms have encountered liquidity problems with their very own. BendDAO, one other NFT finance DAO, had a liquidity disaster in August attributable to underestimating how illiquid NFTs might be in a bear market when setting its preliminary parameters. After rates of interest on borrowed loans elevated, customers let go of their NFTs as a substitute of paying again the loans.

Goblin Sax stated that NFT initiatives are on the lookout for extra income and engagement, whereas NFT holders need liquidity and ground costs. “We imagine Goblin Lend might help create a win-win resolution and we wish to empower these communities to their subsequent stage of progress,” it stated in a press launch.