Ethereum: Why investors should look beyond ETH’s current formation

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Lengthy and short-term ETH holders noticed beneficial properties

- If BTC’s bearish sentiment persists, ETH may discover new help at $1217.22 and $1166.83

Ethereum [ETH] witnessed a drop simply because it headed into the weekend. It misplaced the $1,300 psychological degree after Bitcoin [BTC] struggled to commerce above $17K. At press time, ETH was buying and selling at $1270.69 and will proceed on a downtrend all through the weekend primarily based on the technical evaluation indicators.

If the bearish momentum persists, ETH may discover new help ranges at $1,217.22 and $1,166.83.

Learn Ethereum’s [ETH] worth prediction 2023-2024

ETH fails to interrupt the $1306 resistance once more: Will bears take full management?

Supply: TradingView

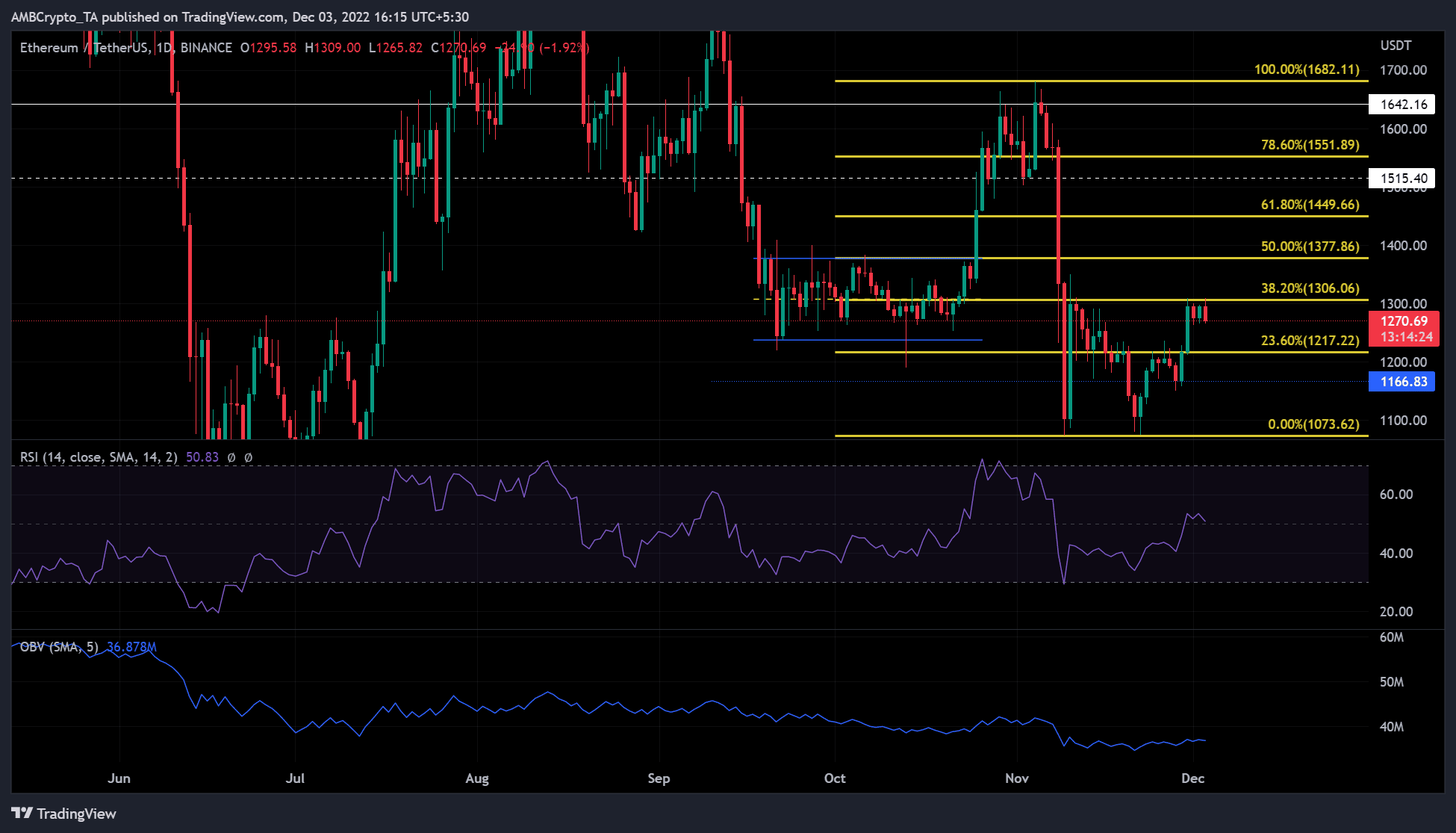

ETH has been working inside the $1,239 – $1,378 vary throughout September and October. An upside breakout from the vary led ETH to pump by over 20%, reaching a excessive of $1,682.11 in early November. However the market crash pressured a downtrend that led to large worth correction the final time ETH tried a rally.

