Even Blue Chips continue to drop

NFT

en.cryptonomist.ch

08 November 2022 15:24, UTC

Studying time: ~3 m

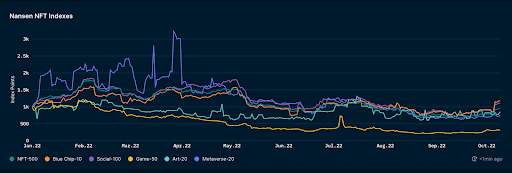

The NFT market has been falling down increasingly, registering double-digit falls in USD year-to-date with Blue Chip collections specifically experiencing the least disadvantage in September 2022.

Revealing this knowledge about non fungible tokens is a report that has been revealed by Nansen, an industry-leading blockchain knowledge analytics platform.

The NFT market, much like most world monetary markets, has suffered from a pointy slowdown part and rising inflation.

It has resulted in elevated volatility throughout all classes of NFTs together with the highest 500 initiatives which reported a -20.6% loss as of thirtieth September 2022.

Gaming and Blue Chip NFT markets

Taking a deeper have a look at the sectors which are experiencing minor volatility, the report factors to a -7.8% lower in the highest 10 Blue Chip NFT initiatives, in addition to in social NFTs which had been solely down -7.9%.

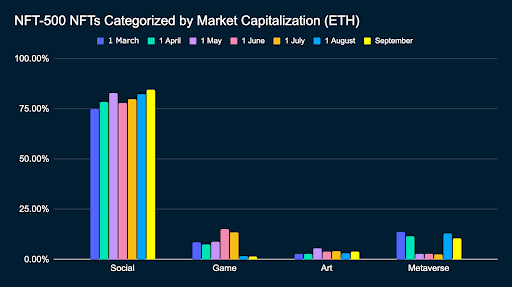

Within the make-up of the NFT-500 (ETH) index, we see that the weighting of Social NFTs continues to extend in Q3.

Equally, this was the case for Metaverse NFTs, though there was a slight lower in weighting within the final month of Q3 (September). Artwork NFTs weighting remained comparatively steady within the NFT-500 (ETH) index, with a slight enhance in September. Lastly, Gaming NFTs dropped considerably in weighting for Q3, in keeping with its important drop in market capitalization as an NFT sector.

However gaming NFT initiatives reported the worst efficiency with a lower of -71.8%. Nevertheless, the index additionally signifies that within the final 30 days of September, the market skilled somewhat enhance.

The report additional shows that Blue Chip NFTs remained the least unstable, and may be attributed to notable Blue Chip NFT gross sales reminiscent of BAYC #6388 – bought for 869.7 ETH, with a revenue of 809 ETH, held for 377 days or CryptoPunks #3614 – bought for 275 ETH, with a revenue of 265 ETH, in Q3 is a probable issue that contributed to the Blue Chip initiatives experiencing the least disadvantage year-to-date.

In comparison with a earlier evaluation from Q2, the gaming and the artwork ecosystems have seen a lower in general development.

The gaming sector noticed the largest drop in efficiency year-to-date when in comparison with different NFT fields.

Within the final week of Q3, the weekly transactions and person counts had been under all metrics. With Mints NFTs and OpenSea NFTs seeing a majority of the decline.

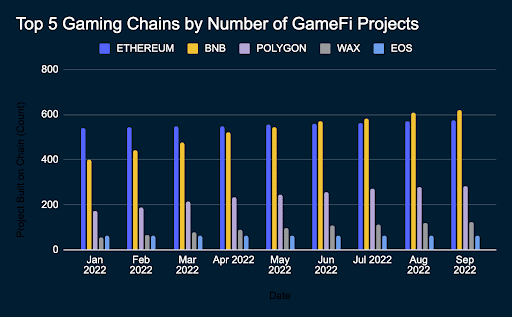

Nevertheless, in response to the evaluation, Nansen’s scrutiny couldn’t ignore the truth that gaming NFTs are migrating to different chains, so this is the reason the Ethereum record goes down.

In actual fact, the report noticed a rise in GameFi associated initiatives being constructed on chains reminiscent of BNB and Polygon.

Louisa Choe, Analysis Analyst at Nansen, stated:

“Given the drop in NFT values and, thus, market capitalization, it isn’t shocking that the typical spending per transaction on NFTs have dropped considerably for the reason that begin of 2022.

We are able to interpret that the NFT market contributors stay cautious of the broad market situations. Nevertheless, extra on-chain knowledge is required to substantiate this remark”.