At press time, ETH confronted vital resistance on the 38.2% Fib degree, which additionally doubled as a bearish order block. Technical indicators advised that ETH may drop additional. The Relative Energy Index (RSI) moved sideways and rested on the 50-neutral degree with a drop in thoughts. This confirmed that consumers’ exhaustion may give sellers extra leverage.

Moreover, the On-Stability Quantity (OBV) additionally moved sideways after forming a delicate slope upwards. It confirmed an absence of serious buying and selling volumes to again shopping for strain. Thus, shopping for strain may very well be undermined. Subsequently, ETH may head down and choose new help ranges at $1,217.22 and $1,166.83.

Nevertheless, an intraday shut above $1306.06 will invalidate the above bearish bias. In such a case, ETH may set sail northwards regardless of quite a few obstacles towards the 100% and 78.6% Fib pocket ranges.

Quick and long-term ETH holders noticed earnings, however ….

Supply: Santiment

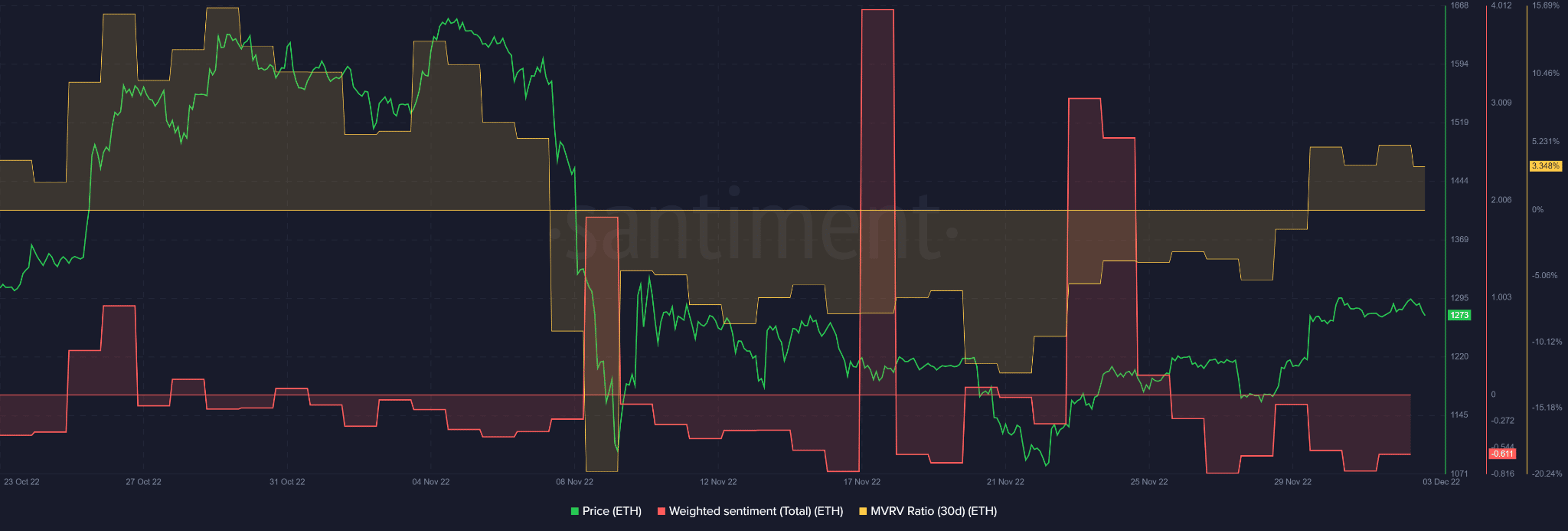

Regardless of the latest bearish sentiment, ETH posted beneficial properties to its quick and long-term holders. For instance, the 30-day Market Worth to Realized Worth (MVRV) was constructive from 29 November. This confirmed that short-term ETH holders made earnings because the finish of November.

Sadly, ETH noticed a adverse sentiment on the time of publication that would delay additional uptrend momentum. Thus, promoting strain might construct over the weekend and early subsequent week if BTC’s sentiment stays bearish.

Nevertheless, if BTC regains $17K and maintains upward momentum, ETH’s market construction may have a transparent bullish path. Subsequently, ETH traders ought to be cautious and ideally make a transfer if the market path is way clearer.